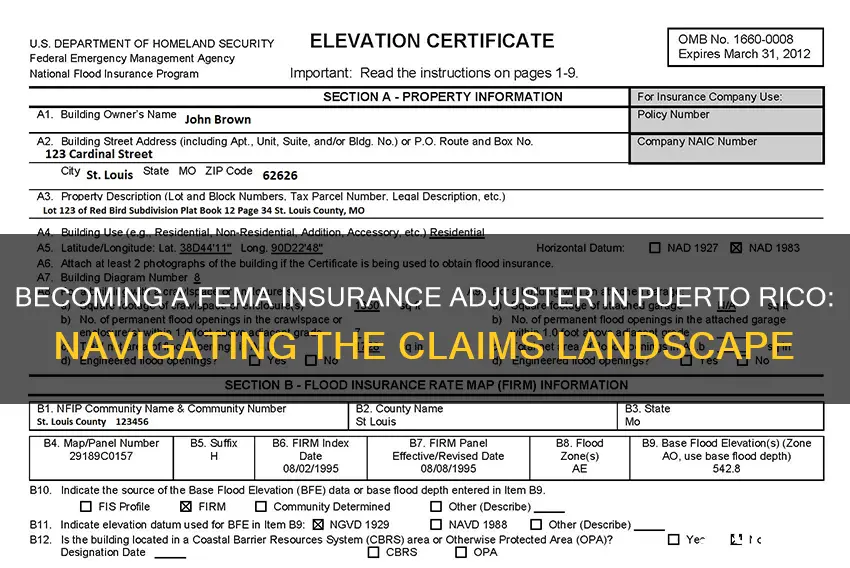

If you want to become a FEMA insurance adjuster in Puerto Rico, there are a few things you need to know. First of all, you must be 18 years old or older and a US citizen. If you are not a US citizen, you must have a resident license for selling insurance in one of the 50 US states. You must also submit a $10,000 bond in favor of the Commonwealth of Puerto Rico to the Office of the Commissioner of Insurance of Puerto Rico. In addition, you are required to submit a copy of your driver's license and professional licenses, such as a real estate, attorney, or accountant license. Keep in mind that you cannot hold or apply for more than one active adjuster license at the same time.

| Characteristics | Values |

|---|---|

| Applicant Age | 18 or older |

| Applicant Background | No serious RIRS actions |

| Applicant Background | No 1033 actions |

| Applicant Citizenship | US Citizen or Non-citizen with a resident license for selling insurance in one of the 50 US states |

| Applicant License | Use NRAR if within the renewal period (30 days prior to the expiration date - to 30 days past the expiration date) |

| Applicant License | If the applicant has had a license suspended or revoked in any state, they must contact the Office of the Commissioner of Insurance of Puerto Rico directly for further direction to amend or apply for a license |

| Applicant License | Individuals may not hold or apply for more than one of the following active adjuster licenses at the same time: Independent Adjuster, Public Adjuster, Emergency Independent Adjuster, or Emergency Public Adjuster |

| Applicant Documentation | If the applicant answers "no" to the US citizenship question, they must send proof of employment authorization to work in the US before the application is processed |

| Applicant Documentation | Applicant must send a Puerto Rico driver's license or an Employment Authorization card issued by the US Department of Homeland Security |

| Applicant Documentation | Applicant must submit supporting documents electronically if they respond "yes" to one of the background questions |

| Applicant Documentation | Applicant must submit a $10,000 bond in favor of the Commonwealth of Puerto Rico to the Office of the Commissioner of Insurance of Puerto Rico |

| Applicant Documentation | Applicant must submit a copy of their driver's license and professional licenses |

| Applicant Documentation | Applicant must submit required documentation by email within 15 days of submitting the application |

| License Validity | 6 months |

What You'll Learn

Be eighteen or older, with no serious RIRS actions

To become a FEMA insurance adjuster in Puerto Rico, there are a number of requirements that must be met. One of these is that the applicant must be eighteen or older, with no serious RIRS actions against them.

RIRS stands for Regional Internet Registries, which are organisations that manage and control internet addresses in specific regions. There are five RIRs worldwide, and they are responsible for allocating and registering internet number resources, such as IP addresses and autonomous system numbers. These resources are essential for any individual or organisation with an online presence, as they enable them to connect to the internet and be found by users.

In the context of insurance licensing, "no serious RIRS actions" means that the applicant should not have any major issues or violations recorded with the Regulatory Information Retrieval System (RIRS). This system is used by state insurance departments to track and report regulatory actions and violations. It is important for insurance adjusters to have a clean record and maintain a good standing with the relevant regulatory bodies.

By ensuring that applicants for insurance adjuster licenses are free from serious RIRS actions, Puerto Rico's licensing authorities aim to maintain the integrity of the insurance industry and protect consumers from potential fraud or misconduct. This requirement helps to hold insurance professionals accountable and promotes fair and ethical practices in the industry.

Therefore, when applying to become a FEMA insurance adjuster in Puerto Rico, it is essential that the applicant can demonstrate that they meet this requirement, along with the other necessary criteria.

Job Prospects for Insurance Adjusters in Florida: A Growing Market

You may want to see also

No US citizen? Need a US insurance-selling license

If you are a non-US citizen and want to sell insurance in the US, you will need to obtain a US insurance-selling license. Here are the steps you can follow to obtain the license:

Step 1: Check the Requirements

First, check the specific requirements of the state in which you plan to sell insurance. Each state has its own requirements for obtaining an insurance license, including pre-licensing courses, exams, fingerprinting, and background checks. Contact the state's Department of Insurance or visit their website for detailed information.

