Auto-Owners Insurance is a company that offers life insurance policies to its customers. The company provides a Life Insurance Needs Estimator to help customers determine their insurance needs. This tool allows customers to input information about their financial goals and obligations, such as mortgage payments, income replacement, and final expenses. The estimator then calculates the estimated life insurance need. Customers can discuss their results and create a customized life insurance package with a local independent agent. Auto-Owners Insurance offers various types of life insurance, including term, universal, and whole life insurance, providing financial protection and security for individuals and their families.

| Characteristics | Values |

|---|---|

| Company | Auto-Owners Insurance |

| Website | www.auto-owners.com |

| Contact Number | 800-346-0346 |

| Types of Insurance | Term, Universal, Whole Life |

| Policy | Financial protection for dependents |

| Permanent life insurance | |

| Long-term needs | |

| Investment options | |

| Income protection | |

| Quote | Available through independent agents |

| Use Agency Locator to find an agent |

Pay off mortgage

Auto-Owners Insurance offers a Life Insurance Needs Estimator to help you plan for your family's future. This tool allows you to discuss your goals with an independent agent and create a life insurance package tailored to your needs.

When filling out the Life Insurance Needs Estimator, the first three fields are listed by importance: pay off the mortgage, replace income, and final expenses. The "pay off mortgage" field is crucial if you want to ensure your family can remain in their home after you're gone.

Understanding Mortgage Protection Insurance

Mortgage protection insurance is a type of life insurance policy that pays off your mortgage debt if you pass away. This ensures your family won't lose their home. However, it's important to note that the mortgage lender is typically the beneficiary of these policies, not your loved ones. This means they won't receive a death benefit directly but will be able to stay in the home as the remaining mortgage balance is paid off.

Term Life Insurance vs. Mortgage Life Insurance

Term life insurance offers more flexibility than mortgage life insurance. With term life insurance, you can choose the coverage amount and policy length, allowing you to factor in other financial responsibilities. Additionally, your beneficiaries can use the death benefit for any purpose, including paying off the mortgage, covering final expenses, or meeting future education costs.

Customizing Your Coverage

You can customize your life insurance coverage to fit your specific needs. Consider combining a whole life policy, which provides long-term coverage, with a term policy to cover the short-term, early period of the mortgage when the amount owed is highest. This way, you can ensure that your family will always be able to pay off the mortgage, regardless of how much is owed.

Seeking Professional Guidance

Speak with an Auto-Owners Insurance independent agent to discuss your options and determine the best course of action for your situation. They can provide additional details, answer any questions, and help you create a comprehensive plan that protects your family's future.

By carefully considering your options and seeking professional guidance, you can ensure that your life insurance policy effectively helps your loved ones pay off the mortgage and maintain their financial stability.

Mercury Auto Insurance: Understanding Your Coverage Options

You may want to see also

Replace income

When it comes to filling out an Auto-Owners life insurance replacement form, one of the most important things to consider is how to replace the income of the insured person. Here are some detailed and instructive guidelines on how to approach this:

Understanding Income Replacement

Firstly, it's important to recognise the significance of income replacement within a life insurance policy. This aspect of life insurance provides financial protection for those who are dependent on the insured person's income. It ensures that in the event of the insured person's death, their beneficiaries can utilise the death benefit to maintain their standard of living by covering expenses such as mortgage payments, car payments, groceries, insurance, and more.

Calculating Income Replacement

To determine the amount of life insurance needed to replace income, a common guideline is to multiply your annual salary by the number of years you wish to cover. For instance, if your annual salary is $60,000 and you want to provide five years of coverage, you would require a $300,000 policy. This calculation serves as a starting point and only considers the base salary, so it's important to also account for potential salary increases and additional expenses like college tuition fees.

Types of Life Insurance

When considering income replacement, it's worth noting that there are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers a specific period, such as 10, 20, or 30 years, and is typically the most affordable option. Permanent life insurance, on the other hand, provides coverage for the entire life of the insured and usually builds cash value over time. While permanent life insurance offers lifelong protection, it tends to be more expensive.

Additional Considerations

When calculating income replacement, it's important to consider the value of daily tasks performed by the insured person, such as childcare, cleaning, and cooking. These services can be costly to replace, so including them in your calculations ensures that beneficiaries can continue affording these essential tasks. Additionally, if you have group life insurance through your employer, remember to factor in the extra coverage amount, keeping in mind that this coverage may be tied to your employment and could be lost if you change jobs.

Reevaluating Coverage

Lastly, it's crucial to reevaluate your life insurance needs if your job, income, or family situation undergoes changes. This may involve purchasing additional policies or adjusting coverage amounts to ensure that your loved ones remain financially secure, especially if you become the sole breadwinner or experience an increase in expenses.

By carefully considering these guidelines and seeking guidance from a trusted financial advisor, you can ensure that your Auto-Owners life insurance replacement form adequately addresses the important aspect of income replacement.

