In most states, insurance companies use an applicant's credit score and credit history when calculating their premium. However, getting an insurance quote does not affect your credit score. When an insurance company checks your credit, a record of the credit check—a soft inquiry—will be added to your credit file. Soft inquiries are not visible to lenders and do not impact your credit score.

| Characteristics | Values |

|---|---|

| Does an insurance quote affect your credit score? | No |

| Type of credit inquiry used for insurance quotes | Soft pull |

| Type of credit inquiry used when applying for credit | Hard pull |

| Does a soft pull affect your credit score? | No |

| Does a hard pull affect your credit score? | Yes |

What You'll Learn

Soft and hard credit inquiries

A soft credit inquiry, sometimes known as a soft credit check or soft credit pull, occurs when you or someone you authorise checks your credit report. It can also happen when a company checks your credit to preapprove you for an offer. These types of inquiries are considered routine checks and can be done without your permission. Examples of soft inquiries include when you receive a credit card offer, when a potential employer performs a background check, or when you check your own credit. While soft inquiries do appear on your credit report, only you can see them, and they are not connected to a specific application for credit.

On the other hand, a hard credit inquiry occurs when a potential lender examines your credit report to decide whether to extend an offer for credit. This typically happens when you apply for a loan, credit card, or mortgage, and you usually have to authorise the inquiry. Hard inquiries are recorded on your credit report and are visible to anyone who pulls your report. They can slightly lower your credit score by a few points and stay on your report for up to two years. However, the impact on your score is usually minimal and temporary, especially if you have a strong credit history.

It is important to note that having multiple hard inquiries in a short period can have a more significant impact on your credit score. Lenders may view this as a sign of high risk, as it suggests you may be short on cash or taking on a lot of debt. Therefore, it is generally recommended to limit the number of hard inquiries and spread out applications for credit.

Understanding Insurance Billing Compliance: Exploring Potential Pitfalls and Penalties

You may want to see also

Credit-based insurance scores

While credit-based insurance scores serve a similar purpose to credit scores, they are used by different types of companies and predict different outcomes. Credit scores predict the likelihood of an individual falling behind on bill payments, while credit-based insurance scores are used to assess the likelihood of filing an insurance claim. Additionally, credit-based insurance scores may have different score ranges compared to credit scores, and insurers must consider factors beyond just the score when setting premiums.

It is important to note that credit-based insurance scores are not the same as credit scores. Credit scores are used by lending institutions to determine the likelihood of repaying a loan on time, while credit-based insurance scores are used by insurance companies to assess the risk of insuring an individual.

In terms of improving credit-based insurance scores, individuals should focus on improving their credit report, as this is the basis for calculating the score. This includes paying bills on time, reducing credit card debt, using different types of credit, and being strategic about applying for new credit.

The Hidden Hazards of Adverse Selection: Unraveling Insurance's Dark Secret

You may want to see also

Credit scores and insurance rates

In most states, car insurance companies use an applicant's credit score and credit history when calculating their premium. A higher credit score is generally associated with lower insurance rates, as it indicates a lower risk of filing claims. Poor credit can significantly increase insurance premiums, sometimes even more than a recent DUI. Additionally, a lack of credit history may be considered equivalent to having poor credit by insurers.

It is important to note that insurance quotes do not affect credit scores. When insurance companies check an individual's credit during the quote process, they perform a "soft pull," which does not impact the credit score. This type of inquiry is not visible to lenders and only verifies basic information. On the other hand, a "hard pull" credit check, which provides a full credit history, can slightly lower an individual's credit score for a short time.

While credit scores play a role in insurance rates, they are not the only factor considered by insurance companies. Driving history, claims history, vehicle type, geography, and property value are also taken into account when determining insurance premiums.

It is worth mentioning that some states, including California, Hawaii, and Massachusetts, have banned the use of credit history in setting insurance rates. In these states, insurance rates are primarily based on driving records, location, and other characteristics.

