Flood insurance is a type of insurance coverage that protects homeowners from financial losses due to flood damage. While standard homeowners insurance policies typically exclude flood damage from their coverage, private flood insurance and FEMA's National Flood Insurance Program (NFIP) offer distinct options for those seeking protection against this specific risk. The choice between private flood insurance and NFIP depends on various factors, including cost, coverage limits, and waiting periods.

| Characteristics | Values |

|---|---|

| Administering body | FEMA/NFIP: Federal Emergency Management Administration (FEMA). Private insurance: Private companies |

| Coverage limits | FEMA/NFIP: Dwelling coverage up to $250,000, contents coverage up to $100,000. Private insurance: Dwelling coverage up to $500,000 or more, contents coverage up to $250,000 or more, depending on the insurer |

| Loss of use coverage | FEMA/NFIP: Not available. Private insurance: Available, depending on the insurer |

| Cost | Varies depending on the flood risk of the property. Private insurance is generally cheaper, with savings ranging from 20% to 50% or more. |

| Dependability | FEMA/NFIP: Guaranteed renewal. Private insurance: May not renew or may cancel coverage if the property is considered too high-risk |

| Waiting period | FEMA/NFIP: 30 days. Private insurance: Varies, some have the same 30-day requirement, while others offer coverage in as little as 10 to 14 days |

What You'll Learn

- Private flood insurance offers more flexibility and broader coverage options

- Private flood insurance is provided by private companies, not the federal government

- Private flood insurance is often cheaper

- Private flood insurance can be written more quickly

- Private flood insurance covers possessions more flexibly

Private flood insurance offers more flexibility and broader coverage options

In addition, private flood insurance often includes coverage for temporary living expenses, such as hotel stays and restaurant meals, if you are unable to live in your home after a flood. This type of coverage is not available through FEMA. Private flood insurance also typically has shorter waiting times to take effect, with some policies starting as soon as you pay the premium, while FEMA has a 30-day waiting period.

Private flood insurance companies can provide higher coverage limits and additional benefits that are not available through FEMA. For example, Neptune Flood, a private flood insurance company, offers residential property coverage of up to $4,000,000, which is 16 times the coverage provided by FEMA. Private flood insurance can also offer coverage for unattached structures, which is not included in FEMA's policies.

The flexibility and broader coverage options of private flood insurance make it a competitive alternative to FEMA's NFIP. Private flood insurance allows for tailored coverage that meets the specific needs of homeowners, ensuring they have the best possible protection for their homes and possessions.

Understanding Private Party Value and Insurance Claims

You may want to see also

Private flood insurance is provided by private companies, not the federal government

Private flood insurance is offered by private insurers, either in addition to or as a replacement for the traditional NFIP plan. Private flood insurance policies tend to offer more flexibility and broader coverage options than the standard FEMA/NFIP policy. For example, private flood insurance policies can offer coverage for temporary living expenses, such as hotel stays and restaurant meals, if you are unable to live in your home after a flood. Private flood insurance policies can also offer higher coverage limits for your home and belongings, with some policies offering up to $500,000 or more in dwelling coverage, compared to the NFIP limit of $250,000.

Private flood insurance policies can also be written more quickly than NFIP policies. NFIP policies require a 30-day waiting period after first paying the premium for a new policy, while some private insurers can offer coverage in as little as 10 to 14 days.

However, there are some potential drawbacks to private flood insurance. Private flood insurance is less dependable than federal policies, as private insurers may choose not to renew or even cancel a policy if they deem the home to be too high-risk. Private flood insurance is also a newer product, so there is uncertainty about future costs and which companies will continue to offer it.

Despite these potential drawbacks, private flood insurance can be a compelling option for homeowners, offering lower costs, higher coverage limits, and additional benefits compared to NFIP insurance.

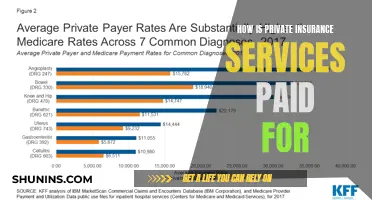

Private Insurance Support: Boon or Bane for Hospitals?

