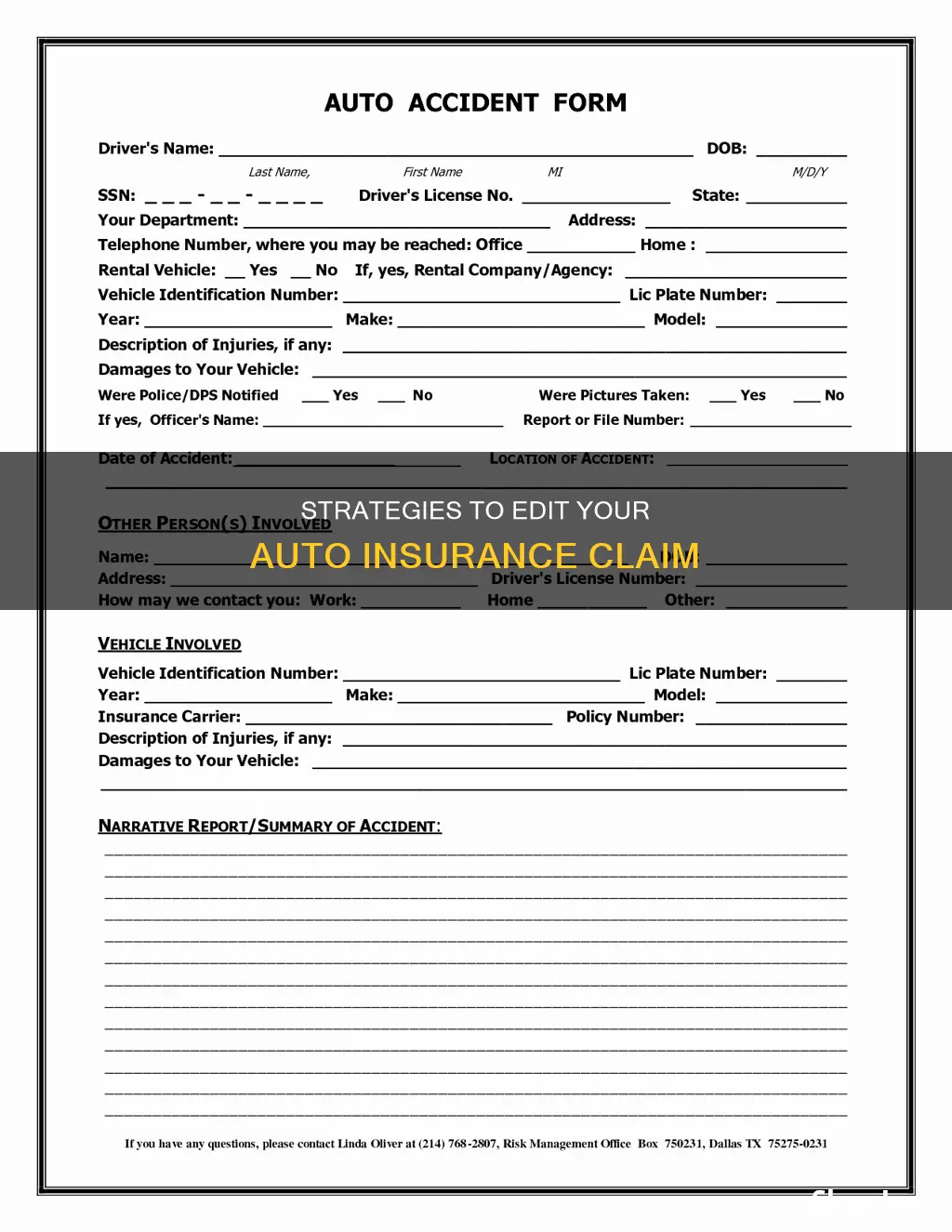

It's rare to need to use your auto insurance, but accidents happen, and when they do, it's important to know how to file a claim. Filing an auto insurance claim is a request for financial compensation from an insurance company for accident-related damages or injuries. The process can vary, but there are some general steps to follow to make filing a claim more seamless and less stressful. This includes gathering the required information, such as the other driver's contact and insurance details, the time, date, and location of the incident, and taking photos of any damage. It's also important to contact your insurance company as soon as possible and understand your policy's coverages and deductibles. You'll then work with an insurance adjuster, who will assess the damage and determine the cost of repairs. Finally, you can choose to repair or replace your car, with your insurer issuing payment directly to the repair shop or to you, minus your deductible.