The Mystery of RFD Insurance: Unraveling the Acronym's Meaning and Its Role in Financial Protection

You may want to see also

Credit scores and insurance claims

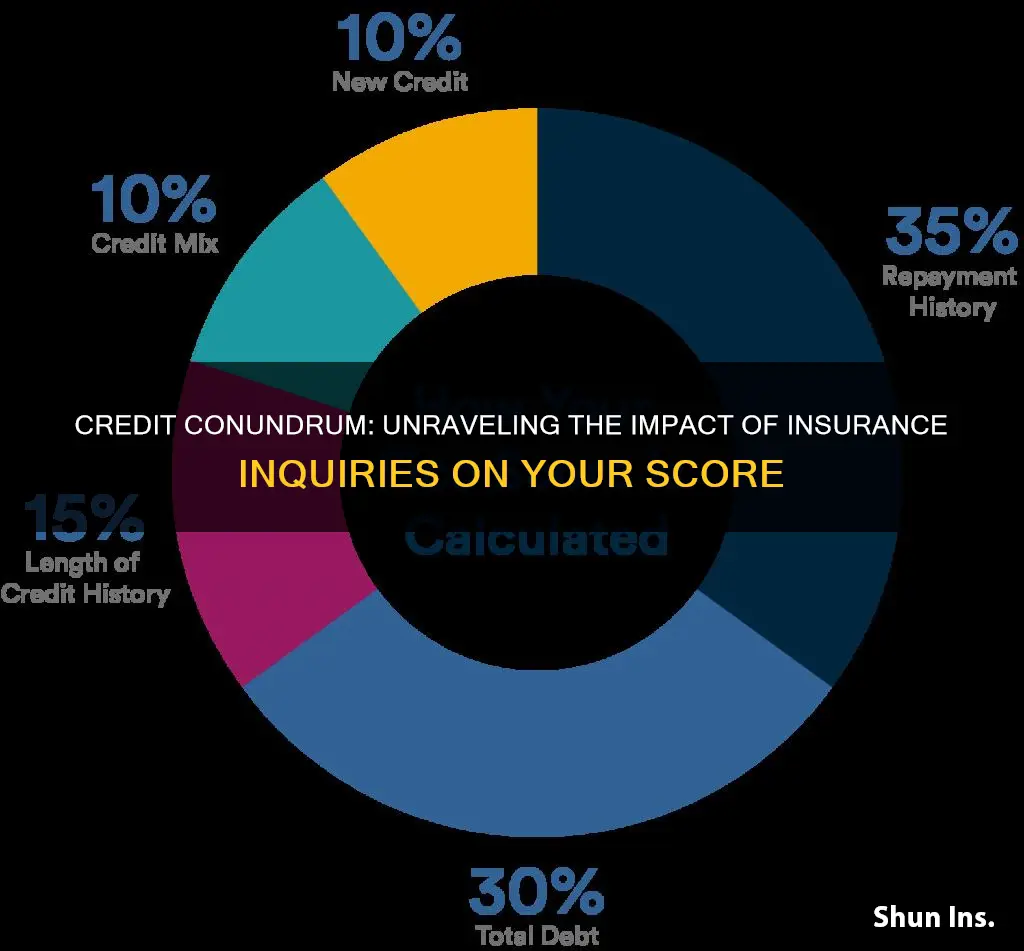

Credit scores are a key factor in determining insurance premiums and rates. While insurance companies do not use the same credit scores as lenders, they consider credit-based insurance scores, which are designed to predict the likelihood of future insurance claims. These scores are calculated using information from credit reports, including payment history, credit history length, and credit card balances.

The Impact of Credit Scores on Insurance Rates

A higher credit score generally leads to lower insurance rates, as it indicates lower risk to the insurer. Poor credit can significantly increase insurance rates, sometimes even more than a DUI. On average, drivers with poor credit pay 61% higher rates than those with good credit. However, the impact varies across states and insurance companies.

How Insurance Quotes Affect Credit Scores

Getting insurance quotes does not negatively impact credit scores. Insurance companies typically perform a "soft pull" or "soft inquiry" on an individual's credit report when providing a quote. This type of inquiry is not visible to lenders and has no effect on credit scores. Individuals can obtain as many quotes as they want without consequences for their credit score.

