Private insurance companies use Current Procedural Terminology (CPT) codes to identify the service provided by a healthcare professional. CPT codes are distinct from ICD-10 codes, which are used to describe a medical diagnosis. While dietitians cannot make medical diagnoses, they can use ICD-10 codes on CMS 1500 forms, referrals, and superbills. CPT codes commonly used by dietitians include 97802 (initial assessment), 97803 (follow-up visit), and 97804 (group visit). These codes are recognised by most health insurance companies and are billed based on the number of units spent face-to-face with the patient.

| Characteristics | Values |

|---|---|

| CPT codes | 97802, 97803, 97804 |

| Diagnosis codes | Z71.3, E11.___, E66.0, E66.3 |

What You'll Learn

- Private insurance companies' use of dietary codes for WCC

- The benefits of accepting health insurance in a nutrition practice

- The challenges of getting credentialed and contracted with private insurance companies

- The process of becoming an in-network provider with insurance companies

- The steps to filing a claim for reimbursement from a private insurance company

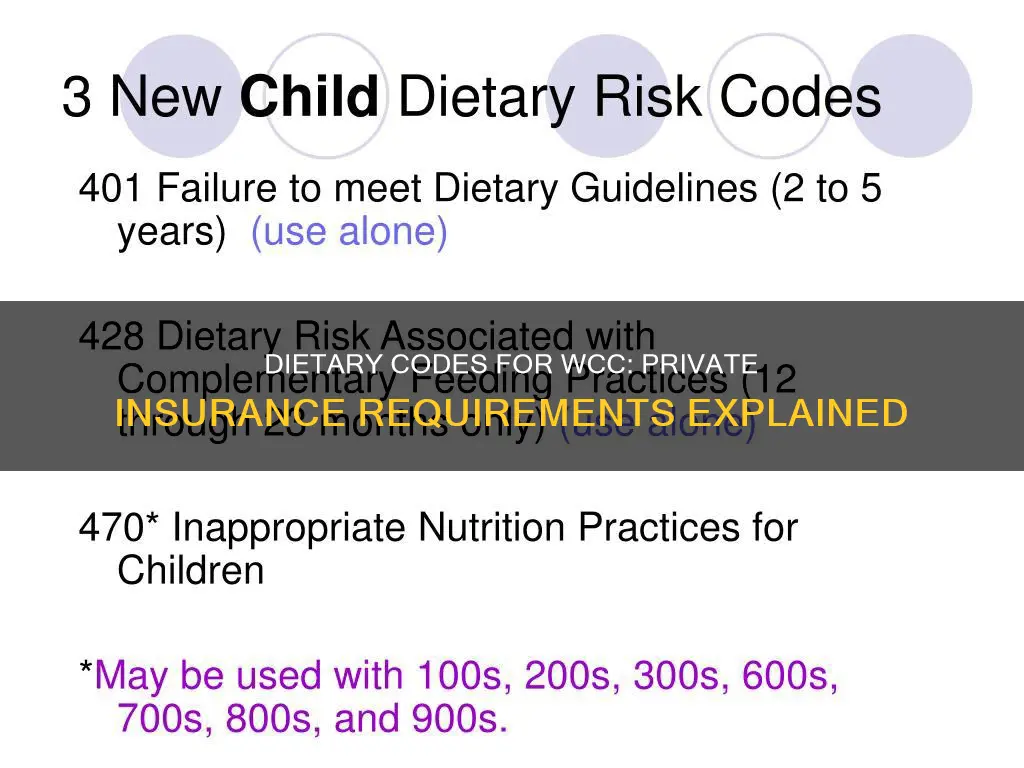

Private insurance companies' use of dietary codes for WCC

Private insurance companies use dietary codes for WCC, which stands for Well Child Care. WCC is a type of preventive care service that is typically covered by insurance plans. The use of dietary codes for WCC helps to identify the specific services provided and ensures proper reimbursement from insurance companies.

In the context of dietary counselling and medical nutrition therapy (MNT), there are several CPT (Current Procedural Terminology) codes that are commonly used by dietitians when billing insurance companies. These codes include:

- 97802: For an initial assessment, face-to-face, 15 minutes per unit

- 97803: For a follow-up visit or reassessment, face-to-face, 15 minutes per unit

- 97804: For a group visit (2 or more individuals), 30 minutes per unit

These CPT codes are used to describe the type of visit and the amount of time spent with the patient. The reimbursement rate for these codes may vary depending on the insurance company, but it is typically based on a per-unit basis, with each unit representing 15 minutes of service.

In addition to CPT codes, diagnosis codes based on the ICD-10 (International Classification of Diseases) are also used in insurance billing. These codes are provided by the client's doctor and are used to determine coverage eligibility and reimbursement rates. A commonly used diagnosis code for dietary counselling is Z71.3 - "Dietary counselling and surveillance".

