In 2022, 25.6 million non-elderly people in the US were uninsured, a decrease of 3.3 million from 2019. This equates to 9.6% of the population, a record low. The number of people without health insurance has been on a downward trend since 2010, when the Affordable Care Act (ACA) was introduced. Despite this, the US healthcare system is still flawed, with many uninsured Americans having to go to great lengths to get treatment. The high cost of insurance is the main reason why many people don't have health insurance.

What You'll Learn

- The number of uninsured Americans dropped by 5.6 million from 2019 to 2022

- In 2022, 25.6 million non-elderly Americans were uninsured

- The main reason for lacking insurance is its high cost

- Uninsured people often face unaffordable medical bills

- The uninsured rate among working-age adults decreased by 0.8% from 2021 to 2022

The number of uninsured Americans dropped by 5.6 million from 2019 to 2022

In 2022, 25.6 million nonelderly Americans were uninsured, a decrease of 3.3 million from 2019. This drop in the number of uninsured Americans is a continuation of a downward trend that started during the coronavirus pandemic. The number of nonelderly uninsured Americans dropped by 1.9 million from 2021 to 2022, and the uninsured rate decreased from 10.2% in 2021 to a record low of 9.6% in 2022.

The decrease in the number of uninsured Americans can be attributed to coverage expansions put in place by the Affordable Care Act (ACA), including Medicaid expansion and subsidized Marketplace coverage. These provisions served as a safety net for people who lost their jobs or faced other economic and coverage disruptions during the pandemic. Additionally, pandemic-era policies such as continuous enrollment for Medicaid enrollees and enhanced Marketplace subsidies further protected low-income individuals against coverage losses and improved the affordability of private coverage.

The decline in the uninsured rate from 2019 to 2022 was driven by an increase in employer-sponsored, Medicaid, and non-group coverage among nonelderly adults. The share of nonelderly people covered by Medicaid increased by 1.7 percentage points from 2019 to 2022, while the share with non-group coverage increased by 0.5 percentage points. During the same period, employer coverage declined by 0.6 percentage points.

The decrease in the number of uninsured Americans is particularly notable among certain demographic groups. Coverage gains were larger among nonelderly American Indian and Alaska Native people and Hispanic people compared to their White counterparts. Additionally, individuals in low-income families, particularly those in poverty, and those in working families experienced greater declines in the uninsured rate. The uninsured rate for nonelderly adults was higher than that for children, with 11.3% of adults uninsured compared to 5.1% of children.

While the overall number of uninsured Americans has decreased, it is important to note that racial and ethnic disparities in coverage persist. Nonelderly Hispanic and American Indian and Alaska Native people have higher uninsured rates than White people. Furthermore, people of color, particularly Hispanic and White individuals, comprise a significant portion of the total nonelderly uninsured population.

The Surprising Benefits of Term Insurance: Unlocking Peace of Mind

You may want to see also

In 2022, 25.6 million non-elderly Americans were uninsured

In 2022, 25.6 million non-elderly Americans were without health insurance, a decrease of 1.9 million from 2021 and 3.3 million from 2019. This number represents a record-low uninsured rate of 9.6% in 2022, down from 10.2% in 2021 and 10.9% in 2019. The decline in the uninsured rate can be attributed to coverage protections put in place during the COVID-19 pandemic, such as the continuous enrollment provision in Medicaid and enhanced subsidies in the Marketplace. These protections ensured that people who lost their jobs during the pandemic could remain enrolled in Medicaid and improved the affordability of private coverage.

The majority of the 25.6 million non-elderly uninsured Americans are adults, with children making up a smaller proportion. Most of these individuals come from low-income families, with nearly three-quarters (73.3%) having at least one full-time worker in their family, and an additional 10.9% having a part-time worker. Over 80% of the uninsured have family incomes below 400% of the Federal Poverty Level (FPL), and nearly half (46.6%) have incomes below 200% FPL.

Racial and ethnic disparities in coverage persist, with people of colour accounting for 62.3% of the total non-elderly uninsured population, despite only making up 45.7% of the non-elderly US population. Hispanic and White people comprise the largest shares of the non-elderly uninsured population at 40.0% and 37.7%, respectively. Non-elderly Hispanic (18.0%) and American Indian and Alaska Native people (19.1%) are more than 2.5 times more likely to be uninsured compared to White people (6.6%).

