Comparing auto full-coverage insurance quotes is a great way to save money. The best way to find car insurance is to compare rates from a number of companies as rates can vary significantly depending on personal factors such as age, gender, vehicle, location, credit history, driving record, and claims history.

While property damage and bodily injury liability coverage are required in most states, it is worth looking into the optional coverage offered by insurance companies. For example, uninsured/underinsured motorist coverages, comprehensive coverage, and collision coverage can provide valuable protection in certain situations.

It is also important to understand the different types of coverage included in a full-coverage policy, such as liability, collision, and comprehensive insurance, and to choose the right coverage limits and deductibles. By gathering relevant information, using insurance comparison websites, and researching companies with the best quotes, you can find the best auto full-coverage insurance for your needs.

| Characteristics | Values |

|---|---|

| How to compare insurance policies | Compare many quotes at once using a trusted insurance comparison site |

| Factors that affect your premiums | Your driving record, your age, your credit history, your vehicle, and the risk level of your area |

| Insurance rates by driving history | Drivers who are new, young, or have a bad driving record or credit history see higher than average rates |

| Insurance rates by credit score | Drivers with poor credit history see higher than average rates |

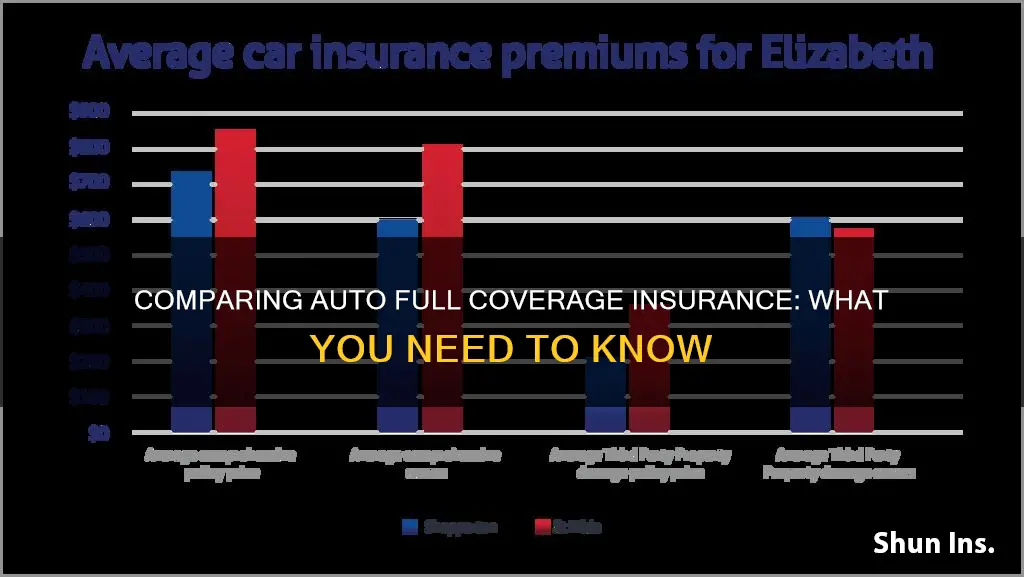

| Insurance rates by age | Drivers aged 40 and older usually pay the least for auto insurance |

| Insurance rates by gender | Women tend to pay less for auto insurance than men |

| Insurance rates by location | Your location can have a huge impact on your insurance premium |

| Insurance rates by vehicle | The type of vehicle you insure will impact your car insurance rate |

What You'll Learn

How your age affects your auto insurance rate

Age is one of the most significant factors in determining your car insurance rate. While there are good drivers in every age group, younger drivers are generally more likely to have accidents or take risks on the road. Inexperience and risky behaviour make teens more likely to get into serious car accidents. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers. This age group is also responsible for 7% of all fatal accidents, despite only making up 4% of drivers.

In general, car insurance is most expensive for teens and young adults, with rates starting to decrease as drivers reach their early 20s. By the time drivers reach their mid-30s to late-50s, they have more practice behind the wheel and road maturity, meaning middle-aged drivers typically have fewer accidents. As a result, car insurance rates are cheapest for drivers aged 35-65.

