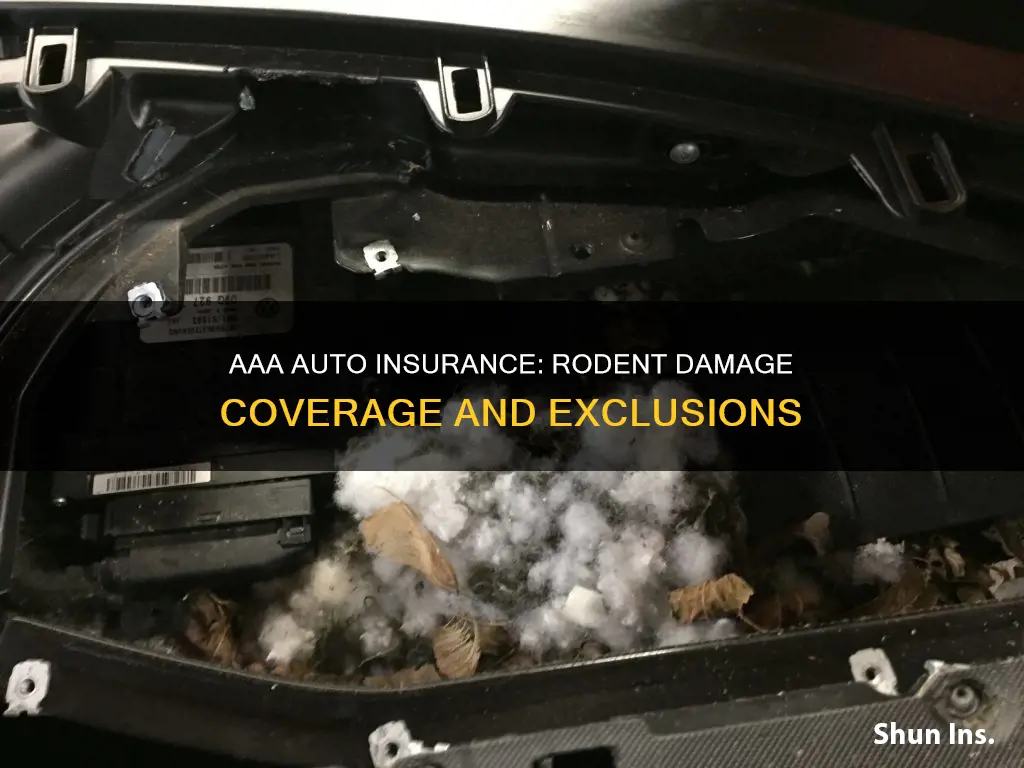

Rodents can cause extensive damage to vehicles, and this can be costly to repair. Rats, mice, squirrels, and other small animals are attracted to the warmth and shelter of cars, especially in cold weather. They can enter through tiny openings and nest in engines, glove compartments, and other areas, chewing through wires and upholstery, and leaving behind hazardous waste. This can result in electrical faults and other issues that can be dangerous and expensive to fix.

Comprehensive auto insurance from AAA can cover damage to your vehicle caused by rodents and other animals. This includes repairs to wiring and other components that have been damaged by chewing or nesting. It is important to note that comprehensive coverage is optional and not a requirement in the United States. However, if you live in an area with a lot of wildlife, or park your car in an area with a lot of rodent activity, it may be a wise investment.

| Characteristics | Values |

|---|---|

| Rodent damage covered by AAA auto insurance? | Yes, if you have comprehensive auto insurance coverage |

| What is comprehensive auto insurance coverage? | Optional coverage that helps pay to replace or repair your vehicle if it’s stolen or damaged in an incident that’s not a collision |

| What does comprehensive auto insurance cover? | Damage to your vehicle caused by natural disasters, fire, fallen objects, animal damage, theft of car parts or the entire vehicle, riots, civil disturbance, vandalism, windshield, door glass, and sunroof damage |

| What isn’t covered by comprehensive auto insurance? | Damage caused by a car collision, medical expenses, legal expenses, the cost of a rental while your car is in the shop, towing expenses, personal items that were stolen from your car |

What You'll Learn

What is covered by comprehensive insurance?

AAA auto insurance covers rodent damage, but only if you have comprehensive auto insurance coverage. Comprehensive insurance covers damage to your vehicle resulting from incidents other than collisions, such as theft, damage from flood, fire, or animals. It also covers damage caused by natural disasters, including earthquakes, floods, and hurricanes, as well as vehicle theft, or theft of certain parts of the vehicle.

Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. It is designed to pay for repairs to your vehicle caused by things other than a collision, such as natural hazards, fire, weather, natural disasters, theft, and acts of vandalism. It does not cover damage caused by a collision with another vehicle or object, or injuries to a passenger or another person.

Comprehensive coverage is optional and can be used regardless of who is at fault. It helps pay for repairs, over your deductible, so you don't have to pay the entire bill yourself. It is required by most lienholders along with collision coverage to protect their interest in the vehicle.

The cost of a comprehensive insurance policy will vary based on the value of the vehicle, the location, and the driver's past insurance history, among other factors. The deductible for comprehensive insurance is the amount you agree to pay before the insurance company starts paying for damages. Typically, the higher the deductible, the lower the insurance cost.

Comprehensive insurance may not make financial sense if you drive an older vehicle that has already lost a significant amount of value. In such cases, you might choose to skip comprehensive insurance or self-insure, but this could result in steep repair bills if your car is damaged.

Auto Insurance: One Policy Per Household?

You may want to see also

What isn't covered by comprehensive insurance?

