The cost of starting an auto insurance policy depends on the total cost of your premium. Your first payment will include a down payment on your total premium (usually 8-33%), your first monthly payment, and a monthly installment fee. For example, for a 6-month policy costing $600 total with a 25% down payment and a $5 monthly installment fee, your first monthly payment would be $230, and your subsequent monthly payments would be $80.

If you want to reduce the cost of your insurance premium, you can pay the full premium upfront, which allows you to skip the down payment and monthly installment fees and may even earn you a paid-in-full discount of 5-10%. You can also compare car insurance quotes from different providers to find the best offer.

| Characteristics | Values |

|---|---|

| Average cost of full coverage car insurance per year | $1,718 |

| Average cost of minimum coverage car insurance per year | $488 |

| Average cost of full coverage car insurance per month | $143 |

| Average cost of minimum coverage car insurance per month | $41 |

| Average cost of car insurance per year | $2,329 |

| Average cost of minimum coverage car insurance per year | $633 |

| Average cost of car insurance per month | $194 |

| Average cost of minimum coverage car insurance per month | $53 |

| Down payment on total premium | 8% to 33% |

| Monthly installment fee | $3 to $10 |

| Average cost of full coverage car insurance | $1,765 |

What You'll Learn

The cost of starting an auto insurance company

Starting an auto insurance company requires careful planning and a substantial financial investment. The costs depend on several factors, such as location, business structure, and the types of policies offered. Here is a breakdown of the costs involved in starting an auto insurance company:

Licensing and Permits:

Obtaining the necessary licenses and permits to sell car insurance is one of the most significant expenses. The cost can vary depending on the state, but it can reach several hundred thousand dollars. Some states may allow you to transfer your license from another state.

Office Space and Technology:

Renting or purchasing office space can be a major expense, especially in metropolitan areas. The cost of renting office space in the US averages $25 per square foot annually. Additionally, there are technology and software costs, which can range from $50,000 to $500,000 for the necessary tools and systems.

Startup Capital:

On average, a startup capital of around $10,000 to $100,000 is needed to cover daily operational expenses such as rent, equipment, licensing, and insurance coverage. However, some sources suggest that it takes about $20,000 in seed money to start an insurance agency.

Marketing and Advertising:

Marketing and advertising campaigns are crucial for attracting customers and building brand awareness. Companies in the automotive insurance industry spend billions of dollars on advertising each year. The cost of these campaigns can vary widely depending on the reach and the platforms used.

Employee Costs:

Hiring and training employees is another significant expense. The average cost to hire a new employee in the US is around $4,129, and the average cost of training is approximately $1,286 per employee per year. Additionally, companies may need to provide employee benefits such as health insurance and retirement plans.

Compliance and Legal Costs:

Compliance with federal and state regulations is essential for the automotive insurance industry. The average cost of compliance is estimated at $5,000 per employee per year. Legal costs associated with lawsuits and claims can also be significant.

Insurance Coverage:

Auto insurance companies also need to insure themselves. This includes general liability insurance, workers' compensation insurance, commercial property insurance, and commercial auto insurance.

Product Development and Testing:

Developing and testing insurance policies is another major expense. This process ensures that policies meet customer needs and comply with regulations. Costs can range from $50,000 to $300,000 or more, depending on the complexity of the product.

Customer Data and Business Intelligence Tools:

Acquiring customer data and utilizing business intelligence tools are crucial for understanding the target market and competitors. The cost of customer data varies, but it typically costs between $0.20 and $0.50 per record. Business intelligence tools can range from $10,000 to $20,000 per year for entry-level options.

In summary, launching an auto insurance company requires a comprehensive business plan and a significant financial investment. The costs outlined above are estimates, and the actual expenses may vary depending on the specific circumstances of the business. It is important to conduct thorough research and consult professionals before making financial decisions.

Auto Insurance Write-Offs: What You Need to Know

You may want to see also

How to pay for auto insurance

The cost of auto insurance can vary depending on several factors, and it's important to understand these factors to make informed decisions about your coverage. Let's go through the key considerations and strategies for paying for auto insurance.

