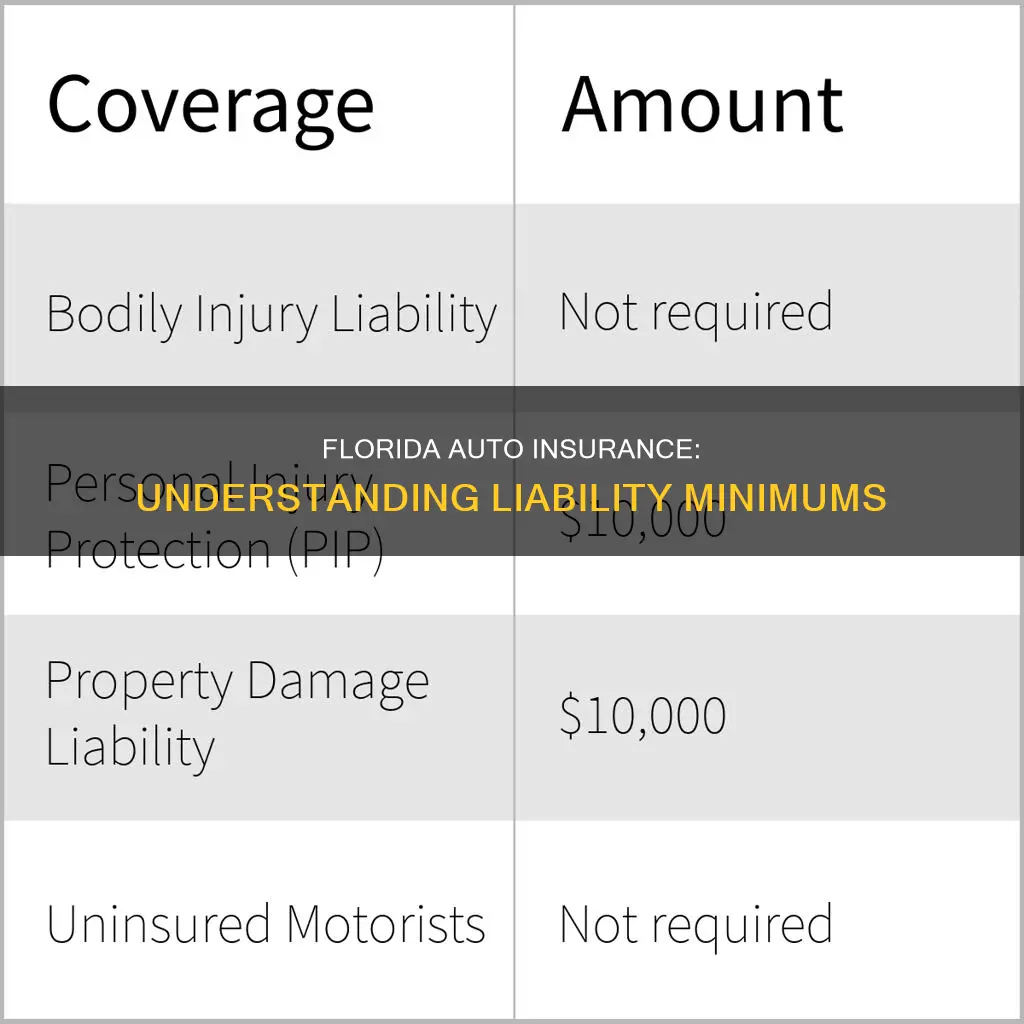

Florida is a no-fault state, meaning that each driver's insurance covers injuries or medical expenses for them and their passengers, regardless of who is at fault. Florida's minimum insurance requirements are $10,000 in property damage liability and $10,000 in personal injury protection. This means that your insurance company may pay up to $10,000 for property damage and $10,000 for personal injury protection in a single accident.

| Characteristics | Values |

|---|---|

| Property Damage Liability Insurance | $10,000 minimum |

| Personal Injury Protection Insurance | $10,000 minimum |

| Average Cost of Minimum Coverage | $986 per year or $82 per month |

| Cheapest Minimum Coverage Providers | GEICO, Travelers |

| Average Cost of Full Coverage | $3,795 per year |

| Cheapest Full Coverage Providers | GEICO, State Farm, Travelers |

What You'll Learn

Florida's minimum auto insurance requirements

Personal Injury Protection (PIP)

PIP insurance covers you regardless of whether you are at fault in a crash, up to the limits of your policy. It covers:

- 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury.