Step 2: Complete Pre-licensing Requirements

If the state you are applying to requires pre-licensing education, enroll in an approved course and complete it successfully. This will help you prepare for the state insurance license exam. While some states may not mandate pre-licensing, it is recommended to improve your chances of passing the exam.

Step 3: Take the State Insurance License Exam

Register and take the state insurance license exam. This exam will test your knowledge of insurance laws, regulations, and products. Passing this exam is a crucial step towards obtaining your license.

Step 4: Submit Your Application

After passing the exam, you can proceed to submit your license application. The application process may vary slightly depending on the state. Some states may require additional documentation, such as fingerprints and background checks. Make sure to pay the necessary fees, as there is usually a filing fee for submitting the application.

Step 5: Obtain a Non-Resident License (if applicable)

If you plan to sell insurance in multiple states, you will need to obtain a non-resident insurance license for each additional state. Contact the insurance licensing department in those states to understand their specific requirements and fees. Maintaining multiple licenses can be complicated, so it is beneficial to work with a large agency that can provide support.

Step 6: Stay Compliant

Once you obtain your license, remember to stay compliant with the regulations. This includes completing continuing education courses, renewing your license periodically, and adhering to the laws and regulations of the state where you are licensed.

It is important to note that the process of obtaining a US insurance-selling license as a non-US citizen may vary based on your specific circumstances, such as your visa status and residency. Ensure that you carefully review the requirements of the state in which you intend to sell insurance.

The Intriguing World of Insurance Adjusters: A Career Choice to Consider?

You may want to see also

Send proof of work authorization to Puerto Rico

If you are a non-citizen of the U.S. and are applying to become a FEMA insurance adjuster in Puerto Rico, you must send proof of employment authorization to work in the United States before your application will be processed.

You must send one of the following to [email protected] and reference the NIPR transaction number:

- A driver's license issued in Puerto Rico

- An Employment Authorization Card issued by the U.S. Department of Homeland Security

- An Admission Record I-94 with a visa class authorized to work, issued by the U.S. Department of Homeland Security

If you are a U.S. citizen, you do not need to send proof of employment authorization to work in Puerto Rico. However, you will still need to present proof of eligibility and identity. This includes completing an Employment Eligibility Verification form (Form I-9, PDF).

Please note that the above information applies to individuals applying for a FEMA insurance adjuster license in Puerto Rico. The requirements may vary for other types of licenses or for applications in other states or territories. It is important to review the specific requirements for your desired license and location.

The Path to Becoming a Public Insurance Adjuster: A Comprehensive Guide

You may want to see also

Submit a $10,000 bond to the Office of the Commissioner of Insurance of Puerto Rico

To become a FEMA insurance adjuster in Puerto Rico, you must submit a $10,000 bond to the Office of the Commissioner of Insurance of Puerto Rico. This is a requirement for both independent and public adjusters. The bond serves as a financial guarantee of the adjuster's compliance with licensing, record-keeping, and professional practice regulations.

- Amount and Purpose: The bond amount is set at $10,000, and it serves as a financial assurance that the adjuster will adhere to the licensing requirements and conduct their professional duties responsibly.

- Beneficiary: The bond must be submitted in favor of the Commonwealth of Puerto Rico, ensuring that the government entity is protected financially if the adjuster fails to comply with their obligations.

- Submission Process: You can submit a copy of the bond to the email address [email protected] after completing your application. However, the original bond with the proper notarization is required for the license to become valid. If the notary is located outside of Puerto Rico, you must provide a copy of the Notary's certificate from the Secretary of State along with the bond.

- License Validity and Renewal: The license issued after submitting the bond is valid for six months and is non-renewable. However, in certain cases, exceptions may be made if requested directly to the Office of the Commissioner of Insurance of Puerto Rico, either in person or in writing.

- Bond Renewal: The Puerto Rico public adjuster bond must be renewed annually by submitting a continuation certificate. This renewal process ensures that the adjuster remains in compliance with the licensing and regulatory requirements.

- Bond Cost: The cost of the bond depends on your credit rating. With good credit, you may be able to obtain the bond for as low as $100. It is recommended to contact a surety bond specialist to receive a free quote.

- Bond Providers: You can obtain the required bond from surety bond providers such as SuretyOne.com, which specializes in the bonding needs of insurance adjusters in Puerto Rico and other states.

- Application Materials: You can download the necessary application materials from the website of the Puerto Rico Comisionado de Seguros or by contacting their licensing division at the following address: Oficina del Comisionado de Seguros B-5 Calle Tabonuco, 5th Floor GAM Tower Guaynabo, PR 00968.

The Art of Negotiation: Navigating Low Bids from Insurance Adjusters

You may want to see also

Apply for an Adjuster Designated Home State electronically

To apply for an Adjuster Designated Home State (ADHS) electronically, you must submit the following:

- Proof of age: You must be at least 18 years old, with proof of age determined from your date of birth.

- Clean record: There must be no serious RIRS actions or 1033 actions against you.

- Proof of residency: You must submit proof of residence that is not in Puerto Rico.

- Proof of US residency: Non-US citizens must have a resident license for selling insurance in one of the 50 US states.

- Proof of employment eligibility: Non-US citizens must provide legal authorization to be employed in the US. This can include an Employment Authorization card, Visa, Work Permit, Green Card, or Puerto Rican Driver's License issued by the US Department of Homeland Security.

- Proof of no active licenses: You must not have an active resident or non-resident adjuster license in any other state.

- Proof of no RIRS or 1033 actions: You must submit proof that you have no RIRS or 1033 actions against you.

Please note that Puerto Rico does not allow Designated Home State applications. If you are applying for an ADHS license in another state, you can submit your application electronically through that state's designated portal.

The Art of Negotiation: Understanding Insurance Adjuster Tactics

You may want to see also