However, car insurance rates start to increase again for drivers over the age of 60. This is because, as people get older, age-related factors like vision or hearing loss and slowed response time might make them more likely to get into accidents. Older people tend to have deteriorated vision and reaction times, making them physically more vulnerable to injury in the event of an accident.

It's worth noting that age isn't the only factor that impacts car insurance rates. Location, vehicle type, driving record, credit score, type of coverage, and deductible can also affect the cost of car insurance.

Keep Auto Insurance Claim Money?

You may want to see also

How to compare insurance rates for drivers with a DUI

Comparing auto insurance rates is a great way to save money on your premiums. This is especially important for drivers with a DUI, as insurance companies consider them high-risk and their rates can be significantly higher. Here are some tips on how to compare insurance rates for drivers with a DUI:

- Shop around for quotes: Compare rates from multiple insurance companies, including major insurers and regional ones. Progressive, State Farm, and Travelers are often recommended for drivers with a DUI, but rates can vary based on your specific circumstances.

- Consider high-risk insurance companies: Some insurance companies specialize in high-risk drivers, such as The General. They may be more affordable and understanding of your situation.

- Look for companies with accident forgiveness: If you cause a small crash while under the influence, having accident forgiveness as part of your policy can help prevent your rates from increasing further. Progressive, for example, offers small accident forgiveness in most states.

- Check customer service reviews: In the event of an accident, you'll want an insurance company with good customer service and claims satisfaction. J.D. Power and the National Association of Insurance Commissioners (NAIC) provide customer satisfaction scores and reviews that can help you make an informed decision.

- Compare rates regularly: Insurance rates can change over time, so it's important to compare rates not just when you get a DUI but also at renewal or when your circumstances change.

- Provide accurate information: When getting quotes, be honest about your DUI conviction. While it may result in higher rates, it's important to be upfront to ensure you're getting accurate quotes.

- Consider bundling policies: You may be able to save money by bundling your auto insurance with other policies such as home or renters insurance.

- Look for discounts: Many insurance companies offer discounts for various reasons, such as signing up for automatic payments or paperless billing. Ask about what discounts are available and how you can qualify.

- Practice safe driving: Maintaining a clean driving record after a DUI can help lower your rates over time. Consider usage-based insurance programs that reward safe driving behaviours.

- Compare coverage options: In addition to price, consider the coverage options offered by each insurance company. Make sure you're getting the coverage you need, such as liability, collision, and comprehensive insurance.

- Understand the impact of a DUI: A DUI can affect your insurance rates for several years, and the cost will vary depending on your state and insurance company. Be prepared for higher rates and be proactive in finding ways to mitigate the increase.

Understanding Auto Insurance: Unlocking the Mechanics of Coverage and Claims

You may want to see also

How to compare insurance rates for drivers with poor credit

Comparing auto insurance quotes from multiple companies is the best way to save money on your insurance. This is especially important for drivers with a poor credit history, as they already pay higher-than-average rates.

Determine Your Budget

Before you start comparing quotes, you need to determine your budget, the type of insurance you need, and how much coverage you require. Knowing your budget will help you quickly weed out overpriced insurance companies and focus on insurers with the lowest prices.

Gather the Relevant Information

Make sure you have the right information available, such as your:

- Social Security number

- Driver’s license number

- Vehicle identification number (VIN)

- Current coverage details

Use an Insurance-Comparison Website

Insurance-comparison websites make comparing quotes faster and easier because you only have to provide your information once. Plus, you can compare prices and coverage options from different companies at the same time. True comparison sites like Compare.com, Insurify, and Jerry partner with insurance companies to provide real-time quotes.

Research Companies with the Best Quotes

The largest insurance companies won’t always have the best price for your specific needs. Do your research before committing to an insurer. Third-party websites like J.D. Power and AM Best analyze insurance companies based on customer feedback and experiences with things like website and mobile performance, the shopping experience, the claims process, and financial strength.

Select the Best Quote for You

After researching, narrow down your list to a few insurance companies. Review your auto insurance quotes again and select the best quote for you. Then, complete the application for your new policy.

