Liberty Mutual and Progressive are two of the largest car insurance companies in the US. Both offer a range of coverage options, including the six standard car insurance types, and have various discounts available. But which is better?

Cost

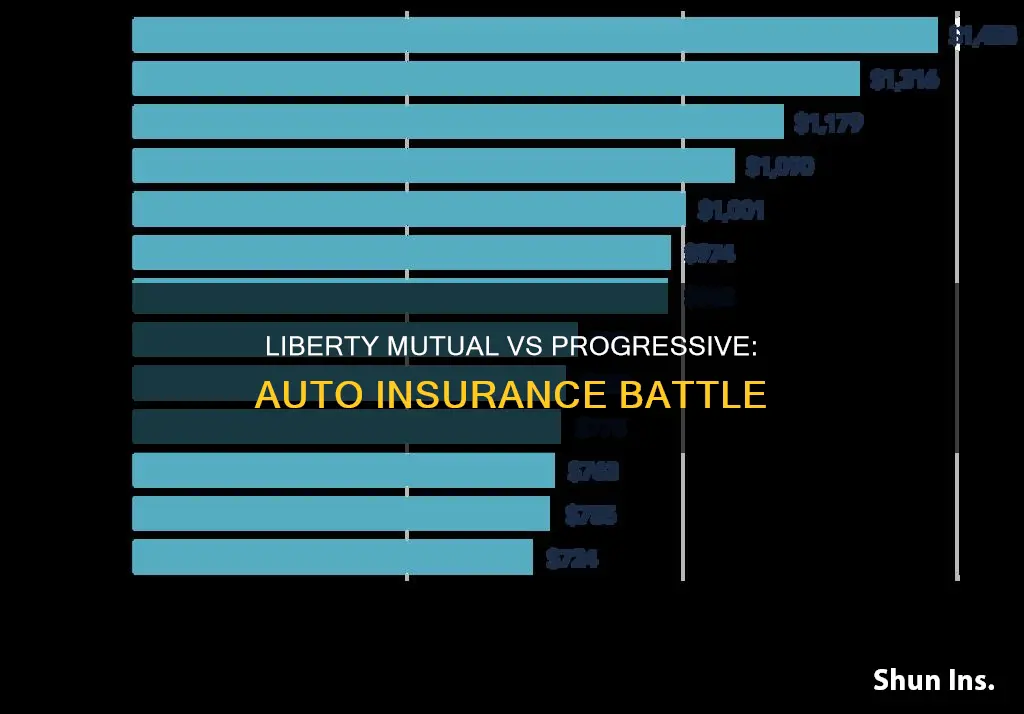

Progressive is generally the cheaper option, with an average rate of $104 per month, compared to Liberty Mutual's $144. However, Liberty Mutual has more options for usage-based savings, and it could be a better choice for drivers with poor credit scores.

Customer Service

Progressive has better customer service scores than Liberty Mutual, and it received fewer complaints relative to its size. However, Liberty Mutual closed more complaints in the last three years.

Coverage Options

While both companies offer the standard coverage options, Liberty Mutual has more unique coverage options, including new car or better car replacement, auto death indemnity coverage, disability coverage, and OEM coverage.

Financial Stability

Progressive has a superior financial strength rating from AM Best, while Liberty Mutual's rating is good.

Online Tools

Progressive has better online tools, including its Name Your Price tool, which allows customers to decide how much they want to pay and adjust their coverage accordingly.

| Characteristics | Values |

|---|---|

| Overall Score | Liberty Mutual: 9.0/10 |

| Progressive: 8.7/10 | |

| Cost | Liberty Mutual: 9.0/10 |

| Progressive: 7.8/10 | |

| Customer Service | Liberty Mutual: Above Average |

| Progressive: Above Average | |

| Coverage Options | Liberty Mutual: Excellent |

| Progressive: Good | |

| Financial Stability | Liberty Mutual: A (AM Best) |

| Progressive: A+ (AM Best) | |

| Online Tools | Liberty Mutual: Good |

| Progressive: Excellent |

What You'll Learn

Customer satisfaction and service

Customer Satisfaction Ratings

According to J.D. Power, a company that provides customer satisfaction data and insights, Progressive scored slightly higher than Liberty Mutual in overall customer satisfaction. Progressive scored 832/1000, while Liberty Mutual received 821/1000.

