Navigating the world of insurance can be daunting, especially when trying to choose the right coverage for your needs. This guide will help you understand how to select the appropriate insurance options through government resources. It will provide a step-by-step approach to evaluating different insurance plans, considering factors such as your specific requirements, budget, and the level of coverage offered. By the end of this guide, you'll be equipped with the knowledge to make informed decisions and choose the insurance that best suits your individual or family's circumstances.

What You'll Learn

- Understand Your Needs: Assess your specific risks and coverage requirements

- Research Options: Explore different insurance types and providers

- Compare Premiums: Evaluate costs and benefits of various policies

- Read Policies: Carefully review terms, conditions, and exclusions

- Seek Advice: Consult experts or advisors for personalized recommendations

Understand Your Needs: Assess your specific risks and coverage requirements

Understanding your insurance needs is a crucial step in making informed decisions when it comes to choosing the right coverage. This process involves a thorough assessment of your personal or business circumstances to identify potential risks and determine the appropriate level of protection. Here's a guide to help you navigate this essential step:

Identify Your Assets and Liabilities: Start by making an inventory of your valuable possessions, both tangible and intangible. This includes your home, vehicles, valuable electronics, jewelry, business equipment, and any other assets of significant value. Also, consider your potential liabilities. For instance, if you own a business, assess the risks associated with operations, such as property damage, employee injuries, or legal issues. Understanding these assets and liabilities will help you gauge the potential financial impact of unforeseen events.

Evaluate Your Risk Tolerance: Risk tolerance refers to your capacity to handle financial losses or disruptions. Consider your financial situation and how comfortable you are with potential risks. For example, if you have a stable income and savings, you might be more willing to take on certain risks. However, if you have a large family or significant financial responsibilities, you may prefer more comprehensive coverage. Assessing your risk tolerance will help you decide between different insurance options and ensure you choose a policy that aligns with your comfort level.

Assess Your Lifestyle and Activities: Your daily activities and lifestyle choices can significantly impact your insurance needs. For instance, if you frequently travel, consider travel insurance to cover unexpected trip cancellations or medical emergencies abroad. If you own a home, assess the potential risks associated with natural disasters, theft, or accidents. Additionally, consider your hobbies and interests, as some activities may require specialized insurance coverage. For example, extreme sports enthusiasts might need adventure sports insurance.

Analyze Potential Risks and Their Impact: Research and identify the specific risks relevant to your situation. This could include natural disasters in your area, health risks, or industry-specific hazards. For instance, if you live in a region prone to hurricanes, consider hurricane insurance. If you have a family history of certain medical conditions, you might want to explore health insurance options that cover those specific risks. Understanding these risks will help you make informed decisions and ensure your insurance policy addresses your most critical concerns.

By following these steps, you can gain a comprehensive understanding of your insurance needs. It empowers you to make choices that provide adequate protection for your assets, liabilities, and lifestyle. Remember, insurance is a personalized journey, and the right coverage will vary for everyone. Taking the time to assess your specific risks and coverage requirements is an essential investment in your peace of mind and financial security.

Understanding Negligence: The Key to Unlocking Insurance Claims

You may want to see also

Research Options: Explore different insurance types and providers

When it comes to choosing the right insurance coverage, especially in the context of government-related programs, thorough research is essential. The first step is to understand the various insurance types available and the providers offering them. This process can be daunting, but it's crucial to make an informed decision. Here's a guide to help you navigate this research:

Understand Your Needs: Begin by evaluating your specific requirements. Different insurance types cater to various needs. For instance, health insurance covers medical expenses, while auto insurance protects your vehicle. Identify the areas where you need coverage and the level of protection you desire. This self-assessment will narrow down your search for suitable insurance options.

Explore Insurance Types: There are numerous insurance types, each designed to address specific risks. Common categories include health, life, auto, home, and disability insurance. Health insurance, for example, can be further divided into medical, dental, and vision plans. Research each type to understand its coverage, benefits, and potential drawbacks. This exploration will help you recognize the options available and make an informed choice.