Compare Quotes Again at Renewal

When your policy comes up for renewal, take some time to compare car insurance quotes again to see if your current insurer is still the best deal.

Factors Affecting Car Insurance Quotes

Your age, location, car, driving record, and credit score will all change your car insurance quotes.

How to Improve Your Credit Score

- Pay your bills on time

- Keep hard credit inquiries to a minimum

- Monitor your score regularly

- Maintain old lines of credit

- Be aware of your credit utilization ratio

DWI Accidents and Auto Insurance: What's Covered?

You may want to see also

How to compare insurance rates for drivers with an accident

Comparing auto insurance quotes is the best way to save money on your insurance. You can save up to $245 per month on full coverage by comparing quotes.

The best way to find affordable insurance after an accident is to compare quotes from multiple companies. Here are the steps to follow:

- Determine your budget and coverage needs: Before you start comparing quotes, decide on your budget and the type of insurance you need. You can choose between full coverage insurance, which costs an average of $164 per month, and minimum coverage insurance, which costs an average of $64 per month.

- Gather the relevant information: Make sure you have the necessary information, such as your driver's license number, vehicle information, and driving history, including any accidents or violations.

- Use an insurance comparison website: Websites like Compare.com, Insurify, and The Zebra allow you to compare quotes from multiple companies at once, making the process faster and easier. Be cautious when using comparison sites, as some may sell your personal information.

- Research companies with the best quotes: Don't just go with the cheapest option. Research the companies with the best quotes by checking third-party reviews and ratings from websites like J.D. Power and AM Best.

- Select the best quote: After researching, choose the company that best meets your coverage needs and budget.

- Compare quotes at renewal: Don't forget to compare quotes again when your policy comes up for renewal. Your current insurer may not always offer the best rate.

By following these steps, you can find the most affordable insurance rates even if you have an accident on your record.

Auto Insurance and Relationships: Am I Covered if My Girlfriend Drives My Car?

You may want to see also

How to compare insurance rates by state

Comparing auto insurance rates by state can be a great way to understand how much state requirements affect the price of car insurance where you live. Each state has different laws and regulations that determine how much car insurance coverage drivers need. Most insurance companies must have their rates approved by state officials before making any changes.

For example, New York has the highest average car insurance rates in the US at $8,232 per year for full coverage and $2,490 per year for minimum coverage. In contrast, the state with the lowest average full-coverage car insurance rates is Maine, with rates of $1,460 per year.

Factors that affect car insurance rates by state include population density, crime rates, and severe weather patterns. For instance, if you live in an area prone to floods, hurricanes, or wildfires, your insurance rates are likely to be higher.

To compare car insurance rates by state, you can use an insurance comparison website or a quote comparison site. These platforms allow you to input your information once and receive quotes from multiple companies, making it easier to find the best coverage and price for your needs.

When comparing car insurance rates by state, it is important to consider your personal information, such as your age, gender, vehicle, location, credit history, driving record, and claims history, as these factors can significantly impact your insurance rates.

Auto Insurance Billing: Doctor's Office Refusal

You may want to see also

Frequently asked questions

To compare auto insurance rates, you will need personal information such as your address, date of birth, occupation, driver's license, and marital status. You will also need vehicle information, including the mileage, date of purchase, and vehicle identification number (VIN). If you have any recent tickets or accidents, you will need that information as well.

It is recommended that you compare auto insurance rates at least once a year to ensure you are getting the best rate. You should also compare rates anytime something changes that could affect your rates, such as buying a new car, moving, adding or removing drivers from your policy, or getting a ticket or being in an accident.

Several factors affect your auto insurance rates, including your age, gender, driving history, the type of car you drive, and where you live. Your credit score may also impact your rates, depending on the state you live in.

There are several ways to get cheaper auto insurance. You can compare rates from multiple companies, increase your deductible, or reduce your coverage limits. You can also take advantage of discounts offered by insurance companies, such as good student discounts or safe driver discounts. Additionally, you can bundle your auto insurance with other types of insurance, such as home or renters insurance, to get a lower rate.