Auto insurance rates are determined by a variety of factors, including a driver's age, credit score, vehicle type, location, driving record, and claims history. Competitive rates for auto insurance companies will vary depending on these factors, and it is recommended that drivers compare quotes from multiple companies to find the best rate for their specific circumstances.

Auto insurance is a highly competitive industry, with companies vying to attract and retain customers by offering lower rates, discounts, and promotional prices. This competition benefits customers by fostering a marketplace where insurance companies strive to offer better coverage options, superior customer service, and competitive rates.

To find competitive rates, drivers can compare quotes from multiple insurance companies, review their coverage options and pricing, and inquire about available discounts. Shopping around and comparing insurance quotes can help customers find the most affordable and comprehensive policy for their needs.

| Characteristics | Values |

|---|---|

| Company | Geico, Amica, Progressive, Auto-Owners, Nationwide, State Farm, USAA, Allstate, American Family, Farmers, Erie, Liberty Mutual, Travelers, NJM |

| Availability | All 50 states except Hawaii |

| Customer Satisfaction | High |

| Discounts | Yes |

| Financial Strength | Excellent |

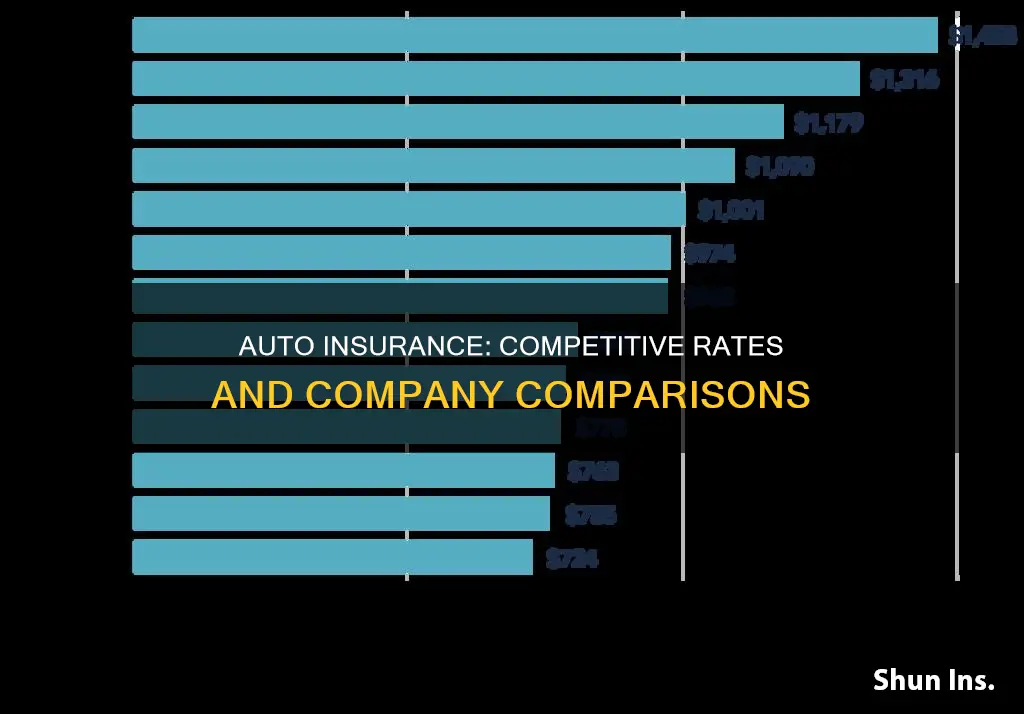

| Premiums | $1,335 - $3,374 |

Discounts

Good Driver Discount

One common discount rewards drivers for being responsible behind the wheel. This usually means going a certain period without any accidents, speeding tickets, or other moving violations. Some companies may offer a discount for new drivers or those under 25 who take a safe driving course.

Student Discount

Students enrolled in high school or college who maintain good grades (usually a B average or better) may be eligible for a discount. This is often called a Good Student Discount.

Anti-Theft Device Discount

If your vehicle has security features such as an alarm or tracking device, you may be eligible for a discount.

Paperless Discount

Insurance companies may offer a small discount if you opt to receive all your policy documents electronically.

Military Discount

Some companies offer discounts for current or former military members as a way to honor their service.

