Private health insurance is a prominent issue in the US, with the majority of the population having some form of coverage delivered by a private health insurer. The impact of private insurance on healthcare is a highly contested topic, with some arguing that it improves access to care, lowers death rates, and enhances health outcomes, while others claim that it leads to reduced competition, higher premiums, and worse experiences for patients.

Proponents of private insurance argue that it facilitates access to care, lowers death rates, and improves health outcomes. They highlight the association between private insurance and a reduced likelihood of individuals delaying or foregoing needed care due to financial constraints. Additionally, private insurance is believed to provide individuals with a sense of well-being and improved financial health, reducing the risk of catastrophic expenditures.

On the other hand, critics of private insurance argue that it leads to reduced competition, higher premiums, and worse experiences for patients. They point to research indicating that consolidation in the private health insurance industry results in premium increases and reduced payments to providers, without passing on savings to consumers. Studies also show that individuals with private insurance are more likely to report worse access to care, higher medical costs, and lower satisfaction compared to those on public insurance programs like Medicare.

The debate around the role of private insurance in healthcare is complex and multifaceted, with a range of factors influencing its impact. Further research and analysis are needed to fully understand the effects of private insurance on healthcare and to develop policies that optimize patient care and outcomes.

| Characteristics | Values |

|---|---|

| Number of people with health insurance | Approximately 90% of U.S. residents |

| Number of people with private insurance | 175 million Americans under 65 |

| Number of people with public insurance | 22 million Medicare beneficiaries |

| Insurance impact on health outcomes | Improved health outcomes, lower death rates, improved productivity |

| Insurance impact on access to care | Easier to obtain access to prescription drug therapies, early diagnosis and treatment |

| Insurance impact on financial health | Reduced financial strain on individuals, families and communities |

What You'll Learn

- Private insurance premiums and out-of-pocket spending are high and projected to grow

- Private insurance is linked to lower death rates, better health outcomes, and improved productivity

- Private insurance is associated with more timely and appropriate use of health care services

- Private insurance is associated with higher medical costs and lower satisfaction

- Private insurance is linked to more medical debt

Private insurance premiums and out-of-pocket spending are high and projected to grow

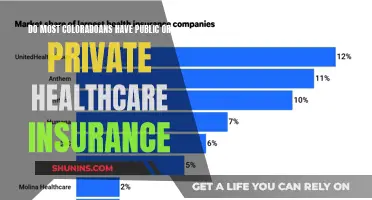

The high costs of private insurance are driven by consolidation in the private health insurance industry, which has led to premium increases even as insurers obtain lower prices from healthcare providers. This consolidation has resulted from mergers and the growth of market shares of Blue Cross Blue Shield affiliates. As a result, the four-firm concentration ratio for the sale of private insurance increased from 74% to 83% between 2006 and 2014.

The high costs of private insurance have significant implications for consumers. Individuals with employer-sponsored insurance are more likely to experience instability in coverage and difficulty receiving medical care or filling prescriptions due to cost compared to those on public insurance programs like Medicare. They are also less likely to have a personal physician and are less satisfied with their care.

The high costs and limited access associated with private insurance have led to a push by Democrats to enact a public health insurance option. This would provide a more cost-effective alternative to private insurance and help reduce the number of uninsured individuals in the US.

Private Insurance Happiness: Americans' Satisfaction Surveyed

You may want to see also

Private insurance is linked to lower death rates, better health outcomes, and improved productivity

Private insurance is linked to several positive outcomes, including lower death rates, better health outcomes, and improved productivity.

Firstly, private insurance is associated with lower death rates. Research has shown that uninsured adults are more likely to die prematurely than their privately insured counterparts. For example, a study following adults aged 25 or older found that, at the end of a 13 to 17-year follow-up period, twice as many uninsured participants had died compared to those with private health insurance. Another study tracking adults between 25 and 65 years of age found that uninsured white men had a 20% higher risk of dying than those with employment-based health insurance.

Secondly, private insurance is linked to better health outcomes. Uninsured individuals are less likely to receive preventive and screening services and often experience delays in seeking care. They are also less likely to have a regular source of care, which can lead to disruptions in medical care and negative health consequences. In contrast, insured individuals have improved access to care, including prescription drug therapies, early diagnosis and treatment, and behavioral health services.

Lastly, private insurance contributes to improved productivity by reducing financial strain on individuals, families, and communities. Insured individuals are less likely to skip medications or avoid seeking care due to cost, reducing the risk of costly emergency department visits and improving their overall financial health. This, in turn, can positively impact their ability to work and seek employment.

Overall, private insurance has been shown to have a positive impact on individuals' health and well-being, leading to lower death rates, better health outcomes, and improved productivity.

