California has made significant strides in reducing the number of uninsured residents in recent years. As of 2022, the percentage of nonelderly Californians without health insurance dropped to 6.2%, a notable decline from 7.4% in 2021. This progress is largely attributed to the implementation of the Affordable Care Act (ACA), which has contributed to a steady decrease in the uninsured rate since 2014. Despite these improvements, however, millions of Californians still lack health insurance, and disparities persist across racial and ethnic groups. Undocumented immigrants constitute the largest group of uninsured individuals in the state, facing barriers to coverage due to their immigration status. Addressing these challenges and ensuring that all Californians have access to adequate health insurance remains a priority for policymakers and legislators in the state.

What You'll Learn

Undocumented Californians are the largest group without insurance

California has made remarkable progress in expanding access to health coverage for its residents. In 2022, the percentage of nonelderly Californians without health insurance dropped to a historic low of 6.2%. Despite this, undocumented Californians remain the largest group without insurance in the state.

In 2024, California expanded Medi-Cal eligibility to all low-income adults, regardless of immigration status. This was the biggest expansion of coverage in the state since the Affordable Care Act (ACA). However, undocumented Californians who earn too much to qualify for Medi-Cal remain uninsured and face significant barriers to accessing affordable coverage.

It is estimated that there are 520,000 uninsured undocumented Californians who do not qualify for Medi-Cal and cannot afford employer-based coverage. This group is categorically excluded from enrolling in Covered California and is not eligible for federal subsidies to reduce the cost of premiums. As a result, they face substantial financial barriers to obtaining health insurance.

In addition to cost, undocumented Californians face other challenges in enrolling in health insurance. These include confusion about eligibility policies, language and literacy challenges, and fear due to past immigration policies. For example, the Trump-era public charge rule, which linked the use of public benefits like Medi-Cal to immigration status, has left many immigrants wary of signing up for health benefits, even though the rule is no longer in effect.

To address these issues, California policymakers are considering applying for a federal waiver to expand eligibility for Covered California to all residents, regardless of immigration status. This would enable an additional 520,000 uninsured undocumented Californians to enroll in health insurance.

While California has made significant strides in expanding health coverage, the large number of uninsured undocumented residents highlights the need for continued efforts to ensure that all residents have access to affordable and comprehensive health insurance.

VA Life Insurance: Is It Worth the Cost?

You may want to see also

Cost is a significant barrier to obtaining insurance

While California has achieved its lowest uninsured rate ever in 2022, with only 6.2% of nonelderly Californians without health insurance, there are still many who are uninsured. Cost is a significant barrier to obtaining insurance for many Californians.

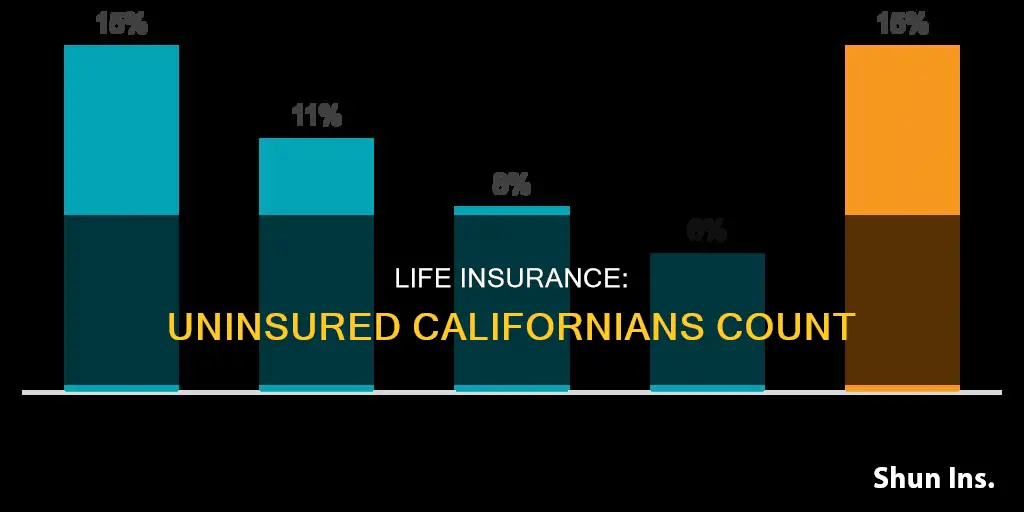

According to estimates, there are four main groups of uninsured individuals in California. The first group, consisting of 1.8 million people, is ineligible for insurance due to their immigration status. The second group, comprising 550,000 individuals, is eligible to purchase coverage but does not qualify for federal subsidies to reduce the cost of premiums. The high cost of living in California makes it challenging for this group to afford health coverage. The third group, consisting of 401,000 people, is eligible for coverage and has low incomes but still faces financial barriers due to high deductibles and premium payments. The final group, with 322,000 individuals, is eligible for Medi-Cal but is not enrolled due to factors such as fear of enrolling in a government program or complex enrollment processes.

The high cost of insurance is a significant barrier, especially for those without financial assistance. Life insurance rates increase with age, and insurers consider factors such as health status, job, weight, smoking status, and family health history when determining premiums. For example, a 20-year term life insurance policy for a 40-year-old with $500,000 in coverage costs around $50 per month. However, the average cost rises to $593 per month for a 65-year-old. Additionally, men tend to pay higher premiums than women due to their shorter life expectancy.

The cost of insurance can be a challenge, especially for those with low incomes or those facing high living expenses, such as in California. This financial barrier leads to individuals and families forgoing insurance or struggling to meet the costs of premiums and deductibles.

