Auto insurance rates typically decrease as you get older, and age 25 is often considered a milestone for lower premiums. This is because younger drivers are statistically more likely to cause accidents and file insurance claims, so insurance companies charge higher premiums to mitigate this risk. However, turning 25 does not guarantee an immediate discount, as insurance providers consider various factors when determining rates, such as driving experience, claims history, marital status, location, vehicle type, and credit history. While age is a significant factor, it is important to understand that other aspects, like driving experience and records, also play a vital role in determining insurance rates.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance for a 25-year-old | $3,207 |

| Average annual cost of car insurance for a 25-year-old (male) | $1,402 |

| Average annual cost of car insurance for a 25-year-old (female) | $1,377 |

| Average annual cost of car insurance for a 25-year-old (male) with full coverage | $2,176 |

| Average annual cost of car insurance for a 25-year-old (male) with minimum coverage | $654 |

| Average decrease in car insurance rates when you turn 25 | 9-11% |

| Average decrease in car insurance rates for males when they turn 25 | 12% |

| Average decrease in car insurance rates for females when they turn 25 | 9% |

What You'll Learn

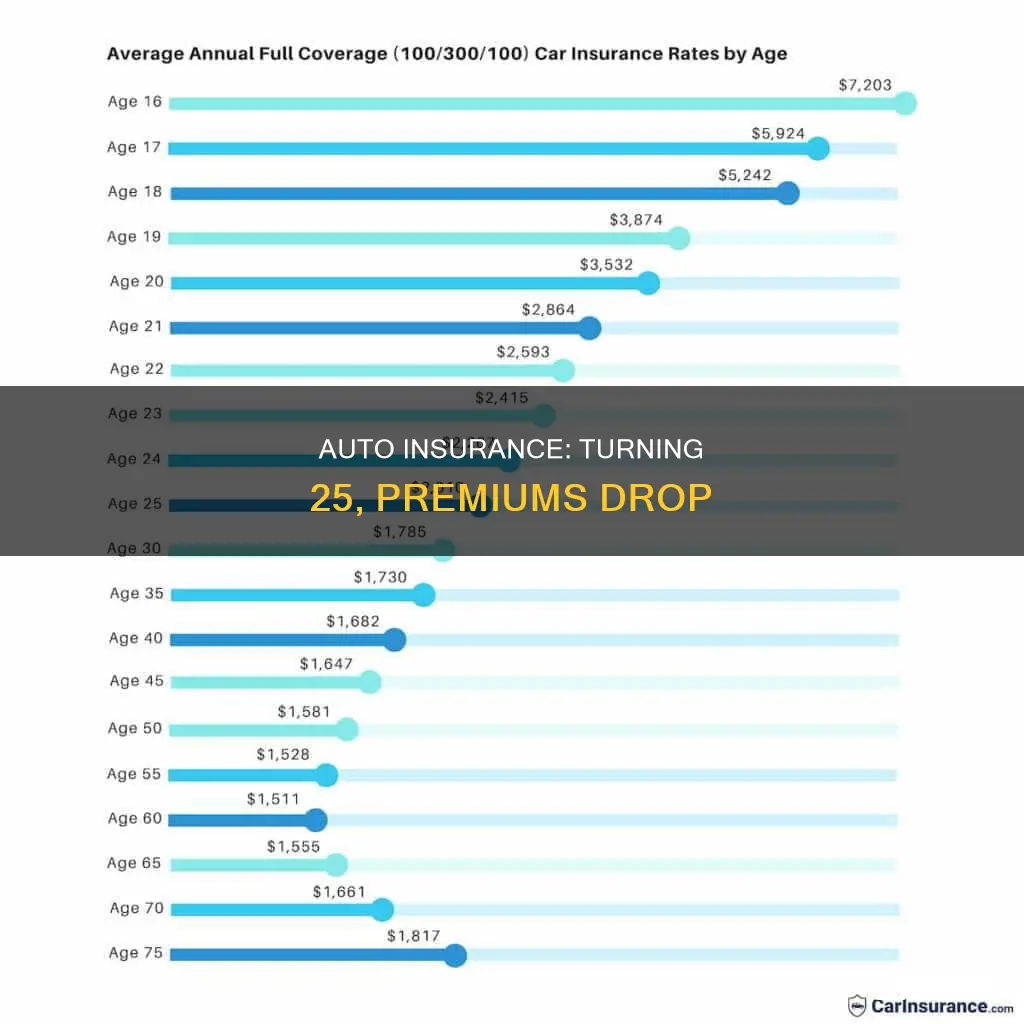

- Auto insurance rates decrease annually for drivers aged 16-24

- Premiums are highest for teen drivers and decrease as they get older

- Premiums are lowest for drivers aged 35-55

- Premiums are based on risk factors, including age, gender, marital status, vehicle type, driving record, and credit history

- There are ways to lower your auto insurance costs, such as taking a defensive driving course or improving your credit score

Auto insurance rates decrease annually for drivers aged 16-24

However, age is just one of many factors that insurance companies use to calculate rates. For example, Progressive reports that rates drop by 9% on average at age 25, but if you have been in an accident or have a poor credit history, your rate may not drop. Similarly, if you are a new driver at 25 and only bought insurance for the first time, you will pay more than a driver who has been driving since they were 16.

Insurance providers also consider marital status, where you live, vehicle type, driving record, annual mileage, and credit history when determining rates.

While auto insurance rates do decrease annually for drivers aged 16-24, the most significant decreases occur at ages 19 and 21.

Equity vs. Gap Insurance: What Car Owners Need to Know

You may want to see also

Premiums are highest for teen drivers and decrease as they get older

The cost of car insurance for teens is extremely high. For this reason, it is usually more affordable to add a teen driver to an existing policy than to have them get their own policy. Rates for teen drivers decrease as they get older, with the biggest drop occurring between the ages of 18 and 19. This is because, as drivers gain experience, they become less likely to file insurance claims.

