Term life insurance is a temporary form of insurance that provides coverage for a specific period, such as 10, 20, or 30 years. If the policyholder dies during this period, their beneficiary will receive a payout from the insurance company. However, if the policy expires and the policyholder still needs coverage, they may have the option to renew or extend their current policy, convert it into a permanent policy, or purchase a new term or permanent policy. While term life insurance premiums are generally not refunded, there are a few instances where they may be, such as if the policy is cancelled within 30 days of purchase or if the policy includes a return-of-premium rider.

| Characteristics | Values |

|---|---|

| Type of insurance | Term life insurance |

| Coverage | Temporary |

| Expiry | Yes |

| Payout | No payout after the policy expires |

| Premium refund | Only if you purchase return of premium life insurance or cancel the policy within 30 days of purchasing it |

| Renewal | Possible but expensive |

| Conversion to permanent life insurance | Possible |

| New policy | Possible |

What You'll Learn

Term life insurance policies do not pay out if the policy has expired

Term life insurance is a temporary product that offers coverage for a set period, typically ranging from 10 to 30 years. Once the term ends, the policyholder is no longer insured, and the coverage ceases. This means that if the policyholder dies after the policy has expired, there will be no payout to the beneficiaries.

When a term life insurance policy expires, the policyholder will typically receive a notice from the insurance company, and the premium payments will stop. The policy will simply end without any further action required from the policyholder. However, it is important to note that some term life insurance policies offer the option to renew on a year-by-year basis after the initial term expires, although this may be more expensive due to age-related risk increases.

In addition, some term life insurance policies include a conversion rider, which allows the policyholder to convert their term policy into a permanent policy without undergoing underwriting again. This can be useful for those who develop health issues that make obtaining a new insurance policy challenging. However, the premium rates will increase due to the increased age of the policyholder.

While term life insurance policies do not typically provide a refund of premiums paid, there are a few instances where this may be possible. For example, if the policy is cancelled within 30 days of purchasing it, the company must refund the money paid. Additionally, if the policy includes a return-of-premium rider, the policyholder will receive a refund of the premiums paid during the term.

Cash Value Life Insurance: A Bad Bet for Your Money

You may want to see also

You can extend your current policy or buy a new one

Term life insurance provides coverage for a specific period, typically between 10 and 30 years. If you outlive your term life insurance, you can either extend your current policy or buy a new one.

Extending your current policy

Technically, you can keep renewing your policy on a year-to-year basis until you are 90-95 years old. Most term life policies have a guaranteed renewability feature that lets you extend your coverage without going through a new underwriting process and getting another medical exam. However, the insurance company will change your premium if you extend, and this will generally increase more every year. This option may only be viable for a few years, but it can be useful if you have been diagnosed with a terminal or life-shortening illness and cannot qualify for a new policy.

