Combining auto insurance policies is a common step for married couples, and it usually makes financial sense to do so. Married couples are often offered cheaper rates by insurance companies, who view them as more financially stable and less likely to be involved in accidents. Combining policies can also qualify couples for discounts and lower rates, especially if they have a good driving record. However, there are situations in which married couples may choose to keep their policies separate, such as when one spouse has a bad driving record, a low credit score, or an expensive car.

| Characteristics | Values |

|---|---|

| Cost | Combining insurance policies is usually cheaper for married couples. |

| Convenience | Combining insurance policies means there is only one payment date and one renewal date. |

| Discounts | Married couples can qualify for multi-car and multi-policy discounts. |

| Coverage | Combining insurance policies ensures both partners are covered when driving the other's vehicle. |

| Requirements | Most insurers require married couples living in the same household to be covered under the same policy. |

| Exclusions | Some states allow spouses to be excluded from insurance policies if they don't have a license or already have a policy. |

What You'll Learn

- Discounts for bundling insurance policies

- Cheaper to keep policies separate if one spouse has a bad driving record

- Cheaper to keep policies separate if one spouse has a low credit score

- Cheaper to keep policies separate if one spouse drives an expensive sports car

- Cheaper to keep policies separate if one spouse has a longer commute

Discounts for bundling insurance policies

Bundling your home and auto insurance policies can be a great way to save money, with some insurers advertising discounts of up to 30%. However, it is not always the cheapest option, so it is important to shop around and compare quotes for bundled and unbundled policies.

Benefits of bundling insurance policies

Bundling insurance policies can save you money, with some companies offering discounts of up to 25% or 30%. It can also be more convenient, as you will only have to deal with one insurance company and make one payment. You may also be able to align the renewal periods and effective dates of both policies and combine your billing statements. Some companies even offer a single-loss deductible, meaning that if the loss includes both your car and home, you only pay one deductible.

Downsides of bundling insurance policies

Bundling insurance policies can sometimes be more expensive than buying policies from two separate companies. It can also be more difficult to switch providers, as you will have to change both your home and auto insurance. You might also end up with an insurer that is great for home insurance but weak on car coverage, or vice versa.

Other policies that can be bundled

In addition to home and auto insurance, you may be able to bundle other types of policies such as umbrella, boat, RV, or life insurance.

Canceling Progressive Auto Insurance: What You Need to Know

You may want to see also

Cheaper to keep policies separate if one spouse has a bad driving record

Married couples do not have to combine their insurance policies. However, it is usually more cost-effective to do so. Combining policies can qualify couples for discounts and lower rates. If both spouses have good driving records, the savings they may qualify for can be significant. This is because insurance companies charge lower rates for married couples, and they can also qualify for multi-vehicle discounts.

However, if one spouse has a bad driving record, it may make sense to keep separate policies. A spouse with a poor driving record can boost insurance rates or make it difficult to get coverage at all, depending on the severity of their record. If the insurer finds that a driver on the policy has multiple traffic violations, it will increase the rates. If any of the violations are major offenses, such as reckless driving or a DUI, then the rates will go even higher.

If you and your spouse live in the same household, many insurers require you to add them to your car insurance policy. However, if your spouse has a bad driving record, you may want to exclude them from your coverage. If you choose to exclude your spouse from your insurance policy, they should not drive your vehicle. Insurance companies may void your policy if they find out that someone excluded from the policy is driving your car.

If you and your spouse live in separate households, it is usually necessary to have separate car insurance policies because the vehicles are garaged at different locations.

Auto Insurance Premiums: The Annual Creep

You may want to see also

Cheaper to keep policies separate if one spouse has a low credit score

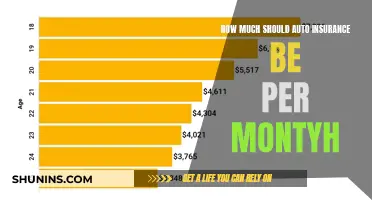

Combining auto insurance plans can save married couples between 4% and 10% on their premiums. However, if one spouse has a low credit score, it may be more cost-effective to keep your policies separate.

