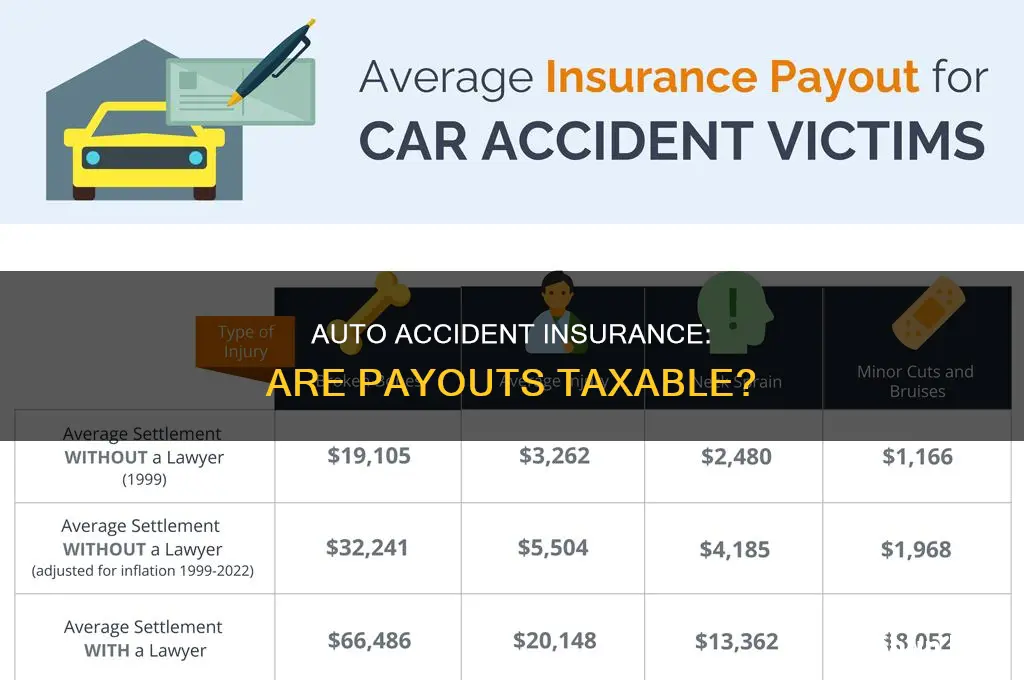

Whether or not an auto accident insurance payout is taxable depends on several factors, including the type of damages received and the state in which the accident occurred. While most insurance claim settlements are not taxable, there are situations where taxes may be incurred, depending on whether the payout is considered income by the IRS.

| Characteristics | Values |

|---|---|

| Are auto accident insurance payouts taxable? | In general, most parts of a car accident insurance settlement are not taxable. However, under U.S. tax codes, some types of damages may count as taxable income. It depends on the taxability of the loss. |

| What is taxed? | Lost long-term income, lost wages, pain and suffering (in some cases), emotional distress (in some cases), punitive damages, interest earned on the settlement |

| What is not taxed? | Medical bills, surgeries and diagnostic procedures, pain and suffering (in most cases), property damage, lost quality of life |

What You'll Learn

Medical bills and property damage are usually non-taxable

When it comes to auto accident insurance payouts, it's important to understand which portions are taxable and which are not. While the taxability of these settlements can vary depending on factors like the type of damages and state laws, there is a general consensus that medical bills and property damage are typically non-taxable. Here's a more detailed explanation:

Medical Bills

In most cases, compensation for medical expenses incurred due to an auto accident is not considered taxable income. This includes costs associated with doctor visits, surgeries, prescription medication, and other medical procedures. The reasoning behind this is that these payments are meant to reimburse you for out-of-pocket expenses and make you whole again, rather than provide additional income. However, there is an exception to this rule. If you previously deducted medical expenses related to the accident on your taxes, receiving a settlement for those expenses may become taxable. This is because you cannot benefit from both the tax deduction and the tax-free settlement.

