Car insurance rates are influenced by a variety of factors, including age, gender, driving history, and location. While age is not the sole determinant of insurance costs, it does play a significant role. Younger drivers, especially those below 25 years old, tend to pay higher insurance premiums due to their lack of driving experience and higher risk of accidents. As drivers reach their mid-to-late 20s and early 30s, insurance rates often decrease as a result of increased driving experience and improved decision-making skills. This trend continues until around age 60, when insurance rates may start to rise again due to age-related physical changes that can impact driving abilities. However, it's important to note that insurance companies may have different age thresholds for offering lower rates, and comparing rates from multiple providers can help identify the most cost-effective options.

| Characteristics | Values |

|---|---|

| Insurance costs | Decrease after age 30 |

| Insurance costs for men | Decrease significantly by age 21 |

| Insurance costs for women | Decrease significantly by age 21 |

| Insurance costs for men vs women | Women typically pay less than men until age 30 |

| Insurance costs for new drivers | Decrease after five years of driving experience |

| Insurance costs for married couples | Married couples pay less than single people |

| Insurance costs for married couples vs single people | Married drivers can pay up to 50% less than single people |

| Insurance costs for older drivers | Increase after age 60 |

| Insurance costs for older drivers | Increase after age 65 |

What You'll Learn

Car insurance rates for women vs. men

While car insurance rates do tend to decrease as people get older, this is not always the case. For instance, rates can vary depending on factors such as gender, location, and driving history.

Women tend to pay less for car insurance than men. This is because men are generally considered to be riskier to insure. They are more likely to speed, drive under the influence of alcohol, and not wear seat belts. Men also tend to drive more miles than women and are more likely to own cars that are considered high risk, such as sports cars.

The gender gap in car insurance rates is most pronounced among young drivers. Men under 20 pay around 14% more per year for car insurance than women of the same age. Between the ages of 20 and 24, male drivers pay about 8% more than their female counterparts. After age 30, the difference in rates between men and women becomes less significant, with men paying only slightly more or less than women, depending on their age.

However, it is important to note that some states in the US do not allow gender to be a factor in determining insurance rates. These states include Hawaii, Massachusetts, Pennsylvania, North Carolina, California, and Montana.

The Hidden Costs of a Heart Attack: Unraveling the Financial Toll Without Insurance

You may want to see also

Insurance rates for married people

Insurance rates are typically cheaper for married people than for single people. This is because insurance companies view married people as more financially stable and safer drivers who are less likely to get into accidents or file claims. Married drivers are also more likely to own a home and qualify for multi-driver discounts.

According to a 2015 study by the Consumer Federation of America (CFA), premiums for single, divorced, and separated drivers were usually higher than for married people with similar driving records. The study also found that two-thirds of the companies increased rates for widows by about 20%.

Married couples can benefit from various discounts, such as multi-car and multi-policy discounts, which can further reduce their insurance rates. However, it is important to note that insurance rates are based on various factors, including age, gender, driving record, credit score, and vehicle type. Therefore, it is essential to compare rates from different insurance companies to find the best option for your specific situation.

While insurance rates generally become more affordable after the age of 30, it is worth noting that rates can vary significantly depending on individual circumstances and the insurance company. It is always a good idea to shop around and compare rates to ensure you are getting the best deal.

The Legal Definition of Common Carrier and Its Impact on Insurance Policies

You may want to see also

How to save money on insurance at 30

Turning 30 is a milestone in many ways, and it's also good news when it comes to insurance costs. Car insurance premiums are at their lowest for 30-year-olds as they are considered experienced and safer drivers. Here are some ways to save money on insurance at 30:

Shop Around and Compare Quotes

The insurance company that offered you the lowest rate in your 20s might not be the best option for you now. Compare quotes from different insurance providers to find the most suitable deal for your circumstances. By shopping around, you can save a significant amount of money.

Ask for Discounts

Insurance companies offer a wide range of discounts, and it is worth asking about these to lower your premium. You can get discounts for being a member of groups like AAA, having a certain occupation, or being a student with good grades. Other discounts may include having safety features in your vehicle, parking indoors, or completing a driver's safety course.

Review Your Coverage

Review your insurance policy to ensure it is up-to-date and reflects your current circumstances. For example, if you have an old car that is paid off, you might want to adjust your collision coverage. If you are working from home, inform your insurance company, as they may offer a pay-per-mile policy that could save you money.

Increase Your Deductible

Your deductible is the amount you pay before your insurance coverage kicks in. By choosing a higher deductible, you can significantly lower your insurance premium. However, remember that this means you will have to pay more out-of-pocket if you need to make a claim.

Bundle Your Policies

If you have multiple insurance policies, such as for your car and home, consider bundling them with the same provider. Insurance companies often offer discounts when you have multiple policies with them, and it can also reduce the amount of paperwork and administration for you.