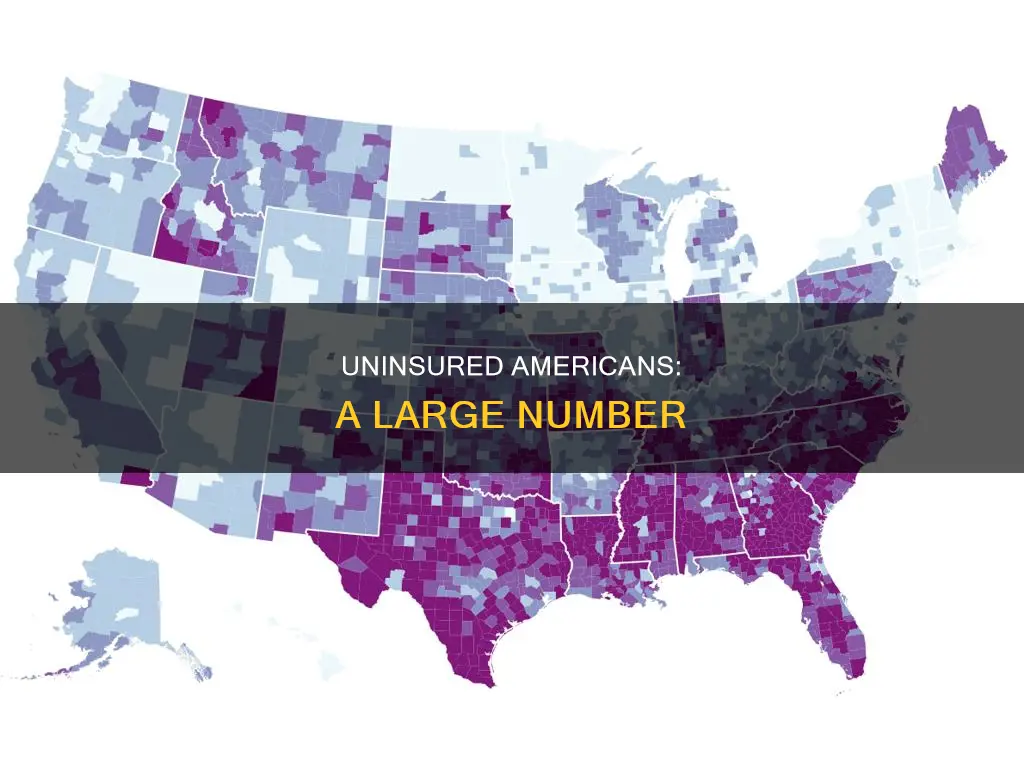

Geographically, most uninsured individuals live in the South or West regions of the US. Additionally, two-thirds of non-elderly uninsured people in 2022 have been without coverage for more than a year, indicating the need for targeted outreach and enrollment efforts to reach this hard-to-reach population.

The high cost of insurance is the primary reason cited by uninsured non-elderly adults for lacking coverage, with 64.2% mentioning affordability as the main barrier. Other reasons include not being eligible for coverage (28.4%), not needing or wanting coverage (26.1%), and finding the sign-up process too difficult (22.2%).

The consequences of being uninsured can be significant, as uninsured individuals often face unaffordable medical bills and are more likely to delay or forgo necessary medical care due to costs. This can lead to medical debt, especially for those with low or moderate incomes, and can result in negative outcomes for their health and financial stability.

Unraveling the Mystery Behind ER Bill Insurance Queries

You may want to see also

The main reason for lacking insurance is its high cost

The United States is the only industrialized nation without universal healthcare coverage. In 2019, there were 30 million uninsured people in the US, a number that has decreased since. The high cost of insurance is the main reason why many Americans lack coverage.

Healthcare spending in the US amounts to $3 trillion a year, straining the budgets of families, businesses, and taxpayers. The price of medical care is the biggest factor in these high costs, accounting for 90% of spending. This includes the cost of caring for those with long-term medical conditions, an aging population, and the increased cost of new medicines, procedures, and technologies.

The high cost of healthcare in the US is driven by several factors. Firstly, there are rising drug costs. Americans pay almost four times as much for pharmaceutical drugs as citizens of other developed countries. This is because drug prices are largely controlled by market forces rather than government intervention, as is the case in other countries.

Secondly, medical professionals in the US earn higher salaries than in other countries. For example, the average annual salary for a family doctor in the US was $235,930 in 2022, compared to $164,155 in the Netherlands. Similarly, nurses in the US earn an average of $77,600, second only to Switzerland.

Thirdly, hospital care accounts for 31% of the nation's healthcare costs, with prices for inpatient services significantly higher than in other countries. For example, a hip replacement in the US costs $28,167, compared to $16,622 in New Zealand.

