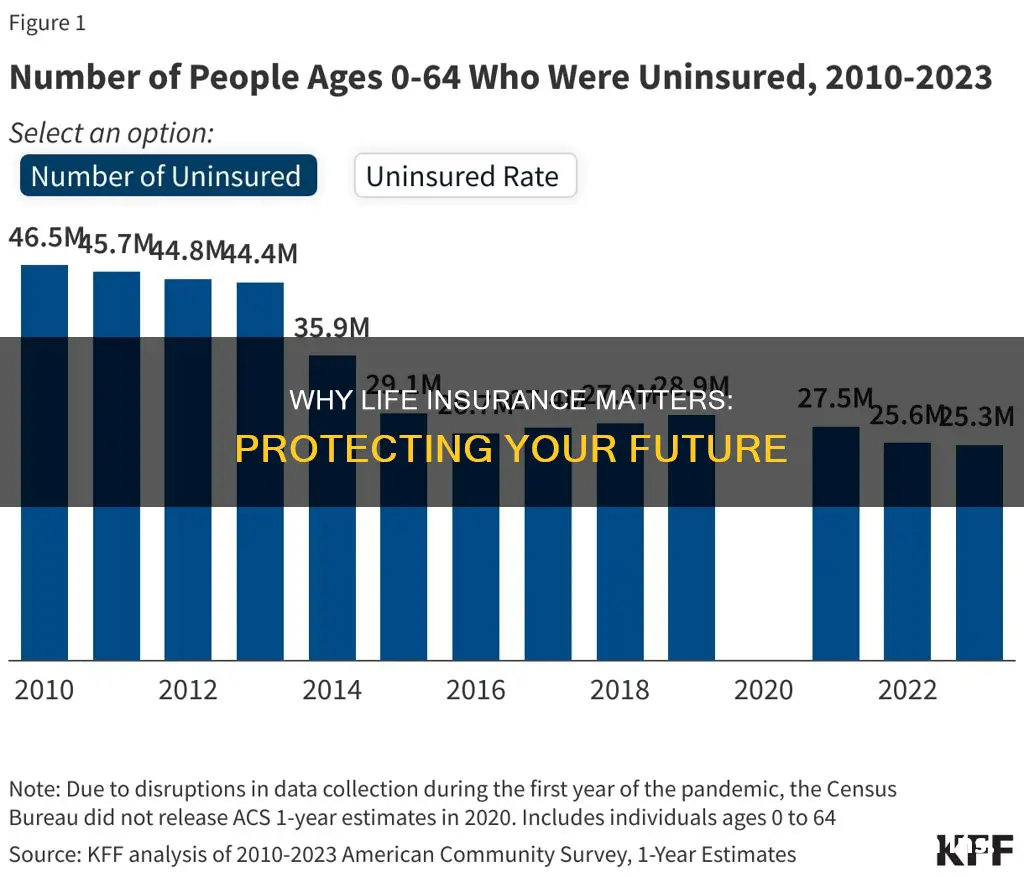

Many people around the world do not have life insurance, which can have significant financial implications for their families and loved ones in the event of their untimely death. This lack of coverage can leave individuals and their dependents vulnerable, as it provides a safety net to cover expenses, such as funeral costs, mortgage payments, or daily living expenses, that may arise after a person's passing. Understanding the reasons behind this absence of insurance is crucial to addressing the issue and ensuring that more people can protect their families from potential financial hardship.

What You'll Learn

- Financial Vulnerability: People without life insurance are financially vulnerable, leaving dependents in a difficult situation

- Debt and Legacy: Lack of insurance can lead to debt and an uncertain legacy for loved ones

- Uninsured Mortality: Uninsured individuals face higher risks of financial loss upon death

- Long-Term Care: Without insurance, covering long-term care costs can be a significant burden

- Health and Safety: Absence of life insurance may indicate health risks or safety concerns

Financial Vulnerability: People without life insurance are financially vulnerable, leaving dependents in a difficult situation

The lack of life insurance can leave individuals and their families in a financially precarious situation, especially when the primary breadwinner passes away. Without this essential safety net, the financial stability of the household is at risk, and the impact can be devastating for those who depend on the income. This vulnerability is a critical aspect of the conversation around life insurance, as it highlights the potential consequences of not having this crucial coverage.