Credit-Based Insurance Scores vs Regular Credit Scores

Credit-based insurance scores differ from regular credit scores, such as VantageScore or FICO scores, in their weighting of factors. While credit scores estimate the likelihood of repaying debts, credit-based insurance scores focus on predicting the likelihood of filing an insurance claim. Factors such as payment history, outstanding debt, and credit history length are considered but may be weighted differently.

Improving Credit Scores to Reduce Insurance Costs

Improving credit scores can help individuals obtain lower insurance rates. Maintaining a good credit history, making timely payments, reducing credit card balances, and limiting hard credit inquiries are effective strategies for improving credit scores and, consequently, reducing insurance costs.

In summary, credit scores play a significant role in insurance claims and rates. Insurance companies use credit-based insurance scores to assess the risk of future claims, and higher credit scores generally lead to lower insurance costs. Individuals can proactively manage their credit scores to optimize their insurance premiums.

The Intricacies of Insurance Endorsements: Unraveling the Added Layer of Protection

You may want to see also

Improving your credit score

- Pay your bills on time: Paying your bills on time, including telco and utility bills, is one of the most significant factors in improving your credit score. Late or missed payments can negatively impact your score and remain on your record for several years. Setting up automatic payments or payment reminders can help ensure you don't miss any due dates.

- Review your credit report for errors: Check your credit reports from different credit bureaus for any inaccuracies or incorrect information. If you find any errors, dispute them with the credit bureau and your lender. This can help remove negative marks from your credit history.

- Reduce your credit utilisation: Keep your credit card balances low, preferably below 30% of your credit limit. Paying off your credit card debt and maintaining low balances show financial discipline and responsibility. It's also beneficial to pay off your credit card debt rather than moving it around to different accounts.

- Avoid unnecessary credit inquiries: Every time you apply for new credit, a hard inquiry is recorded on your credit report, which can lead to a temporary drop in your credit score. Limit your credit applications, especially within a short period, as it may flag you as a credit risk to lenders.

- Maintain a mix of credit accounts: Lenders view a diverse range of credit accounts, such as credit cards, student loans, and mortgages, positively. It demonstrates your understanding of credit fundamentals and ability to manage different types of credit responsibly.

- Keep old accounts open: Avoid closing old credit accounts, even if you no longer use them. Keeping old accounts open helps maintain the length of your credit history, which is a positive factor in calculating your credit score.

- Build a long credit history: Establishing a long credit history takes time and consistency. Start by making timely payments on any existing credit accounts. If you're new to credit, consider options like secured credit cards, student credit cards, or becoming an authorised user on a family member's account.

- Pay down your debts: Demonstrate your ability to manage debt by making regular payments and reducing your overall debt. Focus on paying off credit cards and other high-interest debts first while maintaining minimum payments on other accounts.

- Increase your credit limit: If you've been using your credit responsibly, consider requesting a credit limit increase from your bank. This can help lower your credit utilisation rate and improve your score.

- Consolidate your debt: Consider consolidating multiple credit card debts with a term loan. This can help you pay off your credit card balances, reduce your credit utilisation to 0%, and improve your payment history by making timely loan payments.

- Monitor your credit score: Keep track of your credit score and credit reports from different bureaus. This allows you to identify areas for improvement and take corrective actions to raise your score.

Understanding Insurance Policy Changes: Do You Need to Inform the DMV?

You may want to see also

Frequently asked questions

No, getting an insurance quote does not affect your credit score. This is because insurance companies use a type of inquiry called a "soft pull", which does not show up to lenders. You can get as many inquiries as you want without negative consequences for your credit score.

A soft pull is a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit report, but they are not visible to lenders. A hard pull, on the other hand, is a credit check that will appear on your credit report and may affect your credit score.

Insurance companies check your credit score to gauge the risk they are taking to insure you. Studies have shown that people with lower credit scores tend to file more claims, while those with higher credit scores are less likely to do so.