Insurable earnings are the portion of an individual's income that is used to calculate their contributions to Employment Insurance (EI) and their employer's employment insurance premiums. Insurable earnings include most types of compensation from employment, such as wages, tips, bonuses, and commissions. It is important for individuals to ensure they are contributing the correct amount to take advantage of Canada's employment insurance plan in the event they become unemployed.

What You'll Learn

Wages, salaries, tips, and gratuities

In Canada, the basic rate for calculating Employment Insurance (EI) benefits is 55% of your average insurable weekly earnings, up to a maximum amount. As of January 1, 2024, the maximum yearly insurable earnings amount is $63,200. This means that you can receive a maximum amount of $668 per week.

Insurable earnings include most types of compensation from employment, such as wages, tips, bonuses, and commissions. The Canada Revenue Agency determines what types of earnings are insurable.

The amount of weekly benefits is calculated by first determining your total insurable earnings for the required number of best weeks (the weeks you earned the most money, including insurable tips and commissions). This is based on the information you provide and/or your record(s) of employment. Next, the divisor (number of best weeks) that corresponds to your regional rate of unemployment is determined. Your total insurable earnings for your best weeks are then divided by the required number of best weeks, and the result is multiplied by 55% to obtain the amount of your weekly benefits.

It is important to note that the number of weeks used to calculate benefits can range from 14 to 22 weeks, depending on the unemployment rate in your region. The number of weeks for which you may receive benefits will not change if you move to another region after your benefit period begins.

PMI Insurance: LTV or CLTV?

You may want to see also

Compassionate care leave

To be eligible for compassionate care benefits, individuals must meet certain criteria. Firstly, they need to demonstrate a significant reduction in their normal weekly earnings (over 40%) due to the time spent providing care. Secondly, they must have worked a minimum number of hours of insurable employment during the qualifying period, which is typically the last 52 weeks before the start of the claim. This qualifying period can vary depending on factors such as previous EI claims, periods of unemployment, or self-employment status. The required number of insurable hours is usually 600, and self-employed individuals can opt to pay EI premiums to become eligible.

The benefits offered under compassionate care leave include financial assistance in the form of EI payments. Individuals can receive up to 55% of their earnings, up to a maximum of $668 per week. These benefits are available for up to 26 weeks within a 52-week period following the certification of the family member's critical illness or injury, or their need for end-of-life care. The benefits can be taken all at once or in separate periods, and they can be shared by multiple eligible caregivers.

To initiate compassionate care leave, employees must apply for both an unpaid leave from their employer, as per applicable provincial or federal legislation, and the EI compassionate care benefits. A medical certificate from a doctor or medical practitioner is required, stating the family member's serious medical condition and the significant risk of death within 26 weeks. The leave can begin in the week the doctor signs the certificate, examines the family member, or the week the family member became terminally ill (if determinable).

Exploring the Maximum Limit of Term Insurance: Unraveling the Mystery of Coverage Caps

You may want to see also

Paid maternity leave

In Canada, paid maternity leave is part of the Employment Insurance (EI) program, which offers temporary financial assistance to unemployed workers. This includes maternity benefits for biological mothers, including surrogate mothers, who cannot work because they are pregnant or have recently given birth.

Maternity benefits are only available to the person who is away from work due to pregnancy or childbirth and cannot be shared between parents. The maximum number of weeks for maternity benefits is 15, starting as early as 12 weeks before the expected date of birth and ending as late as 17 weeks after the actual date of birth. The benefit amount is calculated as 55% of the recipient's average weekly insurable earnings, up to a maximum of $638-$668 per week.

To be eligible for EI maternity benefits, individuals must meet specific criteria, have their normal weekly earnings reduced by more than 40%, and have accumulated at least 600 hours of insurable employment during the qualifying period. Self-employed fishers must have earned at least $3,760 during the 31-week qualifying period. Additionally, EI premiums must be paid on all earnings up to an annual maximum, with the rate for workers in Quebec set at $1.20 for every $100, up to a maximum of $723.60.

It is important to note that the Province of Quebec has its own program, the Quebec Parental Insurance Program, which provides maternity, paternity, parental, and adoption benefits to its residents.

Rainwater: Surface Water Insurance Claims

You may want to see also

Parental leave

To be eligible for parental leave benefits, you must demonstrate that your regular weekly earnings from work have decreased by more than 40% for at least one week and that you have accumulated 600 insured hours of work in the 52 weeks before the start of your claim or since your last claim, whichever is shorter. You must take parental benefits within specific periods, starting the week of your child's birth or placement with you for adoption. For standard parental benefits, this period is 52 weeks (12 months), while for extended parental benefits, it is 78 weeks (18 months).