Improve Your Driving Record

Insurance companies favour safer drivers, so maintaining a good driving record is essential for keeping costs down. Follow the rules of the road, pay attention, and avoid traffic violations. Taking a defensive driving course can also help you save on your insurance.

Choose Your Vehicle Wisely

When buying a car, consider the insurance costs associated with different vehicles. Newer cars are often more expensive to insure due to higher repair and replacement costs. Opting for a used vehicle that is a few years old can help keep your insurance premiums lower.

Pay Attention to Payment Methods

Insurance companies often offer discounts if you pay your premiums annually instead of monthly. You can also set up automatic payments and go paperless, which can lead to further savings. Additionally, paying your premiums early can help you avoid late fees.

Monitor Your Mileage

If you drive less than a certain number of miles per year, you may be eligible for a lower premium. Insurance companies take annual mileage into account when calculating your rates, so be sure to report any changes in your driving habits, such as working from home or a shorter commute.

Switch Insurance Companies

If you find a better deal with another insurance company, don't be afraid to switch. Your current company may be willing to price-match to keep your business, and they may even offer you a loyalty discount. It is worth reviewing your options periodically to ensure you are getting the best value.

Get an Independent Insurance Agent

To make comparing policies and premiums easier, consider consulting an independent insurance agent. They can shop around on your behalf and help you find the best deal from a range of insurance companies, including smaller providers that you might not have considered.

Review Life Changes

Finally, remember to review your insurance coverage whenever you go through a significant life change, such as getting married, moving to a new area, changing jobs, or adding a teen driver to your policy. These events can impact your insurance needs and costs, so it's important to keep your policy up-to-date.

Adjusting Insurance Due Dates: A Guide to Policy Date Changes

You may want to see also

Insurance rates for new drivers at 30

Insurance rates for new drivers who are 30 vary depending on several factors, including gender, driving history, location, and the insurance company. Here is an overview of what new drivers at 30 can expect in terms of insurance rates:

Factors Affecting Insurance Rates

- Age and Experience: Age is a significant factor in determining insurance rates, with younger drivers typically paying more than older drivers. New drivers in their 30s will likely pay lower rates than teenage or early 20s drivers due to their increased age and potentially more driving experience.

- Gender: In some states, gender may also influence insurance rates, with men generally paying slightly more than women, especially at younger ages.

- Driving Record: A clean driving record will help lower insurance rates. Accidents, traffic violations, or DUI episodes will likely result in higher premiums.

- Vehicle Type: The type of vehicle you drive can also impact your insurance rates. Sports cars or high-priced vehicles often carry higher insurance premiums than more standard cars.

- Location: Insurance rates can vary significantly from state to state and even between cities within the same state.

Insurance Company Options for New Drivers at 30

- State Farm: State Farm is often recommended as the best option for new drivers over 25, offering reliable customer service and affordable rates. Their full-coverage insurance for new drivers over 25 costs around $117 per month.

- Allstate: Allstate provides the most affordable liability-only insurance for new drivers of all ages, with rates as low as $33 per month for minimum coverage.

- Geico: Geico is known for its excellent online experience and competitive rates. They are a good option for adding a new driver to an existing policy, with average monthly rates of $118 for full coverage.

- USAA: USAA offers competitive rates, especially for military members, veterans, and their families. However, their coverage is limited to this specific group.

- Travelers: Travelers insurance has some of the cheapest rates for drivers under 25, with an average monthly cost of $273 for full coverage.

Ways to Save on Insurance as a New Driver at 30

- Compare Quotes: Shop around and compare quotes from multiple insurance companies to find the best rates.

- Join a Family Policy: If possible, consider joining a family policy, as this can significantly reduce your insurance costs.

- Look for Discounts: Ask about discounts for good students, defensive driving courses, or bundling policies (e.g., homeowners and auto insurance).

- Choose Higher Deductibles: Opting for a higher deductible can lower your monthly premiums, but be prepared to pay more out of pocket if you file a claim.

- Usage-Based Insurance: Consider usage-based insurance, where your rates are set based on your actual driving behaviour and mileage. This can be a cost-effective option for safe drivers.

