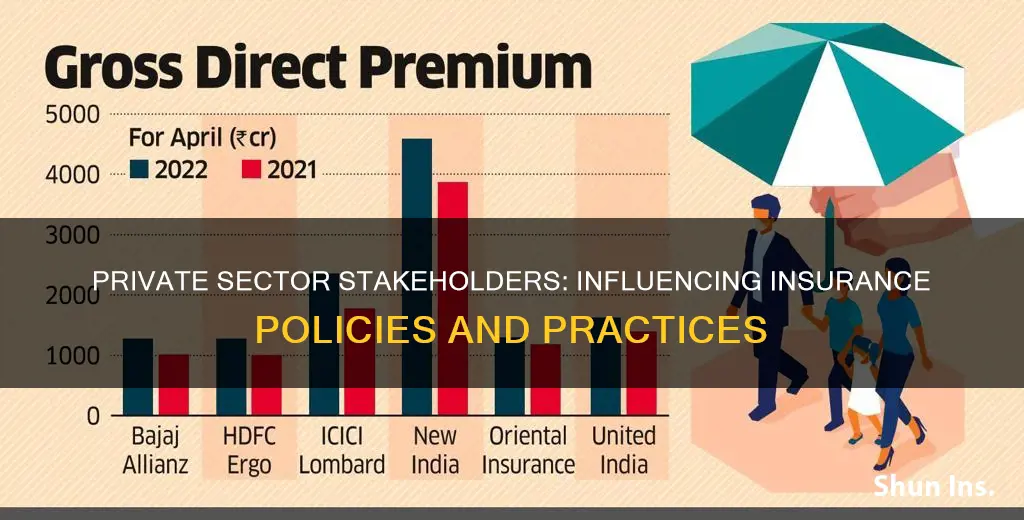

Private sector stakeholders play a crucial role in shaping the insurance industry. These stakeholders include a diverse range of actors, from insurance companies, brokers, and adjusters to the insured individuals themselves. Within insurance companies, various departments, such as commercial, underwriting, and claims management, have specific functions that influence the overall insurance landscape. External stakeholders, on the other hand, include private insurance providers, pharmaceutical companies, and medical equipment manufacturers. The dynamic between internal and external stakeholders is complex and constantly evolving, especially with the rapid adoption of digital technologies and changing customer preferences. Effective collaboration among stakeholders is essential to ensure a positive experience for end customers and drive industry success.

| Characteristics | Values |

|---|---|

| Internal stakeholders | Commercial department, underwriting department, claims department |

| External stakeholders | The insured, insurance broker, official adjuster |

| Market actors | Owners, managers, employees, exclusive agents, independent agents, insurance brokers, private and institutional clients, banks, reinsurers, outsourcing companies, market competitors, insurance organizations, providers of business support services, research and development organizations, members of the community |

What You'll Learn

- Private insurance companies can influence the healthcare sector by affecting health policies, service pricing, and reimbursement rates

- Private insurance companies can drive innovation in the insurance industry by bringing new ideas and ushering in technological advancements

- Private insurance companies can collaborate with insurers and regulators to benefit end consumers and industry growth

- Private insurance companies can influence the insurance market by working with various market actors, including banks, reinsurers, and outsourcing companies

- Private insurance companies can impact the success of the industry by adapting to changing customer preferences and growing digital adoption

Private insurance companies can influence the healthcare sector by affecting health policies, service pricing, and reimbursement rates

Private insurance companies play a significant role in shaping health policies and regulations. They do so by actively engaging in the political and legislative processes, lobbying policymakers, and contributing financially to political campaigns. This allows them to advocate for policies that align with their interests and shape the regulatory environment in their favour.

In terms of service pricing, private insurance companies have a substantial impact on the cost of healthcare services. They negotiate prices with healthcare providers, and these negotiated rates are typically not publicly available, leading to a lack of transparency for patients. While federal and state governments set reimbursement rates for Medicare and Medicaid programs, there is generally no price regulation in the private insurance market. This dynamic gives private insurers considerable influence over healthcare service pricing.

Reimbursement rates, which refer to the amounts that insurance companies pay to healthcare providers for covered services, are also influenced by private insurance companies. These rates are largely dictated by market conditions, and providers can command higher prices when they have more leverage in negotiations with private insurers. Provider consolidation has increased the number of markets where providers have the upper hand in these negotiations. As a result, private insurance companies often pay higher prices for comparable services than public programs like Medicare, contributing to higher healthcare costs for individuals and employers.

The high and rising cost of private healthcare has led to premiums and deductibles for employer-sponsored coverage growing faster than wages and general inflation. This has significant implications for both individuals and employers, as it affects their financial well-being and can impact the job market and economic recovery.

