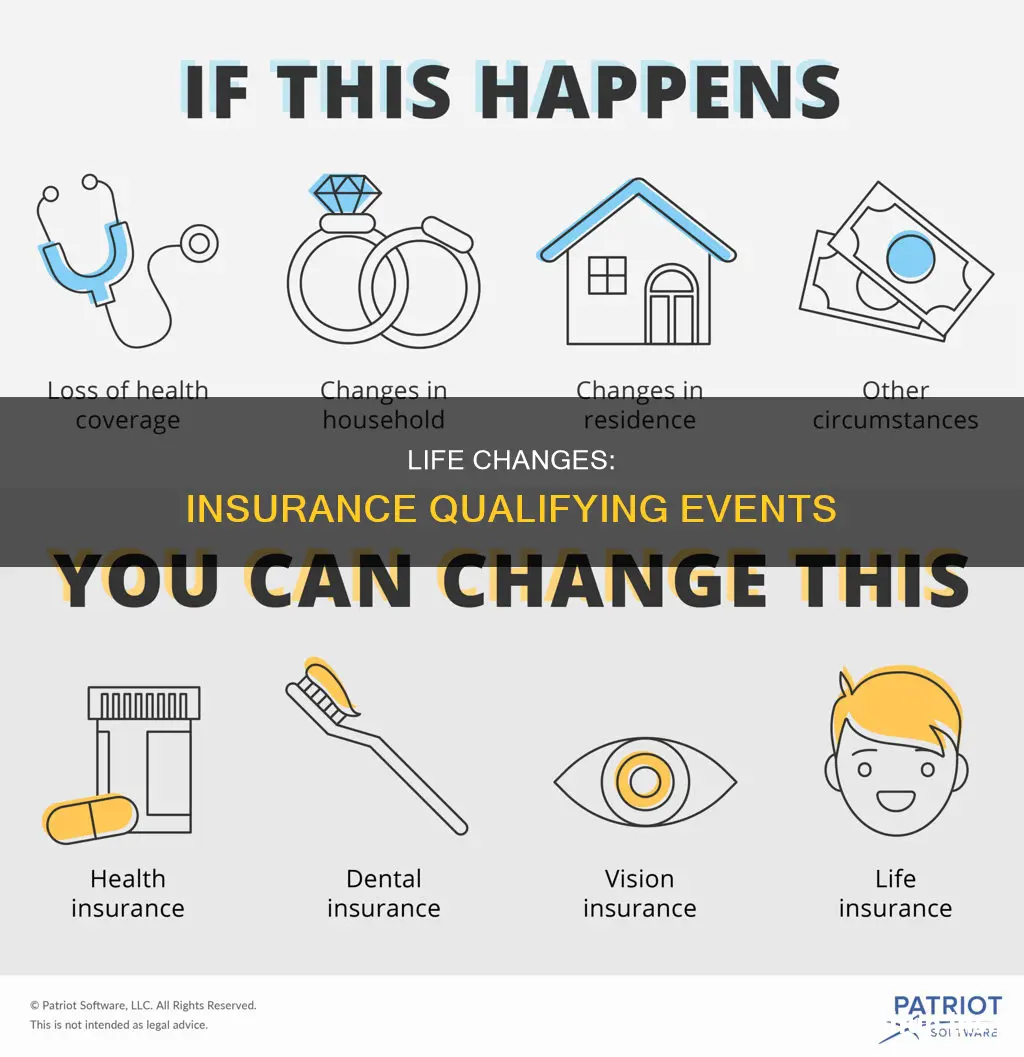

Certain changes in your life situation are known as insurance change qualifying events. These include things like a loss of health coverage, a change in your household, or a change in residence. These qualifying events give you the opportunity to sign up for a new health insurance plan or change an existing one outside the yearly Open Enrollment Period.

What You'll Learn

Loss of health coverage

- Losing existing health coverage, including job-based, individual, and student plans.

- Losing eligibility for Medicare, Medicaid, or CHIP.

- Turning 26 and losing coverage through a parent's plan.

- Losing coverage through a family member, such as a spouse, parent, or guardian.

- Losing COBRA coverage.

- Losing individual health coverage, for example, if your insurance carrier stops offering your individual policy, or you lose eligibility for a student health plan.

- Voluntarily dropping your coverage.

- Losing your coverage because you didn't pay your premium.

- Loss of short-term health coverage.

