Life insurance is not a legal requirement in the UK, but it can offer peace of mind that your loved ones will be financially secure if you pass away. It's designed to provide your family with a financial safety net, helping them to pay off debts and loans, as well as meet daily living expenses. While it's not essential for everyone, it's particularly beneficial for those with financial dependents, such as a partner or children, or those with a mortgage.

| Characteristics | Values |

|---|---|

| Purpose | To provide financial security for loved ones after your death |

| Policy Types | Single, Joint, Term, Whole-of-Life, Over-50s, Income Protection, Funeral Cover, Critical Illness Cover, Terminal Illness Cover |

| Payout | Lump sum or regular payments |

| Payout Amount | Depends on the level of cover |

| Beneficiaries | Common-law partner, biological/stepchildren, grandchildren, close/distant relatives, charitable institutions |

| Cost | Depends on factors such as family medical history, length of policy, occupation |

| Considerations | Dependants, partner's income, mortgage, existing cover, future plans |

| Not Needed | No dependants, partner earns enough, covered by employer, low income |

| Industry Stats | £40.3 billion revenue, 20.7 million policies, 7.4 million group schemes, 35% population coverage |

What You'll Learn

Who needs life insurance?

Life insurance is not a legal requirement in the UK, but it can offer peace of mind that your loved ones will be financially secure if you pass away. Here are some reasons why you might want to consider taking out a policy:

You have financial dependents

If you have people who are financially dependent on you, such as a partner, children, or other relatives, then life insurance can provide them with financial support in the event of your death. This can help them to cover new costs, such as childcare, replace your income so they can continue to pay household bills, or pay off large debts like a mortgage.

You are a homeowner

If you are paying off a mortgage, a life insurance policy can ensure that the remainder of the debt will be cleared if you pass away during the repayment term. Some mortgage providers may also consider your life insurance policy when deciding whether to lend to you.

You are a business owner

If you own a business, a life insurance policy can protect its financial future should anything happen to you, your partner, or an employee. There are several types of life insurance designed specifically for businesses, which can help surviving owners and other key stakeholders to buy out shares, settle debts, or continue running the business.

You want to cover funeral expenses

Life insurance can be used to cover funeral expenses, which can run into thousands of pounds. Over-50s life cover is one option for this, as it tends to have smaller contributions since the payout is significantly lower.

You want to provide an inheritance

Life insurance can be used to leave a legacy to your loved ones or help contribute to the future cost of living for any dependents. It can also be used to cover inheritance tax, which can run into tens of thousands of pounds and make a significant dent in your children's inheritance.

You are a caregiver

If you care for underage children, elderly relatives, or a close friend, life insurance could ensure your dependents are financially supported if something happened to you.

You are planning to start a family

Even if you don't have children yet, it may be a good idea to take out a life insurance policy since premiums tend to be cheaper the younger you are.

You are married or in a relationship

Even if you don't have any financial dependents, you may want to consider a joint life insurance policy to ensure that your partner is provided for if something happens to you. This can help them to maintain their current lifestyle and give them breathing room to adjust.

You want to protect your income

If you are the primary earner in your household, life insurance can replace lost income for your loved ones if you pass away. It can also be used to give them a tax-free inheritance, provided the policy is written in trust.

You have co-signed debts

Life insurance can be useful if you have co-signed debts, such as private student loans, for which someone else could be held responsible if you were to pass away.

However, it's important to note that not everyone needs life insurance. If you have no financial dependents, your partner earns enough for your family to live on, or you have enough assets to provide for your dependents after your death, then you may not need a life insurance policy.

Life Insurance Options for Breast Cancer Patients

You may want to see also

Who doesn't need life insurance?

Life insurance is not always necessary. There are certain situations in which you may not need it. Here are some scenarios where you likely don't require life insurance:

- No Dependents or Financial Dependence: If you are single, have no dependents, and are financially independent, you may not benefit significantly from life insurance. In this case, you are not responsible for anyone else's financial well-being, so there is no need to insure against that responsibility.

- Sufficient Personal Wealth: If you have accumulated enough personal wealth and can cover your final expenses, such as funeral costs and any outstanding debts, you may not need life insurance. This is especially true if you don't have dependents who rely on your income.

- Alternative Coverage: If you already have sufficient alternative coverage in place, you may not need additional life insurance. For example, if you have "death in service" cover provided by your employer, which pays out to your beneficiary if you pass away while employed, additional life insurance may be unnecessary. However, it's important to review the level of coverage provided and consider if it meets your needs.

- Low-Risk Profession: If you work in a profession that is not considered high-risk and you don't have any risky hobbies, you may be less inclined to need life insurance. The riskier your profession or hobbies, the more likely it is that your loved ones will need financial protection in the event of an accident.