Property Damage

Compensation for property damage, such as repairs or replacement of your vehicle or other damaged items, is generally not taxable. This is because it is intended to restore your property to its previous condition, not provide you with additional income. The IRS recognizes that taxing victims for property damage settlements would result in them not being fully compensated for their losses. Therefore, property damage settlements are typically exempt from taxation.

While medical bills and property damage are usually non-taxable, it's important to note that other aspects of an auto accident insurance payout may be taxable. For example, lost wages or income are often considered taxable because they replace your regular income, which would typically be subject to income tax. Additionally, punitive damages, which are intended to punish the defendant for negligence, are also usually taxable.

To summarize, while medical bills and property damage are generally non-taxable, the tax implications of an auto accident insurance payout can vary depending on the specifics of your case. It is always advisable to consult with a tax professional or an attorney specializing in this area to ensure you understand the tax consequences of your settlement.

The Impact of a DUI on Auto Insurance: What You Need to Know

You may want to see also

Lost income is taxable

If you receive compensation for lost income as part of your car accident insurance settlement, it is considered taxable income. This is because lost income damages cover the loss of your regular wages, which you would typically pay taxes on.

The taxability of your settlement depends on the nature of your loss. While most components of a car accident insurance settlement are not taxable, some types of damages may be considered taxable income under US tax codes.

Lost income is considered a taxable loss, and any compensation received for lost income will be subject to tax. This is because lost income is meant to replace the wages you would have earned, which are taxable.

To reduce your tax liability, it is important to work with a legal professional to structure your settlement carefully. For example, compensation for medical bills, property damage, and pain and suffering is generally not taxable. By structuring your settlement to focus on these areas, you can minimise your tax burden.

Additionally, you may be able to reduce your taxes by spreading out your settlement payments over several years, lowering your overall taxable income in any given year.

Credit Checks: The Auto Insurance Secret Weapon

You may want to see also

Punitive damages are taxable

According to the IRS, all punitive damages are fully taxable as ordinary income. This means that even if a plaintiff receives compensatory damages that are excluded from income, any punitive damages awarded will still be taxable. The IRS Publication 4345 states that punitive damages are subject to income tax and must be reported as income. They are to be reported as "other income" under US federal tax law and must be reported on a 1040 tax form.

The taxability of punitive damages can result in a significant financial burden for plaintiffs. For example, if a plaintiff receives a $500,000 settlement for physical injuries in a car accident, that amount would be tax-free compensatory damages. However, if the plaintiff also receives $5 million in punitive damages, the full $5 million would be taxable. The plaintiff will have to pay taxes on the punitive damages, including the portion paid to their attorney as a contingent fee.

To reduce the tax burden, plaintiffs can utilise tools such as a structured settlement annuity or the Plaintiff Recovery Trust. The Plaintiff Recovery Trust allows plaintiffs to pay taxes only on the amount they personally receive after deducting legal fees, rather than on the entire punitive damage amount. This can significantly increase the amount of the settlement that the plaintiff gets to keep after taxes.

Non-Standard Auto Insurance: Who's Covered?

You may want to see also

Emotional distress is sometimes taxable

Emotional distress damages are sometimes taxable. This is because emotional distress is not considered a physical injury or sickness. However, if emotional distress causes physical symptoms, such as insomnia, headaches, and stomach disorders, then the settlement received for this is taxable even when the amount awarded is paid for medical care.

In the case of Domeny v. Commissioner, Ms. Domeny suffered from multiple sclerosis (MS). Her symptoms worsened due to workplace issues, including an embezzling employer. As a result, her physician determined that she was too unwell to work, and she was terminated. This caused another spike in her MS symptoms. She settled her case and claimed a portion of the money as tax-free, but the IRS disagreed. However, she won in Tax Court because her health and physical condition clearly deteriorated due to her employer's actions. Therefore, portions of her settlement were tax-free.

