Prescription insurance and medical insurance are two distinct types of coverage that play crucial roles in healthcare. While medical insurance typically covers a wide range of medical services, including doctor visits, hospitalization, and surgical procedures, prescription insurance is specifically designed to help manage the costs of prescription medications. Understanding the differences between these two types of insurance is essential for individuals to make informed decisions about their healthcare coverage and ensure they receive the necessary treatments at the most affordable prices.

| Characteristics | Values |

|---|---|

| Definition | Prescription insurance is a type of health coverage that focuses on covering the costs of prescription medications, while medical insurance provides broader coverage for various healthcare services, including doctor visits, hospital stays, and more. |

| Coverage | Prescription insurance typically covers the cost of medications prescribed by a doctor, often with a co-pay or deductible. Medical insurance offers comprehensive coverage for a wide range of medical services, including preventive care, specialist visits, surgeries, and more. |

| Purpose | The primary purpose of prescription insurance is to help individuals manage the financial burden of prescription drugs. Medical insurance aims to provide financial protection and access to a full range of healthcare services. |

| Exclusions | Prescription insurance may have specific exclusions, such as over-the-counter medications or certain specialty drugs. Medical insurance often covers a broader range of services but may have certain exclusions as well. |

| Cost | Premiums for prescription insurance can vary based on factors like age, health status, and the specific plan. Medical insurance plans typically have higher premiums due to the extensive coverage they provide. |

| Benefits | Prescription insurance can offer convenience and cost savings for individuals needing regular medications. Medical insurance provides comprehensive coverage, ensuring access to a wide network of healthcare providers and services. |

| Integration | Prescription insurance can be integrated into a medical insurance plan, offering combined coverage for medications and other healthcare services. Some insurance providers offer standalone prescription plans. |

| Trends | The market for prescription insurance is growing, driven by the rising costs of medications. Medical insurance plans are also evolving to include more prescription coverage options. |

What You'll Learn

- Prescription Coverage: Understanding the differences in benefits and exclusions between prescription insurance and medical insurance

- Copayments and Deductibles: Comparing copayment structures and deductible amounts for prescription and medical services

- Network Providers: Exploring how prescription insurance networks differ from medical insurance provider networks

- Formulary Management: Analyzing the impact of formulary management on prescription drug coverage versus medical coverage

- Prescription Drug Costs: Examining cost-sharing mechanisms for prescription drugs versus medical services

Prescription Coverage: Understanding the differences in benefits and exclusions between prescription insurance and medical insurance

The terms "prescription insurance" and "medical insurance" are often used interchangeably, but they represent distinct coverage areas with specific benefits and exclusions. Understanding these differences is crucial for individuals seeking comprehensive healthcare coverage. Prescription insurance, as the name suggests, primarily focuses on covering the costs of prescription medications. It aims to provide financial assistance for the often expensive drugs prescribed by healthcare professionals. This type of insurance is particularly beneficial for individuals with chronic conditions who require long-term medication management.

On the other hand, medical insurance, also known as health insurance, offers a broader range of benefits. It typically includes coverage for various medical services, such as doctor visits, hospital stays, emergency room visits, and diagnostic tests. Medical insurance plans often have a network of healthcare providers, and the coverage may vary depending on the plan's specific terms and the provider's location. While prescription insurance is essential for managing medication costs, medical insurance ensures that individuals have access to a wide array of healthcare services, promoting overall well-being.

One key difference lies in the scope of coverage. Prescription insurance usually has specific formularies or lists of covered medications, and the extent of coverage may vary. Some plans might cover a wide range of drugs, while others may have preferred or generic drug lists with lower copayments. In contrast, medical insurance plans often have a more comprehensive network of healthcare providers, including doctors, specialists, and hospitals, ensuring that individuals can access various medical services without extensive research and coordination.

Exclusions and limitations are also essential aspects to consider. Prescription insurance may exclude certain medications or require specific conditions for coverage, such as prior authorization or step therapy. Medical insurance plans might have exclusions as well, such as limiting coverage for pre-existing conditions or specific services, especially during the initial enrollment period. Understanding these exclusions ensures that individuals are aware of potential out-of-pocket expenses and can make informed decisions when selecting insurance coverage.

In summary, while prescription insurance and medical insurance are related, they serve distinct purposes. Prescription insurance is tailored to manage medication costs, offering coverage for specific drugs, while medical insurance provides a more comprehensive approach to healthcare, covering a wide range of medical services. Individuals should carefully review the benefits, exclusions, and network providers associated with each type of insurance to ensure they receive the necessary coverage for their healthcare needs.