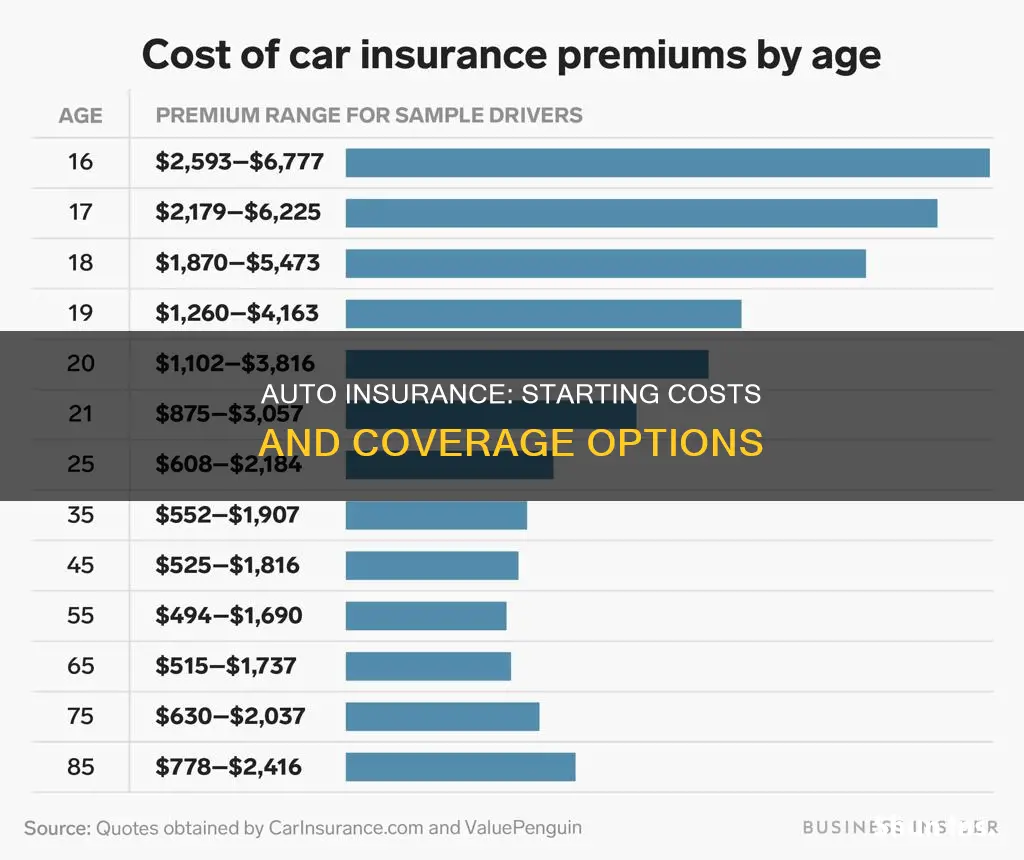

Understanding the Costs

Before purchasing auto insurance, it's essential to estimate the costs accurately. The total cost of your premium will depend on various factors, including your age, gender, driving record, location, and the type of car you drive. It's a good idea to use online tools and calculators to get quotes from multiple insurance providers to compare rates. Remember that full coverage insurance, which includes collision and comprehensive coverage, tends to be more expensive than minimum coverage.

Payment Options

Once you've determined the cost of your auto insurance, you have several options for making payments:

- Monthly Installments: You can choose to pay for your auto insurance in monthly installments. This option allows you to spread out the cost of your premium over time, making it more manageable. However, some companies may charge a monthly installment fee, typically ranging from $3 to $10.

- Down Payment: Some insurance companies may require a down payment, which is typically a percentage of your total premium. This can range from 8% to 33% of the total cost. Paying a higher down payment can reduce your subsequent monthly payments.

- Lump-Sum Payment: If you have the financial means, paying your premium in full upfront can help you avoid down payment and monthly installment fees. Some insurance providers may even offer a paid-in-full discount of 5% to 10% if you choose this option.

Ways to Reduce Costs

There are several strategies you can employ to reduce the cost of your auto insurance:

- Compare Quotes: Shop around and compare quotes from multiple insurance providers. Rates can vary significantly between companies, so it's worth checking to find the most competitive price.

- Bundle Policies: If you have other types of insurance, such as home or renters insurance, consider bundling them with your auto insurance. Many companies offer discounts for customers who have multiple policies with them.

- Improve Your Driving Record: Maintaining a clean driving record can help lower your insurance rates. Avoid speeding tickets, at-fault accidents, and DUI convictions, as these can significantly increase your premium.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium. However, keep in mind that a higher deductible means you'll pay more out of pocket if you need to make a claim.

- Look for Discounts: Insurance companies offer a variety of discounts, such as good student discounts, claims-free discounts, and discounts for paying in full. Ask your insurance provider about any applicable discounts you may qualify for.

- Telematics Programs: Participating in a telematics program, which tracks your driving habits through GPS technology, can earn you a discount if you demonstrate safe driving behaviours.

Final Thoughts

Auto insurance costs can vary widely depending on your personal circumstances and the coverage you choose. By understanding the factors that affect your rates and exploring payment and cost-reduction options, you can make informed decisions about your auto insurance and find ways to save money without compromising your coverage. Remember to review and compare insurance providers periodically, especially after any significant life changes, to ensure you're getting the best value for your needs.

Salvaged Vehicles: Can Insurers Detect?

You may want to see also

Auto insurance rates

The cost of auto insurance depends on a variety of factors, including the driver's age, gender, driving record, location, and the type of car they drive. It is important to note that auto insurance rates can vary widely, and it is recommended to shop around and compare quotes from different insurance providers to find the best rate.

Factors Affecting Auto Insurance Rates

- Age and Gender: Younger drivers, especially teens, tend to pay more for auto insurance due to their lack of driving experience and higher risk of accidents. Additionally, men tend to pay more than women as they are more likely to engage in riskier driving behaviours.

- Driving Record: A driver with a clean driving record will typically pay less for auto insurance than someone with a history of accidents, speeding tickets, or DUI convictions.

