Knowing your insurance carrier's name is important, especially when you need to file a claim. An insurance carrier is the company that provides your insurance coverage and employs your insurance agent. You can find your insurance carrier's name on your declarations page, insurance cards, or by contacting your agent. It is also worth noting that an insurance company may have different subsidiaries with different names, so be sure to check your policy for the correct name.

| Characteristics | Values |

|---|---|

| How to find your insurance carrier's name | Check your insurance policy, declaration page, proof of insurance, or call your agent |

| What is an insurance carrier | Another name for an insurance company |

| How to find an insurance company | Search by using a full or partial company name, Docket Number, Legal Name, DBA Name, or State |

What You'll Learn

Check your insurance policy

To find out the name of your insurance carrier, check your insurance policy. An insurance carrier is simply another term for an insurance company, and you can find out which company that is by referring to your policy documents.

The insurance carrier is the company that provides your insurance coverage and employs your insurance agent, who handles your claims and may help set up your payments. You can file an insurance claim with your agent or directly with your carrier.

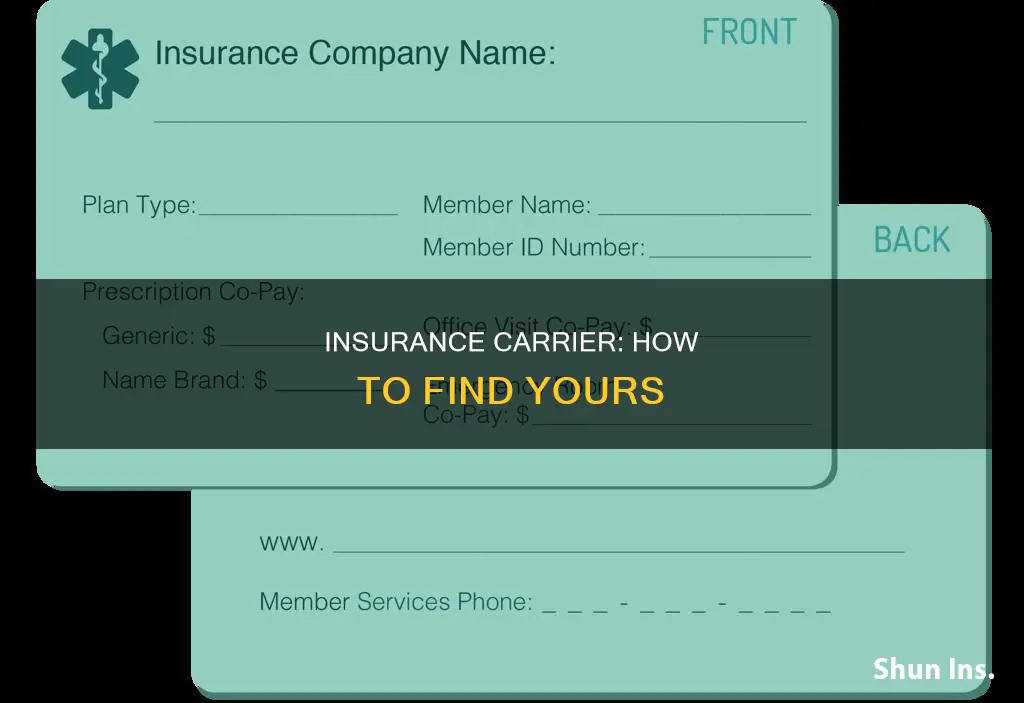

You can find your insurance carrier's information in a few places. Firstly, check your declaration page. This is the document you receive from the company that outlines the details of your coverage, limits, and everything else about your policy. Secondly, check your proof of insurance, which is the card your carrier mails to you to show that you are covered.

If you are still unsure, you can always call your agent, who will be able to provide any information you need about your carrier. It is worth noting that an insurance company may have different subsidiaries with different names, so be sure to check your policy for the correct name.