Medical Insurance Coverage: Understanding Glasses and Vision Care

You may want to see also

Copayments and Deductibles: Comparing copayment structures and deductible amounts for prescription and medical services

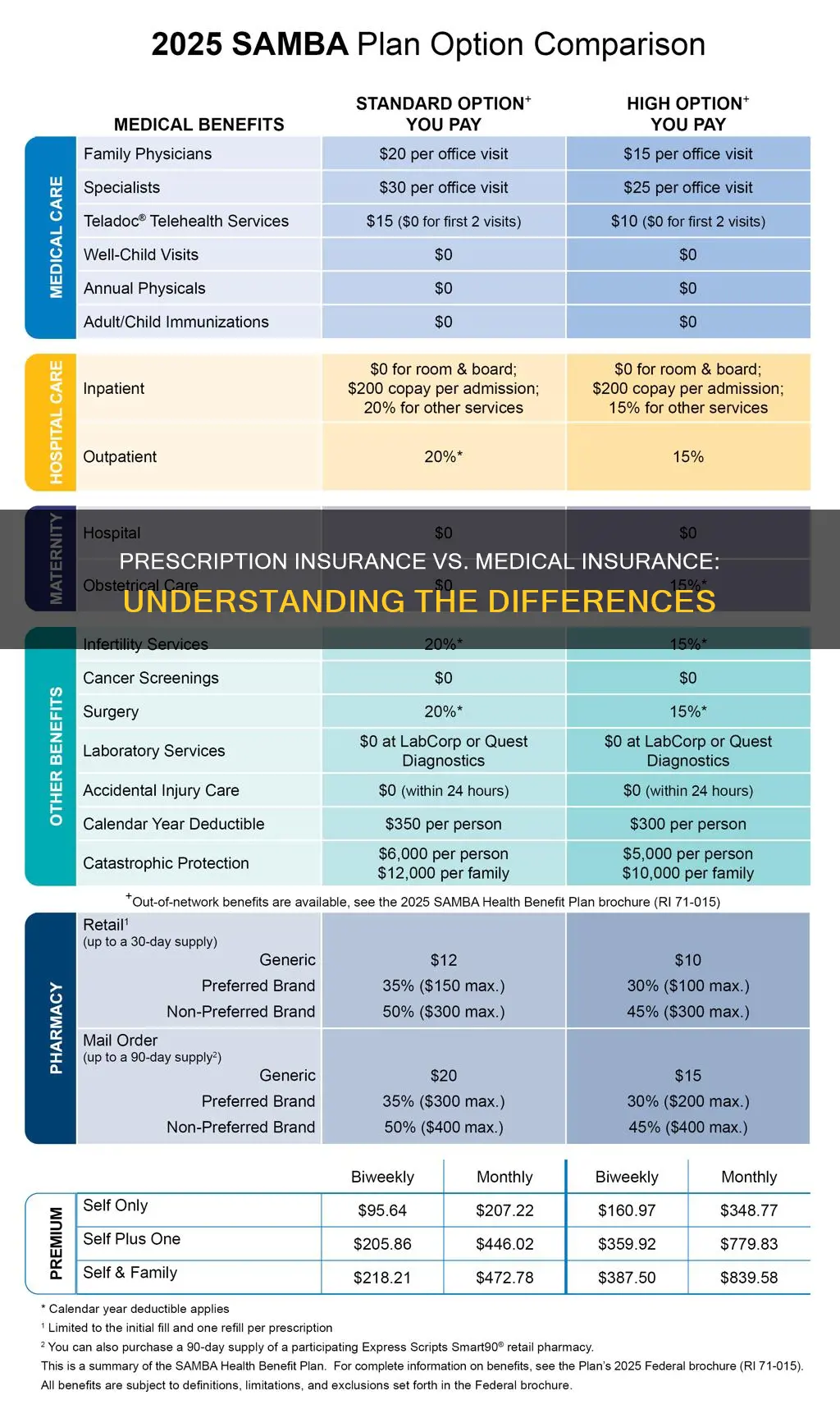

When comparing prescription insurance and medical insurance, understanding the nuances of copayments and deductibles is crucial. These financial aspects significantly impact the overall cost-sharing structure for individuals seeking healthcare coverage. Copayments, often referred to as copays, are fixed amounts paid by the insured individual at the time of service. In prescription insurance, copayments are typically associated with filling a prescription at a pharmacy. For instance, a plan might require a $10 copay for a generic medication and a $20 copay for a brand-name drug. These copayments are usually lower for generic drugs compared to their brand-name counterparts, encouraging the use of more affordable options. On the other hand, medical insurance copayments can vary widely depending on the type of service. A routine office visit might have a copay of $20, while a specialist visit could range from $30 to $50 or more.

