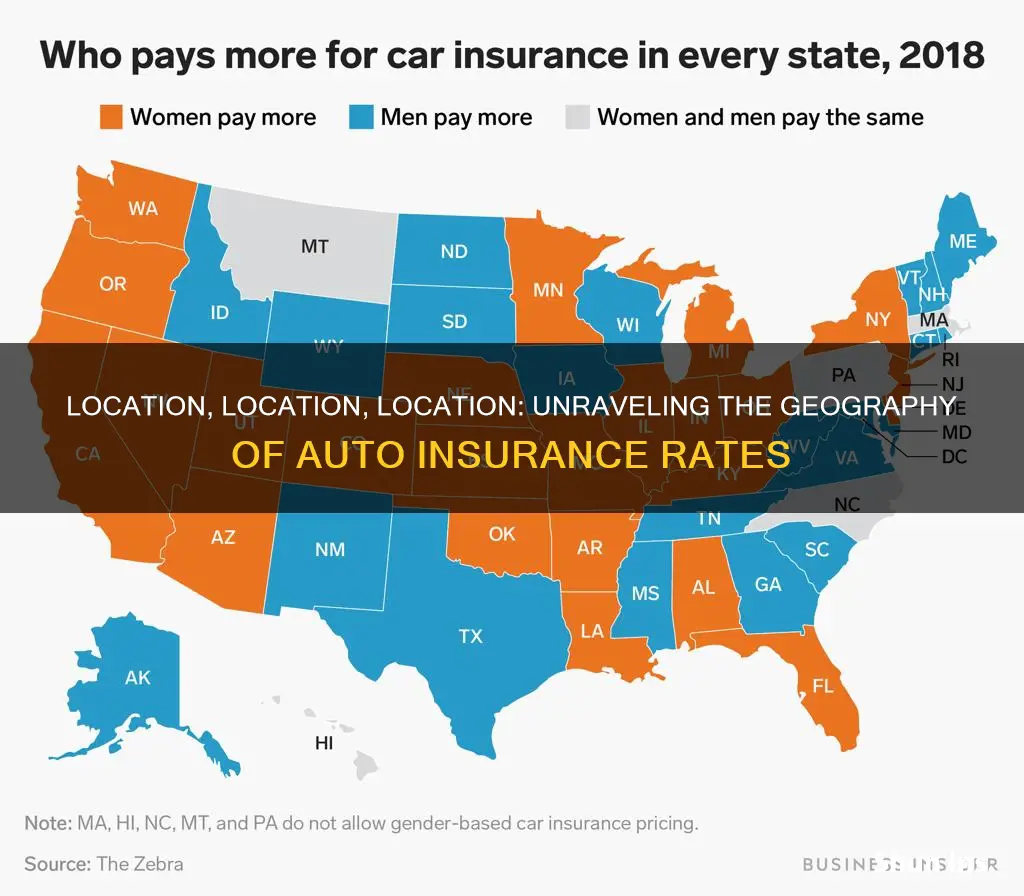

Auto insurance rates are influenced by a variety of factors, including age, credit score, driving record, and marital status. One of the most significant factors is your location. Your place of residence impacts your insurance premium because insurance companies examine data to determine the likelihood of claims being filed in your area. This includes both accidents and incidents of vandalism or theft. As a result, individuals living in urban areas tend to pay higher premiums due to the increased risk of accidents and theft. However, it's not just about rural versus urban; insurance companies also consider specific location-related risks, such as weather conditions, road design, and crime rates.

| Characteristics | Values |

|---|---|

| Type of location | Urban, rural, city, neighborhood, state, country |

| Population density | Higher population density means a higher chance of accidents |

| Crime rates | Higher crime rates mean more theft and vandalism claims |

| Weather | Heavy rain, hail, snow, flooding, and natural disasters can increase the chance of accidents and damage |

| Road conditions | Poorly maintained roads and dangerous intersections increase the likelihood of accidents |

| Traffic patterns | More cars and intersections increase the risk of collisions |

| Fire services | Longer response times can lead to more damage and higher premiums |

| Sewage systems | Older areas with inadequate sewage systems have a higher risk of sewer backup |

| Proximity to other buildings | Closer proximity increases the risk of fire spreading |

| Proximity to bodies of water | Living near water can increase the risk of flooding |

| Regulatory differences | Provincial or state regulations can impact insurance rates |

| Minimum insurance requirements | States with higher minimum coverage requirements tend to have higher premiums |

| Unemployment rates | High unemployment can lead to more uninsured drivers |

| Legal climate | States with higher damage awards or more lawyers per capita can affect rates |

Population density

The impact of population density on insurance rates is evident when comparing states. For example, New York, California, and Delaware have higher insurance premiums because of their dense populations and the sheer number of cars on the road, making accidents more likely. In contrast, states with lower populations, such as Idaho and North Dakota, tend to have cheaper insurance rates as there are fewer accidents and payouts for insurance companies.

Even within the same city, zip codes can play a role in insurance rates. Moving to a different zip code within the same city can result in varying insurance rates due to factors such as traffic volume, accident frequency, and population density.

Additionally, the duration of your commute is also influenced by your location. A longer commute means spending more time on the road, increasing the likelihood of being involved in a collision. Consequently, your insurance rates may be higher even if you relocate to an area with better driving conditions.

In summary, population density is a critical factor considered by insurance companies when determining auto insurance rates. Higher population densities often lead to higher insurance rates due to the increased risk of accidents, collisions, and claims.

