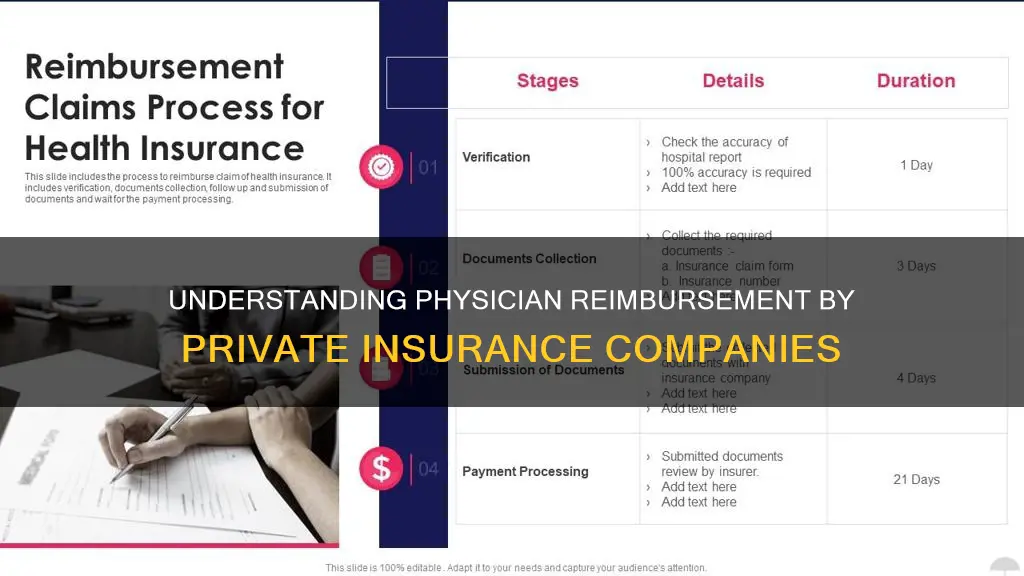

Private insurance companies in the United States pay physicians nearly double the rates of Medicare, with rates averaging 199% of Medicare rates for all hospital services, 189% for inpatient hospital services, 264% for outpatient hospital services, and 143% for physician services. However, there is wide variation across studies due to different market dynamics in different parts of the country and for different types of medical care, as well as differences in the studies' methodology and data sources.

The variation in rates is a function of the market power of hospitals and physicians relative to that of local insurers, as hospitals or physician practices with more negotiating leverage can generally obtain higher payment rates from insurers. Studies have also shown that private-fee data are higher than what physicians actually receive, as private-fee data are based on submitted charges and private insurers employ fee screens to reduce submitted charges for payment purposes.

| Characteristics | Values |

|---|---|

| Physician reimbursement by private insurance | 143% of Medicare rates, on average |

| Physician reimbursement by private insurance (range) | 118% to 179% of Medicare rates |

| Physician reimbursement by private insurance (outpatient) | 264% of Medicare rates, on average |

| Physician reimbursement by private insurance (outpatient range) | 150% to 358% of Medicare rates |

| Physician reimbursement by private insurance (inpatient) | 189% of Medicare rates, on average |

| Physician reimbursement by private insurance (inpatient range) | 150% to 222% of Medicare rates |

What You'll Learn

Medicare Advantage vs Traditional Medicare

Traditional Medicare, also known as Original Medicare, is a fee-for-service program that consists of two parts: Part A (hospital insurance) and Part B (medical insurance). Part A covers inpatient care in hospitals, skilled nursing facilities, hospice care, and limited home healthcare services. Part B covers outpatient care, preventive services, medical supplies, and various doctor services.

Medicare Advantage, also known as Part C, is an alternative way to receive Original Medicare benefits. These plans are offered by private insurance companies approved by Medicare and most include Part D prescription drug coverage as well. Medicare Advantage plans cover the same services as Original Medicare, plus additional benefits such as dental care, vision care, and transportation benefits, among others.

Provider Networks: With Original Medicare, you can see any doctor or specialist that accepts Medicare without the need for a referral. Most Medicare Advantage plans have a provider network, which restricts your choice of healthcare providers.

Maximum Out-of-Pocket Costs: Original Medicare has no out-of-pocket maximum, while Medicare Advantage plans have annual out-of-pocket limits. This means that once you reach the limit, a Medicare Advantage plan will cover 100% of your Medicare-approved expenses for the rest of the year.

Part D Prescription Drug Coverage: Original Medicare does not include prescription drug coverage, so you would need to purchase a separate Part D plan. Medicare Advantage plans, on the other hand, usually include drug coverage, saving you the extra step and expense.

Additional Benefits: Most Medicare Advantage plans include dental, vision, fitness, hearing, and telehealth benefits. Original Medicare does not cover these costs.

Travel Considerations: Original Medicare isn't restricted to a provider network, so your benefits are good across the US. Medicare Advantage coverage is typically limited to the plan's service area, which means your plan may not cover you while travelling (except for emergency care).

Medigap: Medigap is only available to Original Medicare beneficiaries and supplements their coverage for an extra premium. Many Medicare Advantage plans offer similar benefits to Medigap (coverage for Part A and B deductibles and coinsurance) without the extra premium.