It is important for dietitians to familiarise themselves with the billing and coding process when working with insurance companies. This includes understanding the different codes, conducting eligibility and benefits checks, and properly filing claims. By accepting insurance, dietitians can increase their client base and make their services more accessible to those who may not be able to afford care otherwise. However, it is also crucial to be aware of potential challenges, such as claim denials and varying reimbursement rates, when working with insurance companies.

Colorado Healthcare: Public vs Private Insurance Preferences

You may want to see also

The benefits of accepting health insurance in a nutrition practice

Accepting health insurance in a nutrition practice can bring several advantages. Firstly, it can help expand your client base and drive referrals. Many clients seek affordable nutritional care, and accepting insurance allows them to save on their healthcare costs. This can also lead to meeting new clients, as those looking for in-network providers in their insurance company can be directed to your practice. Furthermore, insurance can help retain clients, as they are more likely to continue attending the number of sessions covered by their plan.

Secondly, accepting insurance can alleviate financial difficulties, enabling you to work with a broader range of clients. Becoming a provider with insurance companies such as Medicare and Medicaid can help you connect with low-income or elderly clients who need nutritional care. Additionally, insurance coverage can reduce the financial burden on clients, making it more accessible for them to seek professional nutritional support.

Thirdly, insurance coverage can provide access to a wider range of services. For instance, insurance plans may cover medical nutrition therapy services, dietary counselling, and nutritional counselling for specific conditions such as diabetes, chronic kidney disease, and eating disorders. This can enhance the scope of care provided by nutrition practices.

Moreover, accepting health insurance can streamline billing processes. While there is a learning curve in understanding insurance billing and coding, many dietitians in private practice can effectively manage their own billing. Tools like Healthie can assist with insurance billing, helping to create CMS-1500 claims and superbills, which are required for insurance reimbursement.

Finally, insurance coverage can offer peace of mind to clients, removing the pressure of paying out-of-pocket expenses. This allows clients to focus on their health and well-being without the added financial stress.

Overall, accepting health insurance in a nutrition practice has the potential to increase client accessibility, improve client retention, expand service offerings, and simplify billing procedures, ultimately contributing to a more successful and inclusive practice.

Comp Insurance: Private Investigators for Hire?

You may want to see also

The challenges of getting credentialed and contracted with private insurance companies

Credentialing is a complex, time-consuming process that healthcare providers must complete to verify their education, training, and professional experience and to ensure they meet the requirements to serve as an in-network provider. It is the first step in the revenue cycle, which refers to the process of billing and reimbursement. The process can be challenging and intimidating, especially for those new to private practice. Here are some of the challenges of getting credentialed and contracted with private insurance companies:

- Time Commitment: The credentialing process is time-consuming and can take anywhere from 2 to 6 hours per application, not including follow-up. It is important to plan and set aside dedicated time for completing the applications and gathering the necessary information.

- Complexity: Credentialing requirements vary by state and company. It is essential to understand the specific requirements of each insurance company, as they often have unique sets of criteria, documentation requirements, and application procedures. Failing to meet these requirements can result in delays or denials.

- Experience Requirements: Some insurance companies require healthcare providers to have a certain level of experience before they can be included in the credential process. This can range from 6 months to 2 years of experience, and it may pose a challenge for new practitioners.

- Market Saturation: Not all insurance providers are open to additional medical professionals. Market saturation can be a barrier, and it may be challenging to find insurance companies accepting new providers in your area.

- Contract Negotiation: Once approved for credentialing, the contracting phase begins. This involves negotiating a contract with the insurance company, defining the terms of participation, reimbursement rates, and other important details. It can be challenging to navigate and understand all the clauses and requirements in the contract.

- Re-credentialing: Maintaining credentials is an ongoing process. It is important to stay up to date with renewals, license renewals, and other documentation to avoid lapses in credentialing and difficulties in maintaining provider status.

- Panel Limitations: Some insurance companies have closed panels, which means they are not accepting new providers. It can be challenging to get approved to join a closed panel, and appeals or requests may be necessary.

- Paperwork and Administrative Tasks: Credentialing involves a significant amount of paperwork and administrative tasks. It is crucial to stay organized and manage the various documents and requirements to ensure a smooth process.

- Delays and Rejections: Delays or rejections in the credentialing process can disrupt a provider's revenue stream. Even minor errors or missing information can cause approval delays or rejections, affecting the provider's ability to receive reimbursement for their services.

Warren's Private Insurance: Outlaw or Not?

You may want to see also

The process of becoming an in-network provider with insurance companies

Becoming an in-network provider with insurance companies can be a great way to expand your patient base and ensure that your services are accessible to a wider range of patients. Here is a detailed, step-by-step guide on the process of becoming an in-network provider:

- Obtain Necessary Credentials: Get a National Provider Identifier (NPI) and ensure you have the required licenses and certifications to practice in your state. This is a crucial step as insurance companies and programs like Medicare require an NPI for billing purposes.