In the J.D. Power 2023 U.S. Insurance Shopping Study, Liberty Mutual scored above average, while Progressive scored just under the industry average of 861 out of 1,000 points for large insurers.

In The Zebra's Customer Satisfaction Survey, Progressive placed in the top five overall with a score of 4.3, while Liberty Mutual scored 4.2 and ranked fourteenth out of fifteen carriers.

Customer Complaints

The National Association of Insurance Commissioners (NAIC) measures customer complaint volume by comparing it to an average score of 1. Scores above 1 mean a company has received more complaints than average, while scores below 1 indicate fewer complaints. Liberty Mutual's NAIC score is 3.56, meaning it has received more complaints than average. Progressive's score is 1.33, indicating that it gets slightly more complaints than average but significantly fewer than Liberty Mutual.

Despite the number of complaints, Liberty Mutual has closed more than 2,300 complaints in the last three years, compared to Progressive, which has closed over 4,900.

Customer Service Features

Both Liberty Mutual and Progressive offer a range of customer service features. Liberty Mutual has a quick online application process, and customers can file claims and pay their bills online. Progressive offers 24/7 customer service and a handy mobile app.

Customer Recommendations

In a survey of nearly 7,000 customers, Liberty Mutual and Progressive scored almost identically on a scale of 5.0 for overall satisfaction and customer service from agents. Both companies also scored 7.5 out of 10.0 when customers were asked how likely they were to recommend their car insurance provider to their friends.

The Bottom Line

While Progressive generally comes out on top in terms of customer satisfaction and service, Liberty Mutual is still a great option and is known for its excellent customer service. When choosing an insurance company, it's important to consider not only the cost but also the level of customer service and satisfaction.

Trailer Insurance: What's Covered?

You may want to see also

Cost and affordability

Progressive is generally the cheaper option for car insurance, with an average rate of $104 per month. However, Liberty Mutual may be a better option for drivers with extremely bad credit, as its rates for those with a credit score of less than 580 are cheaper than Progressive's. Progressive is also likely to be more affordable for drivers with a score of 800 or better.

Progressive's average annual cost for full coverage for a 35-year-old is $2,030, compared to an estimate of $2,580 for a 26-year-old with Liberty Mutual. However, Liberty Mutual offers a range of discounts, and with these taken into account, it could work out as the cheaper option.

Both companies offer reasonable rates to most drivers, but it's worth remembering that individual insurance rates will differ from the average depending on your unique driving profile. The factors that go into determining auto insurance premiums are weighted differently from one company to another, so it's a good idea to get quotes from each company to see which is the best fit.

Progressive has lower average rates than Liberty Mutual, but Liberty Mutual still outscores Progressive in the cost category (9.0 to 7.8). Both companies offer many of the same car insurance discounts, but each one helps drivers save on their policies with unique options. For example, Liberty Mutual has a slight advantage when it comes to bundling and usage-based discounts.

When it comes to policy price and customer satisfaction, Progressive wins out over Liberty Mutual. However, Liberty Mutual has more unique coverage options. Both insurers reward drivers for safe driving behaviour and offer a variety of discounts and additional perks.

Sinkhole Safety: Understanding Auto Insurance Coverage

You may want to see also

Financial stability

In terms of customer satisfaction, Progressive ranks higher than Liberty Mutual in J.D. Power's studies. Progressive scored above average in the J.D. Power 2023 U.S. Insurance Shopping Study, while Liberty Mutual scored above average in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study. Progressive also placed in the top five in The Zebra's Customer Satisfaction Survey, while Liberty Mutual scored near the bottom.

Gap Insurance: Refund After Loan Payoff?