CPAs: Errors and Omissions Insurance

You may want to see also

Contact your insurance agent

If you are unsure of your insurance carrier's name, the best course of action is to contact your insurance agent. Your insurance agent works for your insurance carrier and will be able to provide any information you need about your carrier. They will also be able to guide you through the details of your policy, as it is your carrier that underwrites your policy and decides on the amount of coverage you will receive.

You can contact your insurance agent to find out the name of your insurance carrier, as well as other important information such as their location, former names, reference information, and lines of insurance they are authorized to provide. This is especially useful if you purchased your policy through a smaller company or an independent agent, and don't have their direct contact information. Knowing your carrier's name can speed up the process if you ever need to file a claim.

Your insurance agent will be listed on the papers you received from the company that outline the details of your coverage, limits, and everything else about your policy. These papers are known as the declaration page. If you cannot find your declaration page, your insurance carrier may have also mailed you proof of insurance, such as cards that you can show to confirm your coverage.

In addition to finding out the name of your insurance carrier, it is important to do your research about their reputation and financial health. Look into their financial backing and read through both the good and bad reviews to get a sense of their customer service and financial resources. Check the ratings from independent rating agencies to ensure that your insurance carrier is financially healthy and able to handle claims.

Motorcycle Insurance: Missouri Requirements

You may want to see also

Research the company's reputation

Researching an insurance company's reputation is a crucial step in choosing the right provider. A company's reputation is built on its ability to uphold responsibility and engage in transparent communication with its clients. While insurance is an essential safety net, insurance companies often have a negative public perception as profit-driven businesses that put their bottom line ahead of their customers. However, this is not always the case, and it is important to research and compare different companies to make an informed decision. Here are some key factors to consider when researching an insurance company's reputation:

- Customer Experience and Satisfaction: Focus on finding a company that prioritises customer experience and satisfaction. Look for companies with high customer satisfaction ratings and positive reviews from reputable sources such as Feefo and Trustpilot. Check if they have customer testimonials on their website and ask friends and family for referrals. Evaluate their customer service by considering factors such as responsiveness, ease of contact, and claims handling.

- Company Character and Values: Assess the company's character and values to ensure they align with your own. During the COVID-19 pandemic, many insurance companies demonstrated their values by assisting the public through premium credits, suspending late fees, and waiving policy cancellations. Consider the company's broader approach to innovation, environmental issues, and societal impact.

- Financial Stability and Reliability: It is essential to choose a financially stable insurance company to ensure they can meet their obligations and handle claims effectively. In the US, four major agencies—AM Best, Standard & Poor’s, Moody’s, and Demotech—provide ratings that evaluate an insurer's financial strength and claims-paying ability. These ratings consider various financial metrics, including capital reserves, asset quality, profitability, operational performance, and liquidity. Understanding these ratings can help you make an informed decision about the insurer's reliability.

- Industry Recognition and Awards: Look for insurance companies that have received industry recognition or awards for their services. J.D. Power, for example, publishes an annual report on customer satisfaction and claims handling satisfaction, including major insurance companies.

- Customisable Policies and Coverage Options: Choose an insurance company that offers flexible and customisable policies tailored to your specific needs and budget. Review the policy documents carefully to ensure you understand the terms, coverage, deductibles, and limitations.

- Technology and Digital Services: With the advancement of technology, consider the digital services and online tools offered by the insurance company. Evaluate their website, online policy management, claims filing process, and customer service accessibility.

By considering these factors and trusting your instincts, you can make a well-informed decision about the insurance company's reputation and whether it is the right fit for your needs.