Automatic Payment Discount

If you set up automatic premium payments, you may be eligible for a discount. This can be done through electronic funds transfer, debit, or credit card.

Loyalty Discount

If you renew your policy with the same company, they may offer you a loyalty discount.

Low-Mileage Discount

Some insurance companies offer lower rates for drivers who don't drive many miles each year. This usually involves tracking your driving habits through an app or device.

Policy Discounts

You may be able to get a discount by bundling your auto insurance with other types of insurance, such as home or renters insurance. Insuring multiple vehicles with the same company can also result in a multi-car discount.

Driver Behavior Discounts

In addition to safe driving records, some companies offer discounts for taking a defensive driving course or for certain driver characteristics, such as being a student or a member of a specific profession.

Vehicle-Based Discounts

If your vehicle has safety features such as airbags or anti-lock brakes, you may be eligible for a discount. Newer vehicles with advanced safety technology may also qualify for discounts.

These are just some examples of the many discounts that may be available. The best way to find out what discounts you're eligible for is to contact your insurance company or agent. Combining multiple discounts, no matter how small, can result in significant savings over time.

Auto Insurance Policies: Married but Separate

You may want to see also

Customer service

When it comes to customer service, auto insurance companies offer a range of options to meet the needs of their customers. Many companies provide 24/7 support through various channels such as chat, email, phone, and even social media. Some companies also offer in-person support through local agents or offices. It is important to consider the availability and responsiveness of customer service when choosing an auto insurance company.

GEICO, for example, offers a live chat feature on its website, as well as a mobile app that allows customers to track and manage their claims. The company also provides roadside assistance and a dedicated claims page for quick and secure access to claim information. Progressive, on the other hand, offers similar support channels, including 24/7 phone support and email with an average response time of 2 business days. They also have a dedicated fraud reporting email address and phone number.

When it comes to customer satisfaction, it is worth noting that companies like Amica and GEICO have consistently received high ratings in J.D. Power customer satisfaction studies. Amica, in particular, is known for its exceptional claims handling satisfaction. Additionally, companies like State Farm offer the convenience of a large network of local agents, providing customers with expert guidance and support.

It is always a good idea to research and compare the customer service offerings of different auto insurance companies before making a decision. This can include reading reviews, comparing response times, and evaluating the availability of support channels to ensure that you get the level of service you need.

Best Vehicle Insurance in Mexico

You may want to see also

Claims handling

Step 1: Understanding the Claims Process

Before filing a claim, it's important to understand the basic steps involved. The claims process typically starts with notifying your insurance company of the accident or incident. This is usually done by contacting your agent or insurer and providing them with the necessary information and documentation. The insurance company will then assign an adjuster to your claim, who will investigate and assess the situation.

Step 2: Gathering Information and Documentation

When filing a claim, it's essential to have all the relevant information and documentation ready. This includes the names and contact information of everyone involved, insurance policies of both parties, the date, time, and location of the incident, photos of any damage, and a copy of the police report. Preparing this information in advance can streamline the claims process and make it more efficient.

Step 3: Filing the Claim

Once you have all the necessary information, it's time to file the claim with your insurance company. You will be connected with a claims adjuster who will review the details and determine fault. It's important to provide accurate and factual information to the adjuster, as it will be used to make decisions regarding fault and coverage.

Step 4: Approval and Payout

After filing the claim, it will go through a review and approval process. The claims specialist will determine if the incident is covered under your auto insurance policy. If the claim is approved, the insurance company will provide a payout to cover the damages. This payout may be used to repair or replace your vehicle, depending on the extent of the damage.

Step 5: Vehicle Repairs and Premium Review

Once your claim is approved and you receive the payout, you can proceed with repairing your vehicle. It's important to choose a reputable repair shop and ensure that all damages are fixed properly. After the repairs are completed, it's a good idea to review your insurance coverage and premium. If you were found at fault for the accident, your insurance premium may increase when it's time to renew your policy.

Key Considerations:

- The claims process can vary depending on the insurance company and the specific policy.

- It's important to gather all the necessary information and documentation before filing a claim.

- The claims adjuster will play a crucial role in investigating and assessing the incident.

- The approval and payout process may differ depending on the insurance company and the specifics of the claim.

- Reviewing your insurance coverage and premium after an accident can help ensure you have adequate protection.

