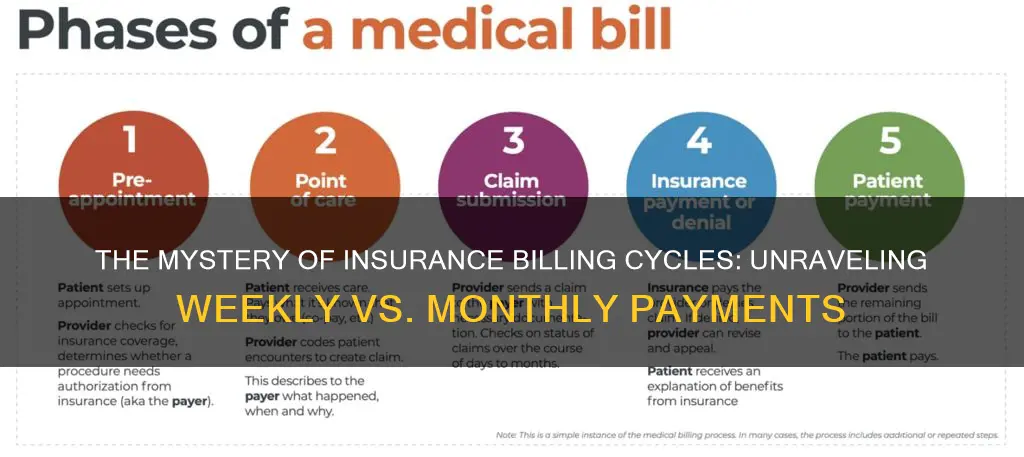

Insurance can be billed either weekly, monthly, bi-annually, or annually, depending on the insurance company and the customer's preference. Most insurance companies offer their customers a choice of payment plans, with options including paying the entire policy upfront annually, or paying in instalments every month, every six months, or once a year. For example, health insurance is usually paid monthly, while car insurance is typically paid annually or semi-annually.

| Characteristics | Values |

|---|---|

| How often is insurance billed? | Monthly, bi-annually, or annually |

| Insurance types billed monthly | Car, health, auto, and homeowners insurance |

| Insurance types billed annually | Car, health, and homeowners insurance |

| Insurance types billed bi-annually | Car and homeowners insurance |

| Pros of monthly billing | Lower barrier to entry for new customers, shorter sales cycle, increased revenue, more customer feedback, lower risk of chargebacks, easier to administer refunds, more flexibility to increase prices, customers feel less "trapped" |

| Cons of monthly billing | Higher churn rate, more volatile revenue forecasting, increased complexity of tracking payments and following up on missed payments, lower cash flow |

| Pros of annual billing | Improved cash flow, lower churn rate, more predictable revenue, lower cost for the customer, more convenient, reduced monthly accounting costs |

| Cons of annual billing | Reduced revenue, increased cost of customer acquisition, less visibility of churn rate, increased risk to revenue, might be a barrier to customers who prefer to pay in increments or cannot afford the lump sum |

What You'll Learn

Annual vs. monthly insurance payments

When it comes to insurance payments, you'll usually be given the choice between paying annually or spreading the cost over the year via monthly instalments. There is no one-size-fits-all answer to which option is best, as it depends on your personal circumstances and preferences. However, there are some pros and cons to each approach that are worth considering when making your decision.

Paying Insurance Premiums Annually

Paying your insurance premium annually is usually the cheapest option, as you won't have to worry about interest being added to the amount. Many companies will also offer a discount for paying in full, as it costs them more if a policyholder pays their premiums monthly, requiring manual processing each month to keep the policy active.

Paying annually can also give you peace of mind, as you know you're covered for the whole year and won't have to worry about making monthly payments. This can be especially helpful for those who work seasonally or receive a yearly bonus or tax refund.

However, the main disadvantage of paying annually is that it requires paying a large lump sum, which may not be feasible for those on a tight budget or with irregular income.

Paying Insurance Premiums Monthly

Paying your insurance premium monthly can make the cost more manageable in the short term, especially for those who are living paycheck to paycheck or who don't have excess savings. It also allows you to spread the cost over the year, aligning with how most people budget their money.