Buying a new policy

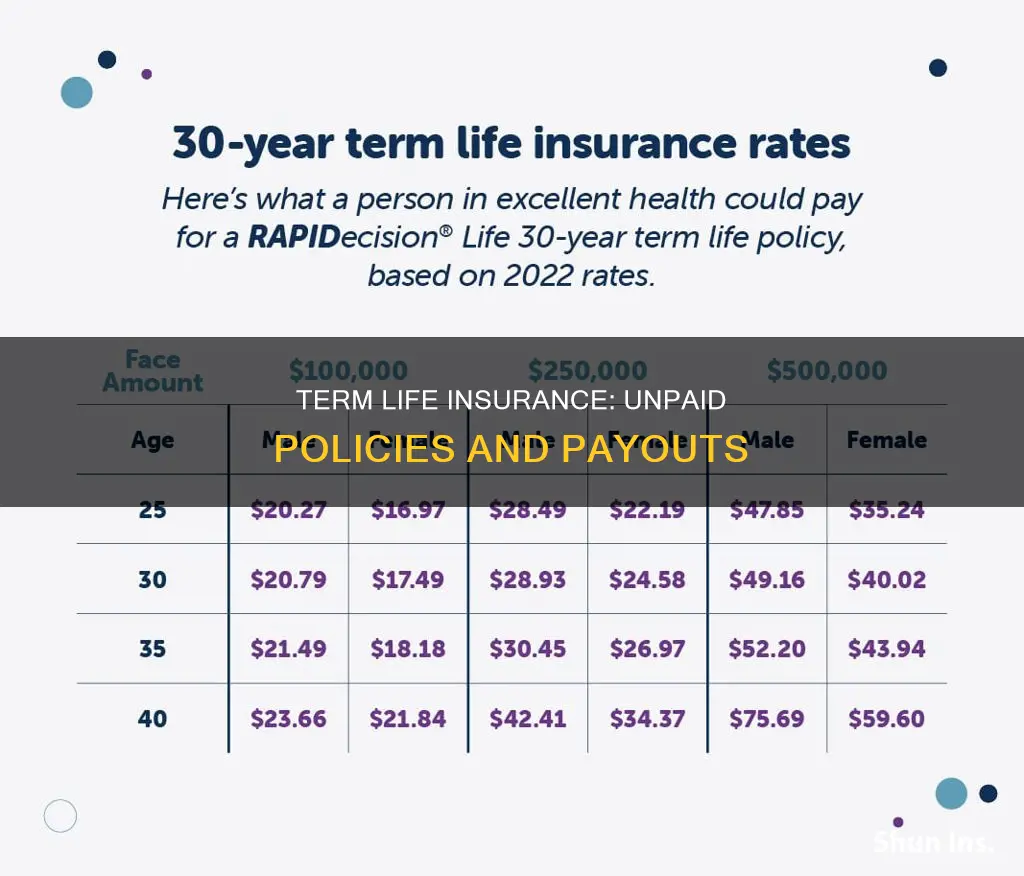

If you are still in good health and want a substantial level of coverage, you can shop around for a new term-life policy. This may be the most cost-efficient way to get the same death benefit you had before. You can also adjust the death benefit level if your coverage needs have increased or decreased. However, you will have to provide evidence of insurability by getting a new medical exam, and you can expect to pay more due to your older age and reduced life expectancy.

Other options

If you don't want to pay high annual premiums, another option is to convert your term plan into a life insurance policy. You can also purchase a new life insurance policy, but this is considerably more expensive than term life insurance.

Creditors and Life Insurance: Can They Garnish Proceeds?

You may want to see also

You can convert a term life insurance policy into a permanent life insurance policy

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Unlike permanent life insurance, which is designed to offer lifelong protection, term life insurance ends once the term expires. However, some term life insurance policies can be converted into permanent life insurance policies. This means that you can upgrade some or all of your coverage to a permanent policy, such as whole life insurance, universal life insurance, or variable life insurance. Here's what you need to know about converting term life insurance into a permanent life insurance policy:

Checking for Convertibility

First, check your term life insurance policy to see if it includes the option to convert. Some policies come with a built-in conversion provision, while others require you to purchase a rider to make them convertible. The policy documents will specify the conversion period, or the timeframe during which you can make the switch, which is typically before the end of your term. If you haven't purchased a term life insurance policy yet, consider inquiring about a term conversion rider before making a decision.

Understanding the Conversion Process

Converting a term life policy to a permanent policy is generally simpler than applying for a new policy. Contact your insurance agent or company to inquire about the conversion process and the types of permanent life insurance available. You won't need to take a life insurance medical exam or go through the underwriting process again, as your original underwriting class will remain the same. Simply fill out a questionnaire, and your new permanent policy will be issued within a few days.

Evaluating the Costs

There are no fees for converting a term policy to a permanent policy. However, your premium, or the rate you pay for coverage, will increase. The higher premium is due to several factors, including your age at the time of conversion and the amount you choose to convert. You have the option to convert the full value of the term policy or just a portion of it. Additionally, the type of permanent policy you choose will also impact your premium. For example, the premium for a whole life insurance policy will generally be higher than that of a universal life insurance policy.

Weighing the Benefits and Drawbacks

Converting your term life insurance policy to a permanent policy offers several advantages. It allows you to obtain permanent coverage, often at a more affordable rate than purchasing a new whole life policy at an older age. Medical exams are usually not required during the conversion process, and you can secure coverage even if your health has declined. Additionally, converting can help you obtain permanent coverage if you've developed a new health issue that could make it challenging to qualify through standard underwriting.