Credit scores are calculated based on an individual's credit history. While a spouse's poor credit score will not directly affect the other spouse's credit score, it can have indirect negative consequences. For example, when applying for loans together, such as mortgages, lenders will consider both spouses' credit scores. A poor credit score can result in higher interest rates or even loan denial.

Similarly, when it comes to auto insurance, a spouse's low credit score can increase premiums or make it challenging to obtain coverage. If one spouse has a low credit score and does not plan to drive the family car, excluding them from the policy may be a viable option to reduce premiums. Named-driver exclusions are not permitted in all states or by all insurance companies, so it is essential to shop around for insurance that accommodates this.

In summary, if one spouse has a low credit score, keeping auto insurance policies separate can be a strategic decision to avoid higher premiums. However, it is important to weigh this against the potential benefits of combining policies, such as the convenience of managing a single policy and the potential for multi-car discounts.

MOT and Insurance: Are You Legal to Drive?

You may want to see also

Cheaper to keep policies separate if one spouse drives an expensive sports car

If one spouse drives an expensive sports car, it may be cheaper to keep your car insurance policies separate. Sports cars are expensive to insure, so adding them to your policy may increase your insurance costs. In this case, it may be more cost-effective to get a separate insurance policy for the sports car and exclude the other spouse if they never drive it.

However, it's important to note that most insurers require you to add your spouse to your policy if you live in the same household. Some states also do not allow you to exclude your spouse from your policy. Therefore, it's essential to check with your insurance provider and understand the specific requirements and restrictions.

By keeping the policies separate, the spouse with the sports car will likely have higher insurance costs due to the vehicle's value. On the other hand, the other spouse may benefit from lower premiums if they have a good driving record and a less expensive car.

Additionally, consider the potential benefits of combining policies, such as multi-car discounts, single payment and renewal dates, and the convenience of managing a single policy. Compare rates and consider the impact of factors like driving records, credit scores, and vehicle values on your insurance costs.

Gap Insurance: Capped or Not?

You may want to see also

Cheaper to keep policies separate if one spouse has a longer commute

If one spouse has a longer commute, it may be cheaper to keep your auto insurance policies separate. Each spouse's commute length and destination can affect insurance rates. If one spouse works from home, and the other has a long commute into a high-risk city, you may decide to keep your policies separate.

Even if you have good driving records and credit scores, you may decide to keep separate policies if one spouse has a longer commute. Costly sports cars can be expensive to insure.

However, unless you specifically exclude your spouse from your policy, your rates could still increase, as the insurance company assumes they will drive your vehicle sometimes. If you choose to exclude your spouse from your insurance policy, they should avoid driving your vehicle. Insurance companies may void your policy if they find out that someone excluded from the policy is driving.

If you want to have separate insurance policies, with access to each other's cars, then each spouse will need to include the other on their insurance policy.

It is always a good idea to compare rates before choosing to have separate policies. While adding a spouse with a long commute to your policy may increase your rates, the addition of a multi-vehicle discount may make up for it.

Auto Insurance Industry: How Many Employees Does It Have?

You may want to see also

Frequently asked questions

Many insurers require you to add a spouse to your car insurance policy if you're both living in the same household. However, some states allow you to exclude your spouse from your policy for reasons such as not having a license or already having their own policy.

Sharing a policy is generally cheaper as you'll split the cost of certain coverages. You'll also benefit from your spouse's clean driving record and it's easier to maintain a single policy than manage two. Additionally, some insurers offer multi-car discounts for having multiple vehicles on one policy.

Yes, married couples can have separate car insurance policies, especially if one spouse has a bad driving record, a low credit score, a long commute, or drives an expensive car. However, you may still be required to list each other on your policies, and your rates could increase as the insurance company assumes your spouse will drive your vehicle sometimes.

You can exclude your spouse from your insurance policy by notifying your agent that your spouse doesn't plan to drive your vehicle. However, if your spouse does drive your vehicle, it could void your policy, and your coverage will not extend to them.