Massachusetts Comprehensive Insurance Requirements

You may want to see also

Look up the company's financial health

When shopping for insurance, it is important to look into the financial health of the insurance company. You want to buy protection from a company that is financially strong enough to pay the claims of its customers, especially in times of financial strain, such as a natural disaster. There are several independent agencies that rate the financial strength of insurance companies. Each agency uses its own rating scale, standards, and population of rated companies. Here are some of the most prominent agencies:

A.M. Best

A.M. Best has the most experience rating insurance companies, having been in the business since 1906. The company publishes Best's Insurance Reports, a multi-volume set in two editions – Life and Health Insurance Companies and Property/Casualty Companies. Best rates each company on either an alphabetical (A++ to F) or a numerical scale. The latter is the Best Financial Performance Rating (“FPR”), with 9 being the highest rating and 1 being the lowest. For the latest ratings, visit the A.M. Best website at www.ambest.com.

Fitch Ratings

Fitch provides an assessment of the financial strength of an insurance organization and its capacity to meet senior obligations to policyholders on a timely basis. For the latest Fitch Ratings, visit the Fitch website at www.fitchratings.com.

Moody's Investor Services

Moody's assigns Financial Strength Ratings that measure an insurance company's ability to meet its senior policyholder obligations and claims. The ratings are broken down into nine distinct symbols, with each symbol representing a group of ratings with similar quality characteristics. For the latest Moody's rating, visit the company's website at www.moodys.com.

Standard and Poor's

Standard and Poor's rates the claims-paying ability of insurance companies that request and pay for a rating. The ratings are based on information furnished by the rated organizations or obtained by Standard & Poor’s from other sources. For the latest Standard and Poor’s Ratings, visit the agency’s website at www.standardandpoors.com.

Demotech

Demotech is a financial analysis firm specializing in evaluating the financial stability of regional and specialty insurers. The company's philosophy is to review and evaluate insurers based on their area of focus and execution of their business model rather than solely on financial size. Visit www.demotech.com for more information or to search for insurers that are currently assigned a Financial Stability Rating.

In addition to checking the ratings from these agencies, you can also analyze the financial health of an insurance company by looking at its balance sheet, income statement, cash flow statement, and financial ratios. These financial statements can provide insights into the company's assets, liabilities, revenue, expenses, profits, cash flow, and overall financial performance.

Rover: Insured and Ready to Go

You may want to see also

Search by company name

If you are trying to find out the name of your insurance carrier, there are a few things you can do. Firstly, you can check your emails. Most insurers send confirmation and essential policy details by email, so searching your inbox for terms like "insurance", "policy", or "premium" should bring up an email from your insurer. You could also try searching for your vehicle registration number, as this may be quoted in emails from your insurer.

Another option is to check any hard-copy insurance paperwork you may have. This may include your policy details, as well as other literature. You can also check your bank statements, as you likely have a standing order or direct debit set up for your insurance payments.

If you have a car, you can enter your vehicle registration into the Motor Insurance Database (MID) to find out whether your car has a valid insurance policy.

If you bought your policy through a large national company, you might know the name from jingles or TV commercials. However, if you purchased your policy through an independent agent, you may not know the name of the carrier. In this case, you can find your carrier's information on your declarations page or insurance cards, or by calling your agent.

If you are looking for the profile of a specific insurance company, you can search using a partial or full company name. This will allow you to access information such as the company's location, former names, reference information (including license status and state of domicile), lines of insurance the company is authorized to transact, and complaint history.

Certified Mail Insurance: What's Covered?

You may want to see also

Frequently asked questions

You can find your insurance carrier's name on your declarations page, insurance cards, or by calling your insurance agent.

An insurance carrier is another name for an insurance company. The terms insurer, carrier, and insurance company are used interchangeably.

If you bought your policy through an independent agent and don't have their direct contact information, you can speed up an insurance claim by knowing your carrier's name. Knowing the name of your carrier is also helpful when you need to contact their customer service center.

If you are unable to find the name of your insurance carrier, you can contact the insurance department in your state or refer to your state's insurance department website to confirm the company or HMO is licensed.

"Insurance carrier" and "insurance provider" are interchangeable terms. Both refer to the company that is behind your policy.