Life insurance is a difficult topic for many people, but it is an important one to consider. Term life insurance is a type of insurance policy that provides coverage for a set period, typically 10 to 30 years. It is a simple and pure form of insurance: you pay a premium for a specified term, and if you die during that time, a death benefit is paid to your beneficiaries. This benefit is usually tax-free and can be used to cover expenses and support dependents. Term life insurance is usually the cheapest option, but it does not build cash value over time, and coverage ends when the term expires.

When considering term life insurance, it is important to remember that not all policies are created equal. Factors such as age, health, and lifestyle can affect the cost of premiums and the benefits offered. Additionally, different policies may include riders, which are supplemental benefits that offer additional protection, such as a waiver of premiums in the event of disability. Understanding the fine print and comparing policies from different insurers can help individuals make informed decisions about their specific needs.

| Characteristics | Values |

|---|---|

| Period | Typically between 10 and 30 years |

| Renewal | Possible at the end of the term but at a higher rate |

| Payout | A death benefit is paid to the beneficiaries |

| Premium | Based on a person's age, health, and life expectancy |

| Cost | Relatively inexpensive |

| Cash value | No cash value |

What You'll Learn

- Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified number of years

- Term life insurance is initially much cheaper than permanent life insurance but has no cash value

- Term life insurance is a good option for covering a single need, such as a mortgage or business loan

- Term life insurance is typically more cost-effective than permanent life insurance but has no cash value, no payout after the term expires, and no value other than a death benefit

- Term life insurance is a relatively inexpensive way to provide a lump sum to dependents if something happens to you

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified number of years

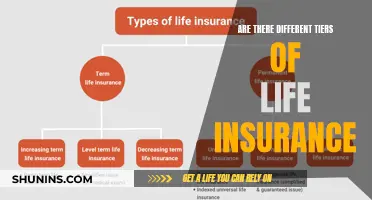

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically between 10 and 30 years. It is a straightforward and cost-effective form of life insurance that guarantees a death benefit to the insured's beneficiaries if the insured person dies during the specified term. Term life insurance is distinct from permanent life insurance, such as whole life or universal life insurance, which offers coverage for the entire lifespan of the insured.

Term life insurance policies offer level premiums, where the premium amount remains fixed for the duration of the policy. The insurance company calculates these premiums based on factors such as the insured person's health, age, and life expectancy. The application process may include a medical exam and inquiries about occupation, hobbies, and driving records.

One of the key advantages of term life insurance is its affordability. Since it is designed for a specific period and does not accumulate cash value, the premiums are significantly lower compared to permanent life insurance. This makes it an attractive option for young individuals or families seeking substantial coverage at a low cost.

Additionally, term life insurance policies often provide the option to convert to permanent insurance within a certain number of years. This feature allows policyholders to extend their coverage if their circumstances change. However, it is important to note that converting to permanent insurance will result in higher premiums.

When considering term life insurance, it is essential to choose an appropriate term length and decide on the desired death benefit amount. It is also worth exploring different types of term policies, such as yearly renewable term or return of premium policies, to find the one that best suits your needs.

In summary, term life insurance is a straightforward and affordable way to ensure financial protection for your loved ones during a specified period. It offers temporary coverage with level premiums and the option to convert to permanent insurance, making it a popular choice for individuals and families seeking peace of mind without breaking the bank.

Pledged Asset: Can Life Insurance Be Leveraged?

You may want to see also

Term life insurance is initially much cheaper than permanent life insurance but has no cash value

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified number of years. It is much cheaper than permanent life insurance initially, but it has no cash value. This means that if the insured person does not die during the specified time period, their beneficiaries will not receive any payout. In contrast, permanent life insurance policies last for the entire lifetime of the insured person and include a cash value component that can be withdrawn or borrowed against.

Term life insurance is ideal for people who want substantial coverage at a low cost. The premiums for term life insurance are based on a person's age, health, and life expectancy. The insurance company calculates the premium by considering factors such as the policy's value, age, gender, and health. Term life insurance policies often offer level premiums, which means that the premium amount stays the same for the duration of the policy.

While term life insurance is much cheaper than permanent life insurance initially, it is important to note that the premiums increase with age. This means that if a person waits until they are older to purchase term life insurance, they will pay higher premiums than if they had bought a policy when they were younger. Additionally, term life insurance policies may have limited coverage periods, typically ranging from 10 to 30 years. If a person still needs coverage after the policy expires, they may have to pay much higher premiums for a new policy.

On the other hand, permanent life insurance provides lifetime coverage as long as the premiums are paid. It also includes a savings or investment component that accumulates cash value over time. This cash value can be withdrawn or borrowed against, providing additional financial benefits to the policyholder. However, permanent life insurance comes with substantially higher monthly premiums.

In summary, term life insurance is a good option for people who want affordable coverage for a specific period of time. It is ideal for young and healthy individuals with families who want to ensure their loved ones are financially protected in the event of their untimely death. However, it is important to consider the limited coverage period and the potential for higher premiums in the future if coverage is still needed. Permanent life insurance, on the other hand, offers lifetime coverage and additional financial benefits through the accumulation of cash value, but it comes with higher initial costs.

