The Free Application for Federal Student Aid (FAFSA) is an annual form filled out by 20 million families in the United States. The form is used to determine eligibility for financial aid for students. The FAFSA does not consider cash value life insurance as an asset, and therefore, it does not need to be reported on the form. However, distributions from a life insurance policy will count as income and must be reported. Whole life and cash value life insurance policies are sheltered as retirement plans, but they are considered bad investments due to their low return on investment, high surrender charges, and high sales commissions.

What You'll Learn

Whole life insurance as a college funding strategy

Whole life insurance is not typically the first thing people consider when it comes to saving for college, but it can be used as part of a comprehensive funding plan. While the primary purpose of life insurance is to provide financial protection for loved ones in the event of the policyholder's death, whole life insurance policies also offer a savings component that can be utilised to cover education costs. This savings feature is the cash value of the policy, which grows tax-deferred over time and can be accessed through withdrawals or loans.

One of the key advantages of using whole life insurance as a college funding strategy is its flexibility. Unlike dedicated college savings plans like 529 plans, the cash value of a whole life insurance policy is not limited to specific types of expenses. This means that the funds can be used for a variety of purposes, including college tuition, room and board, or other education-related expenses. Moreover, the cash value of a whole life insurance policy is typically excluded from college financial aid formulas, so it won't reduce the amount of financial aid your child may be eligible for.

Another benefit of using whole life insurance as a college funding strategy is the potential for tax advantages. The cash value of a whole life insurance policy grows tax-deferred, and withdrawals or loans taken against the policy are generally tax-free up to the amount of premiums paid. Additionally, any dividends received from the policy can be used to purchase additional insurance, further increasing the policy's value and potential benefits.

However, it's important to carefully consider the potential drawbacks of using whole life insurance as a college funding strategy. Whole life insurance policies tend to have high sales commissions and premium costs, and the return on investment may be lower compared to other investment options. Withdrawing or borrowing against the cash value of the policy will also reduce the available cash surrender value and total life insurance benefit. If the policyholder dies before repaying a loan taken against the policy, the death benefit will be reduced, which can be financially detrimental to the beneficiaries.

In conclusion, while whole life insurance can be a valuable component of a college funding strategy, it should be carefully evaluated as part of an overall financial plan. Consulting with a financial professional and tax advisor can help individuals determine if this approach is suitable for their specific needs and circumstances.

Usaa Life Insurance: Annual Fee or Free?

You may want to see also

Cash value life insurance and FAFSA

Cash value life insurance is not reported on the FAFSA. This is because the FAFSA doesn't consider cash value life insurance as an asset. However, settlements from a life insurance policy are counted as income.

The Free Application for Federal Student Aid (FAFSA) is a form that must be filled out by students and parents to determine eligibility for financial aid. The FAFSA considers various factors, including income and assets, to calculate a student's financial need. However, it is important to note that not all assets are treated equally by the FAFSA. While some assets, such as bank accounts and investment properties, are reportable, others, such as qualified retirement accounts and the family home, are not.

Cash value life insurance policies fall into the category of non-reportable assets on the FAFSA. This means that the cash value of a life insurance policy does not need to be included when calculating a student's financial need. This is because the FAFSA does not consider cash value life insurance as an asset. This is in contrast to the CSS Profile, a separate financial aid form used by some colleges and universities, which does consider the cash value of life insurance policies as an asset.

It is important to note that while the cash value of a life insurance policy is not reported on the FAFSA, any distributions or withdrawals from the policy may need to be reported as income. This includes any settlements or proceeds from the policy, which are typically considered income by the FAFSA. Additionally, borrowing from a life insurance policy may not be reported as an asset on the FAFSA, but the interest accrued will likely be considered income.

Why Cash Value Life Insurance is Not Reported on the FAFSA

There are a few reasons why cash value life insurance is not reported on the FAFSA. Firstly, life insurance is typically considered a non-assessable asset by the federal government. This means that it is not included in the calculation of an individual's financial need. Secondly, life insurance policies are often seen as a form of protection rather than an investment or asset. As such, they are not treated in the same way as other financial holdings. Finally, including the cash value of life insurance policies in the FAFSA calculation could potentially reduce the amount of financial aid that a student is eligible for, which may not be in the best interest of the student or their family.