In summary, private insurance companies have a notable influence on the healthcare sector by shaping health policies, impacting service pricing through negotiations, and affecting reimbursement rates through market dynamics. These factors collectively contribute to the overall cost of healthcare and have far-reaching consequences for patients, employers, and the economy as a whole.

Wealth Management Funds: Are Your Investments Insured?

You may want to see also

Private insurance companies can drive innovation in the insurance industry by bringing new ideas and ushering in technological advancements

Private insurance companies are essential drivers of innovation in the insurance industry, bringing new ideas and technological advancements to the forefront. By embracing disruption and leveraging new technologies, they can stay competitive and drive progress.

One key area where private insurance companies can innovate is through the use of data and analytics. With access to vast amounts of data, insurers can identify asset-triggering purchases and life moments, such as graduating college, getting married, or starting a family. This allows them to offer tailored insurance products and services to meet their customers' evolving needs. For example, a new graduate may be in the market for renter's insurance, while a new family may be interested in life insurance. By leveraging data, insurers can anticipate their customers' needs and develop innovative products to meet those needs.

In addition, private insurance companies can drive innovation by analyzing specific market segments and pinpointing the unique needs of their customers. For instance, the small and medium enterprise (SME) space is a target for innovation. By using data analytics, insurers can identify the specific insurance requirements of SMEs and develop customized solutions. This not only helps insurers tap into new markets but also ensures that they are providing relevant and valuable products to their customers.

Another way private insurance companies can innovate is by embracing new technologies, such as artificial intelligence (AI), robotics, blockchain, and data analytics. These technologies can help streamline processes, reduce costs, and improve efficiency. For example, AI can be used to automate certain tasks, such as data entry or claims processing, freeing up resources for more strategic initiatives. Robotics can also enhance speed and accuracy in various operational areas. By adopting these technologies, insurance companies can improve their overall operations and better serve their customers.

Furthermore, private insurance companies can foster innovation through strategic partnerships with non-traditional carriers. By collaborating with startups or technology companies, insurers can bring unique expertise and tools into their organizations. These partnerships can help insurers develop innovative products, enhance their digital capabilities, and drive profitable growth. For example, a partnership between a traditional insurer and a tech startup could result in the development of a new digital platform that improves the customer experience and streamlines processes.

Overall, private insurance companies play a crucial role in driving innovation in the insurance industry. By bringing new ideas, embracing technological advancements, and forming strategic partnerships, they can create value for their customers and stay ahead of the competition. By recognizing the importance of innovation and taking a proactive approach, private insurance companies can shape the future of the industry.

Private Insurance: Self-Protection for the Privacy-Minded

You may want to see also

Private insurance companies can collaborate with insurers and regulators to benefit end consumers and industry growth

Private insurance companies can play a crucial role in collaborating with insurers and regulators to benefit end consumers and support industry growth. Here are some ways in which this can be achieved:

Identifying Right Collaborative Models:

Insurers can identify and adopt suitable collaborative frameworks with private insurance companies. This may involve partnering with private insurance companies to develop customer-centric innovations and enhance the overall consumer experience. By working together, they can leverage each other's strengths and resources to create mutually beneficial outcomes.

Encouraging Innovation:

Private insurance companies often bring new ideas and innovations to the table. Insurers can encourage and support these initiatives, providing a platform for experimentation and development. This can lead to the creation of new products, services, and technologies that benefit consumers and drive industry growth.

Data Sharing and Transparency:

Insurers and private insurance companies can collaborate by sharing data and insights. This data sharing can improve risk assessment, pricing models, and claims handling. Additionally, transparency in data usage, especially with the advent of advanced technologies like AI, is crucial for maintaining trust among consumers and meeting regulatory requirements.

Streamlining Processes:

Collaboration between private insurance companies and insurers can lead to the streamlining of various processes, such as product approval, claims handling, and regulatory compliance. By working together, they can identify inefficiencies and develop standardized procedures, reducing the time and resources needed to bring products to market and improving the overall consumer experience.

Regulatory Support:

Insurers can advocate for regulatory changes that support collaboration and innovation. This may include facilitating partnerships between insurers and private insurance companies, encouraging the use of new data resources, and providing a favourable environment for investment and growth. Regulators play a crucial role in overseeing and supporting these collaborations to ensure fair practices and consumer protection.

By fostering a culture of collaboration and innovation, private insurance companies, insurers, and regulators can work together to create a more robust and dynamic industry that ultimately benefits consumers and drives sustainable growth.

Understanding BCBS: Private Insurance Options and Benefits

You may want to see also

Private insurance companies can influence the insurance market by working with various market actors, including banks, reinsurers, and outsourcing companies

Banks and insurance companies are both financial intermediaries, but they have different business models and face different risks. Banks accept deposits and pay interest on them, then lend the money out to borrowers at a higher interest rate, profiting from the difference. Insurance companies, on the other hand, collect premiums from customers and invest them in suitable ventures to manage their risk. While banks are federally regulated, insurance companies are subject only to state-level regulation. Banks are more susceptible to systemic risk and runs by depositors, whereas insurance companies' liabilities are more long-term and based on insured events occurring.