When an individual without life insurance dies, their dependents may face numerous challenges. The immediate financial impact can be severe, as the family loses the primary source of income. This sudden loss can disrupt the family's ability to maintain their standard of living, cover essential expenses, and plan for the future. The financial strain is often exacerbated by the fact that life insurance can provide a steady stream of financial support to cover various needs, such as mortgage payments, rent, utilities, and daily living expenses. Without this, the surviving family members might struggle to meet these basic requirements, especially if the deceased was the primary earner.

Furthermore, the emotional and psychological toll of this financial vulnerability cannot be overlooked. The stress of dealing with grief while also facing financial instability can be overwhelming. Dependents may find themselves in a race against time to make critical decisions regarding the family's future, such as selling assets, taking on additional debt, or making significant lifestyle changes. These decisions are often made under immense pressure and can have long-lasting effects on the family's financial well-being.

In many cases, the financial impact of not having life insurance extends beyond the immediate family. If the deceased had planned to provide for their children's education, retirement, or other long-term financial goals, the absence of life insurance can leave these plans in tatters. The dependents might struggle to secure the financial future they had envisioned, leading to a sense of loss and uncertainty.

To mitigate this financial vulnerability, it is crucial to understand the importance of life insurance. It provides a sense of security and peace of mind, knowing that your loved ones will be taken care of in the event of your passing. By having life insurance, individuals can ensure that their dependents have the financial resources needed to maintain their standard of living and achieve their long-term goals, even in the face of tragedy.

Canceling Medibank Life Insurance: A Step-by-Step Guide to Termination

You may want to see also

Debt and Legacy: Lack of insurance can lead to debt and an uncertain legacy for loved ones

The absence of life insurance can have profound financial consequences, often leaving loved ones in a state of uncertainty and debt. When an individual passes away without insurance, the financial burden of funeral expenses, outstanding debts, and daily living costs typically falls on their family. These expenses can quickly accumulate, especially if the deceased had significant medical bills or loans. For instance, a funeral can cost anywhere from $7,000 to $10,000 or more, depending on the region and chosen services. Moreover, if the deceased had a mortgage, car loans, or credit card debt, these obligations do not disappear, and the responsibility of paying them off often falls on the surviving family members.

In many cases, the financial strain can be exacerbated by the lack of a clear financial plan. Without life insurance, there is no immediate source of funds to cover the aforementioned expenses, forcing families to liquidate assets or take out high-interest loans to meet these obligations. This can lead to a cycle of debt, where the family struggles to pay off the initial debts while also facing the ongoing costs of living. The emotional stress of dealing with grief and financial burdens simultaneously can be overwhelming.

Furthermore, the impact of not having life insurance extends beyond immediate financial concerns. It can leave a family's future plans and goals in disarray. For instance, if a primary breadwinner passes away, the family may lose their primary source of income, making it difficult to maintain their standard of living or achieve long-term financial objectives. This can include paying for children's education, funding retirement, or even simple daily expenses. The lack of insurance can also mean that loved ones are left without the financial support that would have helped them secure a stable future.

In the context of legacy, life insurance can play a crucial role in ensuring that a family's wishes are respected and their future is secure. It provides a means to cover final expenses, pay off debts, and leave a financial cushion for loved ones. By having a life insurance policy, individuals can provide peace of mind, knowing that their family will be taken care of in the event of their passing. This can include leaving a lump sum for major purchases, such as a home or a child's education, or providing a steady income to cover living expenses for a prolonged period.