Medical Payments Auto Insurance Coverage

You may want to see also

Final expenses

When considering final expenses, it is essential to plan for funeral and burial costs. The average cost of a funeral is $8,300, and it can be even higher depending on the specific arrangements. Cremation, often considered a more affordable option, is only 28% less expensive than a traditional funeral. Final expense insurance can help cover these costs, ensuring that your loved ones don't have to bear the financial burden during their time of grief.

In addition to funeral and burial expenses, final expense insurance can also assist with other end-of-life costs. Out-of-pocket medical bills, legal and accounting fees associated with probate, and unpaid debts are all examples of expenses that can be covered by final expense insurance. These costs can quickly add up and create a significant financial strain for your loved ones. By including these expenses in your life insurance planning, you can ensure that your beneficiaries have the necessary funds to handle these obligations.

When estimating your final expenses, it is important to be as comprehensive as possible. Consider not only the immediate funeral and medical costs but also any outstanding debts or ongoing expenses that your loved ones may need to cover. This can include utility bills, groceries, and other monthly expenses that your family may struggle to pay without your income. By providing a financial cushion through final expense insurance, you can help ease the transition and provide them with time to grieve and heal.

To fill out the Auto-Owners Life Insurance Replacement form effectively, be sure to pay special attention to the "final expenses" section. Discuss your goals and specific needs with your local independent agent, who can guide you in creating a life insurance package tailored to your unique situation. Remember, final expenses can encompass a range of costs, from funeral arrangements to unpaid medical bills, so it's important to be thorough in your estimation. By doing so, you can ensure that your loved ones have the financial support they need during a difficult time.

Safe Auto: Comprehensive and Collision Insurance Costs Explained

You may want to see also

Annual family need

When filling out an Auto-Owners Life Insurance Replacement form, it is important to consider your annual family needs. This is a crucial aspect of financial planning and ensuring your family's security. Here are some detailed instructions and considerations for this section of the form:

Understanding Annual Family Need

The "Annual family need" section of the form focuses on income replacement. It aims to ensure that your family's financial needs are met in your absence. The goal is to provide a sum that can replace your income for a specific number of years, taking into account future expenses and inflation.

Determining the Amount

To determine the amount for annual family need, consider the following:

- Income Replacement: Calculate the income you want to replace annually and for how many years. For example, if you want to replace $40,000 of income annually for 10 years, you would need a total sum of $400,000.

- Inflation Buffer: Add an extra amount to account for inflation and unexpected costs. In the previous example, you might decide to add $100,000, making the total sum $500,000.

- Number of Years: Consider how many years of income replacement your family will need. This could be until your children turn 18 or until your spouse can access retirement funds.

- Future Expenses: Think about any significant future expenses, such as college tuition for your children. Ensure that the sum can cover these costs.

- Existing Assets: Take into account any existing assets, such as savings or investments, that can be used towards these expenses. You may not need as much coverage if you have substantial assets.

Importance of Adequate Coverage

It is essential to provide adequate coverage for your annual family needs. Insufficient coverage may leave your family struggling financially, while over-insuring may result in unnecessary costs.

Seeking Professional Advice

Consider discussing your annual family needs with a financial advisor or insurance agent. They can provide personalized advice based on your unique circumstances and ensure that you select the most appropriate coverage options.

Texas Auto Insurance in Louisiana: What You Need to Know

You may want to see also

Number of children

Auto-Owners Insurance offers life insurance policies to help you plan for the future and protect your loved ones financially. When filling out the Life Insurance Needs Estimator, the 'number of children' field is an important consideration. Here's a detailed guide to help you navigate this section:

This field is crucial when determining your life insurance coverage needs. The number of children you have will impact the amount of financial protection required for your family's future. Auto-Owners Insurance recognizes that each child may have unique needs, and these should be carefully considered when planning your life insurance package.

Education and Tuition Costs:

One of the primary considerations for each child is their education. Think about the estimated yearly tuition fees for each child's education, from primary school through to college or university. The cost of education can be a significant expense, and it's important to ensure that your life insurance coverage can help support your children's academic pursuits.

Childcare and Dependent Care:

If you have younger children, consider the costs associated with childcare or dependent care. This includes expenses such as daycare, babysitting, or nanny services. By factoring in these costs, you can ensure that your life insurance coverage can help alleviate the financial burden of childcare, providing your family with the necessary support.

Future Needs and Goals:

When thinking about your children's future, consider their long-term needs and goals. This could include future milestones such as weddings, starting a business, or purchasing a home. By planning ahead, you can ensure that your life insurance coverage can contribute to these significant events in your children's lives, even if you're not there in person.

Additional Child-Related Expenses:

There are also everyday child-related expenses to consider, such as extracurricular activities, sports, music lessons, or other enrichment programs. These costs can add up, and by including them in your life insurance planning, you can help ensure that your children have access to a variety of opportunities and experiences.