Insurance companies can partner with banks to offer insurance products to bank customers, providing an additional revenue stream for the bank. This practice is common in Europe and is also gaining traction in the United States.

Reinsurance is a way for insurance companies to transfer some of their financial risk to a reinsurance company, especially in the event of a major natural disaster that results in insurable claims. Reinsurance companies charge premiums to the insurance companies they cover, and these premiums can be quite high due to the increased risk of natural disasters. Investors can benefit from reinsurance as well, as the premiums charged by reinsurance companies provide an income stream.

Outsourcing is another strategy that insurance companies can use to influence the market. By outsourcing certain business tasks and processes, insurance companies can cut costs, improve efficiency, and focus on their core business. Common tasks that are outsourced include accounting, claims processing, and IT positions. Outsourcing can also provide access to a global talent pool and specialized knowledge in areas such as regulation and compliance.

Private Insurance Happiness: Americans' Satisfaction Surveyed

You may want to see also

Private insurance companies can impact the success of the industry by adapting to changing customer preferences and growing digital adoption

Understanding Consumer Behaviours

Consumer behaviours and preferences are constantly evolving, and insurance companies must adapt their strategies to meet these changing demands. Enrollment periods are crucial for the success of insurance businesses, and companies must be adaptable to achieve their business goals. By understanding consumer behaviours, insurance companies can create flexible strategies that cater to the needs and preferences of their target demographics. For example, older consumers may prefer using Facebook, while younger audiences are more likely to be active on TikTok. Thus, insurance companies can choose the most effective digital platforms for their marketing strategies by understanding their target audience's habits and preferences.

Embracing Digital Transformation

The insurance industry has witnessed a significant increase in digital adoption, particularly in the wake of the COVID-19 pandemic. Consumers increasingly expect digital convenience and online initiatives from insurance companies. Therefore, insurance companies must enhance their digital capabilities and improve the user experience on their digital platforms. This includes simplifying digital tools and channels, such as self-service channels, to make them more user-friendly and accessible. By leveraging technology, insurance companies can gain valuable insights into consumer journeys and make necessary modifications to meet consumer needs.

Providing Risk-Prevention Services

In addition to digital adoption, insurance companies are also evolving to meet consumers' growing interest in risk-prevention services. Consumers are increasingly looking beyond traditional insurance coverage and seeking help from insurers to reduce and prevent risks in their lives. This shift is driven by factors such as extreme weather events, the pandemic, aging populations, and technological disruptions. Insurance companies have the opportunity to redefine their role by encouraging behaviours and providing solutions that mitigate risks. For example, some insurers now offer connected health apps and online forums that empower consumers to take a more active role in their health and well-being.

Prioritizing Customer-Centric Marketing

To adapt to changing consumer preferences, insurance companies should prioritise customer-centric marketing. This involves shifting the focus from products to customers and connecting with them on a more personal level. By understanding consumer needs and preferences, insurance companies can create marketing strategies that speak directly to their target audience's unique concerns and pain points. Data analytics plays a crucial role in this process, providing valuable insights into consumer journeys and marketing effectiveness.

Enhancing Customer Service

As consumer preferences evolve, insurance companies must also enhance their customer service and support. During enrollment periods, consumers may have questions or concerns about their policies. By outsourcing customer service or leveraging technology, insurance companies can ensure they have the necessary resources to handle a high volume of inquiries. This can include providing online chat functions, quick response times, and knowledgeable staff to address consumer needs.

In conclusion, private insurance companies can impact the success of the industry by adapting to changing customer preferences and growing digital adoption. By understanding consumer behaviours, embracing digital transformation, providing risk-prevention services, prioritising customer-centric marketing, and enhancing customer service, insurance companies can stay aligned with market demands and consumer expectations.

Kaiser Permanente: Private Insurance, Public Good?

You may want to see also

Frequently asked questions

Key private sector stakeholders include insurance companies, insurance brokers, and insured individuals or entities. Additionally, external stakeholders like banks, reinsurers, and outsourcing companies also play a role.

Private sector stakeholders influence insurance by driving innovation and shaping customer experience. They also contribute to the growth of Insurtechs, which bring new ideas and technological advancements.

The internal private sector stakeholders within an insurance company include the commercial department, the underwriting department, and the claims department. Each department has specific roles, such as customer prospecting, drafting insurance policies, and managing the flow of claims.

Private sector stakeholders can improve the industry by collaborating and working together. This includes insurers, Insurtechs, and regulators uniting to benefit consumers and industry growth. Additionally, stakeholders can push for customer-centric innovations, streamline processes, and leverage data analytics.