There are several factors that determine your commercial auto insurance rate. These include the type and number of vehicles covered by the policy, the driving history of the employees who will be using the vehicles, the location where the vehicles will be driven, and the business's credit history.

| Characteristics | Values |

|---|---|

| Vehicle Type and Use | Commercial auto insurance policies vary depending on the number and type of vehicles covered. Trucks, tractors and trailers that weigh more are more likely to cause serious damage in an accident and may have trouble navigating city streets. |

| Driving History of Employees | The driving history of employees will impact auto insurance rates. Carriers will check driving and claim history to assess the likelihood of a claim being filed. |

| Location | Driving in a busy metropolitan area will affect insurance rates differently to driving in a rural area. |

| Credit History | Credit reports are used to gauge the likelihood of a business filing a claim. Payment history, bankruptcies, collections, outstanding debts, and credit history length are all considered. |

What You'll Learn

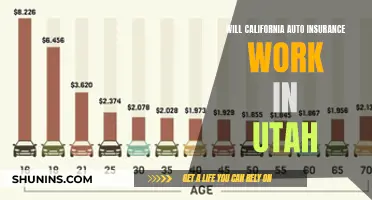

Driver age

Age is one of the most important factors that insurance companies consider when determining car insurance rates. This is because younger drivers have less driving experience, making them more likely to cause accidents. According to the Insurance Institute for Highway Safety, drivers aged 15 to 20 were responsible for 7% of all fatal accidents, despite only accounting for 4% of drivers. As a result, teen drivers often pay double or triple the average insurance rate.

The fatal crash rate per mile for licensed drivers aged 16-19 is nearly three times that of individuals aged 20 and older. In addition, motor vehicle crashes are the second leading cause of death for teens in the US. Younger drivers are also more likely to engage in risky behaviours such as distracted driving, not wearing a seatbelt, speeding, and driving under the influence of alcohol.

Due to these factors, insurance companies view young drivers as high-risk and charge them higher rates to offset the potential costs of claims. The cost of car insurance typically decreases as drivers gain more experience and enter their mid-20s, with rates lowest for drivers in their 50s and early 60s.

However, rates begin to increase again for drivers over 60 as age-related factors such as vision and hearing loss, and slower reflexes, make seniors more likely to be involved in accidents. According to the CDC, older adults are more vulnerable to injuries in car crashes, and their risk of being killed or injured in a crash increases with age.

How to Save on Car Insurance for Young Drivers

- Join a family policy: It is significantly cheaper for a teenager to be added to their parents' policy than to purchase their own coverage.

- Good student discounts: Maintaining good grades in high school or college can lead to discounts of up to 10% on car insurance.

- Defensive driving courses: Completing a driver's education program can lead to insurance discounts, with an average savings of about 10%.

- Shop around: Comparing rates from different insurance companies can help find the best deal, as rates can vary widely between providers.

- Look for discounts: Many insurance companies offer discounts for young drivers, such as good student discounts, driver training discounts, and safe driving discounts.

How to Save on Car Insurance for Senior Drivers

- Shop around: Compare rates from multiple insurance companies to find the best deal.

- Ask for discounts: Insurance companies offer various discounts, such as those for safe driving, multiple policies, and vehicle safety features.

- Usage-based insurance: Some companies offer programs that track driving behaviour and offer discounts for safe driving.

- Safe driving courses: Completing an approved safe driving course can lead to insurance discounts for seniors.

State Regulations

It is important to note that age-based insurance rates vary depending on state regulations. Some states, such as Hawaii and Massachusetts, ban the use of age as a rating factor, while others may have different thresholds for when rates increase or decrease based on age.

Audi Connect: Insurance Tracking System?

You may want to see also

Driving history

Insurance companies use driving records to assess the risk associated with insuring a driver. A history of accidents, traffic violations, and serious moving violations, such as speeding or driving under the influence (DUI), will result in higher insurance rates as these are considered high-risk behaviours. Even a single wreck or speeding ticket can double or triple insurance rates. This is because insurers assume that drivers with a history of violations and accidents are more likely to have similar problems in the future, increasing the insurer's liability and the probability that they will have to pay out claims.

On the other hand, drivers with a clean driving record are considered safer and are often rewarded with lower insurance premiums. Maintaining a clean driving record can be achieved by practising safe driving habits, obeying traffic laws, and avoiding accidents and speeding tickets. Additionally, taking a defensive driving course can help reduce points on a driving record and may even lead to insurance discounts.

The impact of driving history on insurance rates can vary depending on the severity and frequency of violations. For example, a single speeding ticket may not significantly affect insurance rates, especially if the driver has an otherwise clean record. However, multiple speeding tickets or more severe violations, such as DUI convictions, can lead to substantial increases in insurance premiums.

