If you're looking to upload auto insurance documents to the DCU portal, you've come to the right place. DCU, or Digital Federal Credit Union, offers a range of services, including auto loans and refinancing options. To upload your auto insurance documents, you can follow these steps:

1. Log in to your Digital Banking account on the DCU website or mobile app.

2. Navigate to the Loan Status section, where you can view and upload documents related to your auto, personal, and visa applications.

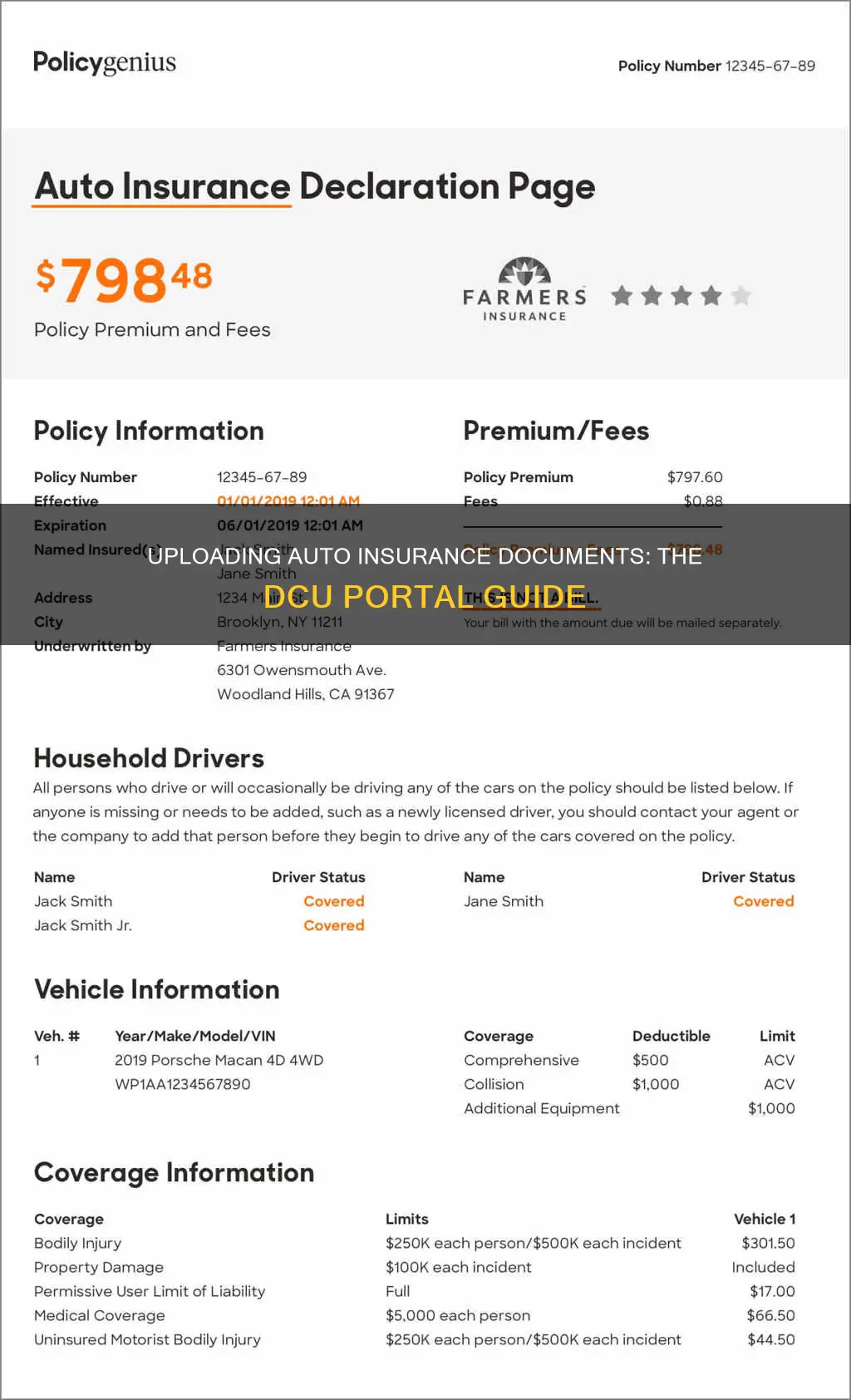

3. Upload your auto insurance documents by selecting the appropriate option. Ensure that you have all the necessary information, such as the year, make, model, and VIN of your vehicle, as well as comprehensive and collision coverage details.

4. Provide DCU's Lien holder information on your insurance paperwork, listing it as Digital Federal Credit Union, PO Box 25007, Fort Worth, TX 76124.

5. Alternatively, you can submit your insurance policy by email to [email protected] or by mail to the address provided on the DCU website.

| Characteristics | Values |

|---|---|

| Where to upload auto insurance documents | DCU Digital Banking |

| Insurance requirements | Year, Make, Model and VIN, Comprehensive and Collision coverage, with deductibles no higher than $1,000 each, DCU listed as Loss Payee/Lien Holder |

| DCU's Loss Payee/Lien Holder address | Digital Federal Credit Union, PO Box 25007, Fort Worth, TX 76124 |

| How to submit proof of insurance | Email: [email protected], Mail: Digital Federal Credit Union, PO Box 25007, Fort Worth, TX 76124 |

What You'll Learn

DCU auto loan insurance requirements

To upload auto insurance documents to the DCU portal, log in to your Digital Banking account and go to the 'Loan Status - Auto, Personal and Visa' section. From there, you can view the status of and upload documents to your DCU auto applications.

DCU has specific auto loan insurance requirements that must be met. When taking out an auto loan, DCU requires that the vehicle is insured against loss and that DCU is identified as the lienholder. This is standard practice for any loan where collateral is pledged as security. In this case, the vehicle is the collateral.

