Bundling home and auto insurance can be a great way to save money and simplify your insurance payments. However, it's not always the cheapest option.

Bundling insurance means buying different types of insurance policies from the same company. This is a popular option for those who own both a car and a home since bundling homeowners and auto insurance can result in significant savings.

Most insurance companies offer discounts for purchasing multiple insurance policies, also known as a multi-policy or multi-line discount. For example, Progressive says new customers can save more than 20% on average by bundling home and auto insurance. State Farm cites average savings of $1,073 annually.

However, bundling doesn't always deliver the biggest savings. Discounts for bundling home and auto insurance can vary widely depending on your location, the insurance carrier and other factors. For instance, Allstate reports that the average customer saves 25% by bundling, but says its customers in California save just 2% on average.

Ultimately, the best way to know if bundling is the right choice for you is to get quotes for both bundles and separate policies and do the math to see which option saves you the most money.

| Characteristics | Values |

|---|---|

| Average bundling discount | 14% or $466 a year |

| Number of policies to bundle | The more policies you bundle, the more you save |

| Single deductible | Some companies offer a single deductible for both home and auto policies if they are damaged in the same event |

| Cheaper to buy policies separately | You may be able to find cheaper prices for auto and home insurance policies by buying them separately from different companies |

| Convenience | Having only one insurance company to deal with for payments and customer service is convenient and can save you time |

| Loyalty | People who bundle their home and auto insurance tend to stay with that company longer |

| Availability | Not all insurers offer both home and auto policies, so bundling might not be an option |

| Limited coverage | It may be difficult to find a carrier that offers all the home and auto endorsements you're looking for |

| Sold by third parties | A car insurance company may have a partner company that sells home insurance, but you won't be able to manage your policies all in one place |

What You'll Learn

Pros and cons of bundling home and auto insurance

Pros

The primary reason to bundle insurance is to save money. Getting multiple policies from the same insurer almost always results in a discount. Multi-policy discounts average 18%, according to NerdWallet, and some insurers offer discounts of up to 25%. If your annual insurance expenditure is $5,000, an 18% reduction would mean savings of $900.

There is also the convenience of dealing with just one insurer when you bundle insurance. You have a single company to deal with when making a payment, using online services, or asking questions. With bundled coverage, you can set up just one account, download one company's mobile app, and schedule automatic bill payments in one place.

Cons

Over time, insurers tend to raise premiums, which diminishes the value of the initial discount. Unless you comparison shop every year, you could end up paying more than necessary. Some insurers start with a higher premium when offering a discount, which may not result in true savings.

Additionally, bundling might not always provide the best coverage. If you have specialized insurance needs, there may not be one insurer that offers the combination of home and auto coverage you want. For example, if you have a record of unsafe driving, your best bet for car insurance might be a company that specializes in high-risk drivers but doesn't offer home insurance.

It's important to shop around and compare prices and coverage options from different insurers to ensure you're getting the best deal.

Understanding Auto Insurance: Reading Your Coverage Selections Page

You may want to see also

Companies that offer the best bundling deals

Bundling home and auto insurance can save you money and simplify your policy management. Here are some of the companies that offer the best bundling deals:

- State Farm: State Farm offers the biggest bundling discount of the companies included in our analysis and some of the most competitive rates for home and auto insurance. The insurer also scores well for customer satisfaction, with a low rate of consumer complaints.

- USAA: USAA offers some of the lowest rates overall for both home and auto coverage, which can add up to significant savings. However, USAA is only available to active and retired military, National Guard, Reserve members, veterans, uniformed personnel and their eligible family members.

- American Family: American Family offers a solid bundling discount for home and auto insurance and has a very low rate of complaints about both types of coverage. Its auto insurance premiums are a bit higher than those of other insurers, but the bundling discount can help offset some of the cost.

- Nationwide: Nationwide offers a competitive bundling discount and low homeowners insurance rates. And though its car insurance rates are average, its homeowners rates and bundling discount make it worth considering. It also has a very low rate of complaints from both homeowners and car insurance customers.

- Auto-Owners: Auto-Owners offers a 10% bundling discount. Though its average homeowners insurance rates are slightly above average, it has highly competitive car insurance rates that make it worth considering. It also has a low rate of complaints among homeowners and car insurance customers, which is a plus if you’re looking for good customer service.