To address these financial barriers, California is considering various proposals. One proposal aims to expand Medi-Cal eligibility to all adults with low incomes, regardless of immigration status. Another suggestion is to use state funds to make coverage more affordable by supplementing or extending federal subsidies for Covered California. Additionally, there is a proposal to streamline the Medi-Cal enrollment process for uninsured children and pregnant women enrolling in specific supplemental nutrition programs.

Life Insurance and Suicide: What's Covered?

You may want to see also

Disparities exist between races and ethnicities

These disparities are driven by socioeconomic characteristics that are more prevalent among minority populations, such as income, employment, citizenship, and language. For example, low-income jobs often do not provide health benefits, and language barriers can prevent individuals from enrolling in public insurance plans. Additionally, racial and ethnic minorities tend to have higher rates of insurance loss, which contributes to overall disparities in insurance coverage rates.

Furthermore, certain events, such as losing employment or getting divorced, are connected to insurance loss, and minority groups are disproportionately affected by these events. For instance, African Americans and Hispanics have higher rates of unemployment and divorce than their White counterparts.

The Affordable Care Act (ACA) has attempted to address these issues by offering subsidies, expanding Medicaid eligibility, and providing outreach in multiple languages. While the ACA has led to gains in health insurance coverage for racial and ethnic minorities, disparities in coverage by race and ethnicity persist.

In the context of life insurance, a study by the Federal Reserve Bank of Chicago found that African American households are more likely to own life insurance than similar White households. This is in contrast to the lower ownership rates of other financial assets by African Americans. The study speculates that this may be due to the historical role of African American-owned life insurance firms or higher mortality rates among African Americans. However, further research is needed to understand this disparity fully.

Haven Life Insurance: Maryland's Top Choice for Coverage

You may want to see also

California has the lowest uninsured rate in 2022

In 2022, California achieved its lowest uninsured rate ever. The percentage of nonelderly Californians (under 65) without health insurance dropped to 6.2% in 2022, a significant decline from 7.4% in 2021. This data is based on the California Health Interview Survey (CHIS).

The rate of nonelderly people without coverage for a year or more also reached a historic low in 2022. Referred to as the "long-term uninsured", their rate dropped from 5.7% in 2021 to 4.5% in 2022, a notable decline.

California's Latino/x population experienced the largest improvement in coverage between 2021 and 2022. The share of this demographic reporting being uninsured dropped from 11.4% in 2021 to 9.1% in 2022, a statistically significant change and a historic low for this group. The uninsured rate for White Californians also declined, from 3.6% to 2.8%. Despite these improvements, disparities persist, with Latino/x and Black and Asian Californians uninsured at triple and double the rate of White Californians, respectively.

While California's uninsured rate is at a historic low, challenges remain. The federal continuous coverage requirement for Medicaid ended in 2023, and it is estimated that 2-3 million Californians may leave Medi-Cal as a result. The state's high cost of living and inflation are also factors that may impact the ability of Californians to maintain insurance coverage. The state legislature is considering various proposals to address these barriers, including expanding Medi-Cal eligibility and making coverage more affordable through state funds.

Joint Term Life Insurance: What Couples Need to Know

You may want to see also

Life insurance ownership has declined over the last decade

While the conversation around insurance in California has predominantly focused on health insurance, it is worth noting that life insurance ownership is also a critical component of financial security for individuals and families. Recent statistics reveal a complex picture of preparedness and awareness, with a significant portion of Americans either uninsured or underinsured. This trend is also reflected in California, where despite overall improvements in health insurance rates, many residents may still lack adequate life insurance coverage.

In 2024, it was reported that approximately 60% of Americans possessed some form of life insurance policy. However, this figure represents a decline from previous years, indicating a concerning trend in insurance ownership. Over the last decade, life insurance ownership among Americans has decreased, with rates dropping from a high of 63% in 2011. This decline in ownership is even more pronounced among women, with only 49% reporting coverage compared to 55% of men, marking the fifth consecutive year of declining life insurance ownership for women.

Several factors contribute to the decline in life insurance ownership. One of the most significant barriers is the perceived high cost of insurance. Many Americans, especially younger generations, overestimate the expense of a basic term life insurance policy, believing it to be far more costly than it is in reality. This misconception persists despite evidence of the affordability of term life insurance. Additionally, a general misunderstanding of policy benefits may deter individuals from purchasing coverage. Life insurance is often solely associated with covering funeral costs, neglecting its role as a financial safety net for dependents, debt management, and business support.

Financial constraints and competing priorities also play a role in the decline of life insurance ownership. For instance, Gen X and millennial respondents cited other financial commitments, such as rent, utilities, and credit card debt, as taking precedence over investing in life insurance. This shift in priorities may be influenced by immediate financial concerns that overshadow the perceived importance of life insurance. Furthermore, a knowledge gap exists, with 44% of Americans admitting to having limited understanding of life insurance policies, which significantly impacts their purchasing decisions.

To address the decline in life insurance ownership, educational initiatives are crucial. By enhancing awareness and providing clear, accurate information about the benefits and affordability of life insurance, more individuals may consider it a viable option for their financial planning. Innovative policy designs that cater to diverse needs, such as no-exam life insurance policies, can also help attract younger demographics who may be deterred by the perceived inconvenience of standard policies.

While California has made significant strides in reducing the number of uninsured residents when it comes to health insurance, the conversation around life insurance ownership highlights the ongoing challenges and the need for informed decision-making and access to affordable policies.

Life Insurance Rating: Is Third-Best Good Enough?

You may want to see also

Frequently asked questions

In 2022, 6.2% of nonelderly Californians were without health insurance, a decline from 7.4% in 2021.

In 2022, nearly 3.2 million Californians were projected to be without insurance, or about 9.5% of the population aged 0-64.

As of 2023, 52% of Americans have life insurance, up from 50% in 2022.