In summary, the decision to obtain life insurance is a critical aspect of financial planning. It ensures that the passing of an individual does not result in financial hardship for their loved ones. By taking this step, people can provide for their families, cover essential expenses, and leave a more secure and stable legacy. It is a responsible and thoughtful action that can significantly impact the well-being of those left behind.

Colonial Life Insurance: AM Best Report Analysis

You may want to see also

Uninsured Mortality: Uninsured individuals face higher risks of financial loss upon death

The lack of life insurance can have significant financial implications for individuals and their families, especially in the event of a sudden or unexpected death. When someone passes away without life insurance, the financial burden often falls on their loved ones, who may be unprepared for such a significant loss. This situation can lead to a range of challenges and potential long-term consequences.

One of the primary risks is the immediate financial strain on the deceased's family. Funeral and burial expenses can be substantial, and without insurance, these costs must be covered by the bereaved. These expenses can quickly accumulate, causing emotional distress and financial hardship for the surviving family members, who may already be dealing with grief and loss. Moreover, the lack of insurance can result in a substantial financial gap, especially if the deceased was the primary breadwinner or contributed significantly to the family's income.

In many cases, uninsured individuals may also face challenges in covering medical expenses, especially if their death was due to a prolonged illness or a medical emergency. Medical bills can be a significant burden, and without insurance, the family might be responsible for paying these costs, which could lead to financial ruin. Additionally, the absence of life insurance can complicate the process of settling the deceased's affairs, including paying off debts, taxes, and any remaining expenses.

The impact of not having life insurance extends beyond the immediate financial strain. It can also affect the long-term financial security of the family. Without insurance, the surviving partners or dependents may struggle to maintain their standard of living, especially if the deceased was the primary provider. This situation can lead to a cycle of financial instability, where the family might need to make significant lifestyle adjustments or even rely on public assistance programs.

To mitigate these risks, it is essential for individuals to consider obtaining life insurance. Even basic coverage can provide a safety net for loved ones, ensuring that financial obligations are met and reducing the emotional burden of unexpected losses. Planning for the future, including life insurance, is a responsible step towards protecting one's family and ensuring their well-being in the event of unforeseen circumstances.

Borrowing Money: Government Mutual Life Insurance Options

You may want to see also

Long-Term Care: Without insurance, covering long-term care costs can be a significant burden

The lack of life insurance can have far-reaching consequences, especially when it comes to long-term care. As people age, the need for medical assistance and support often increases, and without proper insurance coverage, the financial burden can be overwhelming. Long-term care refers to the ongoing assistance and services required by individuals who have chronic illnesses, disabilities, or cognitive impairments, and it can significantly impact both the affected individuals and their families.

When an individual lacks life insurance, the financial responsibility for long-term care falls primarily on their loved ones or themselves. This can lead to several challenges. Firstly, the costs of long-term care services are often substantial and can include medical expenses, nursing home fees, in-home care, and various specialized treatments. Without insurance, these costs accumulate quickly, and families may find themselves facing financial strain, especially if the care recipient has limited savings or assets. The emotional and physical toll of providing long-term care can also take a significant toll on caregivers, who may need to reduce their work hours or even quit their jobs to dedicate time and resources to the care recipient.

In many cases, long-term care insurance can provide a safety net, covering a portion or all of these expenses. However, not having such insurance means that individuals and their families must rely on their own resources, which may not be sufficient. This situation can lead to difficult decisions, such as selling assets, depleting savings, or even going into debt to cover the costs of care. Moreover, the emotional stress of making these financial choices can be immense, affecting the overall well-being of the entire family.

It is essential to recognize that long-term care needs can arise unexpectedly, and without insurance, the financial impact can be devastating. Planning for long-term care is a crucial aspect of financial planning, especially as life expectancy increases and healthcare costs rise. By considering long-term care insurance as part of a comprehensive financial strategy, individuals can ensure that they and their loved ones are protected from the financial burdens associated with extended periods of medical care and support.