By the time drivers reach their mid-20s, their insurance rates have decreased significantly. On average, a 25-year-old driver pays $766 less per year than a 21-year-old. However, turning 25 does not automatically result in lower insurance rates. Insurance providers consider several factors when determining rates, including marital status, location, vehicle type, driving record, annual mileage, and credit history.

Auto Insurance in NJ: How Much?

You may want to see also

Premiums are lowest for drivers aged 35-55

Auto insurance rates are determined by a variety of factors, including age, gender, driving experience, and location. While rates can vary depending on these factors, it is generally observed that premiums are lowest for drivers aged 35–55. This is because insurance companies consider middle-aged drivers to be lower-risk compared to younger or older drivers.

Drivers in their teens and twenties are considered higher-risk due to their lack of experience and higher statistical likelihood of accidents. As a result, insurance companies charge higher premiums to younger drivers to mitigate this risk. However, as drivers mature and gain experience, their premiums tend to decrease. This is reflected in the data, which shows that rates gradually decrease from ages 19 to 34 and then stabilize or slightly decrease from ages 34 to 75.

Several sources indicate that insurance rates are most favourable for drivers aged 35 to 55. During these years, drivers have accumulated significant driving experience and are less likely to engage in risky behaviours on the road. Additionally, physical, cognitive, and visual abilities tend to be at their peak during these ages, contributing to safer driving.

It is important to note that age is not the sole factor influencing insurance rates. Other considerations, such as driving record, vehicle type, and location, also play a significant role. Nonetheless, age is a critical aspect, and the data consistently shows that premiums are most affordable for those in the 35–55 age bracket.

Transferring Car Insurance: MD to Other States

You may want to see also

Premiums are based on risk factors, including age, gender, marital status, vehicle type, driving record, and credit history

Auto insurance premiums are based on several risk factors, and age is just one of them. While auto insurance rates tend to decrease as you get older, there are other factors that can impact the cost of your insurance. Here are some key risk factors that affect your premiums:

Age

Younger and inexperienced drivers are considered high-risk and tend to pay higher insurance rates. This is because they are more likely to be involved in car accidents and commit traffic violations. According to the Insurance Institute for Highway Safety, drivers between the ages of 16 and 19 are three times more likely to be in a fatal crash than drivers over 20. As drivers age and gain more experience, their insurance rates usually decrease. However, rates may start to increase again for drivers over 70 due to age-related impairments that can affect driving ability.

