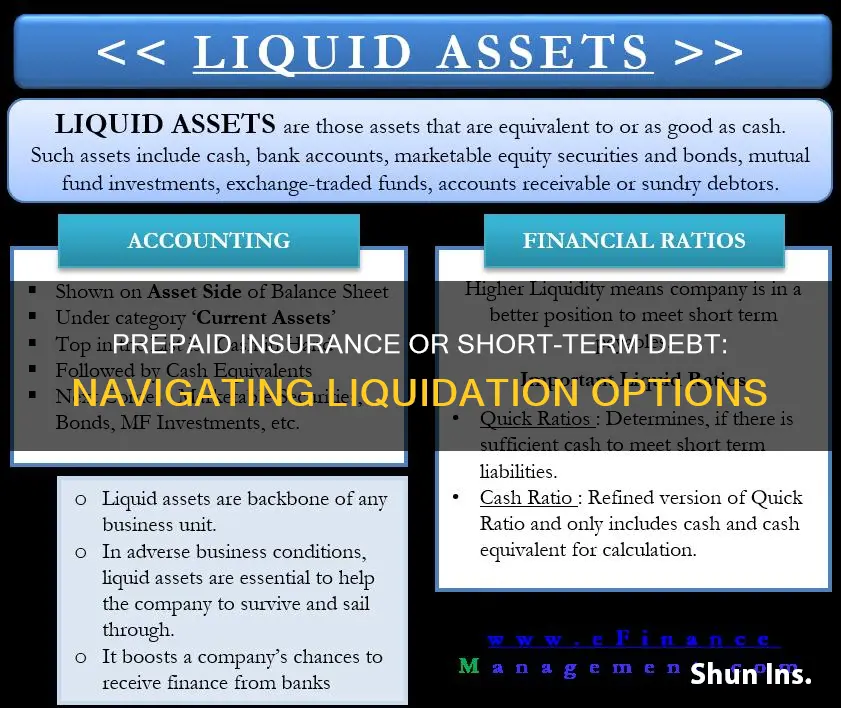

Prepaid insurance and short-term debt investments are both considered liquid assets, meaning they can be easily converted into cash within a short amount of time. Prepaid insurance is typically classified as a short-term or current asset because insurance premiums are rarely billed for periods longer than a year. Short-term debt investments, also known as marketable securities, are financial investments that can be easily converted to cash, typically within five years, and often within three to twelve months. These investments are usually highly liquid and give investors the flexibility to withdraw money quickly if needed.

| Characteristics | Values |

|---|---|

| Definition | Prepaid insurance is an expense that is paid for in advance. |

| Short-term debt investments are financial investments that can be converted to cash within five years. | |

| Time period | Prepaid insurance is usually a short-term asset because insurance premiums are rarely billed for periods greater than one year. |

| Short-term debt investments are typically sold or converted to cash within three to 12 months. | |

| Examples | Prepaid insurance, prepaid rent |

| Government bonds, treasury bills, CDs, money market accounts, high-yield savings accounts | |

| Benefits | Prepaid expenses relieve the obligation of payment for future accounting periods. |

| Short-term debt investments are highly liquid and give investors the flexibility to withdraw money quickly. |

What You'll Learn

Prepaid insurance is a short-term asset

Prepaid insurance is considered a prepaid expense, which is an expenditure paid for by a business or individual before it is used. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. For example, auto insurance companies often operate under prepaid schedules, so insured parties pay their full premiums for a 12-month period before coverage begins.

Prepaid insurance is carried on an insurance company's balance sheet as a current asset until it is consumed. This is because most prepaid assets are consumed within a few months of being recorded. When the insurance coverage comes into effect, it is moved from an asset to the expense side of the company's balance sheet.

Prepaid insurance is a current asset if coverage is used within one year of payment. If coverage extends beyond 12 months, that portion can be a long-term asset.

Prepaid insurance is considered an asset because it has economic value to a business. It is also considered a current asset because it can be easily liquidated – the value can be realised or converted to cash in one year or less.

Insurance Classification Conundrum: Understanding the Nuanced World of Amateur Pilot Insurance

You may want to see also

Prepaid insurance is a current asset

Prepaid insurance is considered a prepaid asset because it benefits future accounting periods. It relieves them of the monthly premium expense, thereby reducing costs while maintaining coverage for the business. It is also considered an asset because of its redeemable value. If a business cancels its insurance policy before the period it has paid for expires, it can receive a refund for the remaining unused months. This refund is a source of future cash revenue for the business.

Prepaid insurance is important because it allows a business to correctly record all of its transactions and resources to have accurate financial statements. Recording prepaid insurance as an asset and adjusting that asset as the policy is consumed on a monthly basis ensures that the business is accurately recording the true value of the policy over time. It also reflects how paying for the policy in advance affects the business's finances from one month to the next.