Does BECU Offer Auto Insurance? Here's What You Need to Know

You may want to see also

Weather conditions

Comprehensive auto insurance covers damage to your vehicle caused by non-crash-related incidents, including weather events. This type of insurance is especially important if you live in an area prone to extreme weather conditions such as floods, hurricanes, tornados, earthquakes, and hailstorms. In such cases, comprehensive coverage can help protect you financially by covering repairs or replacements for weather-related damages.

For example, consider an area that experiences frequent hailstorms. The cost of repairing vehicles damaged by hail can be substantial, and insurance companies may need to pay out large sums to multiple policyholders. To offset these potential costs, insurance providers will often quote higher premiums in areas known for extreme weather conditions.

Seasonal weather conditions can also impact insurance rates. If you reside in a region with snowy winters and icy roads, you are more likely to pay higher insurance rates. This is because harsh weather increases the chances of accidents and vehicle damage. Similarly, if you live in an area with frequent wildfires, your insurance rates may reflect the increased risk of fire-related car damage.

It is worth noting that weather-related claims on comprehensive insurance typically do not affect your rates. The number of claims, rather than the cause, influences the cost. However, a surge in claims due to weather events can lead to an increase in premiums across the board as insurance companies try to compensate for their losses.

Understanding Your Auto Insurance Policy

You may want to see also

Crime rates

Insurers use your address to obtain crime reports from local police to assess the risk. Areas with a high volume of break-ins, vandalism, and theft are more likely to have higher insurance rates. This is because the chances of car break-ins, vandalism, or theft are higher in these areas.

The type of locality, whether it is a city or a rural area, also plays a role in determining insurance rates. People in cities often pay higher insurance premiums than those in rural areas. This is because car theft and vandalism are more common in cities, and the likelihood of filing a claim is higher. However, this is not always the case, as some rural states, such as Montana, have higher insurance rates due to other factors, such as long travelling distances and a higher percentage of uninsured drivers.

Insurers also consider the frequency of claims in a particular area. If a neighbourhood files a lot of auto insurance claims, insurers may designate it as high risk and quote higher premiums. This is to offset their potential costs. Areas with high unemployment rates may also have higher insurance rates, as people may forgo car insurance due to budget constraints, resulting in higher rates for other policyholders in the same area.

To summarise, crime rates significantly impact auto insurance rates. Insurers consider the crime rate of an area, the type of locality, the frequency of claims, and other factors to assess the risk of theft or vandalism and determine the insurance premium.

Auto Owners Insurance Grace Period: What You Need to Know

You may want to see also

Road conditions

Insurers also take into account the presence of hazardous intersections or stretches of road with a history of accidents. These areas often have higher insurance rates due to the increased potential for collisions and subsequent claims. Well-maintained roads with safety features, such as guardrails, speed bumps, or traffic calming measures, can help mitigate these risks and potentially lower insurance premiums.

Additionally, the design and layout of roads can influence insurance rates. For example, roads with multiple lanes, clear line markings, and well-designed junctions can improve traffic flow and reduce the chances of accidents. Conversely, narrow roads with blind spots or inadequate turning lanes can increase the risk of collisions, leading to higher insurance costs.

Furthermore, the presence of road construction or roadworks can also impact insurance rates. Temporary changes in road conditions due to construction can increase the risk of accidents, especially if detours or lane closures are in place. Insurers may factor in these temporary conditions when assessing the overall risk associated with a particular area, which can influence insurance premiums.

Insurance: No License, No Problem?

You may want to see also

Traffic patterns

In densely populated urban areas, the chances of vehicle collisions are generally higher due to increased traffic congestion. As a result, insurance providers often quote higher premiums in these locations to offset potential costs. On the other hand, rural areas with lower traffic volumes may experience reduced rates, as the chances of accidents are comparatively lower.

However, it's not just the volume of traffic that matters. The nature of driving behaviours and the frequency of claims also come into play. For instance, areas with a high number of uninsured drivers, harsh weather conditions, treacherous roads, or a high percentage of drunk drivers can contribute to higher insurance rates. These factors collectively influence the likelihood of accidents and subsequent claims, impacting insurance rates for residents in those areas.

Additionally, the type of vehicle and the purpose for which it is driven can also affect insurance rates. Driving a high-performance sports car, for instance, may result in higher insurance rates compared to a family sedan, as faster vehicles are associated with greater risk. Similarly, individuals who commute daily for work or school may face higher insurance rates compared to those who drive occasionally for leisure.

It's worth noting that insurance companies may also consider your driving history and age when calculating premiums. Younger and less experienced drivers are often deemed higher-risk, and traffic violations can significantly impact their insurance costs. Conversely, maintaining a clean driving record can help mitigate these effects, as insurers may view violations as aberrations rather than patterns of risky behaviour.

Auto Insurance: Natural Disaster Coverage?

You may want to see also

Frequently asked questions

Yes, your location is one of the many variables that can lower or raise your car insurance premiums. Insurance companies calculate your likelihood of an auto accident based on the county or state in which you live.

Insurance companies examine data that determines which areas residents are most likely to file claims. These types of claims fall into two categories: claims arising from an auto accident and claims resulting from vandalism or theft of your vehicle.

People in urban areas typically pay more for their car insurance than those in rural areas. This is because there are more cars in urban areas, leading to a higher chance of accidents. Additionally, individuals who live in states with a high rate of uninsured or underinsured drivers may see higher premiums.