It's important to note that the length of time that violations and accidents impact insurance rates can vary. Most insurance providers will increase premiums for three to five years after a major moving violation or at-fault accident. Additionally, DUI convictions can stay on a driving record for up to ten years in some cases, significantly impacting insurance rates during that period.

College Kids: Vehicle Insurance Dependants?

You may want to see also

Vehicle type

The type of vehicle you drive has a significant impact on the cost of your commercial auto insurance. Insurance companies consider the average cost of claims for different types of vehicles when setting rates, and this is reflected in the policy limit for a given insurance policy.

Vehicles that are heavier or larger than a standard pickup or SUV, such as dump trucks, tow trucks, semi-trucks, or commercial trailers, typically require a commercial auto insurance policy. This is because heavy-duty vehicles can cause more damage in an accident and may need special insurance coverages. The cost of repairing or replacing a vehicle factors into insurance rates, so luxury vehicles with advanced technology and safety features will be more expensive to insure.

The age of a vehicle also matters. A newer, more expensive vehicle with advanced features will be more costly to insure than an older, base-model vehicle with high mileage. Sports cars are considered higher risk than minivans, for example, and will have more expensive insurance policies.

The brand of the vehicle is another factor. For instance, according to Quadrant Information Services, Dodge has the highest car insurance costs on average, while Mazda has the lowest.

The type of vehicle you drive is an important consideration when determining commercial auto insurance rates, and insurance companies will assess the specific characteristics of your vehicle when setting policy rates.

Double Insuring Vehicles: Legal or Not?

You may want to see also

Location

The location of your business is a key factor in determining the cost of commercial auto insurance. The rate varies depending on whether your business is located in a large city or a rural area. Typically, urban areas are associated with higher insurance rates due to the increased risk of collisions, vandalism, and theft. The cost of commercial auto insurance also takes into account the specific state your business operates in. States with harsh weather conditions, such as frequent hurricanes or heavy snow, tend to have higher insurance rates. Additionally, states with higher population densities often lead to higher insurance premiums.

The location of your business also influences the cost of commercial auto insurance through the driving location and distance covered by your vehicles. The number of miles your fleet travels is directly related to the risk of accidents, with longer distances resulting in higher insurance rates. This is an important consideration for businesses that operate across multiple states or cover significant distances within a state.

Furthermore, the location of your business affects the cost of commercial auto insurance by impacting the cost of medical care, car repair, and the frequency of auto accident lawsuits. These location-specific factors are taken into account by insurance companies when calculating commercial insurance rates.

It is worth noting that the number of vehicles your business owns and their value also play a significant role in determining commercial auto insurance rates. The more vehicles your business operates, the higher the insurance cost tends to be. Additionally, the age, size, and purpose of your vehicles can influence the premium. For example, a newer and larger vehicle used for transporting expensive materials will likely have a higher insurance cost than an older and smaller vehicle used occasionally.

Vehicle Insurance: Due Date Reminder

You may want to see also

Gender

In most states, gender plays a role in determining auto insurance rates, with males typically paying more, especially during their teenage and young adult years. The difference in rates between males and females is often attributed to statistical variations in crash and claims histories, driving behaviours, and miles driven. Males are generally considered higher-risk drivers due to a higher likelihood of accidents, receiving tickets, and DUI arrests. This risk factor leads to higher insurance rates for young male drivers.

However, as drivers age, the gender gap in insurance rates narrows, and by around age 30, rates become similar for both genders. After age 50, females may pay slightly less than males, but the difference is usually minimal, amounting to less than $50 annually.

It is worth noting that some states, such as California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania, have banned the use of gender as a factor in setting insurance rates. In these states, insurance companies are prohibited from using gender as a pricing factor, ensuring that rates are unisex.

While gender can impact insurance rates, especially for young drivers, other factors such as age, driving record, vehicle type, and location also play a significant role in determining insurance premiums.

GEICO: Gap Insurance Coverage

You may want to see also

Frequently asked questions

Commercial auto insurance rates vary depending on the number and type of vehicles covered. Trucks, tractors, and trailers that weigh more are generally considered more dangerous and thus have higher insurance rates.

Yes, the Insurance Services Office (ISO) has several classifications for vehicle use that affect rate calculations. These include service use, retail use, and commercial use.

The driving history of your employees will impact your auto insurance rates. Carriers will check driving and claim history to assess the likelihood of a claim being filed. Hiring lower-risk drivers can result in substantial savings on your insurance premiums.

Many insurers use credit reports to gauge the likelihood of your business filing an insurance claim. A strong credit history can lead to lower insurance premiums over time.