- No Mortgage or Debts: If you don't have any significant debts, such as a mortgage, and you're not planning to take on any in the future, life insurance may be unnecessary. Life insurance is often recommended for homeowners to ensure their mortgage is paid off if they pass away, but if you rent and have minimal debt, the need for insurance is reduced.

- Age and Retirement Status: If you are retired and your children are financially independent, you may not need life insurance. At this stage, your financial obligations are likely reduced, and you may have already paid off significant debts like mortgages. However, if you still have financial dependents or outstanding debts, insurance could still be beneficial.

It's important to note that even if you fall into one of these categories, there may be other factors that make life insurance worthwhile. For example, if you plan to start a family or buy a home in the future, purchasing life insurance now can be advantageous due to lower premiums for younger individuals. Ultimately, the decision to purchase life insurance depends on your unique financial situation, goals, and the level of protection you want for your loved ones.

Life Insurance: Impact on Net Worth Calculations

You may want to see also

How much life insurance will you need?

The amount of life insurance you'll need depends on your own unique circumstances. Here are some factors to consider when calculating the right level of cover:

- Dependents: If you have people who are financially dependent on you, such as a partner, children, or other relatives, you'll want to ensure they are provided for in the event of your death. Consider how much income they would need to maintain their current standard of living, as well as any future costs such as university fees.

- Income: Your income will impact the level of cover you can afford and the pay-out your loved ones would receive. You may want to ensure your pay-out is enough to replace your income so that your family can continue to pay household bills and maintain their lifestyle.

- Mortgage and other debts: If you have a mortgage or other large debts, you'll want to ensure your life insurance policy will cover these costs so that your loved ones aren't left with a financial burden. Consider a decreasing term insurance policy, which is designed to match the shrinking amount owed on a mortgage.

- Funeral costs: Planning a funeral can be a difficult and expensive process. You may want to factor these costs into your life insurance cover to ease the burden on your loved ones.

- Critical illness cover: You can add critical illness cover to your life insurance policy, which will pay out if you are diagnosed with a critical illness. This can provide financial support if you become unwell and are unable to work.

- Number of dependents and their ages: If you have multiple dependents, you'll likely need a higher level of cover. Additionally, consider the ages of your dependents—for example, parents of young children may want a longer period of cover than those with older children.

- Existing cover: If you already have some form of life insurance, such as through your employer, consider how this fits into your overall financial plan. You may need to increase your cover or take out a separate policy to ensure your loved ones are adequately provided for.

To calculate the right level of cover, make a list of your financial responsibilities and the associated monthly costs. Consider both current and future costs that would affect your dependents in the event of your death. Multiply these costs by the number of years you want to cover, taking into account factors such as how long it might take to replace your income.

Trust Funding: Life Insurance for Minors

You may want to see also

What type of life insurance policy should you get?

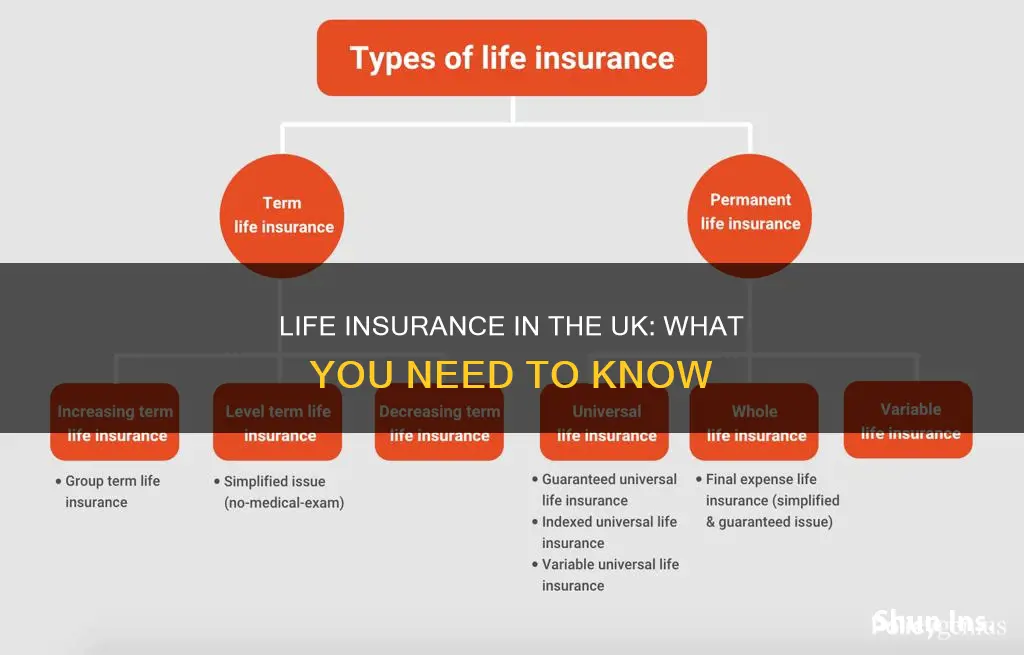

There are several types of life insurance policies available, each with its own set of features and benefits. Here are some of the most common types:

