Liberty Mutual is one of the largest car insurance providers in the US. It offers a wide range of coverage options and discounts, including special coverage and teacher discounts. However, it doesn't offer the most affordable premiums, and the company has mixed reviews for customer satisfaction.

Liberty Mutual has an A rating for financial strength and is available in all 50 states. It has a decent customer service reputation, with MoneyGeek rating both its customer satisfaction and customer complaints as average. However, its car insurance policies are considered expensive.

The company has a mixed bag of ratings for claims and customer service. It ranked 11th in the J.D. Power 2022 U.S. Auto Insurance Claims Satisfaction Study and received a D+ grade in the Crash Network Insurer Report Card. Its consumer complaint index from the National Association of Insurance Commissioners (NAIC) is also worryingly high.

Overall, Liberty Mutual is a good choice for those seeking a wide range of coverage options and discounts, but there may be more affordable options available from other providers.

| Characteristics | Values |

|---|---|

| Customer Satisfaction Rating | 857 out of 1,000 |

| Customer Complaint Ratio | 3.56 |

| MoneyGeek Score | 67 out of 100 |

| J.D. Power Auto Claims Satisfaction Study Score | 866 out of 1,000 |

| NAIC Complaint Index Score | 3.56 |

| Net Promoter Score | 33% |

| AM Best Financial Strength Rating | A |

| Crash Network Insurer Report Card Grade | D+ |

What You'll Learn

Liberty Mutual's customer service reputation

Liberty Mutual has a mixed customer service reputation. While some customers praise the company's timely claims process and responsive customer service, others have reported inconsistencies in customer service and challenges in getting adequate compensation.

Liberty Mutual's customer satisfaction ratings are average to below average. The company received a score of 866 out of 1,000 in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study, which is slightly below the study average of 878. The company also has a high complaint index score from the National Association of Insurance Commissioners (NAIC), indicating that it receives more complaints than expected for a company of its size.

However, Liberty Mutual does offer a wide range of coverage options and discounts, which may make it a competitive option for budget-conscious shoppers. The company also has a strong financial standing, with an "A" rating from AM Best, indicating its ability to meet its financial obligations and pay claims.

Auto Insurance Claims: The Costly Aftermath

You may want to see also

Liberty Mutual's financial strength

Liberty Mutual has a strong financial strength rating, with an A rating from AM Best, indicating that the company has a strong financial standing and an excellent ability to meet its ongoing obligations to policyholders. The company also has an A rating from Standard & Poor's, A (Excellent) from A.M. Best, and A2 (Good) from Moody's.

In terms of financial stability, Liberty Mutual ranks well, with MoneyGeek giving it a score of 67 out of 100. The company also has a good reputation for financial security, with elements that suggest a susceptibility to impairment in the future. However, it is worth noting that Liberty Mutual's car insurance policies are considered expensive compared to other companies.

Overall, Liberty Mutual's financial strength is a key factor in its position as one of the largest car and home insurance providers in the US.

Auto Accidents and Medical Insurance: Understanding the Financial Impact

You may want to see also

Liberty Mutual's coverage options

Liberty Mutual offers a wide range of coverage options for car and home insurance.

Car Insurance Coverage Options

Liberty Mutual offers standard coverages such as liability insurance, comprehensive and collision insurance. They also offer add-on coverages like:

- Roadside assistance

- Rental car and travel reimbursement

- Accident forgiveness

- New car replacement

- Gap insurance

- Better car replacement

- Original equipment manufacturer (OEM) coverage

- Disability coverage

- 24-hour roadside assistance

- Mexico car insurance

- Medical payments coverage

- Uninsured motorist coverage

- Personal injury protection coverage

- Bodily injury liability coverage

- Property damage coverage

Home Insurance Coverage Options

Home insurance coverage options include protection for your house and possessions against damage or loss from events like fire, theft, storm damage, frozen pipes, etc. It also includes liability coverage for personal injuries sustained by others on your property.

Some of the add-on coverage options for home insurance include:

- Blanket jewelry coverage

- Water backup coverage

- Inflation protection

- Personal property replacement cost coverage

Driving Records: Auto Insurance Access

You may want to see also

Liberty Mutual's discounts

Liberty Mutual offers a wide range of discounts to its auto insurance customers, which can be stacked to drive down the cost of insurance coverage. The company categorises its discounts into four main groups: safe driver discounts, vehicle safety feature discounts, customer detail discounts, and customer loyalty discounts.

Safe Driver Discounts

- Accident-Free Discount: Customers who go at least five years without an accident are eligible for a discount.

- Violation-Free Discount: Customers who avoid violations such as speeding tickets, parking citations, or DUIs for five straight years will receive a discount.

- RightTrack Discount: Customers can save up to 30% by enrolling in Liberty Mutual's safe driving program. They will also get a discount just for signing up and participating.

Vehicle Safety Feature Discounts

- Anti-Theft Device Discount: If a covered car is equipped with anti-theft devices or technology, such as passive alarms or LoJack systems, customers are eligible for a discount.

- Advanced Safety Features Discount: If a covered car is equipped with advanced safety features like anti-lock brakes, adaptive headlights, or electronic stability controls, customers will receive a discount.

- Alternative Energy Discount: If a covered car is a hybrid or electric vehicle, customers will get a discount.

Customer Detail Discounts

- Homeowner Discount: Customers who are homeowners can get a discount.