In another case, Parkinson v. Commissioner, a man suffered a heart attack at work. He reduced his hours, took medical leave, and never returned. He sued his employer, claiming that their misconduct caused him to suffer a disabling heart attack, rendering him unable to work. He settled and claimed that one payment was tax-free. The IRS disagreed, but he won in Tax Court. The court distinguished between a "symptom" (subjective evidence of a disease) and a "sign" (objective evidence perceptible to a physician). The court agreed that extreme emotional distress can result in physical harm, such as a heart attack, and so the payment was not taxable.

It is important to note that the distinction between taxable and non-taxable emotional distress damages can be complex and ambiguous. The legislative history of Section 104(a)(2) of the tax code states that emotional distress includes physical symptoms resulting from emotional distress. However, it also provides that damages received for emotional distress attributable to physical injury or sickness are non-taxable. As such, it is crucial to work with an attorney to help structure and label your settlement to minimize tax liability.

AAA and Salvage Vehicle Insurance

You may want to see also

Consult a professional for advice

If you've been in a car accident and are facing an insurance payout, it's important to understand the tax implications. While some aspects of a car accident insurance settlement are typically not taxable, other elements may be taxable or become taxable based on specific circumstances. This can be a complex area, and it's always a good idea to consult a professional for advice. Here's why:

Tax Laws and Regulations:

Tax laws and regulations can be complex and ever-changing. A professional tax advisor will be well-versed in the latest tax laws and regulations, both at the federal and state levels. They can help you navigate the intricacies of tax codes and determine which portions of your settlement are taxable and which are not. This is especially important when it comes to structuring your settlement to minimize your tax liability.

Expert Knowledge:

Professional tax advisors, such as Certified Public Accountants (CPAs), tax attorneys, enrolled agents, and financial advisors, have advanced training and knowledge in tax accounting and tax law. They can provide expert guidance on strategies to minimize your taxes payable while ensuring you remain compliant with the law. Their expertise can be invaluable in helping you make sense of the tax consequences of your insurance payout.

Personalized Advice:

The tax implications of an auto accident insurance payout can vary depending on your specific situation. A professional tax advisor will take the time to understand your unique circumstances, including any complex financial situations you may have. They can then provide personalized advice and strategies tailored to your needs. Whether you're an individual, entrepreneur, or business owner, a tax advisor can help you optimize your tax obligations.

Saving You Money:

Consulting a professional tax advisor can potentially save you a significant amount of money. They can help you identify tax deductions, credits, and strategies to lower your tax bill. By structuring your settlement and payments optimally, a tax advisor can help reduce your overall tax liability. Additionally, a tax advisor can assist in creating a tax plan for upcoming years, ensuring you stay on top of your tax obligations and make informed financial decisions.

Peace of Mind:

Dealing with the aftermath of a car accident is stressful enough without having to worry about the tax implications of your insurance payout. Consulting a professional tax advisor can give you peace of mind. They can guide you through the process, answer your questions, and ensure you don't miss any important considerations. Knowing that your tax obligations are being handled correctly will allow you to focus on your recovery and moving forward.

While online resources can provide general information, consulting a professional tax advisor will give you personalized and detailed guidance specific to your situation. They can help you navigate the complexities of tax laws, optimize your financial situation, and ensure you don't incur unnecessary tax liabilities. Remember, each case is unique, and seeking professional advice can make a significant difference in your financial outcome.

Auto Insurance Rates: The Driving History Factor

You may want to see also

Frequently asked questions

No, auto accident insurance payouts are generally not taxable. However, there are situations where you may have to pay taxes on a settlement.

Auto accident insurance payouts are taxable when they compensate for lost income or emotional distress. Punitive damages are also taxable.

Yes, auto accident insurance payouts for medical expenses, property damage, and pain and suffering are typically not taxable.

You can reduce taxes by structuring your settlement to minimise tax liability. For example, pursuing compensation for medical bills, which are typically not taxable, or classifying the settlement as compensation for pain and suffering.

Yes, it is recommended to consult with a tax professional or an attorney to understand the specific tax implications of your settlement.