Starting an insurance adjuster firm can be a rewarding venture, offering a stable income and the opportunity to help people get back on their feet after a loss. The insurance adjuster role is often referred to as the hidden gem of insurance careers, as it plays a crucial yet unnoticed role in overseeing the claims process. While the specific requirements vary across states, here is a general introduction to guide you through the process of starting an insurance adjuster firm.

| Characteristics | Values |

|---|---|

| Education Requirements | Minimum of a high school diploma or GED equivalent. Some employers prefer an associate or bachelor's degree. |

| Skills | Self-discipline, excellent work ethic, communication skills, analytical skills, computer skills, time management skills, attention to detail, customer service skills, math skills, organisation skills, project management skills, etc. |

| Age | 18 or above |

| Driver's License | Required in most U.S. states |

| Vehicle Ownership | Required in most U.S. states |

| Language Proficiency | Proficiency in reading and writing in English |

| Mobility | Ability to move about freely to accomplish tasks in various environments |

| Licensing | Required in most U.S. states. A license is vital to success as an adjuster, especially if you want to work outside of your state. |

| Training | Training in Xactimate, the industry-standard estimating software, is considered essential. |

What You'll Learn

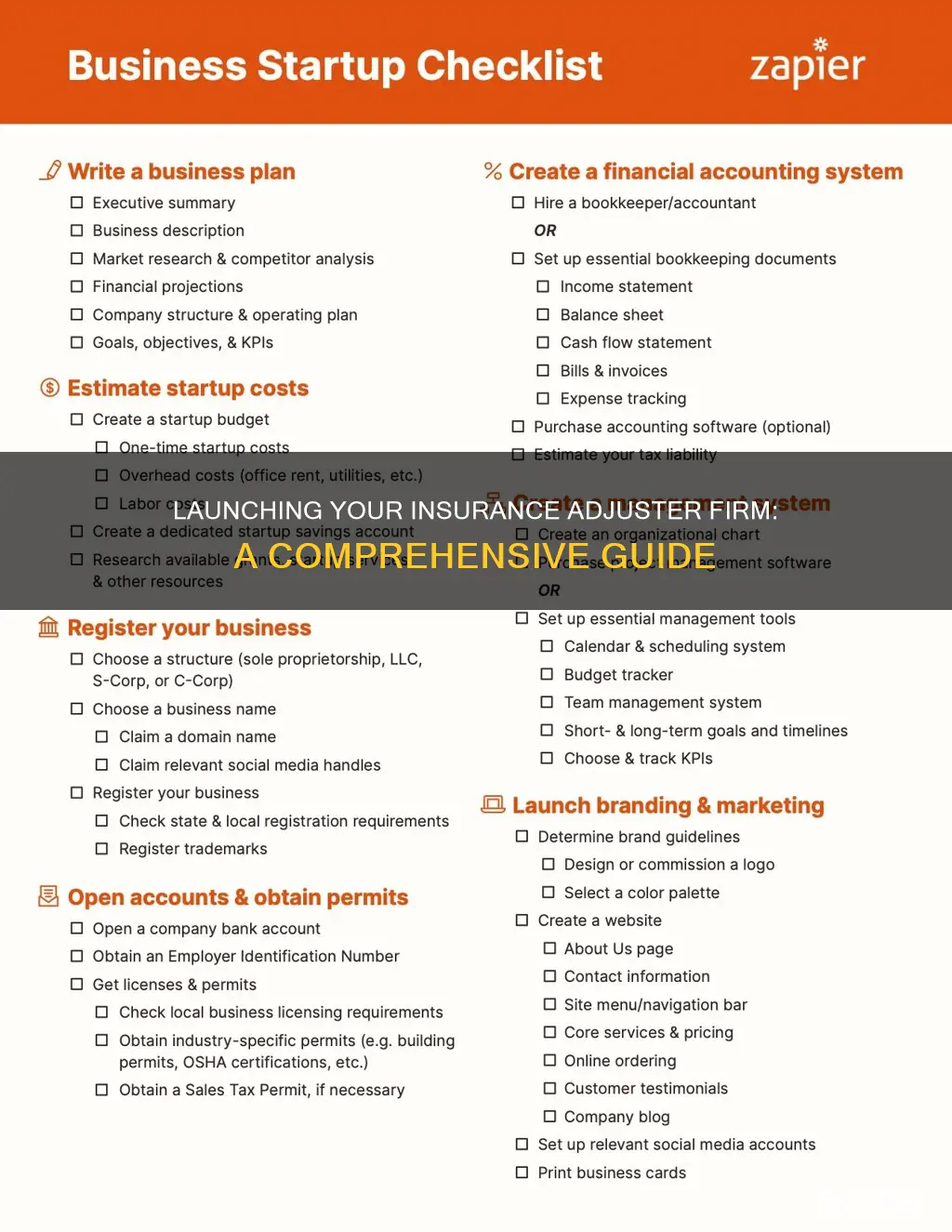

Decide on the type of insurance adjuster firm you want to start

When deciding on the type of insurance adjuster firm you want to start, there are several factors to consider. The first is whether you want to be a staff adjuster or an independent adjuster.