- 60% of lost wages as a result of the accident.

- $5,000 for death benefits.

PIP also covers relatives living in your home, certain passengers who do not own a vehicle, and others who drive your car with your permission. Pedestrians and bicyclists are also entitled to PIP coverage.

Property Damage Liability (PDL)

PDL coverage pays for damage to another person's property caused by you or someone else driving your insured vehicle. The term "property" includes a fence, telephone pole, building, or another car.

Additional Requirements

Any vehicle with a current Florida registration must:

- Be insured with PIP and PDL insurance at the time of vehicle registration.

- Have a minimum of $10,000 in PIP and a minimum of $10,000 in PDL.

- Have continuous coverage even if the vehicle is not being driven or is inoperable.

- Be purchased from an insurance carrier licensed to do business in Florida.

Optional Add-Ons

Florida law only requires you to carry the above-mentioned coverages. However, you can add the following to your insurance policy for more protection:

- Bodily injury liability: This coverage pays for the medical expenses of those injured as a result of an accident you caused.

- Collision: This coverage pays for your vehicle's repairs if you are involved in a collision with another driver or object (except animals).

- Comprehensive: This insurance protects your vehicle against non-collision damages, including theft, weather damage, and hitting an animal.

- Medical payments: This coverage pays for the medical bills and expenses of you and your passengers in the event of a car accident.

- Roadside assistance: This coverage helps if your car breaks down, fixing a flat tire, jump-starting a dead battery, and covering the cost of a tow to a nearby garage, among other perks.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are hit by a motorist who does not have insurance or has insufficient insurance.

Florida's auto insurance requirements are quite low, leaving many drivers financially vulnerable. It is highly recommended that drivers obtain coverage above the state-mandated limits.

The Cost of Adding a Driver to Your Auto Insurance Policy

You may want to see also

Property damage liability insurance

In Florida, the minimum property damage liability coverage required is $10,000. This means that your insurance company will cover up to $10,000 for property damage caused in a single accident, regardless of the number of vehicles or properties involved. However, if the repair or replacement costs exceed this limit, you may be personally responsible for covering the additional expenses. Therefore, it is generally recommended to increase your property damage liability coverage if possible. Most insurance companies allow drivers to raise their limits up to $100,000 or even higher.

Florida's auto insurance requirements are among the most minimal in the United States, yet many drivers remain uninsured. When registering a vehicle in Florida, it is essential to provide proof of property damage liability insurance and personal injury protection insurance to comply with the state's legal requirements. Failure to maintain the necessary insurance coverage can result in penalties such as fines, suspension of your driver's license and vehicle registration, and higher insurance premiums.

Keep Old Auto Insurance Policies? Here's How Long to Store

You may want to see also

Personal injury protection insurance

Florida is a no-fault state, meaning that after a car accident, your insurance covers your damages, regardless of who was at fault, up to your policy's limit. In Florida, drivers are required to have Personal Injury Protection (PIP), also called no-fault insurance. This covers 80% of all necessary and reasonable medical expenses and lost income after a car accident, regardless of who caused the crash, up to a limit of $10,000. PIP also covers 60% of lost wages, subject to a $10,000 limit, and death benefits of up to $5,000 for funeral and burial expenses.

Florida also allows drivers to sue for medical costs over $10,000, even if the injury is not severe. This means that if you are injured in an accident that results in $20,000 worth of hospital bills, you are allowed to sue the other driver for the remaining $10,000 not covered by your PIP.

You must file a PIP claim within 2 weeks of a crash, and treatment for any injuries must happen within this time frame to be eligible for PIP reimbursement. Due to insurance fraud in Florida, insurers have up to 60 days to investigate your claim but must pay for your damages within 30 days, even if there is suspicion.

PIP insurance typically comes with a deductible, the amount you must pay before insurance pays out. To get a cheaper car insurance quote, you can opt for a higher deductible of up to $1,000. However, remember that you will still be responsible for the 20% of your medical bills that PIP won't cover, as well as the deductible.

Medical Payments or MedPay is similar to PIP, except it only covers medical bills and not lost income or other costs. It may be worth having on your Florida car insurance policy because the limits for PIP are quite low. MedPay can add an extra $5,000 worth of coverage for around $100 per year. It can also help pay for the 20% of your costs that PIP won't cover and can help pay for the deductible on your PIP.