| Characteristics | Values |

|---|---|

| When to contact your insurance company | As soon as possible after the accident |

| How to contact your insurance company | By phone, online, through a mobile app, or with an agent |

| Information required by the insurance company | Location, date, and time of the accident; name, address, phone number, and insurance policy number for all involved; photos of the damaged vehicles; copies of the police and/or accident reports |

| Information to gather for your own records | Names and phone numbers of everyone you speak with at your insurer; copies of any bills related to the accident |

| How to monitor the progress of your claim | Through your insurer's website |

| How to get a repair estimate | Through a virtual or in-person inspection at a shop, your home, or another location |

| How to get a rental car | Check if your policy includes rental car reimbursement coverage |

| How to handle repairs | Choose a repair shop, or receive a check from the insurance company if you want to handle the process yourself |

What You'll Learn

Contact your insurance company

Contacting your insurance company is the first step in filing an auto insurance claim. It is important to do this as soon as possible, even if the accident appears minor. You can contact your insurance company over the phone, online, through a mobile app, or in person with an agent. Many insurance companies have 24/7 roadside assistance numbers and emergency hotlines that you can call immediately after an accident.

When you contact your insurance company, they will likely request the following details:

- Location, date, and time of the accident

- Name, address, phone number, and insurance policy number for all involved in the accident

- Photos of the damaged vehicles

- Copies of the police and/or accident reports, if applicable

If you are using a mobile app to file your claim, you may be able to upload photos and documents directly to the app. You can also use the app to check the status of your claim, schedule an appraisal, reserve a rental car, and request reimbursements for towing and glass claims.

It is important to note that even if you switch insurance companies, you will still need to work with your previous insurer to settle any open claims. Your new insurance policy will not apply to an accident that occurred under your previous policy.

If you need to make changes to your policy, such as adding or removing a driver or vehicle, you can also contact your insurance company. These changes can usually be made over the phone, online, or in person.

Grandchild on Your Auto Insurance

You may want to see also

Gather the required information

Gathering the required information is a crucial step in the auto insurance claim process. Here are the key details you should aim to collect:

Details of the Accident

Write down the time, date, and location of the incident, as well as a brief description of what occurred. Note that even minor accidents should be reported to the police, and you should obtain a copy of the police report. It's also important to document the incident by taking photos of all damage to your vehicle, the other vehicle(s) involved, any surrounding property, and the overall scene of the accident.

Information of All Involved Parties

Collect the contact and insurance information of all drivers involved in the accident, including names, addresses, phone numbers, and insurance policy numbers. Additionally, get the license plate information of the other driver(s) and the year, make, and model of their vehicle(s). Collect the contact information for any passengers or witnesses to the accident.

Your Insurance Policy Details

Review your insurance policy to understand your coverage and deductibles. Knowing your policy details will help set proper expectations for your claim. For example, knowing whether you have rental car reimbursement coverage or gap insurance is essential.

Progressive's Auto Insurance: Quick Verification Process

You may want to see also

Work with an insurance adjuster

When you file an auto insurance claim, you will most likely be dealing with an insurance adjuster, who works for the insurance company paying the claim. Adjusters are not on your side, and their goal is to resolve the claim as quickly and cheaply as possible. They do this by inspecting the damage, looking at police reports, talking to witnesses, and asking for more information when reviewing your claim.

Be Present During the Adjuster's Inspection

Try to be there when the adjuster inspects the damage to your car or property. Make sure they don’t miss anything. Ask the adjuster when you should expect the insurance company's offer, and get their contact information and the best time to call.

Contact the Insurance Company if You're Having Issues

If you are having trouble reaching the adjuster or are facing other issues, call the insurance company. If you still can't work it out, you can ask the company to assign a different adjuster.

Disagreeing with the Adjuster's Estimate

If you disagree with the adjuster's estimate, tell the insurance company why. They may adjust the offer. If you still disagree, you have several options, such as contacting your insurance company or agent, providing sufficient evidence to support your case, or hiring a lawyer with expertise in resolving this type of claim.

Communicating with the Adjuster

Many insurance companies have an app or online portal for filing a claim, and you may find yourself mostly communicating with the adjuster via email. This provides a written record of all correspondence and reduces on-the-spot anxiety. However, be careful about what you say or write to an adjuster. Do not offer information that might indicate you were partially at fault for the accident, and do not suggest that you are fully healed from your injuries.

Negotiating with the Adjuster

If the adjuster's settlement offer is unreasonably low, it may be a negotiating tactic. You can put together a formal personal injury demand letter that includes details of the accident, a description of your injuries, a summary of your medical treatment, a narrative of how the accident and injuries have affected your life, and a counteroffer. If you are still unable to get a fair settlement offer, you can tell the adjuster that you're ready to turn the claim over to a lawyer.

