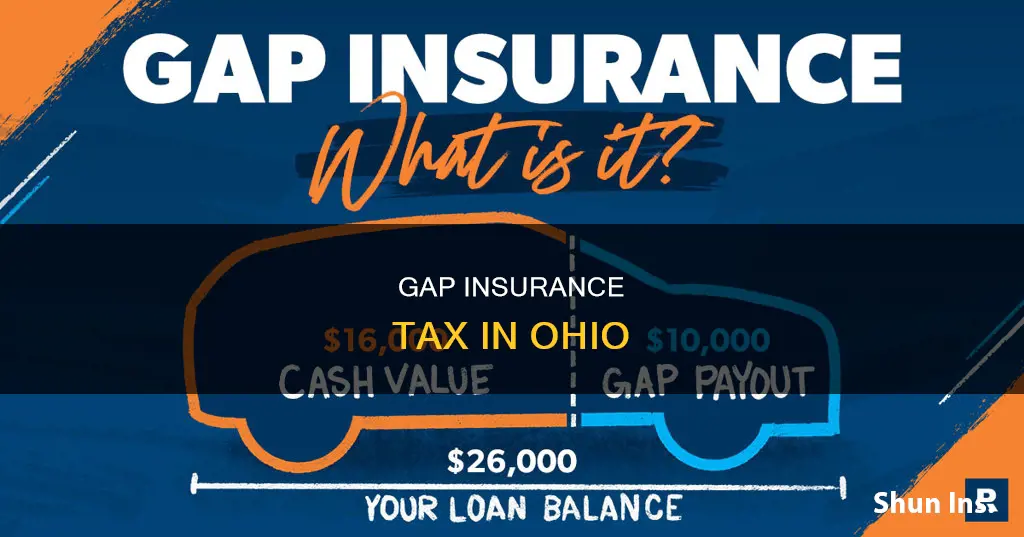

In Ohio, gap insurance is not taxable, but it is still important to understand how it works in the state. Gap insurance, or Guaranteed Auto Protection, covers the difference between the value of your vehicle and the balance on your loan in the event of theft or a total loss. While not required by law, it is often offered by lenders and lessors and can provide financial peace of mind. The cost of gap insurance in Ohio typically ranges from $2 to $30 per month, depending on the provider and the vehicle. It is generally only needed for one to three years or until the vehicle's value exceeds the loan amount.

| Characteristics | Values |

|---|---|

| Is GAP insurance taxable in Ohio? | No, GAP insurance is not taxable in Ohio. However, insurers may not offer to pay the sales tax upfront as part of the original settlement. |

| What is GAP insurance? | Guaranteed Auto Protection. It covers the difference between the value of your vehicle and the balance on your loan in the event of theft or a total loss. |

| Is GAP insurance required by law in Ohio? | No, GAP insurance is not required by Ohio law. |

| When is GAP insurance useful? | GAP insurance is useful if you have a long payoff period (more than 4 years), a small down payment (less than 20%), or a vehicle that depreciates quickly. |

| Where can you buy GAP insurance? | You can buy GAP insurance from dealerships, car manufacturers, or insurance providers. |

| How much does GAP insurance cost in Ohio? | In Ohio, GAP insurance costs an average of $2 to $30 per month, depending on the provider. |

What You'll Learn

When is GAP insurance worth it?

GAP insurance, or Guaranteed Auto Protection, is an optional type of auto coverage that helps pay your car loan if your vehicle is stolen or totaled and you owe more than the car is worth. It is not required by law in Ohio, but it can be a valuable addition to your insurance coverage in certain situations. Here are some scenarios in which GAP insurance may be worth considering:

- Leasing a vehicle: If you are leasing a car, some lenders may require you to have GAP insurance. Even if it is not required, GAP insurance can provide valuable protection in case of a total loss or theft of the leased vehicle.