Remember, the 'number of children' field is about more than just a number. It's about understanding the unique needs and aspirations of each child and tailoring your life insurance coverage accordingly. By working with an independent agent from Auto-Owners Insurance, you can discuss these details and create a comprehensive life insurance package that provides financial security for your loved ones.

Lo Jac: Auto Insurance Rates Adjusted?

You may want to see also

Frequently asked questions

You will need to contact an independent agent to get a quote. Auto-Owners does not offer online quotes.

Auto-Owners offers term, universal, and whole life insurance policies.

Term life insurance is the best mix of price and protection for most families. Auto-Owners offers term life insurance in 10-, 20-, or 30-year terms, which can be extended to age 95.

Permanent life insurance meets long-term needs and has investment options.

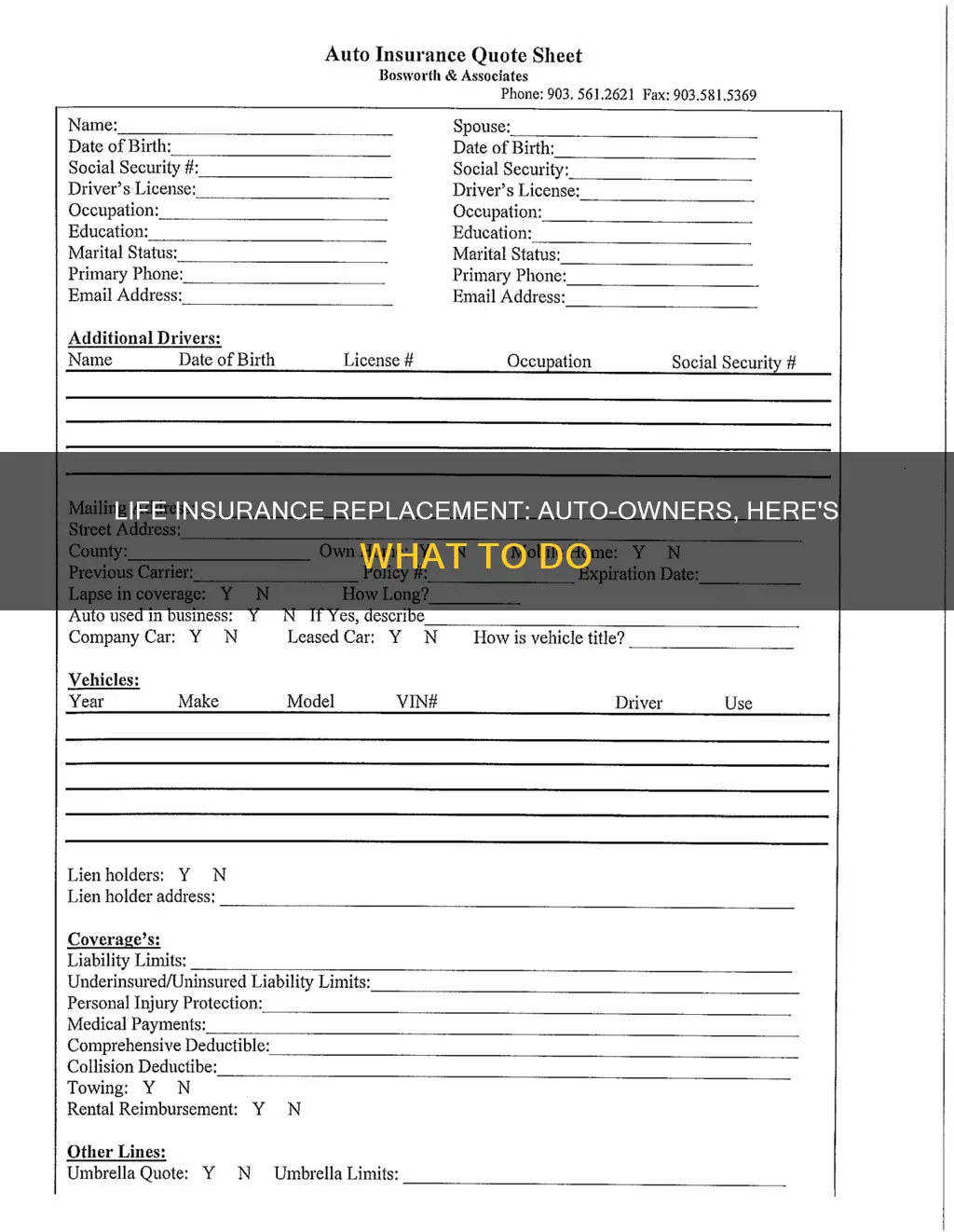

The Life Insurance Needs Estimator helps you plan for your family's future. Pay special attention to the first three fields: pay off mortgage, replace income, and final expenses. Discuss your goals with your local independent agent to create a life insurance package that fits your needs.