Considerations for Using Cash Value Life Insurance for College Savings

While cash value life insurance can be used as a savings vehicle for college tuition, there are some important considerations to keep in mind. Firstly, life insurance should not be purchased solely for the purpose of funding college tuition. It is important to have a genuine need for life insurance protection, such as providing for dependents or covering outstanding debts. Secondly, cash value life insurance policies typically have high fees and commissions, especially in the early years of the policy. Therefore, it may take several years for the policy's cash value to accumulate to a significant amount. Finally, it is important to remember that accessing the cash value of a life insurance policy may have tax implications and could reduce the death benefit paid out by the policy.

Life Insurance: Cremation Coverage and Your Options

You may want to see also

Life insurance and the CSS Profile

The CSS Profile is an application used by over 250 institutions to determine a student's eligibility for institutional aid, grants, and scholarships. It is more detailed than the Free Application for Federal Student Aid (FAFSA) and considers income streams, assets, and expenses not included on the FAFSA. This includes life insurance plans, home equity on a family's primary residence, and income and assets held by non-custodial parents in cases of divorce.

The CSS Profile is not a substitute for the FAFSA but is instead a supplement for specific colleges and universities. Students must fill out both applications to be eligible for federal student loans and grants. While the FAFSA does not consider the cash value of life insurance policies as an asset, the CSS Profile may specifically ask about this. This is because the CSS Profile is used by individual colleges and universities, which treat assets differently.

Families seeking to qualify for more financial aid should be cautious of insurance agents who suggest purchasing permanent life insurance policies as a means of reducing their Expected Family Contribution (EFC) in calculating college financial aid eligibility. While it is true that the cash value of life insurance policies is not assessed by the FAFSA, it may be considered by the CSS Profile or other secondary forms used by colleges.

Before purchasing a life insurance policy to reduce their EFC, families should consider the following:

- Whether the college counts the cash value of life insurance policies in its formula

- The actual cost of the insurance

- The financial strength of the colleges the student will apply to and the amount of aid that can be expected

- The quality of the additional anticipated financial aid

- The costs associated with accessing the cash value of the life insurance policy

- The impact on future financial aid if the cash value of the life insurance policy is accessed during the college funding years

- Whether they actually need or want life insurance

In addition, families should be aware that going to the trouble of hiding assets through life insurance is not only expensive but often unnecessary.

Life Insurance and Government: Understanding Liens and Their Impact

You may want to see also

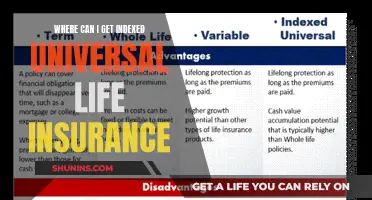

Whole life insurance vs. other investments

Whole life insurance is a type of permanent life insurance that covers you for as long as you live, provided that the premiums are paid. It is not considered an investment but rather a savings vehicle, as it does not carry the same risks that investments do. However, it can be a good addition to a financial portfolio, especially for high net worth individuals and parents with lifelong financial dependents.

Whole life insurance has a cash value component, which grows at a fixed rate over time and is not subject to market risk. This cash value can be used to take out loans, with the insurer subtracting any outstanding loans from the payout upon the policyholder's death. The cash value can also be surrendered for cash, though this may result in income tax.

Advantages of Whole Life Insurance:

- Protection for your family: Whole life insurance offers a death benefit that can keep your family financially secure if you pass away.

- Steady cash value growth: The cash value grows at a guaranteed, steady pace, complementing fixed-income investments in your portfolio.

- No market risk: The cash value growth is not subject to the volatility of the stock market.

- Retirement and asset-safeguarding: The cash value can help pay for big-ticket items, such as a new home or starting a business, and can supplement income during retirement.

- Reinvesting dividends: If purchased from a mutual company, whole life insurance may pay dividends, which can be used to purchase additional coverage, increasing the death benefit and cash value accumulation.