The insurance policy must include the following:

- Year, Make, Model and VIN of the vehicle

- Comprehensive and Collision coverage, with deductibles no higher than $1,000 each

- DCU listed as Loss Payee/Lien Holder: Digital Federal Credit Union, PO Box 25007, Fort Worth, TX 76124

You can submit your proof of insurance to DCU via email or mail. The email address is [email protected], and the mailing address is Digital Federal Credit Union, PO Box 25007, Fort Worth, TX 76124. It takes two business days for the Insurance Tracking Center to review the insurance policy and update their records. You will be notified by email or mail if any additional information is required.

Erase Auto Insurance Claims History: A Step-by-Step Guide

You may want to see also

How to submit proof of insurance

To submit proof of insurance to DCU, you can use MyLoanInsurance.com, a free, simple, and secure online portal. Here's a step-by-step guide on how to do it:

- Go to MyLoanInsurance.com: Access the website by entering the URL into your web browser.

- Login: If you have received a notification from DCU requesting evidence of current insurance, enter the Reference ID and PIN provided in the notice to access the site. If you don't have a Reference ID or PIN, click on the "Don't have a Reference ID/PIN" option.

- Submit Proof of Insurance: Once you are logged in, follow the instructions provided on MyLoanInsurance.com to submit your proof of insurance. This typically involves uploading a copy of your insurance policy or certificate.

- Allow for Processing Time: After submitting your insurance information, allow up to 2 business days for DCU's Insurance Tracking Center to review your policy and update their records. You will be notified by email or mail if any additional information is required.

- Contact DCU for Assistance: If you have any questions or issues during the process, don't hesitate to contact DCU's customer support for assistance. Their contact information can be found on their website.

Remember, providing proof of insurance is essential when pledging collateral, such as a vehicle, for a loan with DCU. By following the steps outlined above, you can ensure that you are meeting the requirements of your loan agreement and maintaining proper coverage.

Understanding Inactive Auto Insurance: What Does It Mean?

You may want to see also

What to do if you can't find the DCU portal

If you are unable to find the DCU portal, there are a few steps you can take to try and locate it.

Firstly, ensure that you are entering the correct web address or URL for the portal. It is easy to mistype or misremember, so double-check the address and try again.

If you are certain the web address is correct, try refreshing the page or closing and reopening your web browser. Sometimes, the portal may be temporarily unavailable due to maintenance or technical issues, so it is worth trying again after a short wait.

If you are still unable to access the portal, check for any updates or notifications from DCU. They may have changed the portal's address or discontinued its use. You can usually find this information on their website or social media pages.

If you are having persistent issues, it may be beneficial to contact DCU directly. You can do this by phone, email, or live chat. Their contact information is usually available on their website. When you reach out, provide as much detail as possible about the issues you are experiencing, including any error messages or technical difficulties.

Additionally, you can try using the search function on the DCU website to look for the specific document or information you are seeking. They may have moved or reorganised their content, so this could help you locate what you need.

Finally, if all else fails, you may need to create a new account or request a password reset. This will usually prompt DCU to send you login instructions and relevant links, which can help you access the portal.

The Legality of Force-Placed Auto Insurance: What You Need to Know

You may want to see also

How to upload documents to the DCU portal

To upload auto insurance documents to the DCU portal, you must first log in to your Digital Banking account. From there, you can view and upload documents to your DCU auto applications.

Uploading documents to the DCU portal is similar to uploading documents to other websites or platforms. The process of uploading a document is essentially the reverse of downloading one. While downloading involves your computer receiving data from another computer, uploading involves sending a file from your computer to another destination in the cloud.

There are several ways to upload documents, depending on the number of documents, their size, and the platform you use. Here are some common methods:

- File transfer protocol (FTP)

- Drag-and-drop feature

- Using a scanner or printer with a built-in scanner

- Taking a photo with your smartphone or tablet

If you have a hard copy of a document that you want to upload, you'll need to convert it to digital format first. You can do this by scanning the document using a scanner, printer with a built-in scanner, or by taking a photo with your smartphone or tablet.

Once you have your documents in digital format, log in to your Digital Banking account and navigate to the relevant section for uploading documents. This is usually found under a tab such as "Documents" or "Upload." Select the files you want to upload and follow the prompts to complete the upload process.

Remember to keep your files organized and named appropriately to make it easier to find and upload the correct documents.

Senior Auto Insurance Discounts: What You Need to Know

You may want to see also

What to do if you can't log in to the DCU portal

If you are unable to log in to the DCU portal, there are a few steps you can take to troubleshoot the issue. Firstly, ensure that you are entering your login credentials correctly, including your username and password. If you have forgotten your username or password, you can reset them by clicking on the "Forgot Username/Password" link on the login page. This will guide you through the steps to recover your account.

If you are certain that you are entering the correct login information, there may be an issue with your internet connection. Check your device's internet access by trying to access other websites or applications. If you are unable to connect to the internet, try restarting your device or checking your network settings.

In some cases, the issue may lie with the DCU website or application itself. In such cases, you can contact DCU's member service representatives for assistance. Their contact information is available on the DCU website. They can help you resolve any technical issues you may be facing and guide you through the login process.

Additionally, it is important to ensure that your device and web browser are up to date. Outdated software may cause compatibility issues that prevent you from accessing the portal. Regularly updating your device and browser can help ensure a smooth login process.

If you continue to experience difficulties logging in, it is recommended to reach out to DCU's support team for further assistance. They can provide additional guidance and help identify any underlying issues that may be causing the problem.

State Farm's Auto Insurance Customers: How Many?

You may want to see also