Fiesta Auto Insurance: Is It Affordable?

You may want to see also

Bodily injury liability insurance

In Florida, Bodily Injury Liability (BIL) insurance is not generally required unless you've been convicted of a DUI or have been in a car accident. However, it's highly recommended that drivers carry at least $10,000 of BIL insurance. BIL insurance covers injury or death to others when your car is involved in an accident and the driver of your car is found to be at fault. This policy pays for injuries caused by you and relatives who live with you, even if they are driving someone else’s car. It also covers people who drive your car with your permission.

BIL insurance is important because it protects you from financial liability if you are found at fault for an accident that results in injuries or death. Additionally, having BIL insurance can help you purchase Uninsured Motorist (UM) coverage, which protects you if you are injured by a driver who does not have adequate insurance. According to a study by the Insurance Research Council, Florida has the highest percentage of uninsured motorists in the country, with over 26% of drivers on Florida roads having no insurance.

If you are required to have BIL insurance, the minimum coverage amounts are set by the Florida Financial Responsibility Law. For most drivers, the minimum requirement is $10,000 per person and $20,000 per accident in BIL coverage. However, if you have been convicted of a DUI, the requirements are higher. You must have $100,000 per person and $300,000 per accident in BIL coverage for a period of three years after your license is reinstated.

In addition to BIL insurance, Florida also requires drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance. PIP insurance covers your own medical expenses and lost wages in an accident, regardless of who is at fault. PDL insurance pays for damage to another person's property caused by you or someone driving your insured vehicle. The minimum requirement for both PIP and PDL insurance in Florida is $10,000.

Auto Insurance: Can Employers Demand Proof?

You may want to see also

Collision and comprehensive insurance

Collision Insurance

Collision insurance covers damage to your vehicle, whether you were at fault or not. This includes damage caused by a collision with another vehicle or object, such as trees or guardrails, and single-car accidents. It does not cover the cost of damage to other vehicles, people, or things. Collision insurance policies usually include a deductible, which is the amount you pay out of pocket before the insurance company covers the rest. The deductible amount can be $500 or more, and the higher the deductible, the lower the insurance charge. Collision coverage usually has a total limit, which is the maximum amount the insurer will pay, often the "actual cash value" of the vehicle, including depreciation. If the cost of repairing the vehicle is greater than the actual cash value, the insurance company will pay the actual cash value, not the cost of repairs.

Comprehensive Insurance

Comprehensive insurance covers damage to your vehicle caused by something other than a collision. This includes damage from theft, natural disasters, vandalism, explosions, falling objects, animal impacts, terrorism, and more. It does not cover collision with another vehicle or medical bills. Comprehensive insurance is particularly useful if you live in an area with a high rate of theft, vandalism, and other crimes, or if you have a vehicle that thieves commonly target.

When to Have Both Comprehensive and Collision Insurance

While not required by law, collision and comprehensive insurance are recommended for peace of mind, knowing that whatever happens to your car, you will only have to pay the deductible to get it fixed or replaced. This is especially important as the cost of repairing a car after an accident can be high, and claims for theft are also increasing. If you are financing or leasing a car, you will probably be required to have both types of insurance.

When to Drop Comprehensive and Collision Insurance

You may consider dropping these insurance types if your car is old and has a low value, as the insurance company will only pay out the actual cash value, which may not be enough to get your car driving again if it is totaled. If you can afford to buy a new car if it is damaged or have the means to pay out of pocket for any damage, you may also want to drop these insurance types.

Gap Insurance: CarMax Coverage?

You may want to see also

Frequently asked questions

Florida residents must have a minimum of $10,000 in personal injury protection (PIP) and property damage liability (PDL) insurance.

Yes, Florida residents must meet the minimum auto insurance requirements to drive legally. The only exception is if you are driving someone else's car, in which case you may be covered under the car owner's policy.

Driving without insurance in Florida can result in fines as high as $500, suspension of your driver's license and car registration for up to three years, and higher car insurance premiums.

New Florida residents have 10 days to obtain auto insurance.

PIP insurance covers medical expenses, lost wages, and death benefits for you and your passengers, regardless of who is at fault in an accident. PDL insurance covers damage to another person's property caused by you or someone driving your insured vehicle.