Car insurance deductibles are the amount you pay out of pocket on a claim before your insurance covers the rest. The higher the car insurance deductible, the cheaper the premiums will be, as the policyholder assumes more financial responsibility in the event of a claim. Conversely, a lower deductible means a higher premium as the insurer assumes more financial responsibility.

For example, if you have a deductible of $1,000 and you have an auto accident that costs $4,000 to repair your car, you will have to pay $1,000 out of pocket as your deductible, and then your insurance would cover the additional $3,000.

While increasing your deductible may result in a lower premium, it is important to consider the overall value. For instance, increasing a deductible from $1,000 to $2,000 may only save around 6%. Therefore, if the savings amount to a small amount each month, it may not be worth it in the event of an accident where a high deductible needs to be paid.

| Characteristics | Values |

|---|---|

| Impact on premiums | The higher the deductible, the lower the premium |

| Impact on out-of-pocket costs | The higher the deductible, the higher the out-of-pocket costs |

| Risk | The higher the deductible, the more risk |

| Flexibility | Deductibles can be changed to fit budgets |

| Peace of mind | Higher deductibles may cause more stress |

What You'll Learn

- Raising your deductible lowers your premium, but you pay more out-of-pocket if you file a claim

- A lower deductible means a higher premium

- The average deductible is $500, but they can range from $100 to $2,000

- Liability insurance doesn't have a deductible

- A higher deductible means you're taking on more risk

Raising your deductible lowers your premium, but you pay more out-of-pocket if you file a claim

Raising your deductible can be a great way to lower your premium payments. However, it's important to remember that this also means you'll have to pay more out-of-pocket if you ever need to file a claim. This is because a deductible is the amount you pay yourself before your insurance company covers the rest. So, while a higher deductible can reduce your regular payments, it also means you'll have to pay more if you ever need to make a claim.

Let's look at an example to understand this better. Imagine you have a $1,000 deductible and get into an accident that causes $3,000 worth of damage to your car. In this case, you would have to pay the first $1,000 of the repair cost yourself, and your insurance company would cover the remaining $2,000. Now, imagine you had a $500 deductible instead. In that case, you would only need to pay $500 yourself, and your insurance company would cover the other $2,500. So, while a higher deductible can lower your regular payments, it also means taking on more financial risk if something happens.

It's also worth noting that the amount you can save by raising your deductible may vary depending on other factors, such as the value of your car, your driving record, and the state you live in. Additionally, if you have a car loan or lease, your options for setting a deductible may be limited, as these agreements often require a maximum deductible for collision and comprehensive coverage.

When deciding whether to raise your deductible, it's essential to consider your financial situation and comfort level with risk. While it can reduce your premium payments, it also means taking on more financial responsibility if you need to make a claim. So, make sure you carefully weigh the pros and cons before making any changes to your deductible.

The Auto-Insurance Score: Uncovering the Secret Rating

You may want to see also

A lower deductible means a higher premium

For example, if your policy includes $5,000 in coverage, a deductible of $500 means your insurance company is covering you for $4,500. If your deductible is $1,000, your insurance company is covering you for only $4,000. Because a lower deductible equates to more coverage, you'll have to pay more in your monthly premiums to balance out this increased coverage.

The relationship between deductibles and premiums is a balancing act. A plan with both a high deductible and a high premium would be too expensive for an individual, whereas a plan with a low deductible and low premium would be too expensive for an insurance company. Making them opposites helps balance costs for both parties.

When deciding between a higher or lower deductible, it's important to consider your financial situation and your tolerance for risk. If you have a well-stocked emergency fund, choosing a higher deductible could be a good way to lower your monthly premium. However, if you don't have the financial buffer to cover a high deductible, a lower deductible and higher premium may be a better option, even if it costs more in the short term.

