Are you interested in becoming an insurance adjuster in Virginia? If so, there are a few things you should know about getting licensed and finding work in this field.

First of all, it's important to note that Virginia does not require a license to work as an insurance adjuster. However, most insurance companies prefer to hire someone with training or experience, so it is recommended that you obtain a Designated Home State (DHS) license from another state, such as Florida or Texas. This will allow you to work in multiple states and give you a better chance of finding employment.

To get a DHS license, you will need to complete a pre-licensing course and pass an exam. The requirements for these courses and exams vary by state, but they typically cover insurance laws, ethics, and claims adjusting practices. You can find many training programs and exam prep courses offered by private companies, both online and in-person.

Once you have your license, you can start applying for jobs with insurance companies or independent adjusting firms. As an insurance adjuster, your main role will be to investigate and assess insurance claims, typically for property damage or personal injury. You will need to verify insurance policies, identify coverages, evaluate damages, complete paperwork, and negotiate settlements.

Becoming an insurance adjuster can be a lucrative and rewarding career, but it also requires excellent communication skills and the ability to handle complex situations. With the right training and experience, you can establish a successful career in this exciting field.

| Characteristics | Values |

|---|---|

| Licensing requirement | Virginia does not have an adjuster licensing requirement and does not offer its own Virginia adjuster license. |

| Recommended license | DHS (designated home state) adjuster license. |

| Popular states for DHS license | Florida, Texas, and Indiana. |

| Virginia Public Adjuster License requirement | Pass the Virginia Public Adjuster Exam. |

| Exam details | 50 scored questions to be completed within one hour. |

| Application fee | $15 |

| Bond requirement | Certify that a $50,000 bond has been obtained from an insurance company licensed within Virginia. |

| Average salary | $56,357 per annum. |

What You'll Learn

- Virginia doesn't require a license to work as an insurance adjuster

- Most employers, however, will require a license, so it's beneficial to get one

- You can obtain a Designated Home State (DHS) license from another state, like Florida or Texas

- A DHS license allows you to work in multiple states and apply for reciprocal licensing privileges

- To get a DHS license, complete a pre-licensing course and pass the included exam

Virginia doesn't require a license to work as an insurance adjuster

Virginia does not require a license to work as an insurance adjuster. However, it is highly beneficial to get licensed as an adjuster to increase your employment opportunities. The solution is to obtain a Designated Home State (DHS) adjuster license from another state. This is because Virginia does not offer its own adjuster license.

A DHS license allows people who live in a non-licensing state, such as Virginia, to designate a different state (e.g. Florida) as their "home state". This enables them to apply for and obtain an insurance adjuster license from that state, as if they were a resident.

- Employment opportunities: Many employers of claims adjusters specifically look for applicants who are already licensed. Even if they don't, they often prefer licensed applicants due to the geographical flexibility advantage.

- Traveling adjusters: If you wish to work on catastrophe (CAT) claims, you will likely need to travel across state lines. To operate in a state other than your home state, you will need a reciprocal license in that state. To apply for a reciprocity license, you must first hold an equivalent license in your own state (such as a DHS license).

The most popular states to obtain a DHS license from are Florida, Texas, and Indiana. Florida is recommended due to its quick application process, short exam, and great reciprocity.

To obtain a DHS license, you will need to complete a pre-licensing course and pass the included exam.

There are four main types of insurance adjusters: staff adjusters, independent adjusters, catastrophe adjusters, and public adjusters. Each of these assesses the monetary value of insurance claims by evaluating property damage or personal injury claims.

Staff, independent, and catastrophe adjusters do not require a license in Virginia, whereas public adjusters do.

A public adjuster is an independent insurance adjuster that customers hire to settle insurance claims. They do not work for any insurance company and are not public employees.

To become a public adjuster in Virginia, you will need to take and pass the Virginia Public Adjuster Exam. You will then need to apply for your license online, paying a $15 application fee.

As part of your licensure, you will be required to certify that a $50,000 bond has been obtained from an insurance company licensed within Virginia. This bond must remain in force as long as your license is in effect.

