Life insurance proceeds are typically not taxable as income, but there are some exceptions. For example, if the beneficiary receives the life insurance payment as a series of installments, the insurer will pay interest on the outstanding death benefit, which is taxable. If the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated. If the policyholder names an estate rather than an individual as a beneficiary, the person inheriting the estate may have to pay estate taxes.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | Typically not taxable as income. |

| When are life insurance proceeds taxable? | If the beneficiary receives the benefit as a series of installments, the insurer will pay interest on the outstanding death benefit, which is taxable. |

| If the beneficiary is anyone other than the insured person's spouse, the life insurance payout will be added to the value of the estate, and if the total value exceeds the federal and state exemptions, it will be subject to estate and inheritance taxes. | |

| If the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. | |

| If the beneficiary is a "skip person", the proceeds may be subject to generation-skipping tax. | |

| If the beneficiary is in a state that enforces inheritance tax (Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania), they may have to pay inheritance tax. | |

| If the beneficiary is the insured person's estate rather than an individual, the person or persons inheriting the estate may have to pay estate taxes. | |

| Are life insurance premiums tax-deductible? | No, life insurance premiums are not tax-deductible for personal policies. |

What You'll Learn

Interest on life insurance proceeds is taxable

Life insurance proceeds are generally not taxable as income. However, any interest accrued on the proceeds is taxable and must be reported as such.

If you are the beneficiary of a life insurance policy, you do not have to pay taxes on the death benefit as it is not counted as taxable gross income. However, if the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, you may have to pay taxes on the interest generated during that period. This means that when a beneficiary receives life insurance proceeds after a period of interest accumulation, they must pay taxes on the interest accrued, but not on the entire benefit.

For example, if the death benefit is $500,000 but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. This interest is considered taxable income, even though the original death benefit is not.

If the policyholder names their estate as the beneficiary, the person or people inheriting the estate might have to pay estate taxes. This could increase the tax burden on your heirs, so it is important to plan carefully and consult a tax professional to ensure you are maximising any potential tax benefits while remaining compliant with the law.

Mountain Climbing: Is Your Life Insurance at Risk?

You may want to see also

Life insurance proceeds are not taxable income

However, there are some cases where a beneficiary may have to pay taxes on the proceeds. For example, if the payout is structured as multiple payments, these payments may be subject to taxes. This is because they include proceeds and interest, and income earned in the form of interest is almost always taxable. If the beneficiary is the spouse of the deceased, the life insurance payout is not taxed and will be passed on in full.

If the beneficiary is anyone other than the spouse, the life insurance payout will be added to the value of the estate. If the total value of the estate exceeds the federal and state exemptions, any amount over the exemption will be subject to estate and inheritance taxes. Federal estate taxes apply when the value of an estate exceeds $12.06 million per individual, with a tax rate of up to 40%. State estate and inheritance taxes vary but can be as high as 20%.

Additionally, if the policyholder has withdrawn money or taken out a loan against the policy, the proceeds may be taxable. If the amount withdrawn or loaned exceeds the total amount of premiums paid, the excess may be taxable.

How to Cancel a Whole Life Insurance Policy?

You may want to see also

Estate and inheritance taxes

Generally, life insurance proceeds are not taxable as income. However, there are certain situations where the beneficiary may have to pay taxes on the proceeds.

If the beneficiary is anyone other than your spouse, such as a child or parent, the life insurance payout will be added to the value of your estate. If the total value of your estate exceeds the federal and state exemptions, any amount over the exemption will be subject to estate and inheritance taxes.

Federal Estate Taxes

The value of an estate that exceeds $12.06 million per individual will be subject to a tax rate of up to 40%.

State Estate and Inheritance Taxes

There are 17 states, plus Washington, D.C., that have an inheritance or estate tax. The estate tax exemption amount varies by state, ranging from $1 million to $7 million. Tax rates can be as high as 20%, depending on the state.

To avoid estate taxes, you can set up an irrevocable life insurance trust (ILIT). This involves transferring ownership of the policy to the ILIT and not being the trustee. While this is an effective way to ensure that the life insurance death benefit is not taxable as part of your estate, there are a couple of situations in which you may face a tax event:

- When setting up the trust, if the life insurance policy's cash value is greater than the gift tax exemption, you may need to pay a gift tax when transferring ownership. The gift tax exemption for 2022 is $16,000.

- If you pass away within three years of transferring the life insurance policy to the trust, the policy will likely become part of your estate from a tax perspective.

Child's Father: Insuring My Child's Future Security

You may want to see also

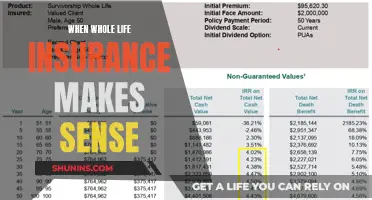

Whole life insurance tax rules

Life insurance is a financial product that pays out a lump sum in the event of the insured person's death, providing financial support to their beneficiaries and heirs. While there are multiple types of life insurance, whole life insurance is a form of permanent life insurance that comes with many features.

Whole life insurance benefits you for your entire life, as long as you keep your payments up to date. It also has a cash value component that is money you can use during your lifetime. The cash value of a whole life insurance policy will increase each year, allowing it to grow throughout your life. This growth is tax-deferred, which means it is not taxed while the policy is active. The interest generated from whole life insurance policies is not taxed until the policy is cashed out.

If you decide to borrow against the cash value of your whole life insurance policy, it is not considered taxable income. However, the insurance company will charge interest on the loan until it is paid back. Taking out a loan will also reduce the death benefit value of the policy.

Dividends received from a whole life insurance policy are generally not taxable, as long as they do not exceed the amount you have paid in premiums.

Life insurance proceeds received by a beneficiary due to the death of the insured person are typically not considered taxable income and do not need to be reported to the IRS. However, any interest received on the proceeds is taxable and should be reported. If the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for the proceeds may be limited, and there may be additional taxable amounts.

Life Insurance Proceeds: Safe from Creditors in Federal Bankruptcy?

You may want to see also

Avoiding life insurance taxes

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

Ownership Transfer

If you want your life insurance proceeds to avoid federal taxation, you can transfer ownership of your policy to another person or entity. Here are some guidelines to remember:

- Choose a competent adult or entity to be the new owner (it can be the policy beneficiary).

- Obtain the proper assignment or transfer of ownership forms from your insurance company.

- New owners must pay the premiums on the policy. You can gift up to $16,000 per person in 2022 and $17,000 in 2023, so the recipient could use some of this gift to pay premiums.

- You will give up all rights to make changes to this policy in the future. However, if a child, family member, or friend is named the new owner, changes can be made by the new owner at your request.

- Obtain written confirmation from your insurance company as proof of the ownership change.

Irrevocable Life Insurance Trust (ILIT)

Another way to remove life insurance proceeds from your taxable estate is to create an ILIT. You cannot be the trustee of the trust, and you may not retain any rights to revoke the trust. In this case, the policy is held in trust, and you will no longer be considered the owner. Therefore, the proceeds are not included as part of your estate.

Permanent Life Insurance

Permanent life insurance allows you to build cash value that you can tap into tax-free while alive and then create an income-tax-free inheritance for your loved ones after your death. Cash value grows tax-deferred, and you can borrow against the value of the policy without owing income tax.

Whole Life Insurance

Whole life insurance can avoid taxes by building cash value. Your cash value savings grow tax-deferred, so you don't owe income tax as long as you leave the money in your account. You can also borrow your whole life insurance cash value through a loan without owing taxes.

Endometriosis and Life Insurance: What You Need to Know

You may want to see also