You may want to see also

Private flood insurance is often cheaper

A research paper by Milliman supports this price advantage. The actuarial and management consulting company found that 77% of single-family homes in Florida, 69% in Louisiana, and 92% in Texas would see cheaper premiums with private insurance. However, there are times when the NFIP will cost less, often in areas of low risk for floods. A property that was once rated lower for risk may have its premium grandfathered in, making the NFIP a more cost-effective option.

Private flood insurance companies are able to offer cheaper rates due to their ability to leverage a rising volume of climactic data to assess risk and price policies. This is in contrast to the NFIP, which uses often-outdated FEMA flood maps to drive premiums for the federal program.

The cost of any flood insurance policy is dependent on several factors, including whether the home is in a high, medium, or low-risk flood zone, proximity to bodies of water, elevation, and coverage limits. Private flood insurance plans offer much greater flexibility in coverage limits, which is where the biggest differences in cost are likely to be seen. As private flood insurance companies gain more experience with flood coverage, their rates may decrease over time due to increasingly accurate risk evaluations.

Haven Insurance: Private Hire Car Protection

You may want to see also

Private flood insurance can be written more quickly

Private flood insurance has a shorter waiting period than FEMA/NFIP insurance, which makes it a preferred option for residents who need coverage right away, such as during hurricane season.

FEMA/NFIP insurance typically has a 30-day waiting period before coverage takes effect, whereas private flood insurance policies usually have a one- or two-week waiting period, depending on the insurance company. Chubb, for example, aims to pay private flood insurance claims within 48 hours.

The shorter waiting period of private flood insurance means that it can be written more quickly than FEMA/NFIP insurance. This is particularly useful if you need coverage right away, such as during hurricane season.

However, it's important to note that private flood insurance can be riskier than FEMA/NFIP insurance. Private insurance companies can choose to change their rates or drop your coverage, whereas FEMA/NFIP insurance is more stable and guaranteed. Additionally, private flood insurance may be harder to obtain if you live in a high-risk flood zone.

Dual Coverage: Medi-Cal and Private Insurance

You may want to see also

Private flood insurance covers possessions more flexibly

Private flood insurance policies offer more flexibility and broader coverage options than the standard FEMA/NFIP policy. The $100,000 total for possessions under NFIP should be adequate for most homeowners. However, federal policies limit the total value of covered jewelry, artwork, furs, and other such collectibles to $2,500. Private insurance allows for a policy to be tailored, category by category, to the value of luxury possessions.

Private flood insurance also covers possessions more flexibly. For example, Neptune, a private flood insurance company, offers up to $500,000 in personal property coverage and up to $10,000 in coverage for belongings stored in your basement. Chubb, another private flood insurance company, offers up to $15 million in building and personal property coverage, as well as up to $15,000 in coverage for belongings stored in your basement.

Private flood insurance policies also typically include coverage for additional living expenses to cover temporary expenses like hotel stays and restaurant meals if you're unable to live in your home after a flood. This is not available with FEMA/NFIP policies.

Private flood insurance is also able to offer higher protection limits for your home and belongings, and policy enhancements like replacement cost value personal property coverage, limiting your out-of-pocket expenses after a flood loss.

Open Enrollment: Public vs Private Insurance Options

You may want to see also

Frequently asked questions

Private flood insurance is provided by private companies, whereas FEMA flood insurance is administered by the Federal Emergency Management Administration (FEMA) and backed by the federal government. Private flood insurance typically offers more flexibility and broader coverage options.

Private flood insurance often offers higher coverage limits, additional benefits like temporary living expenses, and quicker policy initiation. It is also generally more affordable, with savings ranging from 20% to 50%.

Private flood insurance may be harder to obtain for homes in high-risk flood zones, as private insurance companies may not want to take on the risk. Private insurance companies can also choose not to renew or cancel policies if they deem a home to be too high-risk.