Allstate offers gap insurance, which stands for Guaranteed Asset Protection. This policy add-on is available to drivers with financed or leased vehicles with comprehensive/collision coverage. If a car is damaged or stolen while the driver is upside down on the car loan, Allstate's gap insurance will help pay for the difference so that the driver does not have to pay for a non-existent car. Allstate's gap insurance costs approximately $20 for a six-month policy and can be cancelled once a car is worth more than the loan or lease balance.

| Characteristics | Values |

|---|---|

| Is gap insurance offered by Allstate? | Yes |

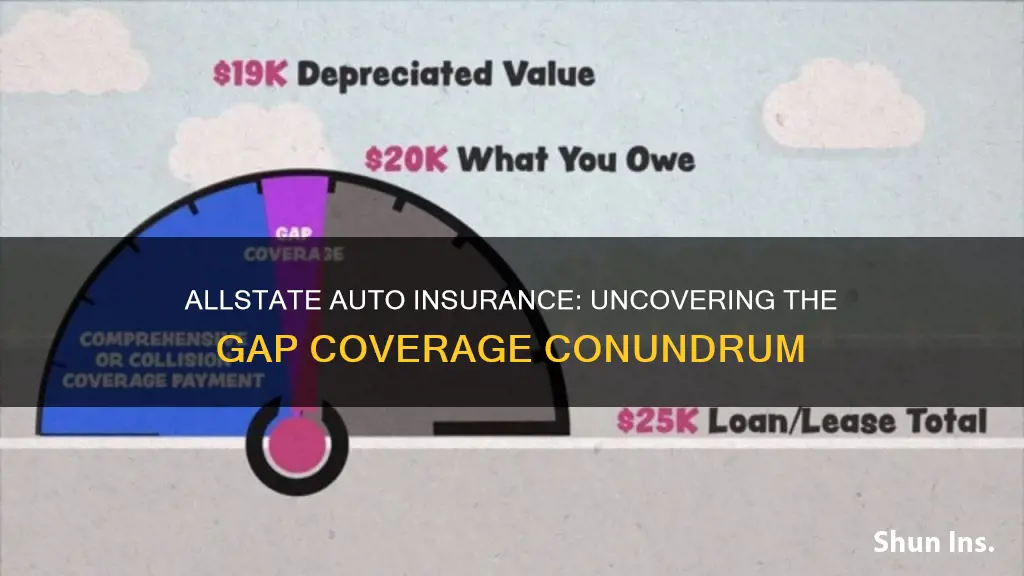

| What is gap insurance? | Guaranteed Asset Protection (GAP) insurance is a type of insurance that covers the difference between the depreciated value of a car and the remaining loan balance in case of theft or total loss. |

| Who is gap insurance suitable for? | Those who have a new or nearly new vehicle, have a long-term loan, a small down payment, or a high-interest rate. |

| How much does Allstate charge for gap insurance? | $20 per six-month policy |

| Can you cancel Allstate gap insurance? | Yes, once your car is worth more than your loan or lease balance. |

What You'll Learn

Allstate's gap insurance cost

Allstate offers gap insurance, also known as Guaranteed Asset Protection (GAP) insurance, to its customers in Texas. This type of insurance is generally recommended for newer vehicles, usually those that are brand new or less than a year old. It is designed to protect drivers financially in the event that their car is stolen or declared a total loss, and they owe more on their auto loan than the car's depreciated value.

The cost of Allstate's gap insurance in Texas typically ranges from $20 to $40 per year, which is a flat rate that can be cancelled at any time. This is significantly more affordable than purchasing gap insurance from a dealership, which can be wrapped into your loan agreement and accrue interest. By contrast, Allstate's gap insurance is a flat rate with no interest charges.

The cost of gap insurance can be influenced by several factors, including the vehicle's actual cash value (ACV), the insurance provider selected, past insurance claims, and where the coverage is purchased. According to the Insurance Information Institute (Triple-I), adding gap insurance to a full-coverage auto policy costs approximately $20 per year. However, this rate is not set in stone and can vary depending on individual rating factors.

In Texas, the cost of gap coverage should not exceed five per cent of the loan amount, as per state law. This guideline can help customers assess the fairness of the pricing they are offered. It is generally recommended to compare prices and coverage options from different providers, including insurance companies, dealerships, and finance companies, to find the most suitable and cost-effective policy.

Covering Your Married Child's Auto Insurance

You may want to see also

Gap insurance vs. loan/lease payoff coverage

Time Frame to Purchase the Coverage

Gap insurance must be purchased within a very short time frame, usually within 30 days of buying a new vehicle. It is also only available for vehicles that have never been titled before. On the other hand, loan/lease payoff coverage can be purchased at any time.

Amount of Coverage

Gap insurance covers the entire difference between what you owe on a vehicle and its actual cash value (ACV). It often covers your deductible as well. Loan/lease payoff coverage, however, usually only covers 25% of the ACV of your vehicle. For instance, if your vehicle has an ACV of $20,000, the maximum loan/lease payoff coverage will pay is $5,000.