Whole Life Insurance

Whole life insurance is a permanent policy that provides coverage for your entire life, rather than a fixed term. It guarantees a lump-sum payout to your beneficiaries when you die, regardless of when it happens. This type of policy is typically more expensive than term life insurance but offers the advantage of lifelong security and a stable death benefit. Whole life insurance may be suitable if you want guaranteed support for your loved ones and want to include long-term financial planning.

Term Life Insurance

Term life insurance is a temporary policy that provides coverage for a specific period, such as 10, 20, or 30 years. It is often the most affordable option and is sufficient for most people. However, if you outlive the policy term, your beneficiaries will not receive a payout. Term life insurance can be a good choice if you only need coverage for a certain period, such as until your children become adults.

Universal Life Insurance

Universal life insurance is a type of permanent policy that offers more flexibility than whole life insurance. It has an investment portion, known as the cash value, which grows in a tax-deferred account. You can adjust the premium payments and benefit value over time. Universal life insurance may be a good option if you want the security of permanent coverage but also want the ability to adapt the policy to your changing needs.

Variable Life Insurance

Variable life insurance is a type of permanent policy where the cash value is tied to investment accounts, such as bonds and mutual funds. The cash value can fluctuate based on the performance of these investments, offering the potential for significant gains. Variable life insurance typically has fixed premiums and a guaranteed death benefit. This type of policy may be suitable for those with a higher risk tolerance who want more control over their investments.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a type of permanent policy with a smaller death benefit payout. It is designed to cover funeral expenses, burial costs, medical bills, and other end-of-life expenses. This type of policy often does not require a medical exam, making it more accessible to seniors with pre-existing health conditions. Final expense insurance can be a good option if you want to ensure your final expenses are covered without placing a financial burden on your loved ones.

Group Life Insurance

Group life insurance is typically offered by employers as a benefit to their employees. It can provide term or whole life insurance coverage to a group of individuals, often at a lower cost than individual policies. This type of policy may be worth considering if you want to provide benefits for your employees or members of an organization.

When choosing a life insurance policy, it's important to consider your budget, the amount of coverage you need, and whether you want access to cash benefits. Additionally, assessing your dependents and long-term financial goals can help you determine the type of policy that best suits your needs.

Life Insurance Benefits: Income or Not?

You may want to see also

What happens to your debts when you die?

In the UK, when someone dies, their debts become a liability on their estate. The executor of the will is responsible for paying off any outstanding debts from the estate. The executor can sell the deceased person's assets to pay their debts. Once all the debts have been settled, the remainder of the estate is distributed to the beneficiaries as per the will.

If there is not enough money in the estate to pay off all the debts, the remaining money owed will usually be written off. Surviving relatives, executors or beneficiaries of the will won't be responsible for paying off any outstanding debts, unless they acted as a guarantor or were a co-signatory of the debt.

The main exception to this is if you had a joint loan or mortgage with the deceased person, in which case you will become responsible for the whole debt.

If the deceased person had a loan in their name alone, the debt should be paid from their estate. If the loan was in joint names, the other person becomes responsible for the entire debt.

Some people take out insurance to cover joint debts if they die. For example, you might take out a life insurance policy that will generate a pay-out sufficient for your partner to repay the whole mortgage if you die.

Whole Life Insurance: Growing Value, Growing Peace of Mind

You may want to see also

Frequently asked questions

No, it is not a legal requirement. However, it is worth considering if you have people who depend on you financially, such as a partner or children.

Life insurance provides financial security for your loved ones after you die. It typically pays out a lump sum or regular payments to your beneficiaries, which can be used to cover expenses such as funeral costs, mortgage payments, or daily living costs.

The cost of life insurance varies depending on factors such as age, health, occupation, and the level of cover required. Premiums tend to increase with age and can be higher for those in high-risk jobs or with pre-existing health conditions.

There are two main types of life insurance policies: term life insurance and whole-of-life insurance. Term life insurance covers a fixed period, while whole-of-life insurance provides coverage for your entire life, as long as premiums are paid.

You can purchase life insurance through specialist brokers, comparison sites, directly from insurers, credit card companies, independent financial advisers, or even retailers. It is recommended to shop around and compare different quotes to find the best deal.