However, there are also some potential drawbacks to consider. Adding a conversion rider to your term policy may increase your term life premium. Once you convert, your premium for the permanent policy will be higher than what you paid for the term policy. You may also be limited in the types of policies you can convert to, as some insurers may only offer one option for conversion. In such cases, purchasing a new policy might provide more flexibility.

Making the Decision

There are several scenarios in which converting your term policy to a whole life policy could be a beneficial decision:

- You can afford the higher premiums associated with permanent life insurance.

- Your health is declining, and you want to secure coverage without undergoing a medical exam or paying steep premiums due to your health condition.

- You want to ensure your dependents or loved ones are financially protected, especially if you are the primary breadwinner.

- You want to cover final expenses, including funeral costs and any outstanding debts, so that your family isn't burdened with these expenses.

- You want to build cash value over time, which is a feature offered by whole life insurance policies where a portion of your premium is invested and grows tax-free.

U.S.A.A. Life Insurance: What You Need to Know

You may want to see also

You can renew your term coverage

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. While it's common to purchase term coverage with the expectation that your financial responsibilities will decrease over time, you may find that you still need coverage for a variety of reasons. If you develop serious health issues, for example, term life insurance can ensure continued financial protection for your family.

Most term life insurance policies offer the option to renew for a limited number of years without requiring evidence of insurability. This means you can extend your coverage even if your health has changed. For instance, a 10-year term policy may be renewable each year for up to 10 additional years. This renewability feature is a valuable safeguard against the uncertainties of future health issues.

However, it's important to note that the premiums for renewed policies are typically significantly higher each year. This increase in premiums is due to age-related risk increases and the fact that age is a factor in determining insurance costs, with older people paying more for their policies. Nonetheless, the increase in premiums due to age at renewal is usually less significant than the potential increase if you were to reapply for a new policy after being diagnosed with a serious health condition.

When considering whether to renew your term coverage, it's essential to assess your current financial situation and future needs. Consult with a financial advisor or licensed insurance professional to help you make an informed decision based on your specific circumstances and goals.

How to Profit from Life Insurance Policies

You may want to see also

You can go without life insurance

Life insurance is not mandatory, and you can choose to go without it. However, it's important to consider the financial implications and potential risks associated with not having life insurance. Here are some scenarios where you may decide to forgo life insurance:

- Financial independence of dependents: If your children or other dependents are financially independent and can support themselves, you may not need life insurance. In this case, they are not relying on your income for their living expenses, education, or other financial needs.

- Paid-off debts: If you have paid off your major debts, such as mortgages, loans, or other financial obligations, and have sufficient savings or assets to cover any remaining debts, you may not require continued life insurance coverage.

- Adequate retirement savings: If you have substantial retirement savings and investments that can cover your living expenses and those of your spouse or partner, additional life insurance coverage may be unnecessary.

- Spouse's financial stability: If your spouse or partner has a stable financial situation and can maintain their lifestyle and expenses without your income, the need for life insurance may be reduced.

- No significant wealth or estate taxes: If you don't have a large estate or substantial wealth, the need for life insurance as a tool for estate planning may be less crucial.

- Alternative risk management strategies: You may have alternative risk management strategies in place, such as sufficient emergency funds, investments, or other financial resources that can provide financial security for your loved ones in the event of your death.

However, it's important to carefully assess your financial situation and consider seeking professional advice from a financial advisor or licensed insurance professional before deciding to go without life insurance. They can help you evaluate your specific circumstances, future financial goals, and the potential impact on your loved ones if you choose to forgo life insurance coverage.

Term Life Insurance Dividends: Who Qualifies and How to Collect

You may want to see also

Frequently asked questions

If your term life insurance policy is expiring and you still need coverage, you can either extend your current policy, buy a new one, or convert your policy into a permanent one. Extending your current policy or buying a new one may be expensive, especially if your health has deteriorated.

No, you don't get your money back if you outlive your term life insurance. However, you can get a refund if you purchase a return of premium life insurance, but this option is more expensive than traditional term life insurance.

If you stop paying premiums before your term life insurance expires, your policy will lapse and your beneficiaries will not receive a death benefit.

If you die after your term life insurance expires, your beneficiaries will not receive a death benefit.