- Small down payment: If you made a small down payment on your vehicle, such as less than 20% of the purchase price, GAP insurance can help protect you from owing more than the car's value in the event of a total loss or theft.

- Long finance period: If you have a long payoff period for your loan, such as more than four years, GAP insurance can be a wise investment. It will protect you from having to continue making payments on a vehicle that has been totaled or stolen.

- Quick depreciation: If you have purchased a vehicle that depreciates quickly, such as luxury cars or sports cars, GAP insurance can be beneficial. It will help cover the difference between the depreciated value of the car and the remaining loan balance if the car is totaled or stolen.

- Negative equity: If you have rolled over negative equity from a previous car loan into a new loan, GAP insurance can help protect you from owing more than the car's value.

- High mileage: If you plan to put a lot of miles on your vehicle, this can accelerate depreciation. In this case, GAP insurance can be a good idea to protect yourself from owing more than the car's value if it is totaled or stolen.

In general, GAP insurance is worth considering if you are concerned about having to pay the difference between your insurance payout and the remaining loan balance in the event of a total loss or theft of your vehicle. However, if you have made a large down payment, plan to pay off the loan quickly, or are purchasing a used car without financing, GAP insurance may not be necessary. Additionally, it is recommended to buy GAP insurance from an independent insurance company rather than the dealership, as it can be significantly cheaper.

Florida: Vehicle Insurance, Mandatory or Not?

You may want to see also

What does GAP insurance cover?

Guaranteed Auto Protection (GAP) insurance covers the difference between the amount you owe on your auto loan and the amount your insurance company pays if your car is stolen or totaled. This type of insurance is intended for people who finance or lease their vehicles.

If your car is stolen or totaled in an accident, your insurance company will pay you the actual cash value (ACV) of your car. However, this might not be enough to pay off your car loan or lease completely. This is where GAP insurance comes in. It covers the "gap" between the ACV of your vehicle and the remaining balance on your loan or lease.

For example, let's say you finance a $25,000 car. A few months later, your car is in an accident and the insurance adjuster declares it a total loss. Your collision or comprehensive insurance will cover the loss. However, if the insurance adjuster determines that the ACV of your car is $20,000, but your loan balance is $24,000, you owe more on your loan than the car is worth. In this case, GAP insurance would cover the remaining $4,000 that you would otherwise have to pay out of pocket.

It's important to note that GAP insurance does not cover costs related to vehicle repairs, personal injuries, or other accident-related expenses. It only covers the difference between the ACV of your vehicle and the outstanding balance on your loan or lease if your car is stolen or totaled.

Insurance: Who or What Is Covered?

You may want to see also

Who needs GAP insurance?

GAP insurance is not a requirement in Ohio. However, it can be a very useful form of coverage in certain situations. GAP insurance is an optional form of auto insurance that covers the difference between the compensation you receive after a total loss of your vehicle and the amount you still owe on your car loan. This type of insurance is particularly relevant for those who:

- Have a long payoff period (60 months or longer)

- Are leasing a vehicle

- Made a low down payment (less than 20%) on a large car loan

- Have purchased a vehicle that depreciates quickly, such as luxury cars or sports cars

- Have rolled over negative equity from a previous car loan into a new loan

If any of these situations apply to you, then purchasing GAP insurance may be a wise decision. It can provide peace of mind and protect you from potential financial losses in the event of a total loss of your vehicle.

Additionally, it is important to note that GAP insurance is not just for new cars. If you have a used car with above-average mileage or have taken out a loan longer than four years, GAP insurance could still be beneficial.

However, if you have made a large down payment on your car or plan to pay it off within a short period, GAP insurance may not be necessary. Similarly, if you have a vehicle that typically holds its value well and you are paying off the loan in less than five years, you may not need GAP insurance.

In conclusion, while GAP insurance is not mandatory, it can be a valuable form of coverage for those who find themselves in any of the above situations. By purchasing GAP insurance, you can ensure that you are protected in the event of a total loss of your vehicle and avoid having to pay out of pocket to cover the gap between the insurance payout and the amount you owe.