Listing Trusts as Life Insurance Beneficiaries: Is It Possible?

You may want to see also

Term life insurance is a good option for covering a single need, such as a mortgage or business loan

Term life insurance is a good option for those who want substantial coverage at a low cost. It is ideal for young, healthy individuals with families who depend on them financially. The premiums are based on the policyholder's age, health, and life expectancy, and the policy has no cash value. This means that if the policyholder outlives the term, they receive nothing back. However, the policy can often be renewed or converted to permanent coverage, although the premiums will increase.

When deciding on the term length, it is essential to consider how long you will need coverage. For example, if you have a 30-year mortgage, you may want a policy that matches this duration. Additionally, term life insurance can be useful for parents who want to ensure their children are financially supported until they reach adulthood.

In summary, term life insurance is a good option for those who want affordable coverage for a specific period to protect their loved ones financially. It is important to carefully consider your needs and choose a reputable insurance company that offers the features you require.

Life Insurance Options Post-Open Heart Surgery

You may want to see also

Term life insurance is typically more cost-effective than permanent life insurance but has no cash value, no payout after the term expires, and no value other than a death benefit

Term life insurance is a type of life insurance that provides coverage for a set period, typically 10 to 30 years. It is a cost-effective way to provide financial protection for loved ones, as it offers a death benefit at a lower cost compared to permanent life insurance. However, term life insurance has no cash value, and there is no payout if the policyholder outlives the policy term.

Term life insurance is a straightforward product where the policyholder pays a premium for a specified period, and the beneficiaries receive a death benefit if the insured person passes away during that time. This type of insurance is ideal for individuals who want substantial coverage at a low cost. The premiums are based on factors such as age, health, and life expectancy, and they remain fixed for the duration of the policy.

One of the key advantages of term life insurance is its affordability. It is much cheaper than permanent life insurance because it offers coverage for a limited time and does not accumulate cash value. For example, a healthy, non-smoking 30-year-old man can obtain a 30-year term life insurance policy with a $250,000 death benefit for approximately $18 per month. In contrast, a permanent life insurance policy with a lower payout would cost significantly more, demonstrating the cost-effectiveness of term life insurance.

However, it is essential to understand the limitations of term life insurance. Unlike permanent life insurance, term life insurance policies do not accumulate cash value over time. They are purely insurance products, and there is no payout if the policyholder outlives the policy term. This means that term life insurance should be chosen based on specific needs, such as covering a mortgage or supporting a family during the policyholder's prime income-earning years.

Additionally, term life insurance premiums increase with age. If a policyholder wishes to renew their policy after the initial term, they will face higher premiums due to their older age. This can be a significant consideration for those who may require coverage beyond the initial term.

In conclusion, term life insurance is a cost-effective way to obtain substantial coverage for a specified period. It is ideal for individuals who want to ensure their loved ones are financially protected in the event of their untimely death. However, it is important to recognize that term life insurance has no cash value, and there is no payout if the policy term is outlived. Therefore, it should be chosen based on specific needs and circumstances.

Veterans Group Life Insurance: Is It Worth It?

You may want to see also

Term life insurance is a relatively inexpensive way to provide a lump sum to dependents if something happens to you

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically between 10 and 30 years. It is a relatively inexpensive way to provide a lump sum to dependents if something happens to you. If the insured person dies during the specified term, the insurance company will pay out a death benefit to the chosen beneficiaries. This benefit is usually tax-free and can be used to cover expenses such as healthcare and funeral costs, consumer debt, and mortgage debt.

Term life insurance is much cheaper than permanent life insurance because it is not designed to last through old age and has no cash value. The cost of term life insurance is based on factors such as age, health, and life expectancy, with younger and healthier individuals paying lower premiums. Additionally, term life insurance policies offer level premiums, meaning the monthly payments stay the same for the duration of the policy. This makes it a predictable and affordable option for individuals seeking life insurance.

When considering term life insurance, it is important to choose an appropriate term length. For example, if you have children, it is recommended to select a term that covers them until they are financially independent. It is also crucial to understand the approval process, which may include a medical exam and health-related questions. Being truthful during this process is essential to ensure that your beneficiaries can receive the payout.

Term life insurance is ideal for individuals who want substantial coverage at a low cost. It is a good option for young and healthy individuals with families, as it provides financial protection at a relatively low price.

Life Insurance Cash Value: Is It Protected in Virginia?

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified number of years. If the insured person dies during the specified time period, and the policy is active, a death benefit will be paid.

The owner of the policy agrees to pay a premium for a specific term, and in return, the insurance company promises to pay a specific death benefit to the beneficiary upon the death of the insured person.

The cost of a term life insurance policy depends on several factors, including age, health, and gender. The younger and healthier you are, the lower your premiums will be. Men typically pay more for life insurance than women, as they have a lower life expectancy.