Variable life insurance is a permanent life insurance policy with an investment component. It has a cash-value account that can be invested, typically in mutual funds, and its value can rise or fall depending on the performance of the underlying securities. This means that variable life insurance carries more risk than other life insurance policies. However, it also offers tax advantages and the potential for higher returns. The cash value of a variable life insurance policy can be accessed during the lifetime of the policyholder and can be used for various purposes, such as paying for a major expense or supplementing retirement income.

What You'll Learn

How does variable life insurance work?

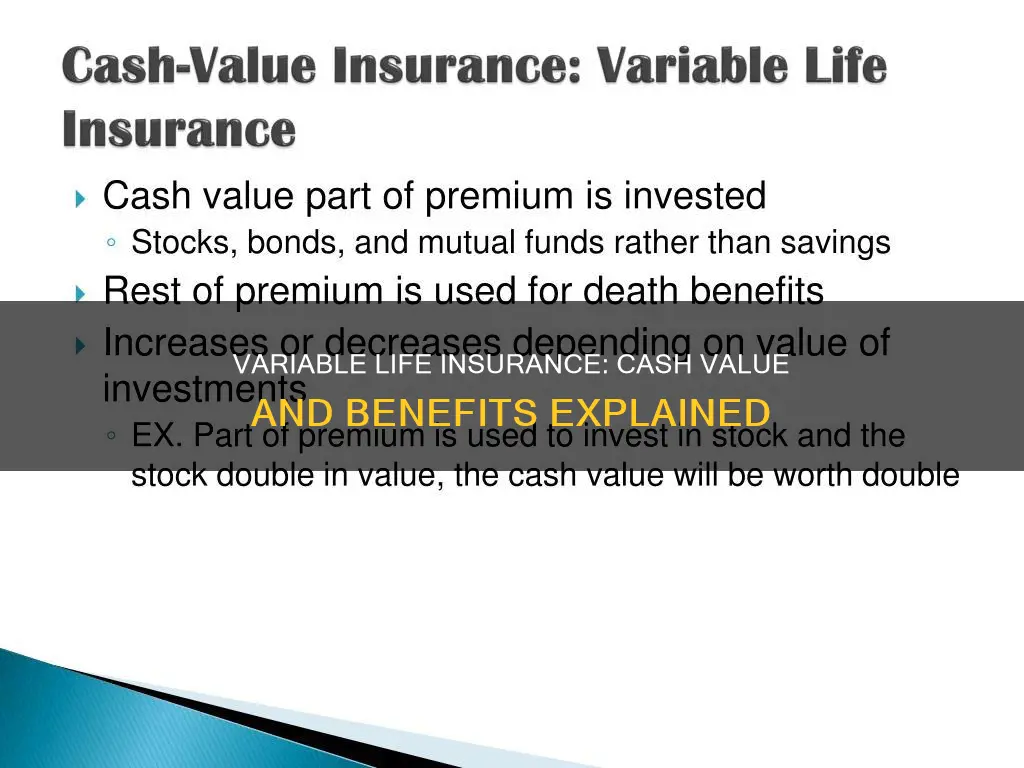

Variable life insurance is a permanent life insurance policy with an investment component. It is a policy that combines lifelong insurance protection with a cash-value account that you can access while alive. The cash value of a variable life insurance policy is invested, typically in mutual funds, and can rise or fall in value. This means that variable life insurance policies carry more risk compared to other life insurance policies.

Variable life insurance works much like any life insurance policy in that you pay a premium, and then your beneficiaries receive a benefit when you die. The coverage is in effect until your death. Variable life insurance policies also include a cash value component that you can access for other purposes, such as paying for a major expense. The unique feature of variable life insurance is that its cash component can be invested in asset options, mainly mutual funds. The value of your account will depend on the premiums you pay, how your investments perform, and the associated fees and expenses.

You can also allocate money towards a fixed account to receive a fixed rate of interest and reduce overall risk. This rate may change annually, but there is typically a guaranteed minimum, such as 3%. Your insurance company may require you to pay a specific amount of premiums, or it may give you the flexibility to pay premiums as long as you pay the required fees. Some providers may also offer protection against a lapse in coverage if you don't have enough cash value to cover policy fees.

A variable life insurance policy can provide you with an opportunity to make money in the market that has tax advantages. The investment portion receives favorable tax treatment, as the growth isn't taxable as ordinary income. So, you can draw from these accounts in later years, through loans using the account as collateral instead of making direct withdrawals, and receive tax-free income.

Life Insurance: When Does Debt Get Paid?

You may want to see also

What are the pros and cons?

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account that can be invested, typically in mutual funds. The cash value of a variable life insurance policy can be invested, offering the potential for greater returns than other types of permanent life insurance.

Pros

- Variable life insurance policies have a higher potential for earning cash compared to traditional policies.

- Variable life insurance policies are permanent and provide lifelong coverage.

- The cash value grows tax-deferred.

- You can borrow against the policy's cash value balance.

- You can decide how to invest the cash value.

- The death benefit is paid to your beneficiaries tax-free.

Cons

- Variable life insurance policies are complex and require more hands-on attention.

- They come with a higher level of risk than other cash value life insurance policies.

- They typically have higher premiums than other cash value life insurance policies.

- Variable life insurance policies typically do not guarantee a rate of return.

- The fees tend to be the highest among permanent life insurance policies.

- The cash value return is not guaranteed and can decrease in value during bad years.

- There is a surrender charge where you owe a penalty if you cancel within 15 years of your purchase.