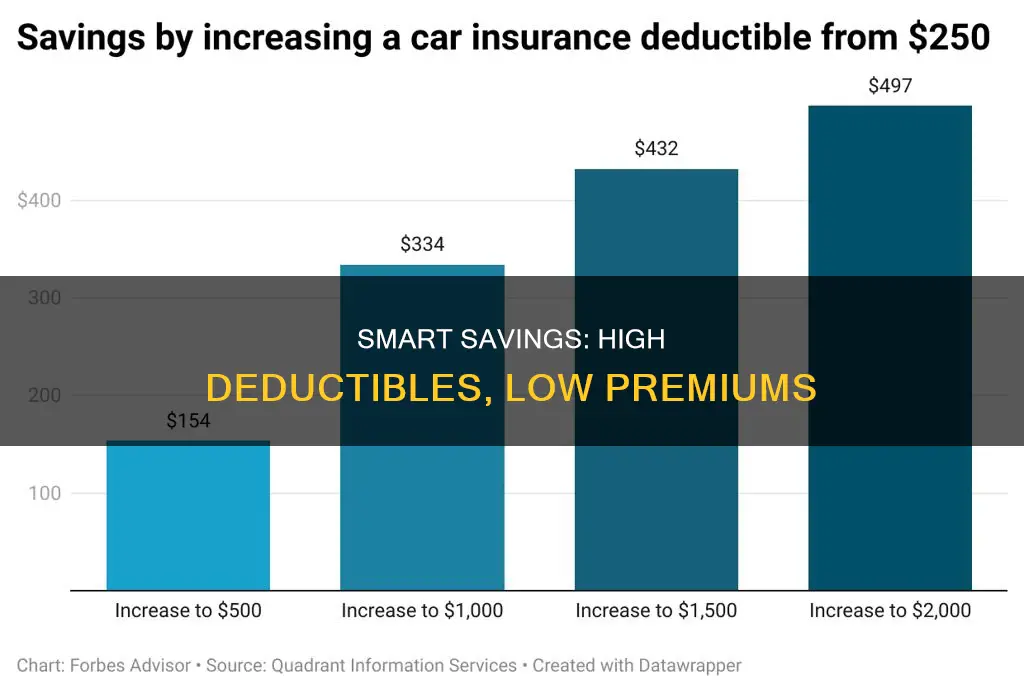

It's also worth noting that the impact of a higher deductible on your premium may vary depending on other factors, such as the value of your vehicle, your driving record, and the state you live in. For example, increasing your deductible from $500 to $1,000 resulted in an average reduction of 8-10% in premium costs, but this varied by state, with Michigan saving only 4% and Massachusetts saving 17%.

Ridesharing: Do Insurers Know?

You may want to see also

The average deductible is $500, but they can range from $100 to $2,000

The average car insurance deductible is $500, but they can range from $100 to $2,000. A deductible is the amount of money you pay out of pocket towards an insured loss before your insurance company covers the rest. For example, if you have a deductible of $500 and your insurance claim is approved for $3,000, you will pay $500 and your insurance company will cover the remaining $2,500.

The higher your deductible, the lower your insurance premium will be. This is because a higher deductible means you assume more financial responsibility in the event of a claim. For example, increasing your deductible from $200 to $500 could reduce your coverage costs by 15% to 30%. Moving up to a $1,000 deductible might save you 40% or more.

However, it's important to consider whether you can afford to pay a higher deductible in the event of an incident. If you have a good driving record and are unlikely to file a claim, a higher deductible could work in your favour. On the other hand, if you have a history of accidents, a lower deductible might be a better option, even though your insurance premiums will be higher.

Additionally, the value of your vehicle can impact whether a high or low deductible is the best option. If your car is worth $3,500 and you have a $1,500 deductible, the insurance company will only pay $2,000 after you cover the deductible. In this case, a lower deductible is preferable. However, if your car is worth $10,000 and you have a $1,000 deductible, the insurance company will pay $9,000, making a higher deductible a more sensible choice.

It's also worth noting that not all types of insurance coverage have a deductible. Liability insurance, for example, does not usually have a deductible. This type of insurance helps cover damages you cause to another person or their property in an accident.