Prior Authorizations: Medicare Advantage plans are more likely to require advance approval for coverage, which can lead to delays in receiving care.

When deciding between Original Medicare and Medicare Advantage, consider factors such as costs, doctor availability, coverage for specific health conditions, and prescription medication needs.

Kaiser Permanente: Private Insurance, Public Good?

You may want to see also

Private insurance rates for physician services

Private insurers' payment rates are typically determined through negotiations with physicians, and rates vary depending on market conditions. Medicare, on the other hand, has adopted payment systems to manage spending and encourage efficiency. As a result, Medicare has been able to limit the growth in expenditures more effectively than private insurers in recent decades.

Proponents of Medicare-for-All and public option proposals argue that aligning provider payments with Medicare rates would help reduce excess costs in the US healthcare system. However, critics argue that bringing private insurer payments closer to Medicare rates could threaten providers' financial viability.

BlueCross BlueShield: Understanding Private Insurance Options

You may want to see also

Medicare physician fees vs private payers

Medicare physician fees are about 76% of private physician fees. Medicare fees for visit and imaging services compare more closely with private fees than do Medicare fees for major procedures, ambulatory procedures, and tests. Private-sector responses to Medicare's across-the-board rate changes appear to unfold over several years. Medicare's influence is particularly strong in areas with relatively concentrated insurance markets and with relatively competitive provider groups.

Oregon's Private Mortgage Insurance Rules: What You Need to Know

You may want to see also

Medicare Advantage and commercial health insurance rates

Medicare Advantage plans are offered by private companies that contract with Medicare. They are also known as Medicare Part C.

Medicare Advantage plans pay physicians less than traditional Medicare. Traditional Medicare rates are set by the Centers for Medicare & Medicaid Services (CMS), a federal body. Medicare Advantage plans are tied to these rates, which act as an anchor. Medicare Advantage plans do, however, take advantage of the commercial market's favourable pricing for services where traditional Medicare rates are higher than necessary.

Traditional Medicare rates are generally below commercial rates. For example, the Congressional Budget Office found that commercial physician rates were 30% higher than Medicare rates.

Medicaid fee-for-service payments for physician services are nearly 30% below Medicare payments, which are in turn well below commercial rates.

MassHealth: Private Insurance or Public Option?

You may want to see also

Medicare payment localities

Locality definitions vary widely and are based on Medicare carrier definitions, which are strictly for Medicare physician payment purposes. Localities can refer to entire states, individual cities, groups of cities, contiguous counties, or non-contiguous counties.

Medicare fees are computed by applying the Medicare fee schedule payment methodology (relative value units, GPCI, and conversion factor) to data obtained from the Health Care Financing Administration's (HCFA) Public Use File (PUF) of Physician Services.

Medicare fees for each procedure in each locality are calculated assuming a fully implemented Medicare fee schedule (MFS), which is a major departure from the customary, prevailing, and reasonable (CPR) reimbursement methodology. The MFS is intended to reduce the difference in reimbursement for cognitive services relative to procedural services and correct geographic distortions in charging practices.

The MFS includes a Geographic Practice Cost Index (GPCI) to adjust for differences in practice costs across localities. It also recognises only one-fourth of the physician work GPCI, reducing the difference in payments between urban and rural areas.

The relationship between Medicare and private fees varies by type of service and across localities. Medicare fees more closely approximate private fees in rural and small metropolitan areas and for visits compared to surgery.

Private fees demonstrate greater geographic variation than Medicare fees. This variation drives the relationship between Medicare and private fees, with private fees appearing to vary dramatically while Medicare fees remain relatively stable.

Example of Payment Localities

As an example, Florida consists of payment localities 03, 04, and 99 (for services paid from the Medicare physician fee schedule [MPFS], 99 = 01 and 02 combined). Locality 03 includes the following counties: Alachua, Baker, Bay, Bradford, Brevard, Calhoun, Citrus, Clay, Columbia, Dixie, Duval, Escambia, Flagler, Franklin, Gadsden, Gilchrist, Gulf, Hamilton, Hernando, Hillsborough, Holmes, Jackson, Jefferson, Lafayette, Lake, Leon, Levy, Liberty, Madison, Manatee, Marion, Nassau, Okaloosa, Pasco, Pinellas, Putnam, Santa Rosa, Sarasota, St Johns, Suwannee, Taylor, Union, Wakulla, Walton, and Washington.

USDA's Stance on Private Flood Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Physician reimbursement in Medicare Advantage was more strongly tied to traditional Medicare rates than to negotiated commercial prices, although Medicare Advantage plans tended to pay physicians less than traditional Medicare.

Private insurers paid nearly double Medicare rates for all hospital services, ranging from 141% to 259% of Medicare rates across studies.

Medicare physician fees are 76% of private fees. Medicare physician fees more closely approximate private fees for visits than for surgery and in rural areas compared to large metropolitan areas.

Private insurance reimbursement rates are determined through negotiations with providers.

Physicians can negotiate better reimbursement by determining their most common CPT codes, reviewing their fees and reimbursement rates, and organizing and analyzing the data to identify which codes or health plans should be targeted for improvement.