Exploring Healthcare Choices: Beyond Short-Term and ACA Insurance Plans

You may want to see also

Prepaid insurance is a prepaid expense

Prepaid insurance is a type of prepaid expense. A prepaid expense is an expense that is paid for in advance. It is a common practice for businesses to pay for expenses in advance, such as insurance and rent, through a single payment that covers the expense for several months or even a year. This is often done to receive a discount or to lock in current rates. Prepaid expenses are considered assets because they have future economic benefits for the business. They are also considered current assets as they can be easily liquidated or converted to cash within one year or less.

In the context of insurance, prepaid insurance refers to payments made by individuals or businesses to their insurers in advance for insurance services or coverage. Insurance premiums are typically paid a year in advance, but they may also cover longer periods. Prepaid insurance is treated as an asset in accounting records and is gradually charged to expense over the period covered by the insurance contract. It is usually classified as a current asset on the balance sheet since insurance contracts are usually for a period of one year or less.

When a business pays for insurance in advance, it records the payment as a debit to the Prepaid Insurance account and a credit to the Cash account. As the insurance coverage period begins, the amount is moved from an asset to an expense on the company's balance sheet. This is typically done through an adjusting entry at the end of each accounting period. The expired portion of the prepaid insurance is transferred from the current asset account to the income statement account, reflecting the consumption of the prepaid expense.

Prepaid insurance is generally considered a short-term asset because insurance premiums are rarely billed for periods longer than one year. As the prepaid amount expires, the company reduces the asset account (Prepaid Insurance) through a credit entry and debits the Insurance Expense account. By the end of the coverage period, the asset value reaches zero, and the expense account reflects the total amount paid.

Overall, prepaid insurance is a type of prepaid expense where individuals or businesses make advance payments for insurance coverage. It is treated as a current asset on the balance sheet and is gradually charged to expense as the coverage period progresses.

Understanding BICE Calculations and Their Impact on Term Insurance Policies

You may want to see also

Prepaid insurance is a liquid asset

Prepaid insurance refers to payments made by individuals and businesses to their insurers in advance for insurance services or coverage. Premiums are typically paid a full year in advance, but they may also cover more than 12 months. When they are not used up or expired, these payments are recorded as current assets on a company's balance sheet.

Prepaid insurance is considered a prepaid expense, which is an expenditure paid for by a business or individual before it is used. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. For example, many auto insurance companies operate under prepaid schedules, so insured parties pay their full premiums for a 12-month period before coverage actually starts.

Prepaid insurance is carried as a current asset on an insurance company's balance sheet until it is consumed. When the insurance coverage comes into effect, it is moved from an asset to the expense side of the company's balance sheet. Unless an insurance claim is filed, prepaid insurance is usually renewable by the policyholder shortly before the expiry date, on the same terms and conditions as the original insurance contract.

Understanding the Art of Calculating Sum Assured in Term Insurance

You may want to see also

Prepaid insurance is a prepaid liability

Prepaid insurance is typically paid as a lump sum that covers multiple months or a year's worth of premiums. It is recorded as a debit to the asset account and as a credit to the cash account. As the prepaid insurance is consumed each month, an adjusting journal entry is made to reduce the asset value and increase the expense. This process is called amortization.

Prepaid insurance is considered a current asset because it is used or converted to cash within one year or the operating cycle, whichever is longer. It is important to note that prepaid insurance is different from accrued insurance, which is a short-term liability. Accrued insurance refers to insurance that a company should have paid but has not yet paid.

Prepaid insurance is beneficial to businesses as it helps ease future expenses and can result in discounts from insurance providers. Additionally, it demonstrates a company's financial strength and care for its assets and employees. However, it is essential to monitor the period for which insurance is prepaid, as advancing too much may negatively impact profitability.

Comprehensive Guide to Purchasing 1 Cr Term Insurance

You may want to see also

Frequently asked questions

A short-term asset is an asset that is to be sold, converted to cash, or liquidated to pay for liabilities within one year.

Examples of short-term assets include marketable securities, trade accounts receivable, employee accounts receivable, prepaid expenses (such as prepaid insurance), and inventory.

Prepaid insurance is an expense that is paid for in advance. Insurance premiums are often paid before the period covered by the payment, and the entire amount is typically paid off within a year.

Yes, prepaid insurance is usually a short-term asset because insurance premiums are rarely billed for periods greater than one year.

Short-term investments are financial investments that can easily be converted to cash, typically within five years. Long-term investments, on the other hand, are designed to be bought and held for at least a year.