Renew Vehicle Insurance: A Quick Guide

You may want to see also

Where can I buy GAP insurance?

When buying a new vehicle, the dealer may offer GAP insurance. You can also purchase it from most car insurers, typically for less than you'll pay with a dealer. While it's possible to purchase GAP insurance as a stand-alone policy, many insurers offer it as an add-on to your existing policy.

If you're trying to keep your monthly auto insurance premiums to a minimum, you might not consider GAP insurance. However, adding GAP insurance to a collision and comprehensive policy only increases your annual premium by about $20, according to the Insurance Information Institute (III).

The price of GAP insurance goes up if you purchase it as an add-on to your car loan. You can expect to pay a one-time flat fee instead of yearly payments, which can range from $500 to $700.

You can buy GAP insurance from a variety of sources, including:

- Auto-Owners: Auto-Owners offers a variety of full-range auto insurance services with competitive premiums. The company also has several additional insurance coverage options, including loan GAP or lease GAP coverage.

- Midvale Home & Auto: Midvale Home & Auto offers GAP insurance at a reasonable rate. Whether you're leasing your vehicle or have a loan, GAP insurance can help you pay the difference if your vehicle is totalled.

- Liberty Mutual: Liberty Mutual has a range of car insurance options, including low-cost GAP coverage. The exact cost of GAP insurance will vary based on the type of vehicle, your claim history, and the actual cost value of your car.

- Associated Credit Union of Texas: You can either add GAP coverage to your existing auto loan with ACU of Texas or opt for it during the loan application process. Refunds are available if the coverage is canceled within the first 60 days.

- Allstate: As one of the largest insurance companies in the US, Allstate provides GAP insurance for its customers in Texas. The insurer typically suggests this coverage for those who have paid less than 20% upfront for their vehicle, have auto loans extending 60 months or more, or are leasing their vehicle.

- Greater Texas Credit Union: This credit union offers affordable GAP insurance to its members, available up to 18 months from the start of the auto loan.

- USAA: USAA caters to military members, veterans, and their families, offering GAP insurance among its range of budget-friendly insurance options.

- Texas DPS Credit Union: Its Gap Plus option includes not only the standard GAP coverage but also deductible assistance in cases where your vehicle isn't totalled. Additionally, it offers a $1,000 discount on your next loan with the credit union.

Two Cars, Two Locations: Insurance Impact?

You may want to see also

How much does GAP insurance cost?

The cost of GAP insurance depends on the underwriter. Dealerships and lenders charge higher prices for GAP insurance than car insurance companies.

Lenders and dealerships sell GAP insurance for a flat rate, typically between $500 and $700, which are the highest rates for this type of policy. Plus, you will pay interest on the sum since it will be rolled into your loan.

Insurance companies, on the other hand, charge an average of $20 to $40 per year for GAP insurance when buyers bundle it into an existing insurance policy. Doing so only increases your comprehensive and collision insurance cost by about five to six per cent on average, making it a lot more affordable. If you want to buy a standalone GAP insurance policy, you can expect to pay between $200 and $300.

If you buy GAP insurance from a dealership, it can cost you hundreds of dollars a year. If you add GAP coverage to a car insurance policy that already includes collision and comprehensive insurance, it typically increases your premium by around $40 to $60 per year.

Insurance Safeguards for Pedestrians Without Vehicle Cover

You may want to see also

Frequently asked questions

GAP stands for Guaranteed Auto Protection. It covers the difference between how much your insurance will pay on a specified claim and the remaining balance on your auto loan.

GAP insurance is not required by law in Ohio. However, it is a good idea to get one if you are leasing your car, have a low down payment, or have a long payoff period.

The cost of GAP insurance in Ohio depends on the provider and can range from $2 to $30 per month.

You can buy GAP insurance from a dealership, a car manufacturer, or your insurance provider.