Research Insurance Providers: Once you've identified the insurance types that align with your needs, it's time to investigate the providers. Government websites, consumer protection agencies, and independent rating platforms can offer valuable insights. Look for providers with a strong reputation, financial stability, and a history of customer satisfaction. Check for any complaints or legal issues associated with the companies to ensure you're making a reliable choice.

Compare and Evaluate: With a list of potential insurance providers, compare their offerings. Pay attention to coverage details, premiums, deductibles, and customer service. Some providers might offer more comprehensive coverage but at a higher cost. Others may provide more affordable options with slightly less extensive benefits. Consider your budget and the level of protection you require to make an informed decision.

Seek Expert Advice: Insurance can be complex, and seeking professional guidance is beneficial. Consult with insurance brokers or agents who can provide personalized recommendations based on your research. They can explain the intricacies of different policies and help you navigate the options. Additionally, online resources and forums can offer valuable insights from those who have gone through similar decision-making processes.

Rooting Your Phone: Insurance Implications and What You Need to Know

You may want to see also

Compare Premiums: Evaluate costs and benefits of various policies

When it comes to choosing insurance, understanding the costs and benefits of different policies is crucial. This process involves a thorough comparison of premiums, which can vary significantly depending on the insurance provider and the specific coverage offered. Here's a step-by-step guide to help you navigate this evaluation process:

- Gather Information: Start by collecting details about the insurance policies you are considering. This includes understanding the coverage options, deductibles, and any additional fees associated with each policy. Government-provided resources or insurance comparison websites can be excellent tools to gather this information. For instance, the official government website often offers a comprehensive list of insurance providers and their offerings, allowing you to compare policies side by side.

- Compare Premiums: The primary factor to evaluate is the premium cost. Premiums are the regular payments you make to the insurance company to maintain coverage. Calculate the total cost of each policy over a year or the entire duration of the policy. Look for any hidden costs or additional fees that might impact your overall expenses. For example, some policies may offer lower monthly premiums but charge higher deductibles, which could increase out-of-pocket expenses in the event of a claim.

- Assess Coverage and Benefits: While premiums are essential, the quality of coverage and benefits should be your primary concern. Evaluate the extent of coverage each policy provides for different scenarios, such as medical emergencies, property damage, or liability claims. Consider your specific needs and potential risks. For instance, if you live in an area prone to natural disasters, ensure that the policy covers such events adequately. Also, look for additional benefits like customer support, claim processing efficiency, and the insurer's reputation for handling claims.

- Consider Customer Reviews: Researching customer reviews and testimonials can provide valuable insights. Check online platforms or forums where people share their experiences with insurance companies. Positive reviews regarding prompt claim settlements and excellent customer service can be indicative of a reliable insurer. Conversely, frequent complaints about delays or denied claims might raise red flags.

- Seek Professional Advice: Insurance can be complex, and seeking guidance from a financial advisor or insurance specialist can be beneficial. They can help you understand the technical aspects of policies, explain the fine print, and provide tailored advice based on your circumstances. These professionals can also assist in comparing policies from different providers to ensure you make an informed decision.

By following these steps, you can systematically compare premiums and evaluate the costs and benefits of various insurance policies. This approach ensures that you make a well-informed choice, selecting the coverage that best suits your needs and budget. Remember, the goal is to find a balance between affordable premiums and comprehensive coverage.

Understanding Direct Appointment Insurance: Unraveling the Term and Its Benefits

You may want to see also

Read Policies: Carefully review terms, conditions, and exclusions

When it comes to choosing the right insurance plan through government-assisted programs, one of the most crucial steps is to thoroughly read and understand the policy documents. This process is essential to ensure you make an informed decision and select a plan that best suits your needs. Here's a guide on how to approach this task:

Understanding the Policy Documents:

Start by obtaining the insurance policy documents, which typically include the insurance contract, policy statement, and any additional riders or endorsements. These documents outline the specific terms, conditions, and coverage details of the insurance plan. It is important to note that insurance policies can be complex, and they may contain technical language or jargon. Therefore, it is advisable to take your time and read through each section carefully.