Unraveling the Accuracy of AAA Insurance Adjusters: An In-Depth Analysis

You may want to see also

Most employers, however, will require a license, so it's beneficial to get one

Although Virginia does not require a license to work as an insurance adjuster, possessing a license is highly beneficial. Most insurance adjusting positions in Virginia will require a license, and operating without one can limit your employment opportunities.

The solution is to obtain a Designated Home State (DHS) license, which allows you to designate a different state as your "home state." This is because most employers will require a license, and a DHS license enables you to apply for reciprocal licensing privileges.

The most popular states to obtain a DHS license from are Florida, Texas, and Indiana. Obtaining a license from Florida is recommended due to its quick application process, short exam, and great reciprocity. The Texas license is also a good option, as it is recognized by many states, allowing you to work across state lines without needing additional licenses.

Unraveling the Education Mystery: Degree Requirements for Insurance Adjusters

You may want to see also

You can obtain a Designated Home State (DHS) license from another state, like Florida or Texas

If you live in a state that does not require adjusters to be licensed, you can still obtain a Designated Home State (DHS) license from another state. This is beneficial if you want to work in more than one state, as it can increase your earnings.

Several states offer DHS licenses, but the most popular ones are Florida, Texas, and Indiana. This is because these states have great reciprocity, a quick application process, and a relatively short insurance adjuster exam.

To obtain a DHS license from Texas, for example, you must meet the state's licensing requirements. This typically includes completing pre-licensing education courses, passing a licensing examination, and fulfilling any other state-specific requirements. You will then be able to apply for reciprocal licenses in other states that recognize the DHS license.

Florida is also a good choice for a DHS license, as it has great reciprocity and the quickest application process in the country. To obtain a Florida DHS license, you must complete a 40-hour pre-licensing course and pass the included exam. No additional coursework or testing is required.

ACA Profits: Unraveling the Risk Adjustment Factor

You may want to see also

A DHS license allows you to work in multiple states and apply for reciprocal licensing privileges

If you live in a state that does not require licensing for insurance adjusters, such as Virginia, you can still obtain what is known as a Designated Home State (DHS) license. This license allows you to work in multiple states, including your home state, by designating another state, such as Florida, Texas, or Indiana, as your "home state." This is particularly beneficial if you want to work as a catastrophe (CAT) adjuster and travel to areas affected by severe weather to handle claims en masse.

Obtaining a DHS license is a relatively straightforward process. For example, to get a Florida DHS license, you need to complete a 40-hour pre-licensing course and pass the included exam. This qualifies you to apply for the Florida 70-20 license, and no additional coursework or testing is required. The Florida DHS license has a quick application process, a short exam, and great reciprocity. Similarly, Texas is another popular choice for a DHS license due to its wide recognition and reciprocity with many states.