Private Insurance: Drug Screening for Opioid Users?

You may want to see also

Private insurance is associated with more timely and appropriate use of health care services

People with private insurance are more likely to receive preventive and screening services and to receive them in a timely manner. This is especially true for relatively costly services, such as mammograms. Private insurance facilitates a continuing care relationship or regular source of care, which increases the likelihood of receiving appropriate care.

Private insurance is also associated with better health outcomes for adults. Uninsured adults are at greater risk of late-stage, often fatal cancer. Early diagnosis, which is more common among those with private insurance, frequently improves the chances of surviving cancer. Private insurance also enhances the opportunities to acquire a regular source of care, which is key to high-quality health care.

In addition, private insurance is associated with lower death rates, improved productivity, and reduced financial strain on individuals, families, and communities.

Dual Coverage: Medi-Cal and Private Insurance

You may want to see also

Private insurance is associated with higher medical costs and lower satisfaction

A study published in JAMA found that privately insured individuals are more likely to report worse access to care, higher medical costs, and lower satisfaction than those on public insurance programs like Medicare. The study, which surveyed almost 150,000 people, found that people with employer-sponsored insurance were less likely to have a personal physician and more likely to report instability in insurance coverage when compared to those on Medicare. They also faced more difficulties in receiving medical care or filling prescriptions due to cost and reported lower satisfaction with their care. Similar results were observed when comparing individuals with individually purchased insurance to those on Medicare.

Another study, conducted by the Institute of Medicine, found that uninsured adults are less likely to receive preventive and screening services and are less likely to receive them in a timely manner when compared to adults with any kind of health coverage. The study also reported that uninsured adults are at greater risk of late-stage cancer, which often leads to premature death.

The high costs associated with private insurance can also be seen in the context of industry consolidation. Research shows that consolidation in the private health insurance industry has led to premium increases, even though insurers with larger market shares obtain lower prices from healthcare providers. This suggests that the savings from reduced payments to providers are not passed on to consumers.

Furthermore, the impact of private insurance on healthcare costs is also reflected in the variation across states. For example, the proportion of people without health insurance ranges from a high of 17.7% in Texas to a low of 2.8% in Massachusetts. This indicates that the availability and affordability of private insurance can significantly influence healthcare costs for individuals.

In addition to higher costs, private insurance can also lead to lower satisfaction due to the quality of benefits offered. Medicare beneficiaries, for instance, typically experience relatively low out-of-pocket costs and higher satisfaction. On the other hand, private insurance often comes with high deductibles and other cost-sharing requirements, which can result in lower satisfaction for those who have to bear these additional expenses.

Understanding Private Insurance: What Counts and What Doesn't

You may want to see also

Private insurance is linked to more medical debt

A study by the Institute of Medicine (US) Committee on the Consequences of Uninsurance found that uninsured adults are less likely than adults with any kind of health coverage to receive preventive and screening services and less likely to receive these services on a timely basis. The study also found that health insurance that provides more extensive coverage of preventive and screening services is likely to result in greater and more appropriate use of these services.

The study concluded that health insurance improves the likelihood of appropriate care and is associated with better health outcomes. Adults without health insurance coverage die sooner and experience greater declines in health status over time than do adults with continuous coverage.

Another study by the Commonwealth Fund found that consolidation in the private health insurance industry leads to premium increases, even though insurers with larger local market shares generally obtain lower prices from health care providers. The study also found that mergers lead to reduced payments to providers, but the cost savings are not usually passed through to consumers.

A report by JAMA Network Open also found that privately insured individuals are more likely to report worse access to care, higher medical costs, and lower satisfaction than those on public insurance programs like Medicare. The report suggested that public options may provide more cost-effective care than private ones.

The Affordable Care Act has led to significant gains in health coverage, with nearly 20 million individuals newly insured. However, more than 28 million individuals still lack coverage, putting their physical, mental, and financial health at risk.

Understanding Private Insurance Payouts: Are They Taxable?

You may want to see also

Frequently asked questions

Private insurance can impact healthcare accessibility in a variety of ways. For example, individuals with employer-sponsored insurance are less likely to have a personal physician and more likely to experience instability in insurance coverage compared to those on public insurance.

Private insurance can also impact healthcare affordability. For instance, individuals with employer-sponsored insurance are more likely to face difficulties in receiving medical care or filling prescriptions due to high costs compared to those on public insurance.

Private insurance may also influence the quality of healthcare. People with employer-sponsored insurance generally report lower satisfaction with their care compared to those on public insurance.

Private insurance can further impact healthcare outcomes. Research suggests that uninsured adults are less likely to receive preventive and screening services, leading to poorer health outcomes and higher mortality rates.