- Keep in mind that filing a claim may result in an increase in your insurance premium, especially if you are found at fault.

Understanding AARP's Impact on Auto Insurance Savings

You may want to see also

Customer loyalty

According to J.D. Power's Quarterly Insurance Shopping LIST Reports, NJM, USAA, Erie Auto Insurance, Mercury Auto Insurance, and The Hanover are the top auto insurance companies for customer loyalty as of Q1 2024. These carriers have either competitive prices or well-regarded customer service, or both, which contributes to their high customer retention rates.

One notable example of a company with strong customer loyalty is USAA, which caters exclusively to military members, veterans, and their families. USAA consistently offers some of the lowest rates in the industry, along with exceptional customer service, resulting in high customer satisfaction and loyalty. Their availability is limited to eligible individuals, but for those who qualify, USAA is a top choice.

Erie Auto Insurance is another carrier that demonstrates strong customer loyalty. They offer low rates and highly regarded customer service. One unique feature that sets them apart is their Rate Lock benefit, which prevents premiums from increasing over time. This is especially valuable considering the recent surge in auto insurance rates, providing their customers with stability and predictability.

Mercury Auto Insurance takes a different approach to customer loyalty by focusing on in-person service. They have a network of over 9,400 independent agents who provide personalized assistance to their policyholders. While their customer satisfaction ratings are not the highest, their commitment to face-to-face interactions builds strong relationships with their customers, fostering loyalty.

In conclusion, customer loyalty in the auto insurance industry is influenced by a combination of competitive rates, exceptional customer service, and unique benefits tailored to the needs of their clientele. Companies that prioritize these aspects are more likely to retain their policyholders and develop long-lasting relationships. It is essential for consumers to periodically review their policies and compare them with other providers to ensure they are getting the best value and service.

Lyft Auto Insurance: Claims and Denials

You may want to see also

Rates for young drivers

Young drivers are considered high-risk by insurance companies due to their lack of driving experience, making their insurance rates significantly higher than those of older drivers. Male drivers are also deemed riskier than female drivers, as they are statistically more likely to be involved in accidents.

According to MarketWatch, 16-year-olds pay an average of $5,769 for full coverage or $2,706 for minimum coverage per year. The best car insurance for teens and young drivers is Liberty Mutual, as it offers many ways to save. State Farm is another good option, as it offers usage-based insurance options and considerable discounts for students.

WalletHub's analysis of 17 major car insurance companies found that Travelers, USAA, and Progressive are the best car insurance companies for teens and young drivers. The cheapest car insurance for 21-year-old young adult drivers comes from USAA, with monthly rates of $218, while Travelers offers the lowest rates for 25-year-old drivers at $166 per month.

Bankrate's research found that Progressive, Geico, Auto-Owners, State Farm, and Nationwide offer low average premiums and robust coverage options for young drivers.

Nationwide was identified by USA Today as the best car insurance company for teens, as it has the lowest average rate for parents adding a teen driver to their policy. Erie has the lowest rates for teens on their own policy. USAA has the second-lowest rates for parents adding a teen to their policy and teens on their own policy.

Forbes Advisor's analysis found that Erie, USAA, American Family, and Nationwide are among the best cheap car insurance companies for teens and young drivers.

The Open-Ended Obligation: Auto Insurer's Defense Duty Beyond Policy Limits

You may want to see also

Frequently asked questions

The best way to find the right auto insurance is to get car insurance quotes from multiple companies. That’s the only way you’ll know what companies are going to charge and which companies are coming in with the lowest rates.

Choosing the right car insurance is an important decision and there are various factors that will shape what coverage is right for you. Here are some tips for identifying the best insurance coverage to meet your needs:

- Understand your state’s laws.

- Check customer reviews.

- Customize your coverage.

- Adapt to life events.

- Lender requirements.

The amount of insurance you need depends on several factors. One of the most important indicators of how much coverage you may need is state requirements. Most states have laws that require drivers to carry a minimum amount of liability coverage.

Your car insurance premium is the specific amount of money you pay to your insurance company in exchange for coverage for you and your vehicle. Customers typically have the option to pay premiums monthly, semi-annually, or annually.

The best way to find the right auto insurance is to shop around: Get quotes from at least three insurers, keeping the limits, coverage, and deductible the same.