Reviewing Terms and Conditions:

The 'Terms and Conditions' section of the policy is a comprehensive overview of the insurance plan. It defines the rights and obligations of both the insurance provider and the policyholder. Pay close attention to the following aspects:

- Coverage Details: Understand what is covered under the policy. Identify the specific events, accidents, or circumstances that the insurance will protect against. Look for any exclusions or limitations mentioned, as these will determine what is not covered.

- Premiums and Payments: Review the premium amount and payment schedule. Understand the frequency and method of premium payments. Check for any additional fees or charges mentioned in the policy.

- Policy Duration: Note the period for which the policy is valid. Some policies may have annual or term-based coverage, while others might offer long-term or permanent coverage options.

Identifying Exclusions and Limitations:

The 'Exclusions and Limitations' section is critical as it reveals what the insurance will not cover. This part of the policy is often lengthy and detailed, so it requires careful reading:

- Excluded Events: Look for any specific events or circumstances that are explicitly excluded from coverage. For example, certain pre-existing conditions, natural disasters, or high-risk activities might be excluded. Understanding these exclusions is vital to manage your expectations.

- Limitation of Benefits: Check for any limitations on the amount of coverage provided. Some policies may have maximum payout limits for specific events or may not cover certain types of losses beyond a certain threshold.

- Waiting Periods: Be aware of any waiting periods before the policy starts providing coverage. These periods can vary and may apply to new policies or specific benefits.

Asking for Clarifications:

If you come across any complex or unclear terms, don't hesitate to seek clarification. Contact the insurance provider or their customer support team to get explanations tailored to your understanding. They can provide insights into specific policy aspects and help you make an informed decision.

By thoroughly reading and comprehending the policy documents, you can ensure that you are aware of the insurance plan's strengths and weaknesses. This process empowers you to make a choice that aligns with your specific needs and preferences, ultimately leading to a more satisfying and effective insurance experience.

Understanding New York's DMV Insurance Services: A Comprehensive Guide

You may want to see also

Seek Advice: Consult experts or advisors for personalized recommendations

When it comes to choosing the right insurance coverage, seeking expert advice is an invaluable step towards making informed decisions. Here's why consulting professionals is essential:

Personalized Guidance: Insurance options can be complex and varied, especially when navigating government-offered plans. Insurance advisors or brokers are experts in their field and can provide tailored recommendations based on your unique circumstances. They will consider your specific needs, budget, and lifestyle to suggest the most suitable insurance products. For instance, they might assess your health status to recommend the appropriate medical insurance plan or evaluate your financial situation to advise on the best coverage for your assets.

Expert Knowledge: These professionals possess extensive knowledge of the insurance market, including various policies, coverage details, and industry trends. They stay updated on the latest government regulations and can ensure you are aware of any changes that might impact your insurance choices. Their expertise allows them to explain complex insurance jargon and help you understand the implications of different coverage options. This understanding is crucial in making a well-informed decision.

Risk Assessment: Insurance advisors can conduct a thorough risk assessment to identify potential vulnerabilities in your life or business. They will analyze your situation to determine the likelihood and impact of various risks, such as health issues, property damage, or legal liabilities. By understanding these risks, they can recommend appropriate coverage to mitigate potential financial losses. For example, they might suggest additional insurance for high-risk activities or recommend specific coverage for rare but significant events.

Comparison and Analysis: With numerous insurance providers and plans available, comparing options can be overwhelming. Consultants can simplify this process by providing detailed comparisons of different policies. They will analyze the coverage, premiums, exclusions, and benefits of various plans, ensuring you receive a comprehensive overview. This analysis helps you make an informed choice, considering both short-term and long-term requirements.

Long-term Benefits: Consulting experts for insurance advice is not just about immediate coverage; it's also about long-term financial security. Advisors can help you plan for future needs, such as retirement or long-term care, by recommending appropriate insurance products. They can also assist in reviewing and adjusting your coverage as your life circumstances change, ensuring you always have the right protection.