Staff adjusters are typically employed directly by an insurance company and work as year-round, full-time employees. They often receive benefits and have a more steady schedule and income compared to independent adjusters. Staff adjusters usually handle claims related to automobile accidents and other auto-related incidents, but they can also work in other areas such as health, life, and property insurance.

On the other hand, independent adjusters are contractors who work for one or more insurance adjusting firms or third-party organisations. They often handle claims for multiple insurance companies and may work on a more flexible schedule. Independent adjusters are commonly hired for catastrophe-related claims, such as natural disasters, and may travel to affected areas. This type of work can be more unpredictable, with busy seasons requiring long hours and slower periods with fewer work hours.

Another type of adjuster to consider is a public insurance adjuster, who works directly for policyholders or customers. Public adjusters are typically hired when a person or business feels that their insurance settlement is unfair or inadequate.

It's important to note that your state's licensing requirements may also impact your decision. Some states require adjusters to be licensed, while others do not. If you plan to work across multiple states, obtaining licenses in each state or a Designated Home State (DHS) license can be advantageous.

In addition to the type of adjuster, you may also want to consider specialising in a specific type of work or claim, such as catastrophe (CAT), auto, workers' compensation, or marine claims. This decision may depend on your previous experience, education, and the specific needs of the market you plan to serve.

Becoming an Insurance Adjuster in Michigan: A Comprehensive Guide

You may want to see also

Understand the basic requirements to become an insurance adjuster

Understanding the basic requirements to become an insurance adjuster is a crucial step in starting an insurance adjuster firm. Here are the key points to consider:

Education Requirements

To become an insurance adjuster, a minimum of a high school diploma or GED equivalent is necessary. While a degree is not always mandatory, some employers may prefer candidates with an associate's or bachelor's degree, especially in business or a related field. Obtaining a degree can set you apart from other applicants and enhance your knowledge and skills.

Licensing Requirements

Most states in the US require insurance adjusters to be licensed. The specific requirements vary by state, and it is essential to check with your state's insurance department for the most accurate information. You will typically need to pass a licensing exam, which may involve completing a pre-licensing course beforehand. Some states, such as California and New York, have additional requirements like bonding. Obtaining a license is crucial, as it demonstrates your proficiency and understanding of the profession.

Skills and Qualifications

Insurance adjusters need a combination of hard and soft skills. Hard skills include a valid driver's license, proficiency in English, and basic math skills for damage calculations. Soft skills, such as self-discipline, excellent communication, and empathy, are also essential for interacting with clients and building strong relationships. Proficiency in industry-specific software like Xactimate is highly advantageous.

Career Path Options

There are several types of insurance adjuster career paths to choose from, including staff adjuster, independent adjuster, catastrophe adjuster, and public adjuster. Understanding the differences between these paths will help you make an informed decision about your specialization. Staff adjusters typically work full-time for an insurance company, while independent adjusters are contractors who work for multiple firms. Catastrophe adjusters may be staff or independent but are specifically deployed to areas affected by natural disasters. Public adjusters work directly for policyholders, advocating for fair settlements.

Additional Considerations

In addition to the basic requirements, building relevant work experience is beneficial. Consider entry-level positions or internships within insurance companies or adjusting firms to gain valuable hands-on experience. Networking within the industry and staying up-to-date with continuing education credits are also important for career development and maintaining your license.

Understanding the Language of Claims: Decoding an Insurance Adjuster's Statement of Loss

You may want to see also

Meet the educational requirements

To start an insurance adjuster firm, you must first meet the minimum educational requirements to become an insurance adjuster. While a high school diploma or GED is the minimum educational requirement to become a licensed insurance adjuster, some employers may prefer candidates with a degree in business or a related field. Obtaining a degree, particularly in insurance, can help set you apart from other candidates and make you more attractive to potential employers.

If you are considering a career as an insurance adjuster, it is important to first ensure that you meet the basic requirements. In the United States, this includes being at least 18 years old, holding a valid driver's license, owning a vehicle, possessing proficient reading and writing skills in English, and being able to navigate and perform tasks in diverse settings.

Once you have confirmed that you meet the basic requirements, the next step is to obtain the necessary education. As mentioned, a high school diploma or GED is the minimum requirement, but pursuing a degree can be advantageous. An associate's, bachelor's, or master's degree can enhance your employability and make you a competitive candidate for insurance adjuster positions.

It is worth noting that some states may have specific education requirements for insurance adjusters. For example, some states may prefer or require a degree in a related field, such as business or insurance. Therefore, it is important to research the specific requirements of the state in which you plan to operate your insurance adjuster firm.

After completing the necessary education, you can then focus on obtaining the required licenses and certifications to practice as an insurance adjuster. This typically involves taking a licensing exam, which may be preceded by a pre-licensing course. Obtaining licenses and certifications will not only ensure you comply with legal requirements but will also enhance your credibility and expertise in the field.

