Cigna offers a range of health insurance plans for individuals and families, including medical, dental, pharmacy, behavioural, and voluntary benefits. After receiving a healthcare service, you will get a medical bill from your provider and an Explanation of Benefits (EOB) from Cigna. The EOB is not a bill but outlines how much of the bill you will need to pay. It is important to compare your medical bill and EOB to ensure you have been charged the correct amount.

| Characteristics | Values |

|---|---|

| What you receive after a health care service | A medical bill from your provider and an Explanation of Benefits (EOB) from your insurer |

| What an EOB is | An insurance statement that shows how much of the bill you will need to pay |

| What to do when you get a bill, an insurance statement, a revised bill based on the statement, or a payment you've already made | Organize your medical bills, keep a calendar of your medical appointments, organize your medical bills by date of service, pair medical bills with insurance statements, create a list or spreadsheet |

| What to include in the list or spreadsheet | Date, type of service, and provider, allowable amount, amount insurance pays, amount you pay, your payment/date paid, amount you've paid toward your deductible |

| What to do when you get several bills for the same care | Compare your medical bill and insurance statement, read carefully through your medical bill and insurance statement, call your provider's billing office or your insurer if you have questions about any part of a bill |

| What to do if your insurer won't cover a service that your policy says should be covered | File an appeal, ask your insurer about the appeal process |

| What to do if you realize you've missed a due date for a bill | Call the billing office right away, pay on the phone if you can |

| What to do if you can't pay a bill in full | Ask to arrange a payment plan |

What You'll Learn

Cigna's claims process

Understanding the Claims Process:

- When you receive medical care, you or your doctor will submit a claim to Cigna, requesting payment for the services provided. This claim is similar to a bill.

- Upon receiving the claim, Cigna will verify it against your insurance plan to ensure that the services are covered. It is important to note that certain procedures, medications, or locations may require pre-approval from Cigna before the services are provided, otherwise, the claim may be denied.

- Once the claim is approved, Cigna will either pay the healthcare provider directly or reimburse you, depending on who submitted the claim.

- If there are any remaining charges not covered by your plan, your healthcare provider will bill you directly for those amounts.

Submitting a Claim:

- Cigna offers different ways to submit a claim, depending on the type of service. For medical, dental, or mental health claims, you need to download and print the appropriate claim form, follow the instructions to complete it, and mail it to the address provided on the form.

- For supplemental health claims, you can submit an online claim or fill out a paper form available on SuppHealthClaims.com. You can then submit the completed form via email, fax, or mail to the specified addresses.

- Cigna also provides various state-specific forms for prior authorization and appeals, which can be found on their website.

Understanding Explanation of Benefits (EOB):

- After your claim is processed, Cigna will provide you with an Explanation of Benefits (EOB). This is not a bill but a statement explaining how your claim was paid, including the amount paid and to whom it was paid.

- The EOB helps you understand the cost of each service, what your insurance plan covers, and how much you need to pay to your healthcare provider or hospital.

- It is important to keep your EOBs for tax purposes and as a record of your healthcare services.

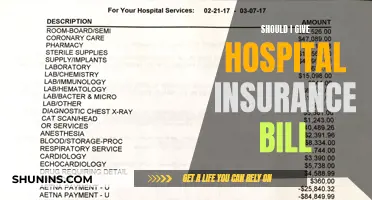

Managing Your Medical Bills:

- Cigna recommends organizing your medical bills, keeping a calendar of your appointments, and pairing medical bills with insurance statements to stay on top of your expenses.

- Comparing your medical bill and insurance statement is crucial to ensure accuracy in billing and understanding your financial responsibility.

- If you have questions or find discrepancies, contact your provider's billing office and your insurer to resolve the issues.

- Cigna also provides tips for solving payment problems and arranging payment plans if needed.

Appeals and Disputes:

- If your claim is denied, Cigna will notify you in writing about your appeal rights, and you can initiate the appeals process.

- Cigna strives to resolve issues informally whenever possible, and their customer service team can help address many claim-related concerns.

- For more complex issues, Cigna offers a formal appeal process, including external review options, to resolve contractual disputes and payment denials.

