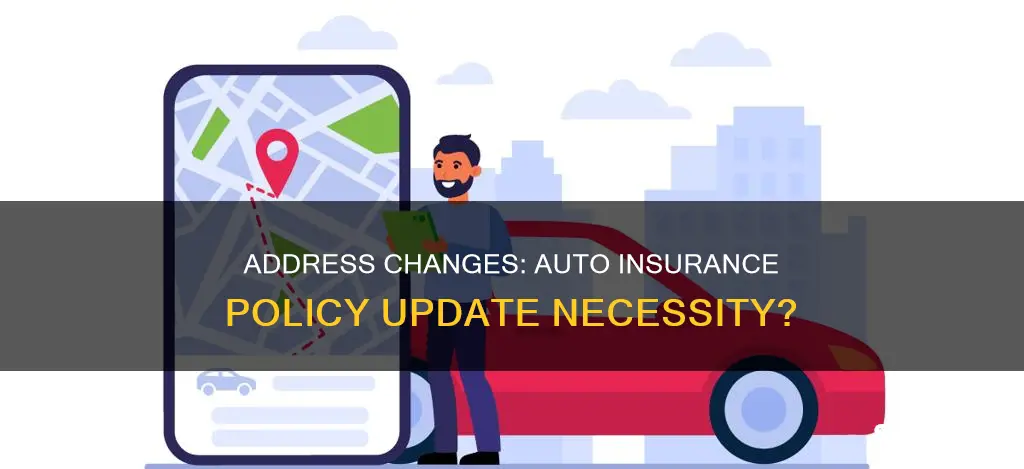

Failing to update your address with your auto insurance company can have serious consequences. Your address is one of the factors that insurance companies use to determine your premium, so it's considered insurance fraud to use a different address from where you live to get cheaper rates. If your insurer finds out, you could face legal charges, policy cancellation, higher rates, and denied claims. Therefore, it's important to notify your insurer as soon as possible when you move to ensure you remain properly covered.

| Characteristics | Values |

|---|---|

| Is it illegal? | Yes, using a different address for car insurance is considered insurance fraud and can lead to penalties such as fines, suspension of your driver's license, and jail time. |

| Policy cancellation | Failing to change your address could result in policy cancellation. |

| Higher rates | Using a different address for car insurance to get cheaper rates will lead to higher rates if discovered by the insurer. |

| Claims denial | If you need to file a car insurance claim, it could be denied if your insurer finds out that you have the wrong address on your policy. |

What You'll Learn

You could be committing insurance fraud

Failing to update your address with your insurance provider can have serious consequences. Even if you forget to update your address, you could be committing insurance fraud. This is because your address is a significant factor in determining your insurance premium. Insurance companies use your address to calculate the risks associated with your location, such as crime rates, traffic conditions, and the number of uninsured drivers. By not updating your address, you may be providing false information that could influence your premium.

Insurance fraud is a serious offence and can result in legal and financial repercussions. Your insurance provider may increase your premium, deny your claims, or even cancel your policy if they discover that you have provided false information. In some cases, insurance fraud can also lead to criminal charges and jail time.

To avoid any penalties, it is essential to update your address with your insurance provider as soon as possible after moving. Most insurance companies give policyholders a grace period of up to 30 days to make these changes.

Additionally, it is important to note that using a different address for car insurance than your actual residence is considered insurance fraud and could result in penalties such as fines, suspension of your driver's license, and jail time. Therefore, it is always best to be honest and provide your correct address to your insurance company.

Texas Auto Insurance: Understanding Non-Owned Vehicle Coverage

You may want to see also

Your policy could be cancelled

Failing to update your address with your auto insurance company could result in your policy being cancelled. This is because your address is one of the factors that insurance companies use to determine your premium. If you move from a high-crime area to a low-crime area, for example, your premium could decrease as a result of a lower risk of car theft. Similarly, if you move from a densely populated city to a rural area, your premium could decrease due to a reduced risk of accidents.

Insurance companies need to have up-to-date information to ensure that your car insurance coverage is valid and to process any claims. If you don't update your address and you need to file a claim, your insurer could deny it. In addition, if you're leasing or financing your car, failing to update your auto insurance address could mean you violate your lease or loan contract.