The Importance of Term Insurance for Wives: Securing a Family's Future

You may want to see also

How insurance rates change over time

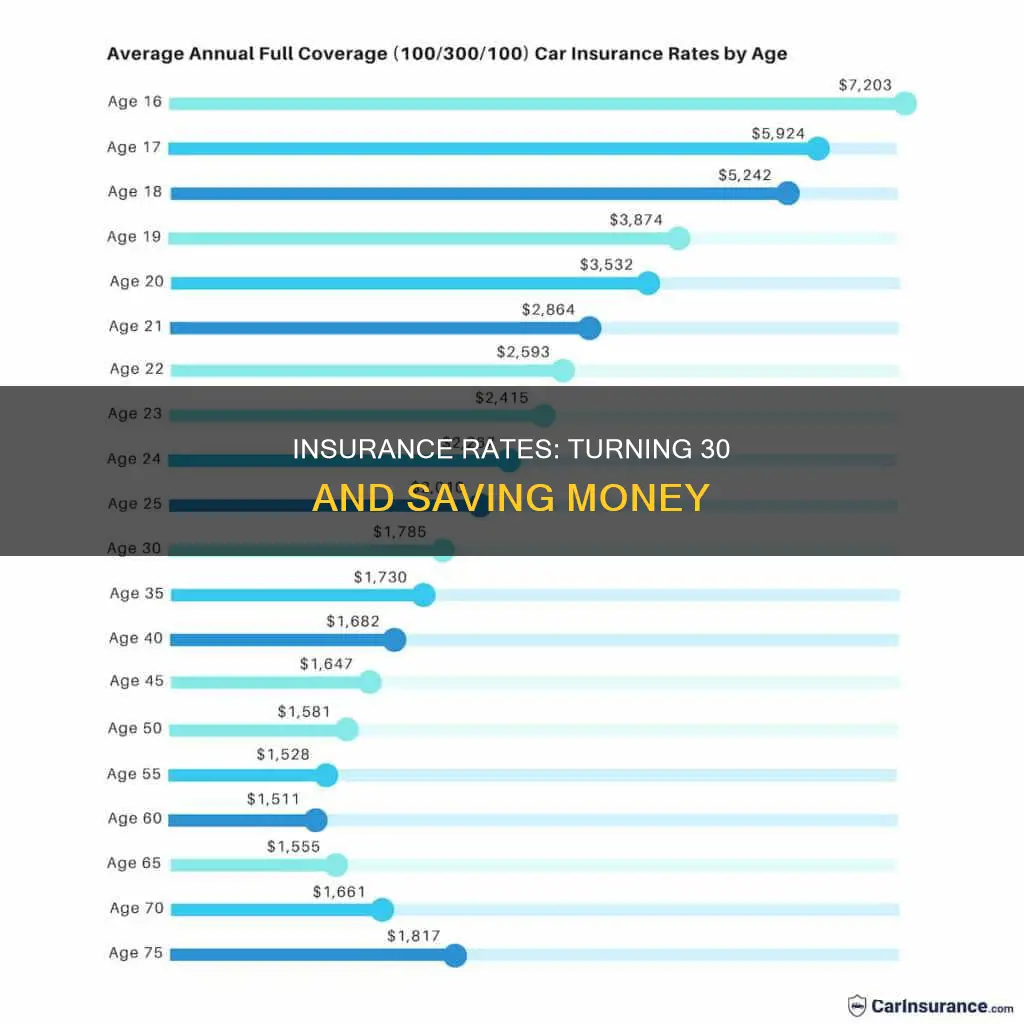

Age is one of the most important factors in determining insurance rates. The younger a person is, the more they will pay for insurance. This is because younger drivers are less experienced and more likely to get into accidents. For example, drivers under the age of 25 tend to pay the highest insurance rates. A 16-year-old driver pays around $613 for full coverage insurance, while a 25-year-old pays $552. This drops down to $158 for 60-year-olds, but rates begin to increase again after age 60 as physical ailments become more common and can make driving more dangerous.

Insurance rates for new drivers tend to decrease after five years, with the most significant drop occurring at age 25. This is because a person is considered more mature at this age, with better decision-making skills and more careful driving habits. The rates then continue to decrease gradually until the driver turns 65. At this point, the physical effects of aging start to impact driving ability, and insurance rates begin to rise slowly.

It's worth noting that gender also plays a role in insurance rates. Men tend to pay more than women, especially at younger ages, due to their higher likelihood of speeding, getting into accidents, and engaging in reckless driving. However, rates for women may increase after the age of 30, as they are more likely to be driving with children, which can lead to distractions.

In addition to age and gender, other factors influencing insurance rates include marital status, the number of drivers on a policy, driving history, credit history, location, vehicle type, and coverage level. Comparing rates from different insurance companies and taking advantage of discounts can help drivers find the best rates.

The Intriguing World of Insurance Billing: Unraveling Trade Secret Mysteries

You may want to see also

Frequently asked questions

Yes, insurance costs tend to decrease for those over 30, as they are considered more experienced and less risky drivers.

Aside from age, insurance costs can be influenced by gender, marital status, driving history, location, vehicle type, and coverage level.

The cost of insurance can vary significantly, but on average, rates tend to decrease by 16-17% each year for those in their 30s.

Yes, maintaining a clean driving record, comparing rates from different providers, and taking advantage of discounts can help reduce insurance costs.

Insurance costs tend to continue decreasing through the 30s and 40s, with some companies offering lower premiums to attract older drivers. However, rates may start increasing again after 60 due to age-related physical changes that can impact driving ability.