Additionally, if you expect a major change to your policy before the year is up (e.g. removing a teenage driver), paying monthly gives you the flexibility to make that change and see immediate savings.

On the other hand, paying monthly usually incurs interest and administrative fees, making it the more expensive option overall. There is also a risk of missing payments, which could lead to late fees and even cancellation of your policy.

Other Payment Options

While annual and monthly payments are the most common options, some insurance companies may also offer quarterly or bi-annual payment plans. Additionally, some insurers are starting to offer continuous policies that charge a rolling monthly subscription fee until you switch insurers.

Ultimately, the decision between annual and monthly insurance payments depends on your financial situation, budget, and personal preference.

Uncovering the Mystery of 'Cappers': Understanding Insurance Terminology

You may want to see also

Pros and cons of each payment frequency

Pros and cons of paying insurance monthly

Paying insurance monthly is the most common way to pay. This sees customers paying small instalments towards their overall annual fee each month. This method suits people who are living paycheque to paycheque, or don't have excess savings to pay a large lump sum.

Pros of paying insurance monthly:

- Smaller payments may be easier to budget.

- It may be easier to switch insurance companies mid-term.

- It may be easier to free up funds for other expenses.

Cons of paying insurance monthly:

- You will have to pay an administrative fee every month, as well as the monthly premium owed.

- You may be charged late fees if you can't make your payments on time.

- Missing a payment can lead to your policy lapsing and your premium may increase as a result.

- You may pay more per year than if you paid the whole amount upfront.

- You will lose out on the discount that's usually applied to annual payments.

Pros and cons of paying insurance annually

Paying insurance annually always works out to be the least expensive option. However, it requires having thousands of dollars at the ready. Getting the bill out of the way at the beginning of the year is helpful for people who work seasonally, or receive a yearly bonus or tax refund.

Pros of paying insurance annually:

- Your insurer may offer you a discount of around 7% on the total cost.

- You won't have to pay any administration fees associated with paying in monthly instalments.

- You don't need to worry about making monthly payments on time to avoid being charged a late fee.

Cons of paying insurance annually:

- It can be a lot for someone to pay in one go.

- You will most likely lose money if you want to cancel your policy early, as you will be subject to a cancellation fee.

Unlocking the Billing Process: Understanding Insurance Coverage for Residential Sober Living

You may want to see also

Payment options for auto insurance

Auto insurance can be paid for in a variety of ways, depending on the insurance company and your preferences. The frequency of payments can be monthly, bi-monthly, quarterly, bi-annually, or annually.

Monthly Payments

Monthly payments are usually the most convenient option for consumers, as funds are typically paid out either weekly or bi-weekly. However, paying monthly may result in paying more over the long term, as it is often the most expensive option. Additionally, there may be processing fees for electronic payment methods like bank transfers and credit cards, which apply to each payment. There is also a risk of forgetting a payment and incurring late fees or penalties for lapsed coverage.

Bi-Monthly Payments

Bi-monthly payments are made twice a month and can be tricky to implement effectively as months vary in length, meaning payment dates may not always align.

Quarterly Payments

Quarterly payments are made every three months and are particularly effective for insurance companies that engage in a usage-based billing model.

Bi-Annual Payments

Bi-annual payments are made twice a year and are usually offered as semi-annual payments. This option can help reduce costs, as insurance companies often provide discounts for paying the premium in full upfront.

Annual Payments

Annual payments are made once a year and are the least expensive option. Many companies offer a discount for paying in full, as it is more costly for the insurance company to process monthly payments. However, the main disadvantage is that a large sum of money is required upfront, which can be difficult to budget for.

Other Payment Options

In addition to the frequency of payments, there are also various methods for making auto insurance payments. Common options include credit or debit card, electronic funds transfer (EFT), paper check, cash, or billing by mail. Some companies also offer the convenience of paying through a mobile app or by phone.

Payment options for health insurance

Health insurance is typically paid on a monthly basis, although some providers may offer alternative payment schedules. The payment options available to you will depend on the insurance company and your preferences. Here are some common payment options for health insurance:

Monthly Payments

Monthly payments are the most common option for health insurance. You will be billed each month for your premium, which must be paid by a specified due date to maintain your coverage. This option is convenient for those who receive a regular income, as it allows them to budget their expenses accordingly. However, it is important to make timely payments to avoid late fees and ensure uninterrupted coverage.