Navigating the Path to Becoming a FEMA Insurance Adjuster

You may want to see also

Obtain an insurance adjuster license

The requirements for obtaining an insurance adjuster license vary depending on the state in which you reside. Some states do not require a license to practice as an insurance adjuster. These include Colorado, Kansas, Nebraska, South Dakota, North Dakota, Missouri, Iowa, Illinois, Wisconsin, Tennessee, Ohio, Virginia, Maryland, Pennsylvania, New Jersey, and Massachusetts. However, most states (34 out of 50) do issue their own licenses for claims adjusters.

If your state requires a license, you will need to pass an exam to earn it. To qualify to take the licensing exam, you may need to first complete a pre-licensing course. These courses are offered both in the classroom and online. The pre-licensing course will help you understand the information required to pass the licensing exam. The exam itself is a proctored test, meaning it will be administered in a controlled environment with an examiner overseeing you. The cost of the exam varies by state but is generally between $30 and $150.

Once you have passed the exam, you will need to submit a licensing application to your state's insurance department. There may be additional requirements, such as a background check or fingerprinting. The application fee also varies by state but is generally between $15 and $300.

If you live in a state that does not require licensing, you can still benefit from obtaining a license. This is because most Independent Adjusting (IA) firms require adjusters to have a license, regardless of their location. In this case, you can obtain a Designated Home State (DHS) license from another state. This will allow you to work in the state that issued the license and any states that have reciprocity with that state.

After obtaining your license, you may need to apply for reciprocal licenses in other states where you plan to work. This will allow you to work across state lines without having to retake the licensing exam in each state.

The Role of Independent Insurance Adjusters: Unraveling the Claims Process

You may want to see also

Gain experience and build the required skills

Gaining experience and building the right skills are crucial steps in starting an insurance adjuster firm. Here are some detailed instructions to help you get started:

Gain Industry Experience:

- Entry-level positions: Consider starting as a "claims specialist" or adjuster at an insurance company. You can work as a desk adjuster, handling claims from an office, or as a field adjuster, working outside the office. This will give you valuable insights into the claims process and help you build connections in the industry.

- Internships and trainee programs: Look for internship or trainee opportunities within insurance companies or independent adjusting firms. These programs can provide structured training and help you develop the skills needed to become an adjuster.

- Staff adjuster experience: Working as a staff adjuster for an insurance company can give you valuable hands-on experience. You'll learn about claims management and gain a better understanding of the insurance industry.

Build the Required Skills:

- Self-discipline and project management: As an independent adjuster, you'll need strong self-discipline to manage your workload and projects effectively.

- Computer and software proficiency: Adjusters rely heavily on computers and software like Xactimate to manage claims. Proficiency in typing and using industry-specific software is essential.

- Organisation and attention to detail: Sloppiness can lead to costly errors in the insurance industry. Develop excellent organisational skills and pay close attention to detail, especially when identifying fraudulent claims.

- Record-keeping, time tracking, and invoicing: As you'll essentially be running your own business, these skills are crucial for managing your work and finances effectively.

- Communication etiquette: Daily interactions with clients, insurance companies, and professionals require clear and effective communication skills, both oral and written.

- Analytical and critical thinking: Being able to assess complex information, analyse research findings, and interpret data is vital for making sound decisions as an adjuster.

- Persistence and self-promotion: You'll need persistence when dealing with unresponsive claimants. Additionally, self-promotion and lead generation skills will help you attract new business.

Remember, gaining experience and building these skills takes time and dedication. Don't rush the process, as it will help ensure you're well-prepared and confident when you eventually launch your insurance adjuster firm.

The Essential Question: Unraveling the Role of Insurance Adjusters in Times of Crisis

You may want to see also

Frequently asked questions

A high school diploma or GED is the minimum educational requirement to become an insurance adjuster. Some employers may prefer a bachelor's degree or a degree in a related field. You must also pass a licensing exam, which may require you to complete a pre-licensing course.

In addition to strong communication skills, insurance adjusters need proficiency in computer systems and time management skills to handle multiple claims. Analytical skills, attention to detail, and interpersonal skills are also important for interacting with claimants and understanding complex insurance information.

This depends on the state in which you reside. Most states (34 out of 50) require insurance adjusters to be licensed. It is recommended to obtain a license even in states that do not require it, as it enhances your credibility and allows you to work in other states with reciprocal agreements.

There are three main types of insurance adjusters: staff adjuster, independent adjuster, and public adjuster. Staff adjusters work directly for an insurance company, while independent adjusters work as contractors for multiple insurance companies. Public adjusters work directly for policyholders, helping them get a fair settlement.

The cost varies depending on your state's requirements. You may need to pay for pre-licensing courses ($100 to $500), licensing exam fees ($30 to $150), license application fees ($15 to $300), and continuing education credits ($50 to $200 every few years).