Cholesterol and Life Insurance Blood Tests: What's the Link?

You may want to see also

How does it compare to other types of life insurance?

Variable life insurance is a type of permanent life insurance. It differs from term life insurance, which lasts for a specific number of years, in that variable life insurance policies are designed to last for the entirety of the policyholder's life. Variable life insurance also has an adjustable death benefit and premiums, making it one of the more flexible life insurance policies available.

Variable life insurance is similar to other types of permanent life insurance, such as whole life insurance and universal life insurance, in that it carries an investment component known as its cash value, as well as a guaranteed death benefit. However, variable life insurance is unique in that it gives the policyholder the freedom to decide how to invest the cash value. The cash value of a variable life insurance policy can be invested, offering the potential for greater returns than other types of permanent life insurance. The cash value in a variable life insurance policy can be invested in numerous ways, but the most common way is to invest in mutual funds.

Variable life insurance is typically more expensive than other types of permanent life insurance policies. The premiums for variable life are generally pricier than other types of life insurance, and policyholders may also have to pay management fees for their investments. Variable life insurance policies may also have fees and other charges associated with the policy's investment component.

Variable life insurance is an option for individuals who don't mind risk. When the market is doing well, the policy's cash value may also do well. However, if the market is performing poorly, the policy could lose value. Depending on the company and policy language, the gains may be capped at a certain percentage, with any excess return forfeited to the insurer.

Variable universal life insurance (VUL) is a form of variable life insurance that combines the features of a variable life policy with elements of a universal life insurance policy. Specifically, VUL allows the policyholder to adjust the premium amount and the death benefit amount within certain limits. VUL can be a good fit for those who want lifelong coverage and who want to take an active role in their life insurance investments.

Does Smoking Pot Affect Your Life Insurance?

You may want to see also

What are the fees?

Variable life insurance policies tend to have the highest fees of all permanent life insurance policies. These fees can be broken down into several categories, each of which will be charged to the policyholder in different ways.

Firstly, there are mortality and expense risk charges. These are the costs incurred by the insurance company in providing the death benefit if the policyholder does not live to the estimated age calculated for them.

Secondly, there are sales and administrative fees. These cover the agent's commission, policy setup and maintenance costs, and the insurer's ongoing expenses.

Thirdly, there are investment management fees, which compensate fund managers and vary depending on how the policyholder chooses to invest the policy's cash value. These fees are similar to expense ratios for mutual funds and can be quite high if the money is being actively invested.

Variable life insurance policies also have a surrender period, during which the policyholder will pay fees if they withdraw part of the cash value or decide to terminate their coverage. This period typically lasts for the first 10 to 15 years of coverage.

Each time the policyholder withdraws money from the policy's cash value, they may be charged a fee. Additionally, if they use the cash value of the policy as collateral for a loan, the insurer will charge interest on the loan.

Riders are add-ons that can be used to alter the terms of the policy, and these will also incur fees.

Variable life insurance policies also have higher administrative fees than other life insurance policies because they are investments regulated by the U.S. Securities and Exchange Commission (SEC).

It is important to carefully review the prospectus provided by the insurance company, as this will detail all the fees and expenses associated with the policy. These fees can significantly impact the value of the policyholder's account and may require them to contribute additional premiums to prevent the policy from terminating.

Pregnancy: A Life-Changing Event for Insurance Purposes?

You may want to see also

Is it worth it?

Variable life insurance is a permanent life insurance policy with an investment component. It has a cash-value account with money that is invested, typically in mutual funds. The cash value can be invested in certain securities, which resemble mutual funds. The unique feature of variable life insurance is that its cash component can be invested in asset options, mainly mutual funds.

Variable life insurance is worth considering if you are looking for lifelong coverage and want to take an active role in your life insurance investments. It is also worth considering if you are looking for a permanent life insurance policy that offers a higher potential for earning cash compared to traditional policies.

However, variable life insurance policies are complex and require more hands-on attention. They also come with risk and typically have higher premiums than other cash-value life insurance policies. The fees and expenses associated with the insurance policy may be significant, and if you cannot pay those fees and expenses, your policy may terminate.

Variable life insurance is not worth it if you are looking for a low-risk, low-maintenance investment option. It is also not worth it if you are looking for a short-term investment vehicle, as substantial fees, expenses, and tax implications generally make variable life insurance unsuitable for short-term savings.

Overall, variable life insurance can be worth it for individuals who are comfortable with risk and want to take an active role in their life insurance investments. However, it is important to carefully consider the fees, expenses, and potential risks before deciding if variable life insurance is the right choice for your financial goals and risk tolerance.

Life Insurance and Suicide: What Does KY Cover?

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance with a death benefit and a cash value. It is intended to meet certain insurance needs, investment goals, and tax planning objectives.

Variable life insurance works like other types of life insurance, paying a tax-free death benefit to your beneficiaries after you die. It also includes a cash value component that changes based on the amount of premiums you pay, the fees and expenses charged by the insurance company, and the performance of the investments you choose.

Variable life insurance offers the potential for greater returns than other types of permanent life insurance. It also provides flexibility, allowing you to adjust your premium payments and the death benefit amount within certain limits. Additionally, you can take out loans or withdrawals against the policy's cash value.

Variable life insurance carries the risk of investment losses, as the cash value is invested in the market and can decrease in value. Poor investment performance or high fees can lead to a policy lapse, requiring unexpected extra premium payments. There may also be tax implications and fees associated with withdrawals or loans against the cash value.