The Intricacies of Insurance: Unraveling the Concept of Contribution

You may want to see also

In-network vs out-of-network services

When it comes to health insurance, understanding the difference between in-network and out-of-network services can help you save money and avoid unexpected medical bills. Here's a detailed overview of in-network vs out-of-network services, specifically for Cigna insurance:

In-Network Services:

In-network services refer to healthcare providers, such as doctors, facilities, and pharmacies, that have a contract with your health insurance plan, in this case, Cigna. These providers have agreed to accept a discounted rate for covered services, which helps lower your healthcare expenses. When you visit an in-network provider, you typically pay a copay, which is a set fee for each visit, and your insurance plan covers the rest as per your plan's terms. In most cases, your in-network provider will submit claims for reimbursement directly to your insurance company, and you will receive an explanation of benefits (EOB) outlining how the claim was paid.

Out-of-Network Services:

Out-of-network services, on the other hand, refer to healthcare providers that do not have a contract with your health insurance plan. These providers can charge you the full price for their services, which is often much higher than the discounted rate offered by in-network providers. When using out-of-network services, you may have to pay the full amount upfront and then seek reimbursement from your insurance company. Additionally, you may be responsible for paying the difference between the provider's bill and what your insurance plan covers, known as "balance billing." Out-of-network costs can add up quickly, even for routine care, so it's important to be aware of these potential expenses.

Choosing a Provider:

When choosing a healthcare provider, it's essential to understand the specifics of your insurance plan. Cigna offers various networks, and a provider participating in one network may not participate in another. You can use tools like the Cigna directory or the MultiPlan Savings Program to find in-network providers in your area and potentially receive discounts. By staying informed about the differences between in-network and out-of-network services, you can make more cost-effective decisions regarding your healthcare.

The Evolution of P2P Insurance: A New Era of Risk Sharing and Community Trust

You may want to see also

Prior authorization

In the case of Cigna, prior authorization is required in some cases before receiving care, otherwise the claim may be denied. This applies to procedures, medications, and locations.

To get approval for prior authorization from Cigna, you or your provider must call at least four business days before you plan to have the procedure or service. Cigna will respond to your request within 10 calendar days if all the information needed to make a decision is received. If the request is urgent, Cigna will respond within 72 hours.

It is important to note that prior authorization is not a guarantee that your insurance plan will cover the cost of the service or medication.

Understanding Level Term Insurance: Unlocking the Benefits of Level Term V Policies

You may want to see also

Retroactive denial

A retroactive denial is a claim that has been paid by Cigna Healthcare and then later denied, requiring the customer to pay for the services. This could be due to eligibility issues, services that are not covered by the customer's plan, or cancellation of coverage. In the case of a retroactive denial, Cigna Healthcare will notify the customer in writing about their appeal rights.

To avoid denied claims, customers should pay their monthly premiums on time, present their current ID card when receiving services, stay in-network if required by their plan, and obtain prior authorization for any necessary procedures or services.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

Explanation of Benefits (EOB)

An Explanation of Benefits (EOB) is a statement from your health insurance plan that describes what costs it will cover for medical care or products you've received. It is generated when your provider submits a claim for the services you received.

The insurance company sends you EOBs to clarify:

- The cost of the care you received

- Any money you saved by visiting in-network providers

- Any out-of-pocket medical expenses you will be responsible for

An EOB is not a bill. It is simply a statement of the medical services you received and details of how you and your plan will share costs. You will not use this to pay any outstanding bill.

An EOB will include:

- Your patient details

- The medical services you received and from whom

- The amount billed—the cost of those services

- Discounts—any money you saved by accessing care or medical products from within your plan's network of providers

- The amount paid by your health insurance plan

- The amount not covered—costs your health plan did not cover

- The amount that may have been paid from spending accounts, such as a health reimbursement account (HRA), if applicable

- Any outstanding amount you are responsible for paying

You should always save your EOBs for tax purposes and for your records.

The Unseen Hazards: Understanding Insurance Liabilities and Their Impact

You may want to see also

Frequently asked questions

A claim is a request to be paid, similar to a bill. If you recently went to the doctor and received care, you or your doctor will submit or “file” a claim. In most cases, if you received in-network care, your provider will file a claim for you.

An EOB is a claim statement that Cigna Healthcare sends to you after a health care visit or procedure to show you how your claim was paid. It is not a bill but a document to help you understand how much each service costs, what your plan will cover, and how much you will have to pay when you receive a bill from your health care provider or hospital.

In some cases, you may need to submit a claim, depending on your plan type and whether you received in-network or out-of-network care. Use the following general plan information to help decide if you need to submit a claim.

When we receive a claim, we check it against your plan to make sure the services are covered. In some cases, you need to have a procedure, medication, or location pre-approved by Cigna Healthcare before you receive care, otherwise the claim may be denied. This is known as prior authorization.