Insurable earnings for parental leave include various types of compensation from employment, such as wages, tips, bonuses, and commissions. The Canada Revenue Agency determines which types of earnings are insurable. Generally, if a worker is paid in cash and in kind (non-cash benefits), only the cash portion is considered insurable earnings. However, if a worker receives remuneration and board and lodging in the same pay period, the value of the board and lodging is included in insurable earnings.

Exploring Healthcare Choices: Beyond Short-Term and ACA Insurance Plans

You may want to see also

Severance pay

In Canada, EI benefits are calculated based on 55% of your average insurable weekly earnings, up to a maximum amount. Insurable earnings include most types of compensation from employment, such as wages, tips, bonuses, and commissions. Severance pay is typically considered a part of insurable earnings. However, it is important to note that EI benefits are taxable, and taxes will be deducted from the payments.

To qualify for EI benefits, you need to have a certain number of "Hours" of work during a 52-week "Qualifying Period". While severance pay does not count as Hours worked, it can still impact your eligibility. If the severance pay is for a statutory severance period, a contractual notice period, or a constructive dismissal, it may be considered Hours for EI purposes. On the other hand, if the severance pay is classified as a "Retiring Allowance", it would not count towards your EI eligibility.

The government of Canada provides resources to help individuals understand their severance pay and EI benefits. It is recommended to review documents such as offer letters, employee handbooks, and employment contracts to determine the expected severance pay and any applicable regulations.

The Great Healthcare Divide: Unraveling the Republican Exception

You may want to see also

Frequently asked questions

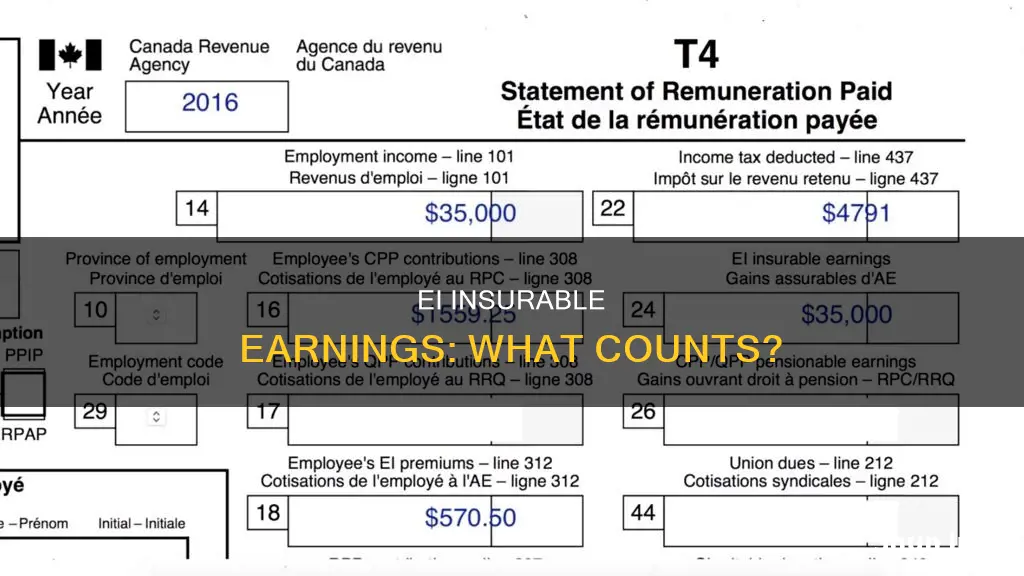

Insurable earnings are the portion of your income that is used to calculate your contributions, and your employers' contributions to employment insurance premiums.

All wages, salaries, tips, and gratuities are considered insurable earnings. Any payment that is controlled by your employer is typically considered an insurable earning.

For all of Canada except for Quebec, maximum insurable earnings amounts are set at $54,200. This means you will pay your employment insurance premiums on all money made up to $54,200. However, this is the cap on insurable earnings, which means that any money you make above this threshold will not add to the employment insurance premiums you need to pay.

Quebec has its own employment insurance plan, called the Quebec Insurance Plan, which covers maternity, parental, and paternity leave. Those who work in Quebec have a lower premium, set at $1.20 per every $100 of insurable earnings.

Your employer includes your insurable earnings on your T4 slip automatically, and they withhold your premiums in every pay period. You will need to know your insurable earnings amount when applying for employment insurance.