Gap Insurance: Where to Buy

You may want to see also

Liability insurance doesn't have a deductible

When it comes to auto insurance, not all types of coverage include a deductible. Liability insurance, for instance, does not require a deductible. This type of insurance covers damages you cause to another person or their property in an accident. If you're found to be at fault in a collision, your liability insurance will pay for the other party's repairs and medical expenses, and you won't have to pay any deductible yourself.

Liability insurance is an essential component of any auto insurance policy. It protects you financially if you're responsible for injuring someone else or damaging their property in a car accident. Without liability insurance, you would be personally responsible for covering these costs, which could result in significant financial hardship.

When purchasing auto insurance, you have the option to choose a deductible amount for other types of coverage, such as collision and comprehensive insurance. Collision insurance covers accidents, regardless of who is at fault, while comprehensive insurance covers damage from events outside your control, like fires, floods, falling objects, or vandalism. The deductible is the amount you must pay out of pocket before your insurance company covers the remaining costs. For example, if you have a $500 deductible and $3,000 in damage from an accident, you will pay the $500 deductible, and your insurance will cover the remaining $2,500.

It's important to note that liability insurance provides coverage for others, not yourself or your vehicle. If you want protection for your own vehicle, you would need to purchase additional coverages like collision and comprehensive insurance, which typically include a deductible.

When deciding on a deductible amount, consider your financial situation and the level of risk you're comfortable with. A higher deductible will lower your insurance premium, but it also means you'll pay more out of pocket if an accident occurs. On the other hand, a lower deductible results in higher monthly payments but provides more coverage from your insurance company, reducing your out-of-pocket expenses in the event of a claim.

Gap Insurance: Down Payment Refund?

You may want to see also

A higher deductible means you're taking on more risk

When you choose a higher deductible for your car insurance, you're opting for a lower premium each month but taking on the risk of having to pay more out of pocket in the event of an accident or claim. This is because a deductible is the amount you pay out of pocket when you make a claim, before your insurance coverage pays out. So, with a higher deductible, you're essentially taking on more financial responsibility in the event of a claim.

For example, if you have a deductible of $1500 and the cost of repairs after an accident is $4000, you will have to pay the $1500 deductible before your insurance company covers the remaining $2500. This can result in a delay in getting your vehicle repaired, especially if you don't have the funds readily available.

The trade-off of a higher deductible and lower premium makes sense if you're a safe driver with a good driving record and few past claims. In this case, the savings on your premium could be put towards your deductible in the event of a claim. However, if you have a history of accidents and claims, a lower deductible and higher premium might be a better option, as you'll pay less out of pocket each time you have a claim.

It's important to consider your financial situation and comfort level with risk when deciding on your deductible. While a higher deductible can reduce your insurance costs, it also means taking on more financial responsibility if you need to make a claim. Additionally, in some cases, the cost of repairs may be less than your deductible, meaning you'd have to cover the full cost of repairs out of pocket.

When deciding on your car insurance deductible, it's crucial to weigh the potential savings on your premium against the increased financial risk of a higher deductible. It's a balance between keeping your monthly costs low and ensuring you have adequate coverage in the event of an accident or claim.

Obtaining Vehicle Insurance Proof: A Quick Guide

You may want to see also

Frequently asked questions

A car insurance deductible is the amount of money you pay out of pocket on a claim before your insurance covers the rest.

After an accident, you will have to pay a deductible before your insurer covers the remaining cost to repair or replace your vehicle.

Typically, the higher the car insurance deductible you are willing to accept, the cheaper the premiums will be as you are assuming more financial responsibility in the event of a claim.

The average car insurance deductible is $500, but deductibles can range from $100 to over $2,000.

Choosing your deductible is about balancing your budget and the amount of risk you can tolerate. If your budget is tight, you may prefer a lower deductible and a higher premium to avoid the stress of covering a high repair bill out of pocket.