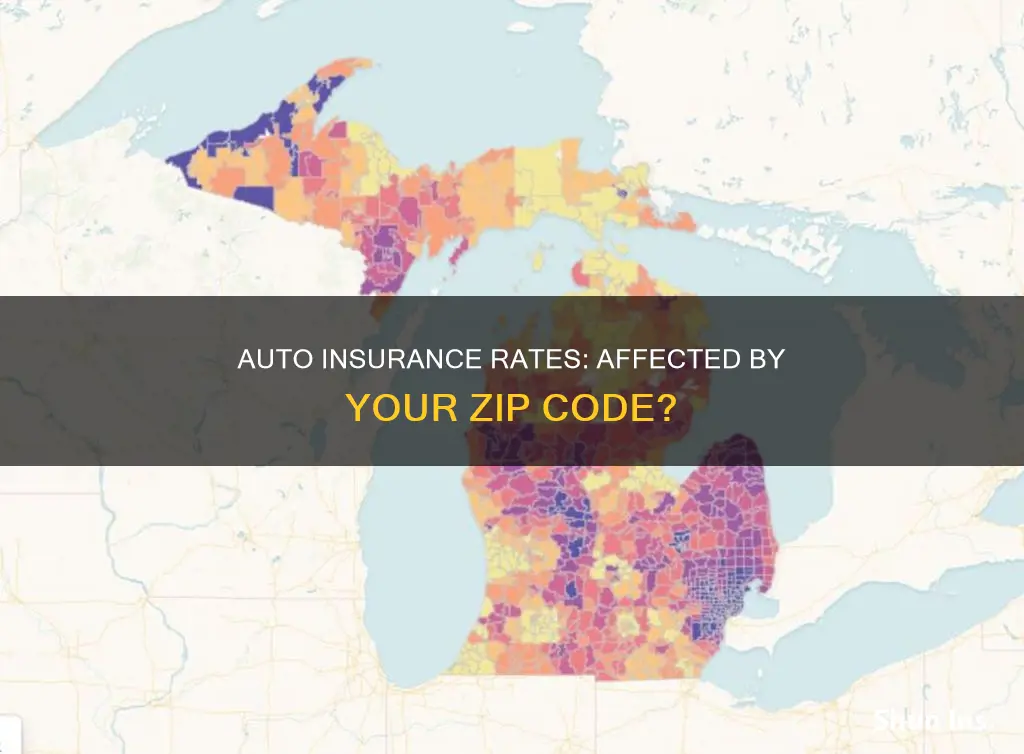

Auto insurance companies use a variety of criteria to determine insurance rates, including the type of vehicle, driving history, and desired coverage. One of the most important factors is the ZIP code, as it is associated with a particular level of risk. Insurers evaluate ZIP codes based on traffic, accident rates, the number of uninsured motorists, claims history, weather conditions, and government regulations. This information helps them assess the likelihood of claims being filed and adjust rates accordingly. For example, areas with high congestion, poor road conditions, or high crime rates may lead to increased premiums due to the higher risk of accidents or theft. Conversely, ZIP codes with lower risk profiles may benefit from reduced rates. The impact of ZIP codes on insurance rates varies across states, with some states banning their use in pricing due to concerns about the effect on low-income and minority drivers.

| Characteristics | Values |

|---|---|

| Crime rates | Higher crime rates, especially of auto theft and vandalism, can lead to higher insurance premiums |

| Population density | Urban areas with higher population density tend to have higher insurance rates due to increased traffic congestion and accident rates |

| Repair costs | Locations with higher repair costs can result in increased insurance premiums |

| Natural disasters | Areas prone to natural disasters may have higher insurance rates due to the potential for more claims |

| Traffic patterns | Areas with challenging traffic patterns, such as high-speed roads or complicated intersections, can lead to higher accident rates and insurance premiums |

| Road conditions | Poor road conditions, such as potholes or debris, can contribute to accidents and higher insurance rates |

| State and local regulations | State and local government regulations can impact insurance rates, with some states prohibiting the use of ZIP codes for insurance pricing |

| Claims history | ZIP codes with a history of frequent claims may have higher insurance rates |

What You'll Learn

Crime rates

For example, Irvington, NJ, has a crime rate that is six times higher than the state average, leading to higher insurance rates. Similarly, areas with higher levels of vandalism and other car-related criminal activity, such as hit-and-run accidents or drunk driving, will also have higher insurance rates.