You may want to see also

Online tools and apps

Liberty Mutual and Progressive both offer a range of online tools and apps to help customers manage their policies.

Liberty Mutual's Online Tools and Apps

Liberty Mutual offers the RightTrack® program, which rewards drivers for safe driving. The program can be accessed through a mobile app or a plug-in device. The app also allows customers to manage their policies, pay bills, download insurance ID cards, request roadside assistance, and file and track claims. Liberty Mutual also offers a quick online application process and the ability to customise your car insurance coverage.

Progressive's Online Tools and Apps

Progressive offers the Name Your Price Tool®, which allows customers to decide how much they want to pay for car insurance and adjust their coverage accordingly. They also offer a mobile app with similar features to the Liberty Mutual app, as well as 24/7 customer service.

Comparison

Both companies offer useful online tools and apps with similar features. However, Progressive has been rated higher for its online tools and customer satisfaction. Progressive's app has a rating of 4.8 out of 5 stars on both the App Store and Google Play, while Liberty Mutual's app has a near five-star rating on both platforms. Progressive also scored higher than Liberty Mutual in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study and was rated as the best for online tools by MoneyGeek.

Umbrella Insurance: Auto Accident Coverage

You may want to see also

Discounts and additional features

Liberty Mutual offers 17 auto insurance discounts to its customers, which can save drivers up to 30% on their car insurance. These discounts are divided into four main groups: safe driver discounts, vehicle safety feature discounts, customer detail discounts, and customer loyalty discounts.

Safe driver discounts include an accident-free discount, a violation-free discount, and the RightTrack safe driving program, which offers an initial discount for signing up and a final discount of up to 30%.

Vehicle safety feature discounts include an anti-theft device discount, an advanced safety features discount, and an alternative energy discount for hybrid or electric vehicles.

Customer detail discounts include a homeowner discount, a military discount, an early shopper discount, a good student discount, and a student-away-at-school discount.

Customer loyalty discounts include a multi-car discount, a multi-policy discount, a preferred payment discount, a pay-in-full discount, an online purchase discount, and a paperless policy discount.

Progressive also offers a range of auto insurance discounts, including:

- Loyalty-based discounts for customers with two or more policies, such as a combination of auto, boat, motorcycle, RV, or home insurance.

- Continuous insurance discounts for customers who switch to Progressive after being with a previous insurer.

- Teen driver discounts for drivers aged 18 or under.

- Accident forgiveness discounts for small accidents (under $500) and large accidents (for customers with at least five years of accident and violation-free driving).

- Snapshot safe driver discounts, which personalizes rates based on actual driving behaviour.

- Good student discounts for full-time students with a "B" average or better.

- Distant student discounts for full-time students aged 22 or under who live more than 100 miles from home and do not have a vehicle at school.

- Homeowner discounts, even if the home is not insured through Progressive's network.

- Multi-car discounts for customers with more than one vehicle on their policy.

- Online quote discounts for customers who get a quote online or over the phone with a Progressive representative.

- Sign online discounts for customers who are comfortable signing documents online.

- Paperless discounts for customers who opt to receive documents via email.

- Paid-in-full discounts for customers who pay their policy upfront.

- Automatic payment discounts for customers who set up automatic payments.

- Safe driving discounts for customers with no tickets or accidents in the past three years.

Auto and Renter's Insurance: Different Addresses?

You may want to see also

Frequently asked questions

Progressive is generally the cheaper option, with an average rate of $104 per month. However, Liberty Mutual could be a better option for those with extremely bad credit.

Progressive has better customer satisfaction scores than Liberty Mutual. Progressive scored 832/1000, while Liberty Mutual received 821/1000.

Progressive has a superior financial strength rating from AM Best, while Liberty Mutual's rating is good.

Both companies offer the standard coverage options, but Liberty Mutual has more unique coverage options, including new car or better car replacement, auto death indemnity coverage, disability coverage and OEM coverage.

Both companies offer similar discounts, but Liberty Mutual has a slight advantage when it comes to bundling and usage-based discounts.