The complexity of the US healthcare system also contributes to high costs. There are multiple tiers of coverage, rules, funding sources, enrollment dates, and out-of-pocket costs associated with different forms of insurance. This complexity leads to high administrative costs, which are a significant driver of excess medical spending.

The high cost of insurance in the US has several implications. Firstly, it leads to increased mortality, with studies estimating that lack of health insurance is associated with 30,000 to 90,000 deaths per year. Secondly, it results in people delaying or forgoing needed medical care due to cost concerns. This includes skipping medications, avoiding doctor's visits, and postponing necessary treatments. Thirdly, it contributes to financial instability, with many Americans struggling with medical debt and facing negative consequences such as using up savings, difficulty paying living expenses, or borrowing money. Finally, it affects health outcomes, particularly for vulnerable populations such as children and adults with chronic conditions, who may not have access to timely diagnosis, treatment, and preventive care.

Corolla S: Sports Car or Not?

You may want to see also

Uninsured people often face unaffordable medical bills

In 2022, there were 25.6 million nonelderly uninsured people in the US, a decrease of 3.3 million from 2019. The uninsured rate also decreased from 10.2% in 2021 to a record low of 9.6% in 2022. Despite this, the uninsured often face unaffordable medical bills when they seek care. This is because they have to pay for almost 40% of their care out-of-pocket. Hospitals also frequently charge uninsured patients higher rates than those paid by private health insurers and public programs.

Who Are the Uninsured?

Most uninsured people are in low-income families and have at least one worker in the family. Nonelderly adults are more likely to be uninsured than children due to the more limited availability of public coverage in some states. People of color make up a large proportion of the uninsured, and most uninsured individuals are US citizens.

Despite policy efforts to improve the affordability of coverage, many uninsured people cite the high cost of insurance as the main reason they lack coverage. In 2022, 64% of uninsured nonelderly adults said that they were uninsured because the cost of coverage was too high. Many uninsured people do not have access to coverage through their jobs, and some people remain ineligible for financial assistance. Additionally, undocumented immigrants are ineligible for federally funded coverage.

The Impact of Being Uninsured

The Consequences of Unaffordable Medical Bills

Unaffordable medical bills can lead to medical debt and negative consequences such as using up savings, difficulty paying living expenses, or borrowing money. Two-thirds of uninsured adults with medical debt report having to make sacrifices like eating less or changing their housing situation to pay it off. Unaffordable medical bills can also lead to lower access to care, as uninsured people are more likely to delay or forgo care due to costs. This can result in preventable conditions or chronic diseases going undetected, with severe consequences.

GHI Insurance: Making Changes Easy

You may want to see also

The uninsured rate among working-age adults decreased by 0.8% from 2021 to 2022

The number of nonelderly uninsured individuals in the US has been on a downward trend since the coronavirus pandemic. In 2022, the number of nonelderly uninsured people was 25.6 million, a decrease of 1.9 million from 27.5 million in 2021. The uninsured rate also decreased from 10.2% in 2021 to a record low of 9.6% in 2022. This decrease in the uninsured rate was driven by an increase in employer-sponsored, Medicaid, and non-group coverage among nonelderly adults.

Among working-age Americans (those aged 18–64), 12.2% did not have health insurance in 2022, a decrease from 14.7% in 2019. This means that the uninsured rate among working-age adults decreased by 2.5% from 2019 to 2022, and by 0.8% from 2021 to 2022.

The decrease in the uninsured rate among working-age adults can be attributed to the coverage expansions put in place by the Affordable Care Act (ACA) and pandemic-era policies. The ACA's Medicaid expansion and subsidized Marketplace coverage served as a safety net for people who lost their jobs or faced economic and coverage disruptions during the pandemic. Additionally, continuous enrollment for Medicaid enrollees and enhanced Marketplace subsidies further protected low-income individuals from coverage losses and improved the affordability of private coverage.

The decline in the uninsured rate among working-age adults was also driven by increases in coverage among nonelderly American Indian, Alaska Native, and Hispanic people, as well as individuals in low-income families. From 2019 to 2022, the uninsured rate for American Indian and Alaska Native people decreased by 2.4 percentage points, while the uninsured rate for Hispanic people decreased by 2.0 percentage points.

Unraveling the Pharmacy Insurance Billing Process: A System Call Guide

You may want to see also

Frequently asked questions

25.6 million nonelderly individuals were uninsured in 2022, a decrease of 3.3 million from 2019.

8.4% or 27.6 million Americans of all ages did not have health insurance in 2022.

3 million children did not have health insurance in 2022.

Prohibitively high cost is the primary reason Americans give for not having health insurance.