Gender

In most states, gender is also a factor in determining insurance rates. Women typically pay less for auto insurance than men because they are statistically less likely to be involved in accidents or commit serious driving violations, and they are more likely to wear seatbelts. However, some states have prohibited the use of gender as a factor in setting insurance rates to address concerns of discrimination.

Marital Status

Married policyholders often pay lower premiums than single people. This is because married couples are generally older and more experienced drivers. Additionally, insurance companies predict that married couples with children will drive more safely. However, if one spouse has a poor driving record or bad credit, it could lead to higher premiums for both partners.

Vehicle Type

The type of vehicle you drive also affects your insurance rates. Insurance companies rate different car models based on factors such as the likelihood of theft, safety features, and repair costs. For example, a flashy sports car with high-end features will typically be more expensive to insure than a standard SUV. Electric cars may also be more costly to insure due to higher repair costs.

Driving Record

Your driving history is one of the most significant factors in determining your insurance rates. If you have a history of accidents, traffic violations, or DUI convictions, you will likely pay more for insurance. A clean driving record, on the other hand, can help lower your premiums. Most driving infractions remain on your record for about three years, but more serious violations like a DUI may affect your rates for longer.

Credit History

In most states, your credit history is also considered when setting insurance rates. Auto insurance companies may use a credit-based insurance score to assess your risk as a driver. A poor credit history can lead to higher insurance rates, while a good credit score may result in lower premiums. However, some states have banned or restricted the use of credit history in determining insurance rates.

Kansas Gap Insurance: Taxed?

You may want to see also

There are ways to lower your auto insurance costs, such as taking a defensive driving course or improving your credit score

Auto insurance costs are typically lower for drivers over 25 than for those under 25. This is because younger drivers are statistically more likely to cause accidents and file insurance claims. However, age is just one of many factors that insurance companies consider when determining rates. For example, insurance providers also take into account your marital status, location, vehicle type, driving record, annual mileage, and credit history.

There are ways to lower your auto insurance costs. Here are some strategies to consider:

Take a defensive driving course

Defensive driving courses teach drivers how to anticipate and respond to hazards and potential risks on the road. Completing such a course can lead to a discount on your insurance premium. Check with your insurance provider to see if they offer this option.

Improve your credit score

Insurance companies may calculate a credit-based insurance score based on your credit profile. A higher credit score can lead to lower insurance rates, as it is correlated with making responsible decisions. You can improve your credit score by paying your bills on time, keeping your credit balances low, and regularly reviewing your credit report to address any errors.

Shop around for a better rate

Rates can vary significantly between insurance providers, so it's worth getting quotes from multiple companies. Remember that each insurer weighs factors differently, and some offer unique discounts. Comparing rates can help you find a more affordable option.

Adjust your coverage and deductibles

Review your policy to identify any optional coverage that you may not need. Additionally, consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. By doing so, you can lower your monthly premiums. Just make sure you have enough savings to cover the higher deductible in case of an accident.

Bundle your insurance policies

Many insurance companies offer discounts if you purchase multiple types of insurance from them, such as bundling your auto insurance with homeowners or renters insurance. You may also get a reduction if you insure more than one vehicle with the same company.

Gap Insurance: Essential Protection for Car Owners

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to decrease when you turn 25. This is because drivers under 25 are statistically more likely to get into an accident than older drivers. However, this is not a guarantee, as insurance companies take various factors into account when setting rates.

The decrease in auto insurance rates when you turn 25 varies depending on the company. On average, rates drop by about 9% to 11%.

Yes, other factors that can impact auto insurance rates include your driving record, marital status, vehicle type, credit history, and where you live.

To get cheaper auto insurance as a 25-year-old, you can shop around for a better rate, adjust your coverage and deductibles, bundle your auto insurance with other policies, or take a defensive driving course.