- Location: The state or city in which the driver lives can also impact the cost of auto insurance. Some states have higher average insurance premiums due to factors such as accident frequency, cost of labour and vehicle parts, and road conditions.

- Type of Car: The make and model of the vehicle can affect the insurance rate. Sports cars, luxury cars, SUVs, and electric vehicles tend to have higher insurance premiums due to repair costs, safety features, and the likelihood of accidents.

- Credit Score: In most states, a driver's credit score can influence their auto insurance rate. Drivers with poor credit are often seen as more likely to file claims, resulting in higher insurance costs.

Understanding Auto Insurance Coverage

Auto insurance coverage can be categorised into two types: minimum coverage and full coverage. Minimum coverage refers to the legal insurance requirements that vary from state to state, while full coverage includes additional protections such as collision and comprehensive insurance. Full coverage is generally more expensive but offers more financial protection in the event of an accident.

Tips for Reducing Auto Insurance Costs

- Compare Multiple Quotes: Different insurance companies use varying rating factors, so it is essential to compare quotes to find the most competitive price.

- Bundle Policies: Combining auto insurance with other types of insurance, such as home or renters insurance, can often result in a discount.

- Reduce Mileage: Driving fewer miles can lead to lower insurance rates as it reduces the risk of accidents.

- Raise Your Deductible: Increasing the deductible, which is the amount paid out of pocket before the insurance coverage kicks in, can lower monthly premiums.

- Look for Discounts: Many insurance companies offer discounts for various reasons, such as being a good student, having a claims-free record, or paying the premium in full.

Gap Insurance: Job Loss Protection

You may want to see also

Auto insurance discounts

Multi-Policy or Bundling Discounts

If you buy multiple policies from the same company, such as car insurance and home insurance, you can often get a discount. This is known as "bundling" and can result in savings of up to 25% on your car insurance. Even if you're not a homeowner, you can usually bundle car insurance with other types of insurance, such as renters, condo, motorcycle, boat, or life insurance.

Vehicle Safety Discounts

If your car has safety features like anti-lock brakes, airbags, and daytime running lights, you may be eligible for a discount. Airbag discounts can be significant, offering up to 40% off your medical payments or personal injury protection coverage. Cars that are less than three years old may also qualify for a new car discount, which can be around 10-15%.

Anti-Theft Device Discounts

If your car has anti-theft features, you can typically get a discount on your comprehensive coverage. This can range from 5-25% off. Examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching, which permanently engraves the vehicle identification number on the windshield and windows.

Good Driver Discounts

Insurance companies often reward safe drivers with discounts. This could include maintaining an accident-free driving record, taking a defensive driving course, or using a drive safe app. Good driver discounts can range from 10-40% off your policy.

Student Discounts

If you or your student driver is enrolled full-time in high school or college and meets certain requirements, you may be eligible for a discount. Insurance companies typically require the student to maintain at least a B average and be aged 16-25. Good student discounts can range from 8-25% off.

Pay-in-Full Discounts

If you pay your policy in full upfront, rather than in monthly installments, insurance companies often offer a discount. This can range from 6-14% off your policy.

Paperless or Automatic Payment Discounts

Many insurance companies offer small discounts if you agree to receive your policy documents electronically or set up automatic payments from your bank account. These discounts typically range from 1-6%.

Other Discounts

There are also other, more specific discounts that may be available, such as occupational discounts, loyalty discounts, continuous insurance discounts, and discounts for getting an online quote. It's always worth asking your insurance agent about any potential discounts that you may qualify for.

Canceling Travelers Auto and Home Insurance

You may want to see also

Auto insurance by location

The cost of auto insurance varies depending on your location. In the United States, the national average annual car insurance cost is $1,718 for full coverage and $488 for minimum coverage. However, these rates can differ significantly from state to state.

For example, Wyoming has the lowest average full coverage annual rate of $972, while Florida has the highest at $3,067. Other states with low full coverage rates include Vermont ($1,082), New Hampshire ($1,119), Idaho ($1,162), and Ohio ($1,209). On the other hand, Louisiana ($3,037), Texas ($2,567), Rhode Island ($2,413), and Kentucky ($2,394) are among the states with the highest average full coverage rates.

The cost of auto insurance is influenced by various factors, including personal characteristics such as age, gender, and marital status, as well as driving history, location, and the type of vehicle. It's important to note that rates can change frequently, so it's recommended to compare quotes from multiple providers to find the most competitive price.

Drivetime: Gap Insurance Options

You may want to see also

Frequently asked questions

The average cost of car insurance in the US is $194 per month for full coverage and $53 for minimum coverage.

The average annual cost of car insurance in the US is $2,329 for full coverage and $633 for minimum coverage.

The average cost of car insurance for a 20-year-old driver with good credit and a clean driving record is $3,576 for full coverage and $1,023 for minimum coverage.

The average cost of car insurance for a driver with a DUI is $2,213 per year for a full coverage policy in Idaho and around $7,714 per year in Michigan.

The average cost of car insurance for a driver with poor credit is $2,741 per year for full coverage and $756 per year for minimum coverage.