Progressive Auto Insurance: Anytime Access

You may want to see also

Have your car repaired or replaced

Having your car repaired or replaced is an essential part of the auto insurance claim process, as it gets you back on the road and restores your vehicle to its pre-accident condition. Here's a step-by-step guide to navigating this process effectively:

Step 1: Choose a Reputable Repair Shop

Select a reputable and trusted auto repair facility. You have the right to choose the repair shop you prefer. Your insurance company may provide a list of recommended repair shops, but you are not obligated to use those shops. It is your choice. It is advisable to research and choose a shop with trained technicians and modern equipment to ensure a quality repair.

Step 2: Get Multiple Estimates

Before proceeding with any repairs, it is standard practice to obtain multiple repair estimates. Most insurance companies will send out an adjuster to assess the damage and provide an estimate for repairs. It is beneficial to also obtain estimates from a few trusted repair shops of your choice. This will give you a comprehensive understanding of the costs involved and help you make an informed decision.

Step 3: Authorize and Monitor the Repairs

Once you have chosen a repair shop and agreed on the scope and cost of repairs, you will need to authorize the shop to proceed with the work. It is essential to maintain open communication with the repair shop and your insurance provider throughout the repair process. Ask for updates and inquire about the use of original equipment manufacturer (OEM) parts to ensure the highest quality repair.

Step 4: Inspect the Repaired Vehicle

When the repairs are complete, thoroughly inspect the vehicle before accepting it. Look for signs that the repair was done properly and to your satisfaction. Check that all agreed-upon repairs have been completed and that the vehicle's appearance and functionality are restored to pre-accident condition. If you are not satisfied, discuss your concerns with the repair shop, and if necessary, involve your insurance provider to mediate.

Step 5: Finalize the Claim

After you have confirmed that the repairs meet your standards, the repair shop will typically handle the final billing and claim closure with your insurance company. Ensure you understand the warranty terms provided by the repair shop and any additional services or maintenance your vehicle may require following the repairs.

Remember, a reputable repair shop and open communication with your insurance provider are key to a successful and stress-free car repair or replacement process. Always keep detailed records of all communications, estimates, and repairs for future reference.

U-Haul Rental: Am I Covered?

You may want to see also

Understand the timing of your claim

Understanding the timing of your auto insurance claim is crucial to ensure a smooth and efficient process. Here are some key points to consider:

Deadlines and Time Limits:

Ask your insurance provider if there is a time limit for filing claims, submitting bills, and resolving claims disputes. Be mindful of these deadlines to avoid any issues with your claim.

Response Time:

Typically, an insurance adjuster will contact you within one to three days of filing your claim. They will arrange an inspection, assess the damage, and address any personal injury claims. It's important to respond promptly to their inquiries to keep the process moving.

Claim Settlement Timeline:

The time it takes to settle an auto insurance claim can vary. On average, you can expect your insurance company to pay a claim within about 30 days. However, more complex claims, especially those involving severe injuries or disputes over fault, can take much longer.

Factors Affecting Claim Timing:

Several factors can influence the timing of your claim settlement:

- The severity of the accident and any resulting injuries

- The number of vehicles involved

- The clarity of fault

- The need for negotiations or lawsuits

- The size and resources of the insurance company

- The state in which the accident occurred—some states have specific claim settlement timelines

Ways to Expedite the Process:

To speed up the process, be proactive and provide as much information as possible. Take photos, gather evidence, and document the details of the accident, including the location, date, time, and contact information of all involved parties. Stay in regular communication with your insurance adjuster and provide any requested information promptly.

Delays and Prevention:

While delays can occur, there are ways to prevent them:

- Provide comprehensive documentation and cooperate with the adjuster.

- Research the laws in your state regarding claim settlement timelines and take action if the insurance company exceeds those timelines.

- Be proactive and reach out to your insurance company for updates if you feel there are delays.

California's Auto Insurance Exodus

You may want to see also

Frequently asked questions

Stay calm, call the police, remain at the scene in a safe location, take photos, and exchange information with the other driver if possible.

As soon as possible, even if the accident appears minor.

The location, date, and time of the accident, as well as the name, address, phone number, and insurance policy number for all involved. You will also need to provide photos of the damage and a copy of the police report.

An insurance adjuster is appointed by your insurance company to investigate your claim. They will review your coverages, inspect your vehicle, and assess the damage. They may also interview witnesses and analyse police reports.

You will still need to work with your previous insurer to settle the claim, as your new coverage will not apply to an old accident.