- Get Malpractice Insurance: Malpractice insurance is essential for becoming an in-network provider. It protects providers in the event of a medical malpractice lawsuit and assures insurance companies that their network providers are adequately covered.

- Make a List of Insurance Companies: Research and create a list of insurance companies that are widely accepted by patients in your area. Consider factors such as geographic location, patient demographics, insurance plan types, reimbursement rates, and administrative requirements when deciding which companies to approach.

- Open a CAQH Account: The CAQH application process streamlines the provider in-network process by allowing you to submit your information once for multiple insurance companies. Insurance companies use the CAQH application to verify your education, licensure, certifications, and work history, ensuring you meet their quality standards.

- Contact Insurance Companies: Reach out to the insurance companies you wish to work with after completing your CAQH application. Evaluate the contract and fee schedule before registering. Understand the contract requirements, including any specific conditions or restrictions.

- Follow up with Insurance Companies: Stay in regular contact with the insurance companies to avoid potential issues with your application. Provider applications can sometimes be misplaced or delayed, so it's recommended to check on the status of your credentialing applications every two weeks.

- Response from Insurance Companies: Once your application is reviewed, you will receive a notification of approval or denial. If approved, you will be added to the insurance company's network of providers. If denied, they will provide a reason and may allow you to appeal or submit additional information.

By following these steps, healthcare providers can increase their chances of becoming in-network providers with insurance companies, making their services more accessible and affordable to potential patients.

Private Insurance Patients: Face-to-Face Requirements Explained

You may want to see also

The steps to filing a claim for reimbursement from a private insurance company

When it comes to dietary codes for WCC, it's important to note that registered dietitians cannot make medical diagnoses. However, they often work with clients on weight management and nutritional counselling, which may be covered by private insurance companies.

Step 1: Understand the Coverage

Before filing a claim, it's crucial to review your insurance policy to understand what services are covered. Different insurance plans have varying levels of coverage, and it's important to know if your specific plan covers the service you're seeking reimbursement for.

Step 2: Gather Documentation

Collect all the necessary documentation, including itemized receipts or bills from your healthcare provider. These documents should outline the services provided, the dates of service, and any applicable codes or diagnoses. Keep all your documents organised in a safe place, as you'll need them throughout the claims process.

Step 3: Obtain Necessary Forms

Visit your insurance company's website or contact them directly to obtain the necessary claim forms. Each insurance company has its own specific claim forms, and they may also provide instructions on how and where to submit them. Make sure to carefully review the instructions provided by your insurance company.

Step 4: Complete the Claim Form

Fill out the claim form accurately and completely. Provide all the requested information, including your personal details, insurance policy information, the reason for your visit or treatment, and the provider's information. If you have any questions or need clarification, don't hesitate to contact your insurance company.

Step 5: Attach Supporting Documents

Along with the completed claim form, you'll need to attach copies of your itemized receipts or bills. These documents provide detailed information about the services you received and the associated costs. Make sure to include all relevant receipts to support your claim.

Step 6: Submit the Claim

Once you have completed the claim form and gathered all the necessary documents, it's time to submit your claim. You can submit your claim by mail, email, or fax, depending on the options provided by your insurance company. Keep a copy of everything you submit for your records.

Step 7: Follow Up

After submitting your claim, don't hesitate to follow up with your insurance company to ensure they have received all the necessary documents and that your claim is being processed. Inquire about the expected timeline for claim reimbursement and make a note of it.

Step 8: Handle Claim Denials

In the event that your claim is denied, don't panic. Claim denials can happen for various reasons, such as coding errors, missing information, or lack of prior authorization. Review the reason for the denial and consider appealing the decision. You may need to involve your healthcare provider or seek assistance from your insurance company's customer support to resolve the issue.

MassHealth: Private Insurance or Public Option?

You may want to see also

Frequently asked questions

The Medical Nutrition Therapy (MNT) CPT codes that can be used to bill insurance companies are 97802, 97803, and 97804. These codes are used for an initial assessment, follow-up visit, and group visit, respectively.

Accepting insurance in a private nutrition practice can expand the client base and drive referrals. It makes nutritional care more accessible and affordable for clients. Additionally, it can help dietitians build a successful and growing practice.

First, create a list of insurance companies you want to credential with in your area. Then, contact each company to inquire if they are accepting new providers for your location. If they are, they will direct you to fill out an application to become an in-network provider. The process can take several months, so it is important to plan accordingly.

CPT codes, or Current Procedural Terminology codes, describe the service provided by the healthcare professional. On the other hand, ICD-10 codes are used to describe a medical diagnosis and are assigned by physicians or medical coders. Dietitians cannot make medical diagnoses, so they rely on referrals from the client's doctor for the ICD-10 code.