Annual Payments

Some insurance companies may offer the option to pay the entire year's premium in advance. This option often comes with a discount, resulting in overall lower costs for the customer. Additionally, it eliminates the hassle of making monthly payments and ensures coverage for the entire year. However, the main drawback is that a large lump sum payment may be difficult for some individuals to manage.

Semi-Annual Payments

Semi-annual payments involve paying your health insurance premium twice a year, typically every six months. This option reduces the frequency of payments compared to monthly billing and may be more manageable for those who prefer fewer payments. However, each payment will be for a larger amount, so it is important to plan accordingly.

Quarterly Payments

Quarterly payments divide the annual premium into four equal payments, due every three months. This option can provide a balance between the convenience of less frequent payments and the manageability of smaller payment amounts. However, it is important to note that the total cost of quarterly payments may be slightly higher than monthly payments due to administrative fees.

Bi-Weekly or Weekly Payments

In some cases, insurance companies may accommodate bi-weekly or weekly payments, especially for individuals with irregular incomes. These options ensure that payments are aligned with the frequency of income and can help prevent missed payments. However, the administrative burden of processing more frequent payments may result in additional fees.

Regardless of the payment option chosen, it is crucial to prioritize timely payments to maintain active coverage. Late or missed payments can result in penalties, lapsed coverage, and even policy cancellation. It is always a good idea to review the specific payment options, associated fees, and potential discounts offered by your insurance provider to make an informed decision that best suits your financial situation.

Understanding Insurance Billing for Procedure 92065: A Comprehensive Guide

You may want to see also

How insurance payment frequency affects cost

The frequency of insurance payments can vary depending on the type of insurance and the preferences of the insured. While some people may opt for monthly payments, others may choose to pay annually. The choice between these options can have an impact on the overall cost of insurance.

Monthly Payments

Monthly payments are a popular option for many individuals as they align with how most people receive their income. This payment frequency is also more manageable for those who cannot afford to pay a large sum upfront. Additionally, monthly payments provide flexibility, allowing individuals to make changes to their policy before the next payment is due. This can be especially beneficial for those who anticipate changes, such as removing a teenage driver from their auto insurance policy.

However, opting for monthly payments may result in slightly higher costs. Insurance companies often charge an installment fee for the convenience of paying in smaller, more frequent installments. These fees cover the additional administrative work required to process multiple payments. Moreover, monthly payments may not offer the opportunity to take advantage of discounts that are sometimes provided for paying the full amount upfront.

Annual Payments

Paying insurance premiums annually can often result in cost savings. Many insurance companies offer discounts for annual payments since it is more cost-effective for them to receive a single payment rather than process multiple installments. This discount can be substantial, potentially saving individuals hundreds of dollars. Additionally, paying annually eliminates the need to worry about monthly bills, allowing individuals to focus their attention and budget on other expenses.

However, a significant disadvantage of annual payments is the requirement to pay a large sum upfront, which may be challenging for some individuals. It demands careful financial planning to ensure the availability of funds when the payment is due. Moreover, annual payments may not provide the flexibility to make changes to the policy throughout the year, and cancelling the policy early could result in a loss of prepaid funds.

Other Payment Frequencies

In addition to monthly and annual payments, some insurance companies offer alternative payment frequencies such as semi-annual or quarterly payments. These options provide individuals with more choices to align their payments with their financial situation and preferences.

Navigating the Cigna Claims Process: A Guide to Submitting Bills for Swift Reimbursement

You may want to see also

Frequently asked questions

Yes, insurance can be billed annually, and some companies may offer a discount for paying in full.

Insurance can also be billed monthly, but this option may be more expensive in the long run as it usually involves additional processing fees.

Insurance can sometimes be billed bi-annually, or every six months.

Some insurance companies offer quarterly billing, meaning payments are made every three months.

While weekly billing is not common, some insurance companies may split deductions evenly and take them from an employee's first paycheck of the month and their first paycheck after the 15th.