Mapfre Auto Insurance Cancellation: Understanding the Potential Fees

You may want to see also

How bundling works

Bundling home and auto insurance is a popular option for those who own both a car and a home, as it can result in significant savings. It is the process of buying more than one policy from the same insurance company, typically at a discounted rate. Here's how bundling works:

- Research insurance companies: Pick several promising options and request quotes to compare rates and coverage. Consider your existing policies and whether you can get a better rate by adding another policy.

- Review your options: Compare the quotes to determine which company offers the best coverage at the most affordable price. Consider all your insurance needs and any changes or updates you want to make to your policies.

- Choose quality: Select a company and agent you're comfortable with, offering both a solid reputation for quality and service, and the coverage you need.

- Start new policies and cancel existing insurance: Call the insurer you've chosen and purchase the bundle. Remember to cancel your existing policy to avoid overlap or a lapse in coverage. Ensure the start date of your new policy coincides with the end date of your current policy.

Bundling your home and auto insurance offers several benefits, including potential discounts, simplified account management, and savings on deductibles. However, there are also disadvantages, such as limited plan options, potentially higher costs with separate policies, and the possibility of being discouraged from shopping around for better rates. Ultimately, the decision to bundle depends on finding the best combination of coverage and price for your needs.

State Farm Auto Insurance: Costs and Coverage

You may want to see also

How to find the right bundling deal

Bundling your home and auto insurance can be a great way to save money, but it's not always the best option. Here are some tips for finding the right bundling deal:

- Shop around for quotes: Compare quotes from multiple insurance companies, both for bundled and separate policies. This will help you find the most cost-effective option.

- Consider your needs: Think about the type and amount of coverage you need for both home and auto insurance. Make sure the bundle you choose meets your specific needs and includes any necessary endorsements or add-ons.

- Research companies: Look into the reputation and customer service of the insurance companies you're considering. Choose a company with a solid reputation for quality and service, and make sure they offer the coverage you need.

- Compare prices and coverage: When comparing quotes, don't just focus on the price. Make sure to compare the coverage offered by each company as well. Choose a bundle that offers the best combination of price and coverage for your needs.

- Ask about discounts: In addition to bundling discounts, many insurance companies offer other discounts such as loyalty discounts, paperless statement discounts, or discounts for safety features in your home or vehicle. Ask about any additional discounts you may be eligible for.

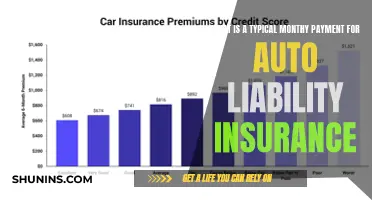

- Consider your credit score: If you live in a state where insurance companies can use your credit score to determine your rates, work on improving your credit score to get better rates.

- Review your policies regularly: Stay up-to-date on new offerings or changes from your insurance provider, and periodically shop around for new quotes to ensure you're still getting the best deal.

Switching States: Updating Your Auto Insurance Coverage

You may want to see also

How to save money when bundling

Bundling home and auto insurance can be a great way to save money, but it's not always the cheapest option. Here are some tips to save money when bundling:

- Shop around for quotes: Compare quotes from multiple insurance companies for both bundled and separate policies. Calculate the total cost of your home and auto insurance separately and together to find the most affordable option. Don't just go with the first company that offers a bundling discount.

- Choose a reputable company with strong customer service: Opt for an insurer with excellent customer service and a range of coverage options and perks. A company with fewer consumer complaints is a good sign.

- Look for companies with high bundling discounts: Some companies offer bundling discounts of up to 30%, which can significantly reduce your premiums.

- Consider your specific needs: Evaluate your insurance needs and circumstances. For example, military members and veterans may find better deals with insurers specializing in those demographics. If you prioritize a quick claim process, look for companies that excel in that area.

- Compare coverage and quality: In addition to price, consider the coverage and quality of the insurance. Ensure the bundle includes the coverage you need, including any add-ons or endorsements. Choose a company with a solid reputation for quality and service.

- Check your existing policies: If you already have home or auto insurance, consider the timing of any changes. Some insurers may require a notice period before dropping a policy, and early termination fees may apply.

- Bundle multiple policies: The more policies you bundle, the greater the potential savings. Consider bundling other types of insurance, such as life insurance, renters insurance, or insurance for RVs or boats.

- Evaluate your options regularly: Don't get complacent with your insurance. It's recommended to request insurance quotes annually to ensure you're still getting the best deal. Compare prices and coverage details from different insurers to make an informed decision.

Insuring Your New Ride

You may want to see also