Availability

Gap insurance is more common than loan/lease payoff coverage. Most auto lenders offer gap insurance at the time of purchase, and many lease agreements automatically include it. More insurance companies offer gap insurance than loan/lease payoff coverage. However, loan/lease payoff coverage is offered by Progressive, but they do not offer gap insurance.

Cost

Both types of coverage are fairly inexpensive since the risk for the insurance company is low. To find out the final cost of the coverage, you will need to get multiple quotes.

Applicability to Used Cars

Loan/lease payoff coverage is applicable to used cars, whereas gap insurance is typically not offered for used vehicles.

Gap Auto Insurance: What's Covered?

You may want to see also

When to use gap insurance

Gap insurance is designed for very specific situations. It is used when your car is considered a total loss. This could be due to a major accident, theft, or other damaging events like a fire. It is important to note that gap insurance is not used for covering repair costs, no matter how expensive they are.

For example, if a tree falls on your parked car and causes significant damage, gap insurance might be applicable if the insurance adjuster deems your car a total loss, and you owe more on your loan than the car’s current market value. In this case, if the cost to repair the damage is $7,000, but the car is repairable, then this repair cost would typically be covered by your comprehensive coverage, not by gap insurance.

In essence, gap insurance is there to help you financially when your car is beyond repair, and the amount you owe on it exceeds its depreciated value. This specific coverage is a crucial aspect to consider, especially if you have a new car with a substantial loan amount.

- You decide to put less than 20% down as a down payment.

- You have an auto loan that is longer than 60 months, such as a 72 or 84-month loan.

- You have accepted a high-interest rate.

- You have accepted a loan with front-loaded interest terms.

- You have rolled over a previous car loan balance into your current loan.

Gap insurance is also more commonly used for newer vehicles. While each car insurance company is different, many require that your car is less than two or three years old to purchase gap insurance. Your gap coverage could also expire after your car reaches a certain age.

Unpaid Parking Tickets: Auto Insurance Impact

You may want to see also

Who is eligible for gap insurance

Gap insurance is an optional add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a covered incident where their car is declared a total loss.

Gap insurance is generally available for newer vehicles. It is a common misunderstanding that gap insurance is available for any financed vehicle, regardless of its age. However, typically, your car needs to be brand new or no more than a year old to qualify for gap insurance.

If your vehicle is not financed, there is no reason to purchase gap coverage. If you do finance your vehicle, gap coverage can be a good idea, but it depends on how much you drive and how quickly your car depreciates.

Drivers who are eligible for gap insurance include:

- Drivers who owe more on their car loan than the car is worth.

- Drivers whose car loan requires gap insurance.

- Drivers whose lease requires gap insurance.

- Drivers who made a small down payment.

- Drivers who have a long finance period.

- Drivers who purchased a vehicle that depreciates quickly.

The Hartford Auto Insurance: When and How to Contact Them

You may want to see also

Cancelling gap insurance

- Review your contract: Check your gap insurance contract for any cancellation restrictions or deadlines for requesting a refund. It's important to understand the terms and conditions of your policy before initiating the cancellation process.

- Get quotes from other providers (if necessary): If your car is leased or you have a loan agreement, your lender may require you to carry gap insurance. In such cases, you'll need to purchase a new policy from another provider before cancelling your current one to avoid a lapse in coverage.

- Prepare your paperwork: Ensure you have all the necessary documents, including your original gap insurance paperwork, new gap insurance paperwork (if applicable), and your auto loan or lease agreement. Having all the required paperwork will make the process smoother.

- Contact the dealership: Reach out to the dealership and inform them of your intention to cancel. They will guide you through the necessary steps, which may include providing written notice or submitting specific forms.

- Request a refund: If you paid your premium in full, you may be eligible for a refund for the unused portion of your coverage. This refund is typically prorated, meaning you'll receive a refund for the months of coverage you no longer need. However, be sure to review your contract to determine your eligibility for a refund, as some policies may have different conditions.

- Provide your current contact information: When corresponding with the dealership and their insurance provider, ensure they have your updated address. This will ensure that any refund cheque is sent to the correct address.

- Purchase alternate gap coverage: If you're switching providers, be sure to have your new policy in place before cancelling your current one. This will ensure there is no gap in your coverage. Contact your new provider to get the details of when your new coverage will take effect.

- Act promptly: To expedite the process, respond promptly to any requests from the dealership or their insurance provider and return all required paperwork as soon as possible.

It's important to note that you may not be eligible for a refund if your vehicle has been declared a total loss, your gap insurance policy has expired, you haven't fully paid your premium, or you've missed the deadline to request a refund. Additionally, if your gap insurance payment was rolled into your loan amount, the refund process may be more complicated.

Loan Lease Payoff vs. Gap Insurance: What's the Difference?

You may want to see also

Frequently asked questions

Yes, Allstate offers gap insurance for approximately $20 per six-month policy.

Allstate gap insurance pays the difference between your car’s actual cash value and your remaining loan or lease balance if the vehicle is stolen or totalled.

Allstate gap insurance costs around $20 per six-month policy.

Allstate gap insurance is usually a better investment than dealership gap insurance, where the cost is often added to your loan/lease balance and charged interest.