Deductibles, another essential component of insurance plans, represent the amount an individual must pay out-of-pocket before the insurance coverage kicks in. For prescription insurance, the deductible is the amount you pay before your coverage starts covering medications. If your plan has a $500 deductible, you'll need to pay $500 in copayments and/or coinsurance before the insurance starts covering prescription costs. Medical insurance deductibles work similarly, but they apply to a broader range of medical services, including doctor visits, hospital stays, and other medical procedures. For instance, a plan might have a $1,000 deductible for medical services, meaning you must pay the first $1,000 in copayments and/or coinsurance before the insurance coverage begins.

The comparison between copayments and deductibles for prescription and medical services can vary significantly. Prescription insurance often has more standardized copayment structures, making it easier for individuals to understand and predict their costs. Medical insurance, however, may have more complex copayment systems, especially when it comes to specialist referrals or specific medical procedures. Deductibles can also differ, with prescription insurance plans sometimes having lower deductibles to encourage medication adherence, while medical insurance deductibles might be higher to balance the overall cost of the plan.

Understanding these differences is vital for individuals to make informed decisions about their healthcare coverage. When choosing a plan, consider your specific healthcare needs, the medications you require, and the likelihood of requiring medical services. Plans with lower copayments for generic prescriptions might be more cost-effective for those with chronic conditions, while those with higher deductibles but lower overall premiums could be suitable for individuals who require less frequent medical interventions.

In summary, copayments and deductibles play a significant role in differentiating prescription insurance from medical insurance. Prescription insurance often features standardized copayments for medications and lower deductibles, while medical insurance may have more variable copayments and higher deductibles. Being aware of these differences will enable individuals to select a plan that best aligns with their healthcare requirements and financial goals.

Unraveling the Coverage: What Nationwide Major Medical Pet Insurance Includes

You may want to see also

Network Providers: Exploring how prescription insurance networks differ from medical insurance provider networks

The concept of insurance networks is crucial to understanding the differences between prescription and medical insurance. These networks are essentially lists of healthcare providers (doctors, hospitals, pharmacies, etc.) that have agreed to provide services to insurance policyholders at discounted rates. When you have insurance, you typically choose a plan that offers a network of providers, and accessing care within this network often results in lower out-of-pocket costs for the insured individual.

In the context of prescription insurance, the network is specifically tailored to pharmacies and other prescription drug providers. Prescription insurance plans negotiate discounted rates with pharmacies to offer lower prices for medications. This network ensures that policyholders can access their necessary medications at reduced costs. For instance, if you have a prescription insurance plan, you might be able to fill your prescriptions at a network pharmacy for a lower copay or even no copay at all, depending on your plan.

On the other hand, medical insurance provider networks encompass a broader range of healthcare services, including medical doctors, specialists, hospitals, and other medical facilities. These networks are designed to provide comprehensive healthcare coverage, ensuring that policyholders can access various medical services at negotiated rates. When you have medical insurance, you can visit in-network doctors for routine check-ups, consultations, and treatments, often at reduced costs compared to out-of-network providers.

The key difference lies in the scope and focus of these networks. Prescription insurance networks are specialized for pharmacies and prescription drugs, ensuring that policyholders can access medications at discounted prices. In contrast, medical insurance networks provide a wider range of healthcare services, covering both medical and surgical treatments, as well as preventive care. This means that while prescription insurance focuses on medication costs, medical insurance aims to cover a comprehensive array of healthcare needs.

Understanding these network differences is essential for individuals to make informed decisions about their insurance coverage. When choosing a prescription insurance plan, you're primarily concerned with accessing affordable medications, and the network ensures that you can do so. Conversely, when selecting a medical insurance plan, you're considering a broader range of healthcare services, including both prescription and non-prescription medical care. This distinction highlights the importance of aligning your insurance choice with your specific healthcare needs and preferences.

Understanding Medical Bill Adjustments: A Guide to Insurance Reimbursement

You may want to see also

Formulary Management: Analyzing the impact of formulary management on prescription drug coverage versus medical coverage

The concept of formulary management is crucial in understanding the differences between prescription drug coverage and medical coverage within the insurance industry. Formulary management refers to the process of creating and maintaining a list of covered medications, known as a formulary, which is a key component of prescription drug plans. This practice significantly influences the availability and cost of prescription drugs for insured individuals.

In the context of prescription insurance, formulary management plays a pivotal role in determining which medications are covered and at what cost. Insurance companies often negotiate with pharmaceutical manufacturers to secure lower prices for medications included in their formulary. This negotiation power allows insurers to offer more affordable prescription drug coverage to their policyholders. However, it also means that certain medications might not be covered, especially if they are newer or more expensive, as insurers strive to balance coverage options and costs.

On the other hand, medical coverage, which typically includes a broader range of healthcare services such as doctor visits, hospitalization, and diagnostic tests, is less directly influenced by formulary management. Medical insurance plans often provide comprehensive coverage for various medical procedures and treatments, ensuring that insured individuals have access to a wide array of healthcare services. While there may be some restrictions or specific requirements for certain medical procedures, the overall scope of medical coverage is generally more extensive than prescription drug coverage.