In some cases, providing an incorrect address may be considered insurance fraud. If your insurer finds that you deliberately gave incorrect information, your policy could be cancelled immediately, and any resulting claims may not be honoured.

Auto Insurance and Credit Score: What's the Connection?

You may want to see also

Your rates may increase

Failing to update your auto insurance address could result in higher rates. This is because insurance companies use your address to determine your premiums. Where you live has a big impact on how much your policy costs.

For example, if you move from a rural area to a densely populated city, your insurance rates will likely increase. This is because cities tend to have higher crime rates and more traffic, leading to a greater chance of accidents and insurance claims. Additionally, cities often have a higher number of uninsured drivers, which can further drive up insurance costs.

Other factors that can affect your insurance rates include the type of car you drive, your age, gender, and marital status.

It's important to note that insurance companies consider it fraud to use a different address from where you live to get cheaper rates. If your insurer discovers that you have provided a false address, you may face higher rates, policy cancellation, or even legal charges.

Claiming Auto Insurance: A Step-by-Step Guide

You may want to see also

Your claims may be denied

It is essential to update your auto insurance address when you move. Your insurance company needs to have up-to-date information to ensure your coverage remains valid and to process any claims properly. If you fail to update your address, your claims may be denied.

Your premiums may be affected

Where you live has a significant impact on how much your auto insurance policy costs. Insurance companies use your address to determine the level of risk associated with your location. Factors such as crime rates, traffic conditions, population density, and the number of uninsured drivers in your area influence your premiums. For example, moving from a rural area to a densely populated city will likely result in higher insurance rates due to increased risk factors.

State-specific requirements

Each state has its own laws and requirements for auto insurance coverage. By not updating your address, your current policy may not meet the mandatory requirements of your new state, leading to potential issues with claims.

Leasing or financing considerations

If you are leasing or financing your vehicle, failing to update your auto insurance address can result in a violation of your lease or loan contract. It is important to review the terms of your agreement to ensure you remain compliant.

Policy cancellation

In some cases, not updating your address may result in policy cancellation. Insurance providers require current and accurate information to assess the validity of your coverage. By not providing your new address, you may inadvertently invalidate your policy.

In summary, it is important to remember that updating your auto insurance address is not just a recommendation but a necessary step when you move. By keeping your information current, you can avoid potential issues with claims, ensure compliance with state regulations, and maintain valid coverage.

Pennsylvania's No-Fault Auto Insurance: Understanding the System

You may want to see also

You could be held criminally liable

Failing to update your auto insurance address could result in criminal liability. This is because insurance companies use your address to determine your premium, and providing a false address to get cheaper rates is considered insurance fraud.

Insurance fraud is a serious offence and can result in legal charges, policy cancellation, higher rates, and claims denial. For example, if you get into an accident and need to file a car insurance claim, your insurer may deny your claim if they find out that you have provided a false address.

Additionally, insurance companies need to have up-to-date information to process any claims. If you fail to update your address, your insurance company may not be able to process your claim, resulting in higher rates or denied claims.

It is important to note that insurance companies use your address to assess your risk level. If you move to an area with a higher crime rate or more traffic, your insurance rates may increase. Therefore, it is essential to update your auto insurance address when you move to ensure you have the correct coverage and are not overpaying for insurance.

Most insurance companies give policyholders a grace period of up to 30 days to update their address after moving. It is recommended to contact your insurance company as soon as possible to avoid any issues.

Comprehensive Auto Insurance: Engine Guardian or Not?

You may want to see also

Frequently asked questions

Yes, failing to update your address with your auto insurance provider is considered insurance fraud and can result in legal charges, policy cancellation, higher rates, and claims denial.

The consequences of not updating your address with your auto insurance provider can include legal charges, policy cancellation, higher rates, and claims denial. Additionally, your insurance company may drop your policy if they discover your incorrect address.

Updating your address with your auto insurance provider is important because it affects your premium and coverage. Insurance companies use your address to determine your premium, and each state has its own laws and requirements for car insurance coverage.

To update your address with your auto insurance provider, contact your insurer and provide your new address. They will update your information and send you a new insurance card or update their mobile app. In most cases, you will also need to update your registration with the DMV.