- Tax advantages: The cash value grows tax-deferred, and you may be able to access this money tax-free if you withdraw less than the policy basis.

Disadvantages of Whole Life Insurance:

- High premiums: Whole life insurance premiums tend to be much higher than term life insurance.

- Slow cash value growth: It can take 10 to 15 years or longer to build up enough cash value to borrow against.

- Low rate of return: The average annual rate of return is 1% to 3.5%, which may underperform compared to other investments like stocks, bonds, and real estate.

- Lack of control: Policyholders cannot control their portfolio or choose investments, as the insurance company declares the dividend or interest rate and manages the investments.

- Tax implications: Withdrawing cash from the policy, surrendering the policy, or not repaying loans taken against the policy may result in income tax.

When comparing whole life insurance to other investments, it is important to consider your financial goals, risk tolerance, and time horizon.

Whole life insurance is suitable for those who:

- Want to leave money to beneficiaries regardless of when they die, even if it means paying higher premiums.

- Prefer a conservative, stable investment with guaranteed, predictable returns and a low-risk profile.

- Have already maxed out retirement accounts and are looking for additional tax-advantaged savings options.

- Want to have cash to tap into later, such as for retirement or their children's education.

Other investments may be more suitable if you:

- Only need life insurance for a specific period and want lower premiums.

- Have a high-risk tolerance and want to maximize returns, even with the potential for market volatility.

- Desire control over your investments and the ability to choose from a range of investment options.

- Are seeking a higher rate of return and are willing to accept more risk.

In summary, whole life insurance can be a valuable addition to a financial portfolio for those who want stable, long-term returns with low risk. However, it may not be the best choice for those seeking higher returns, control over their investments, or life insurance coverage for a specific period.

DUI's Impact on Life Insurance: What You Need to Know

You may want to see also

Life insurance agents and commission

Life insurance agents can be paid via salary, commission, or a combination of the two. Commission structures vary by policy and company, but agents typically receive 60% to 80% of the premiums paid in the first year as commission, with smaller commissions in subsequent years. Overall, 5% to 10% of all the premiums paid over the life of the policy could go towards commissions.

Life insurance agents receive the highest commission rates for whole life insurance plans—often over 100% of the total premiums for the first year. The exact percentage depends on the age of the policyholder. Commissions for universal life insurance plans are usually at least 100% of the premiums paid in the first year, up to the amount of the target premium. However, the rate decreases if the insured pays above the target level in the first year. Term life insurance plans pay the lowest commissions, ranging from 30% to 80%.

Captive agents, who work exclusively with one insurance carrier, typically earn lower commissions than independent agents, who represent several insurance companies. However, independent agents are often responsible for their own business expenses, such as rent and advertising costs.

If a policyholder stops paying premiums and lets their policy lapse within the first few years, the insurance company may require the agent to pay back some or all of the commissions they earned.

When purchasing life insurance, it is important to consider the agent's commission as it may impact the policies they promote. Agents have an incentive to promote policies with higher premiums, such as permanent life insurance, as these policies generally offer lifelong coverage and have a cash value component that accumulates interest over time. As a result, the premiums for permanent life insurance are often seven to ten times higher than those for term life insurance.

To make an informed decision when purchasing life insurance, it is recommended to ask the agent about their commission and look into "low-load" insurers, who have salaried "consultants" instead of commissioned agents. Ultimately, the decision should be based on the long-term policy performance rather than just the commission structures.

Who Controls Life Insurance Beneficiaries: You or Your Spouse?

You may want to see also

Frequently asked questions

No, the FAFSA doesn't consider cash value life insurance as an asset.

The FAFSA doesn't consider cash value life insurance as an asset because of an omission that allows insurance agents to peddle cash value life insurance as a way to hide parents' assets.

The high sales commissions, high premium, low return on investment, the nondeductible nature of the premiums, and the surrender charges, among other problems, may cost the family more than they save from sheltering the money from the need-analysis process.

If your assets are making a significant difference, there are several places you can put money that could prevent them from reducing your financial aid. One option is retirement accounts. You can contribute up to $5,500 or ($6,500 if you turn 50 or older this year) this year to an IRA.