The impact of formulary management becomes evident when comparing prescription drug plans to medical coverage. Prescription drug plans often have specific tiers or categories of medications, with lower-cost generic drugs typically covered at a higher rate than brand-name drugs. This structured approach encourages patients to opt for more affordable alternatives. In contrast, medical coverage is more focused on providing access to a wide range of healthcare services, ensuring that insured individuals can receive necessary medical treatments without significant financial barriers.

In summary, formulary management is a critical aspect of prescription insurance, shaping the availability and affordability of prescription drugs. It directly influences the cost of medications and, consequently, the overall prescription drug coverage offered by insurance companies. In contrast, medical coverage, while also subject to certain restrictions, provides a more comprehensive range of healthcare services, ensuring that insured individuals have access to a wide array of medical treatments and procedures. Understanding these differences is essential for individuals seeking appropriate insurance coverage for their healthcare needs.

Understanding Medication Costs: Navigating Without Insurance

You may want to see also

Prescription Drug Costs: Examining cost-sharing mechanisms for prescription drugs versus medical services

The distinction between prescription insurance and medical insurance is often misunderstood, leading to confusion about the coverage and costs associated with each. While both types of insurance are designed to provide financial protection, they operate under different principles and cover distinct aspects of healthcare. Prescription insurance, as the name suggests, primarily focuses on covering the costs of prescription medications, ensuring that individuals have access to necessary medications without incurring substantial financial burdens. On the other hand, medical insurance provides coverage for a broader range of medical services, including doctor visits, hospital stays, diagnostic tests, and other healthcare procedures.

When examining the cost-sharing mechanisms for prescription drugs versus medical services, several key differences emerge. Prescription insurance plans typically employ strategies such as copayments, coinsurance, and deductibles to manage costs. Copayments are fixed amounts paid by the insured individual at the time of service, often a small fee for each prescription filled. Coinsurance, on the other hand, is a percentage of the total cost that the individual must pay after meeting a deductible. These cost-sharing mechanisms aim to encourage cost-conscious behavior and reduce unnecessary prescription usage. In contrast, medical insurance plans often have more comprehensive coverage, with lower copayments or coinsurance rates for in-network providers and services.

The cost of prescription drugs can vary significantly, and insurance plans may have specific strategies to manage these expenses. Some plans offer preferred drug lists, which are lists of medications with lower copayments or coinsurance rates, encouraging the use of cost-effective drugs. Additionally, prescription insurance may include features like mail-order pharmacy programs, which can reduce costs by providing a convenient and often more affordable way to receive medications. These programs are particularly beneficial for individuals with chronic conditions who require long-term medication use.

In contrast, medical services often involve a wider range of costs, including doctor visits, emergency room visits, and diagnostic procedures. Medical insurance plans typically have more structured cost-sharing mechanisms, such as annual deductibles and out-of-pocket maximums, which limit the amount an individual must pay in a year. These plans often provide comprehensive coverage for various medical services, ensuring that individuals have access to necessary healthcare without incurring excessive expenses.

Understanding the cost-sharing mechanisms for prescription drugs and medical services is crucial for individuals to make informed decisions about their healthcare coverage. Prescription insurance plans may offer more targeted cost-saving measures, while medical insurance plans provide broader coverage and financial protection. By examining these differences, individuals can choose insurance plans that best suit their healthcare needs and financial goals, ensuring they receive the necessary care without facing excessive financial burdens.

Life Insurance and Medical Bills: What You Need to Know

You may want to see also

Frequently asked questions

Prescription insurance and medical insurance serve distinct purposes. Medical insurance primarily covers a wide range of healthcare services, including doctor visits, hospital stays, surgeries, and various medical treatments. It provides comprehensive coverage for general healthcare needs. On the other hand, prescription insurance specifically focuses on covering the costs of prescription medications. It helps individuals manage the financial burden of buying necessary medications, ensuring they have access to essential drugs for their health conditions.

Yes, it is common for individuals to have both types of insurance coverage. Many people opt for a combination of medical and prescription insurance to ensure they are protected for a wide range of healthcare needs. Medical insurance can cover routine check-ups, specialist visits, and other medical services, while prescription insurance takes care of the medication costs. This dual coverage can provide comprehensive protection and peace of mind.

Prescription insurance can be beneficial for anyone who requires regular medications or has a chronic condition that requires long-term medication management. If you frequently visit the pharmacy or have a high out-of-pocket expense for medications, prescription insurance can help reduce these costs. It is especially useful for individuals with specific health conditions, such as diabetes, hypertension, or mental health disorders, who often rely on regular medication. Additionally, prescription insurance can be valuable for those who have limited coverage or no insurance at all, ensuring they can access necessary medications without financial strain.