What to Do if You Lose Your Health Coverage

If you lose your health coverage, you will have 60 days to enrol in a new health insurance plan. You may need to provide documentation that proves your loss of coverage, such as notices from your previous insurance company or employer.

Billing Strategies for School Psychology Residents: Navigating Insurance Claims

You may want to see also

Changes in household

A change in household is a qualifying life event that allows you to change your health insurance plan outside of the Open Enrollment Period. This typically includes:

- Getting married, divorced, or legally separated

- Having a baby, adopting a child, or receiving a foster child

- Death of someone on your health insurance policy

In each of these situations, the size of your household is changing, and your health insurance coverage must be adjusted to reflect this change. For example, if you get married, you will be allowed a window of time from the date of marriage to change your coverage, including adding your spouse to your employer-sponsored health plan.

Similarly, if you experience a loss of health coverage due to the death of a family member who was the primary holder of your family's health insurance policy, this is a qualifying life event.

In the case of adding a child to your family, whether through birth, adoption, or fostering, you will need to contact your health plan to inform them of the event and choose a suitable plan for your entire family.

Unraveling the Complexities of Retroactive Insurance Billing

You may want to see also

Changes in residence

Moving to a new address can trigger a QLE if it results in a change of your health plan area. This could include moving to a different zip code or county, or moving out of state. For example, if you are a student moving to or from college, or a seasonal worker moving to or from a work location, you may be eligible for a QLE. Moving to or from a shelter or transitional housing can also be a qualifying life event.

If you are moving, it is important to notify your health insurance provider as soon as possible, as you will typically have up to 60 days after a qualifying life event to make changes to your health insurance plan. You may be required to provide documentation of your move, such as proof of residency from your new and old addresses.

**Farmers Insurance: 21st Century's New Identity**

You may want to see also

Changes in income

- Losing Program Eligibility: If you rely on public programs like Medicaid, SCHIP, or other income-based programs for health insurance, an increase in income may cause you to become ineligible for these programs. In this case, you can use a Special Enrollment Period to purchase insurance without government assistance.

- Income Increase Affecting Medicaid Coverage: A change in income that affects your eligibility for Medicaid coverage can be considered a qualifying life event.

- Income Increase Affecting Subsidy Eligibility: If your income or circumstances change, making you newly eligible or ineligible for premium tax credits or cost-sharing subsidies, you may be able to switch insurance plans. This applies to both on-exchange and off-exchange insurance plans.

- Income Increase Affecting the Coverage Gap: If you live in a state with a Medicaid coverage gap and experience an income increase during the year that moves you out of this gap, you may become eligible for premium subsidies. This change can trigger a Special Enrollment Period.

- Income Affecting Eligibility for Marketplace Coverage: For new US citizens, a change in income that makes them eligible for Marketplace coverage can be a qualifying life event.

It is important to note that the impact of income changes on insurance options may vary depending on your specific plan and location. It is always a good idea to consult with your insurance provider or a licensed insurance agent to understand how a change in income may affect your insurance options and to determine your eligibility for a Special Enrollment Period.

Updating Final Wishes: Changing Beneficiaries on Burial Insurance Policies

You may want to see also

Death of a family member

The death of a family member is a qualifying life event that allows you to change your health insurance plan outside of the standard open enrollment period. This is known as a Special Enrollment Period (SEP).

Who Qualifies?

The death of a family member who was the primary holder of a health insurance policy that covered you will qualify you for a Special Enrollment Period. This means that you can either change your existing plan or enroll in a new one.

Timing

In most cases, you will have 60 days before or after the date of the qualifying life event to apply for health coverage. However, this may vary depending on your state and insurance provider, so be sure to check with your provider as soon as possible after the event.

Documentation

You will likely need to provide documentation to confirm the qualifying life event. This could include a legal certified death certificate for the deceased family member.

Other Changes

In addition to the death of a family member, other changes in your household may qualify you for a Special Enrollment Period, such as marriage, divorce, having a baby, or adopting a child. Losing your health coverage also qualifies you for a Special Enrollment Period.

Marriage: A Gateway to Insurance Changes

You may want to see also

Frequently asked questions

Certain changes in your life situation are known as qualifying life events. These include things like a loss of health coverage, a change in your household, or a change in residence.

Qualifying life events typically include, but are not limited to, getting married, divorced, having a baby, or adopting a child.

You may qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child.

Documentation often depends on the event and could include birth certificates, adoption records, marriage licenses, divorce papers, or death certificates.