In summary, the absence of life insurance can significantly impact an individual's ability to manage long-term care costs. It underscores the importance of proactive financial planning, including the consideration of long-term care insurance, to safeguard one's financial well-being and that of their family during challenging times. Being prepared and informed about these matters can help alleviate the potential strain on both personal finances and family relationships.

Understanding Life Insurance: A Comprehensive Guide for Australians

You may want to see also

Health and Safety: Absence of life insurance may indicate health risks or safety concerns

The absence of life insurance can be a significant indicator of potential health risks and safety concerns for individuals and their families. Here's an exploration of this topic:

Health Implications:

People without life insurance might face financial burdens in the event of unexpected death. This can lead to a lack of access to necessary medical care, especially in cases of critical illnesses or accidents. Without adequate financial resources, individuals may delay or forgo essential treatments, potentially impacting their health outcomes. For instance, a person without insurance might avoid seeking immediate medical attention for a severe injury, fearing the high costs associated with treatment. This delay could result in complications and even death, highlighting the direct link between financial insecurity and health risks.

Safety and Security Concerns:

Life insurance provides financial security for dependents in the event of the insured individual's death. Without this coverage, families may struggle to maintain their standard of living, cover daily expenses, or pay for their children's education. This financial vulnerability can lead to increased stress and anxiety, potentially impacting overall well-being. Moreover, the absence of life insurance might indicate a higher risk of involvement in dangerous activities. Some individuals may engage in risky behaviors, such as extreme sports or illegal activities, to generate income or cover financial gaps, which could result in injuries or even fatalities.

Long-Term Health Management:

Life insurance often includes critical illness coverage, which can provide financial support for individuals facing serious health conditions. Without this coverage, managing chronic illnesses or recovering from major surgeries becomes more challenging. The financial burden of medical expenses, especially for long-term treatments, can lead to emotional distress and potential health deterioration. Additionally, life insurance policies sometimes offer disability benefits, ensuring income replacement during periods of illness or injury. This financial safety net is crucial for individuals who may struggle to maintain their standard of living while recovering from health issues.

Addressing the Issue:

It is essential to recognize that the absence of life insurance doesn't solely indicate health risks but also highlights the need for comprehensive financial planning. Individuals should assess their health status, family dependencies, and financial obligations to determine appropriate insurance coverage. Consulting with financial advisors or insurance professionals can help identify suitable policies, ensuring that individuals and their families are protected in the event of unforeseen circumstances.

Unveiling the First Non-Life Insurance: A Revolutionary Concept

You may want to see also

Frequently asked questions

There are several reasons why individuals might opt-out of life insurance. Some may feel it's unnecessary if they believe their financial responsibilities are covered by other means, such as savings or social security. Others might be concerned about the cost, especially if they have limited budgets. Additionally, some people may have pre-existing health conditions that make obtaining affordable coverage challenging.

The absence of life insurance can have significant financial implications for the policyholder's family and beneficiaries. In the event of the insured person's death, their dependents may face financial hardships, especially if the primary earner is no longer providing income. Without life insurance, the family might struggle to cover expenses, pay off debts, or maintain their standard of living.

Having a family is a strong reason to consider life insurance, but it doesn't necessarily mean everyone needs it. The decision should be based on individual circumstances. For some, the financial impact of their death might be minimal, and they can rely on their partner's income or other sources of support. However, it's essential to evaluate your family's financial situation, including any outstanding debts, future education costs, and the overall financial stability of your household.

Absolutely! There are alternative financial products and strategies that can provide similar benefits. Term life insurance, for instance, offers coverage for a specific period, which can be a more affordable option. Additionally, some people opt for whole life insurance, which provides lifelong coverage and a savings component. Other alternatives include critical illness insurance, which covers medical expenses, and disability insurance, which replaces income if the policyholder becomes unable to work.