In summary, seeking advice from insurance experts is a strategic approach to selecting the right government-offered insurance. Their personalized guidance, industry knowledge, and risk assessment skills empower you to make confident decisions, ensuring you have the appropriate coverage for your specific needs.

Phone Battery Replacement: Insurance Coverage and Your Warranty

You may want to see also

Frequently asked questions

When navigating government services, it's essential to assess your unique circumstances. Consider factors like age, health status, income, and assets. For instance, if you're a young adult, basic health insurance might suffice, but if you have a family and specific medical needs, comprehensive coverage is crucial.

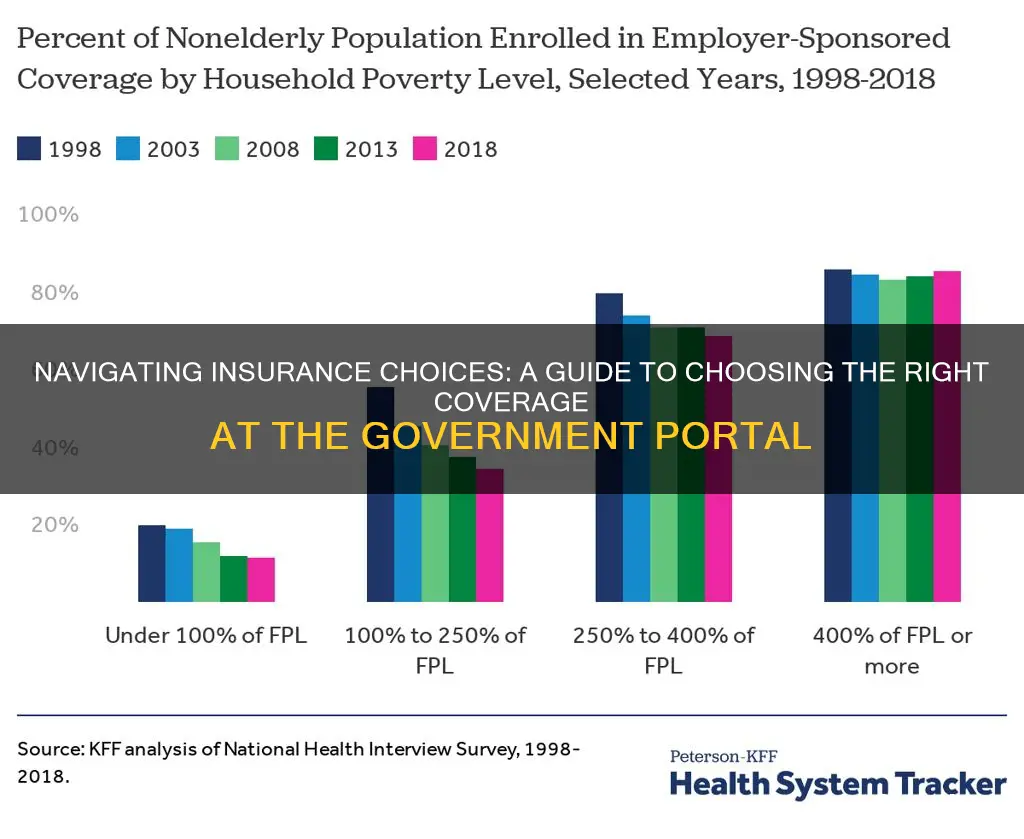

Government-offered insurance, such as Medicare or Medicaid, often provides extensive coverage for specific demographics, like the elderly or low-income individuals. These plans are standardized and may offer more affordable premiums. Private insurance, on the other hand, offers a wider range of options, allowing customization based on individual needs, but typically comes with higher costs.

Striking the right balance is crucial. Evaluate your expected healthcare costs and choose a plan with adequate coverage. Consider deductibles, copayments, and out-of-pocket maximums. For instance, if you have a chronic condition, opt for a plan with lower copayments for specialist visits.

Absolutely! Government websites often provide comparison tools and calculators to assist in making informed decisions. These tools can help you compare premiums, coverage details, and network providers for different plans, ensuring you select the most suitable option for your healthcare needs.