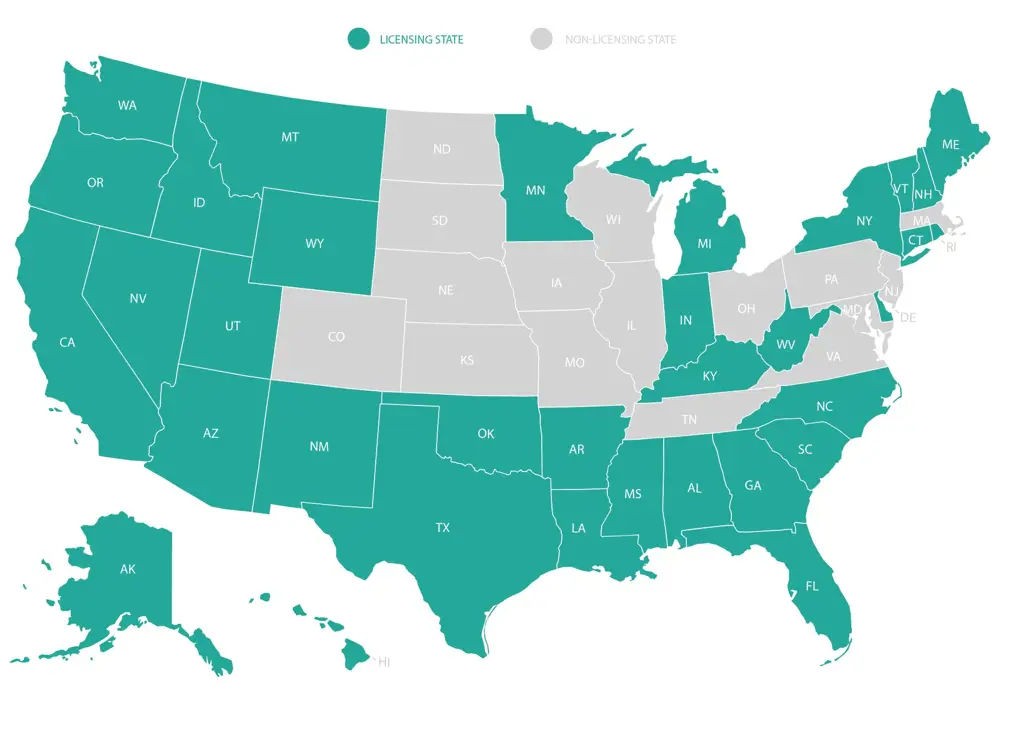

Once you have your DHS license, you can apply for reciprocal licensing privileges in other states. Reciprocity allows licensed adjusters to obtain a license in another state without going through the entire licensing process again. However, it's important to note that not all states have reciprocity agreements, and some states, like California, Hawaii, and New York, require adjusters to take their own exams or pre-licensing courses. To obtain a reciprocal license, you will typically need to submit an application, pay the required fees, and meet the specific requirements of the state you're applying to.

In summary, if you're looking to work as an insurance adjuster in Virginia or another non-licensing state, obtaining a DHS license is a great option to gain the necessary credentials and work across multiple states.

Negotiating a Fair Settlement: Strategies When Disagreeing with an Insurance Adjuster

You may want to see also

To get a DHS license, complete a pre-licensing course and pass the included exam

To become an insurance adjuster in Virginia, you have two options:

Option 1:

The first option is to obtain a Designated Home State (DHS) license from another state. This is because Virginia does not have an adjuster licensing requirement and does not offer its own adjuster license. By obtaining a DHS license, you can designate another state as your "home state," which will allow you to apply for and obtain an insurance adjuster license in that state. This is a popular option, and the most popular states for DHS licenses are Florida, Texas, and Indiana.

The recommended state to obtain a DHS license from is Florida. This is because Florida has the quickest application process, a relatively short insurance adjuster exam, and great reciprocity. To obtain a Florida DHS Adjuster License, you will need to complete a pre-licensing course and pass the included exam. The pre-licensing course is 40 hours long, and after completing the course and passing the exam, you will be qualified to apply for your Florida 70-20 license.

Option 2:

The second option is to obtain a Texas All Lines Adjuster's License. This license will designate Texas as your home state and allow you to enjoy the full benefits of reciprocity when trying to obtain an adjuster's license in other states. The Adjuster School offers a 40-hour Texas All-Lines Adjuster Licensing Course that satisfies all the requirements for obtaining this license. After completing the course and the final exam, you will only need to submit your adjuster application and fingerprints to the Texas Department of Insurance. The final exam is a 150-question multiple-choice exam, and you must answer at least 70% of the questions correctly to pass.

While it is not required to have a license to work as an insurance adjuster in Virginia, it is highly beneficial to obtain a license, as it will open up more employment opportunities. By completing a pre-licensing course and passing the included exam, you can obtain either a Florida DHS Adjuster License or a Texas All Lines Adjuster's License, both of which will allow you to work as an insurance adjuster in Virginia.

When Insurance Adjusters and Police Cross Paths: A Collaborative Investigation

You may want to see also

Frequently asked questions

No, Virginia does not require a license to work as an adjuster. However, most insurance companies prefer to hire people with training or experience, so it is still recommended that you obtain a license from another state (a "Designated Home State" or DHS license).

A DHS license is a type of license that allows people who live in a non-licensing state, such as Virginia, to designate a different state (e.g. Florida or Texas) as their "home state". This allows them to apply for and obtain an insurance adjuster license in that state, which can improve their employment opportunities.

To obtain a DHS license, you will need to complete a pre-licensing course and pass an exam. The specific requirements may vary depending on the state you choose, but popular options include Florida and Texas due to their quick application processes and reciprocity agreements with other states.