Comprehensive insurance is an optional type of automobile insurance that covers damage to your car from causes other than a collision. It is designed to pay for repairs to your vehicle caused by things other than a collision. Comprehensive insurance covers damage to your car from animals, falling trees, natural disasters, theft, and vandalism. However, there are some things that comprehensive insurance does not cover.

Comprehensive insurance does not cover damage to other vehicles or people. It also does not cover damage caused by a collision with another vehicle or injuries to a passenger or another person. In addition, it does not cover damage to your own vehicle caused by potholes, normal wear and tear, engine failure, or other mechanical difficulties. Personal belongings inside your car are also not covered by comprehensive insurance.

It's important to note that comprehensive insurance is typically required by lenders if you are leasing or financing your vehicle. If you own your vehicle outright, you can decide whether or not to purchase this coverage, depending on the value of your car and your financial circumstances.

Self-Insured Vehicles: Who Pays?

You may want to see also

How does comprehensive insurance compare to collision insurance?

AAA auto insurance covers rodent damage under its comprehensive insurance policy. Now, let's compare comprehensive insurance with collision insurance.

Comprehensive and collision insurance are both optional types of vehicle insurance that protect your car from damage. However, they differ in the type of incidents they cover. Comprehensive insurance covers non-collision-related damage, such as theft, vandalism, hail, fire, and animal damage. On the other hand, collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object, including single-car rollovers and accidents with stationary objects.

Comprehensive insurance is particularly useful if you live in an area with a lot of wildlife, or if you park your car outdoors and want protection from weather-related damage. Collision insurance, on the other hand, is essential for all drivers, as it covers accidents that can happen to even the safest drivers.

Both types of insurance typically include a deductible, which is the amount you must pay out of pocket before the insurance company begins to cover damages. The deductibles for comprehensive and collision insurance are usually in the range of $500 to $1,500, and you can often choose different deductible amounts for each coverage.

While comprehensive insurance is usually cheaper than collision insurance, the cost of both can vary depending on factors such as your location, the value of your vehicle, and your driving record. It is worth noting that some insurers may require you to purchase both comprehensive and collision coverage together.

When deciding whether to opt for comprehensive or collision insurance, consider factors such as the value of your car, how often you drive, and your current savings. If you have a high-value car and drive long distances, purchasing both types of insurance is highly recommended. Even if you rarely drive or live in a low-risk area, comprehensive and collision coverage can provide valuable peace of mind in the event of an accident or unexpected damage.

In summary, comprehensive insurance and collision insurance serve different purposes but are both important components of a full-coverage car insurance policy. Comprehensive insurance covers a wide range of non-collision incidents, while collision insurance specifically covers accidents involving other vehicles or objects. By understanding the differences between these coverages, you can make an informed decision about the level of protection you need for your vehicle.

Denied Auto Insurance: What You Need to Know

You may want to see also

Is comprehensive insurance required?

Comprehensive insurance is not a requirement anywhere in the United States. However, if you have taken out a loan or leased your car, your lender may require it.

Comprehensive insurance is an optional type of insurance that covers damage to your vehicle that is not caused by an accident, such as damage caused by animals, vandalism, or falling objects. It is particularly useful if your car is exposed to certain risks, such as if you live in an area that is prone to violent storms, park in an area with high levels of car theft, or drive on dark country roads where you are more likely to hit a deer.

Comprehensive insurance can also provide a financial safety net, which is important if you wouldn't be able to pay for costly repairs or a replacement car out of pocket. According to the Insurance Information Institute, the average cost of comprehensive coverage is just over $134 per year, or about $11 per month.

If you have comprehensive coverage as part of your auto insurance policy, damage caused by rodents that get inside your vehicle may be covered. However, if you don't have comprehensive insurance, you will have to pay for the damage yourself.

Insuring Your New Vehicle

You may want to see also

Do I need comprehensive insurance?

Comprehensive insurance is an optional type of insurance that covers damage to your vehicle that is not caused by an accident. This includes damage caused by animals, vandalism, or falling objects. It is important to note that comprehensive insurance does not cover wear and tear, engine failure, or other mechanical difficulties.

Comprehensive coverage is typically mandatory if you lease or loan a car. Lenders require it to protect their investment. If you own your vehicle outright, comprehensive insurance is optional but can provide valuable protection against unexpected costs.

Most incidents involving animal damage, including rodents chewing on wires, are covered by comprehensive auto insurance. This can save you from paying for costly repairs out of pocket. However, not every insurance policy includes comprehensive coverage, so it is important to review your policy carefully.

Even if you have comprehensive coverage, there may be a deductible, or a threshold for the extent of damage required to qualify as a claim. Additionally, some insurance providers may require evidence of a rodent infestation before approving a claim, which can be challenging to provide.

Comprehensive insurance typically increases the cost of a basic, liability-only insurance policy by 7% to 11%. The exact amount you'll pay depends on factors such as the model of your car, your location, and your driving history.

In summary, while comprehensive insurance is not required, it can provide valuable protection against unexpected costs associated with animal damage, vandalism, or falling objects. It is important to review your policy carefully to understand what is covered and what deductibles or thresholds may apply.

Umbrella Insurance: Auto-Optional

You may want to see also

Frequently asked questions

Yes, AAA auto insurance covers rodent damage under its comprehensive coverage.

Comprehensive coverage helps pay for repairing or replacing your vehicle if it is stolen or damaged in an incident that is not a collision.

Comprehensive coverage typically covers damage to your vehicle caused by natural disasters, fire, fallen objects, animal damage, theft of car parts or the entire vehicle, riots, civil disturbance, and vandalism.

Comprehensive coverage does not cover damage caused by a car collision, medical expenses, legal expenses, the cost of a rental while your car is being repaired, towing expenses, and personal items that were stolen from your car.

The average cost of comprehensive coverage is just over $134 per year, or about $11 per month.