- Military Discount: If one of the drivers listed on an auto insurance policy is an active, retired, or reserve member of the United States Armed Forces, customers will receive a discount.

- Early Shopper Discount: Customers who sign up for a new policy before their current policy expires will get a discount.

- Good Student Discount: If a student driver listed on the policy has a GPA of a 3.0 or better, customers will get a discount.

- Student Away-at-School Discount: If a driver listed on the auto insurance policy is a student who is away at school (typically one located 100+ miles from home) and doesn't take a car with them, customers will receive a discount.

Customer Loyalty Discounts

- Multi-Car Discount: If multiple vehicles are listed on a policy, customers will get a discount.

- Multi-Policy Discount: If a customer bundles other policies – such as home, life, or umbrella coverage – with auto insurance, they will get a discount.

- Preferred Payment Discount: Customers who enrol in automatic payments from a bank account will get a discount.

- Pay-in-Full Discount: If customers pay for their entire policy in one or two payments, they will receive a discount.

- Online Purchase Discount: Customers who buy their policy online will get a 12% discount.

- Paperless Policy Discount: Customers who go paperless by signing up for electronic communication will get a discount.

It's worth noting that the availability and eligibility criteria for each discount vary by state, and Liberty Mutual doesn't disclose its discount amounts in most cases.

National Insurance Record: Fill Gaps or Not?

You may want to see also

Liberty Mutual's pricing

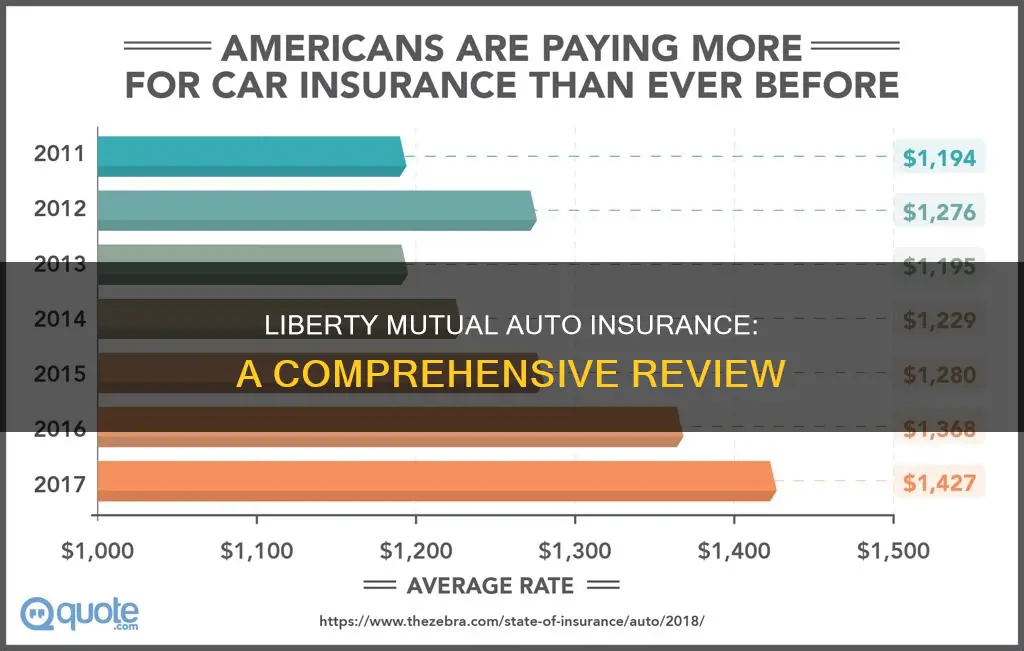

The cost of a Liberty Mutual car insurance policy depends on various factors, including your driving record, location, age, and the type of car you drive. The company also offers several add-on coverage options, such as rental car reimbursement and roadside assistance, which can increase the cost of the policy.

Liberty Mutual offers various discounts that can help reduce the cost of car insurance. These include discounts for safe driving, multiple cars, good students, and accident-free records. The company also offers a pay-per-mile program called ByMile, which can save drivers who don't drive often or have short commutes an average of 25%.

In terms of home insurance, Liberty Mutual's rates are typically lower than the national average. The company offers several discounts for home insurance as well, including claims-free discounts, early shopper discounts, and new/renovated home discounts.

Homeowners' Secret Weapon: Insurance Coverage for Auto Theft in Attached Garages

You may want to see also

Frequently asked questions

Liberty Mutual's customer satisfaction ratings are mixed. It has a Net Promoter Score of 33% and received an average score in J.D. Power's 2023 U.S. Insurance Digital Experience Study. However, it scored below average in the 2023 U.S. Auto Insurance Study across all regions where it was assessed.

Liberty Mutual's auto claims satisfaction ratings are also mixed. It received a score of 866 out of 1,000 in J.D. Power's 2023 U.S. Auto Claims Satisfaction Study, slightly below the study average of 878. Its customer complaint index from the National Association of Insurance Commissioners (NAIC) is also higher than the industry average.

Liberty Mutual has strong financial strength. It received an A rating from AM Best, indicating that it has a strong ability to meet its financial obligations and pay out claims.

Liberty Mutual's pricing is generally higher than its competitors. However, it offers various discounts and has competitive rates for specific demographics, such as teens and seniors.

Liberty Mutual ranks as the sixth-largest auto insurer in the U.S. based on direct premiums written. It offers a wide range of coverage options and discounts, but its ratings for customer satisfaction and claims are below average compared to other companies.