Insurers also consider the number of uninsured motorists in an area. If your zip code has a high number of uninsured drivers, you can expect to pay more for your auto insurance policy.

While crime rates play a significant role in determining insurance rates, other factors, such as population density, road conditions, and accident statistics, also come into play when calculating auto insurance rates by zip code.

Financed Vehicle: Essential Insurance Coverage

You may want to see also

Population density

The relationship between population density and auto insurance rates is clear when comparing urban and rural areas. Urban areas typically have higher insurance rates than rural areas due to the increased number of cars and higher traffic congestion. The higher accident rates in urban areas also contribute to the higher insurance rates.

The impact of population density on auto insurance rates is also evident when comparing different zip codes within the same city. Even a short move within a city can significantly affect insurance rates, as the new zip code may have a different population density, leading to changes in the number of cars, traffic patterns, and accident rates.

In addition to population density, other factors such as crime rates, road conditions, and weather conditions also influence auto insurance rates. However, population density plays a crucial role in determining the cost of auto insurance, especially in highly populated urban areas.

Florida's Digital Car Insurance and Registration

You may want to see also

Repair costs

The conditions of the roads in a particular ZIP code can also affect the probability of filing auto insurance claims. Roads with potholes, rough surfaces, and debris can damage vehicles or cause accidents as drivers attempt to avoid unsafe road conditions. Streets that flood easily during rain showers and roads that quickly turn icy in frigid temperatures are also hazardous and may lead to more accidents or vehicle damage. ZIP codes with many roads in poor or potentially dangerous conditions are considered more risky, and insurance companies may charge higher premiums to offset the potential costs.

Additionally, the availability of parking in an area can impact repair costs. In densely populated urban areas with limited parking, vehicles are at a higher risk of being damaged while parked on the street. This can result in higher repair costs for vehicle owners.

Get Auto Insurance in California: A Step-by-Step Guide

You may want to see also

Natural disasters

For example, states like Florida, which is prone to flooding and wind damage, or California, which experiences earthquakes and wildfires, typically have higher auto insurance rates. The increased risk of natural disasters in these areas leads to a higher probability of insurance claims, which insurers factor into their pricing.

It's important to note that natural disasters are considered "acts of God" in the insurance industry. This means that they are events outside human control and are typically covered under comprehensive coverage in auto insurance policies. Comprehensive coverage is optional in most states, but it is highly recommended for residents in areas susceptible to natural disasters.

The impact of natural disasters on auto insurance rates can also vary depending on other factors, such as the number of uninsured motorists in an area, crime rates, and population density. Additionally, insurance companies may implement temporary restrictions on policy changes or new purchases during an impending major storm, making it crucial for individuals to have the appropriate coverage in place beforehand.

While natural disasters can contribute to rising auto insurance rates, other factors related to the specific location, such as congestion, road conditions, and local claims history, also play a role in determining insurance premiums.

Mazda CX-5 Auto Insurance: What's the Cost?

You may want to see also

State and local government regulations

Other states have different insurance regulations and minimum legal insurance requirements. Some states follow at-fault laws, where the driver who caused the accident is responsible for the damages. In contrast, other states have no-fault laws, where drivers must rely on their insurance providers, regardless of who is at fault. These differences significantly impact auto insurance rates, with no-fault states tending to have higher insurance premiums.

Additionally, state laws mandate the minimum coverage levels required to drive legally in that state. For example, Texas requires liability insurance of $30,000 per person for injuries, $60,000 total for all injuries, and $25,000 for property damage per accident. On the other hand, Iowa requires lower liability coverage of $20,000 per person for injuries, $40,000 total for all injuries, and $15,000 for property damage. These variations in state laws and regulations directly influence the cost of auto insurance for residents.

Arizona Auto Insurance Rates: The Rising Trend

You may want to see also

Frequently asked questions

Yes, auto insurance rates vary by zip code due to several factors. Insurance companies assess risks based on the location, which includes factors like crime rates, population density, accident rates, and even the frequency of severe weather conditions.

To find out the auto insurance rates in your zip code, you can contact insurance companies directly and request quotes. Additionally, there are online tools and comparison websites that allow you to enter your zip code and obtain estimates from multiple insurers.

Moving to a different zip code might impact your auto insurance rates. If you relocate to an area with lower crime rates or a lower likelihood of accidents, you may be eligible for lower insurance premiums. However, it's important to note that factors such as your driving history and the type of vehicle you own will also affect your rates.