Auto insurance coverage codes are a type of classification system used by insurance companies to define the terms of a policy. These codes are used to indicate the type of vehicle that is covered, the type of coverage provided, and any additional endorsements or exclusions. For example, the code 1 under liability coverage indicates that any auto is covered, while the code 9 indicates that only non-owned autos are covered. These codes help insurance companies communicate the specifics of a policy in a standardized way, allowing for easy reference and comparison. Understanding these codes is essential for policyholders to know their coverage limits, endorsements, exclusions, and other vital information in the event of an accident or covered event.

What You'll Learn

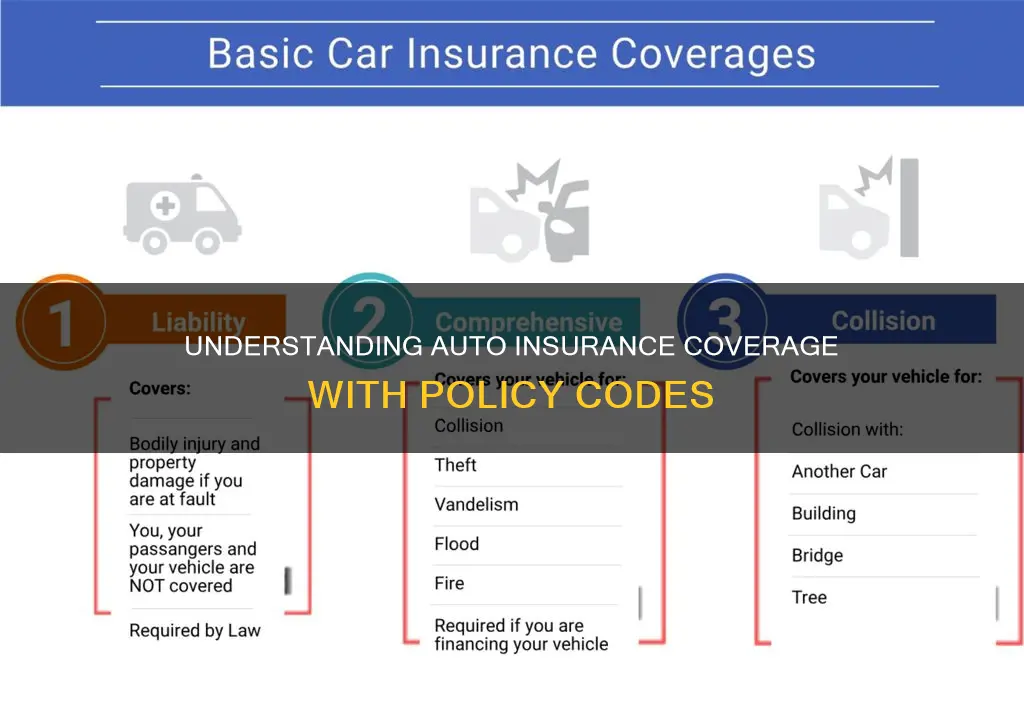

Liability Coverage

The cost of liability insurance depends on various factors, including the amount of coverage selected. Higher coverage limits typically come with a higher price tag. When choosing liability coverage limits, it is essential to understand the state's minimum requirements and select limits that align with your financial situation and potential risks. In California, for example, the minimum liability insurance requirements are $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage.

Liability insurance provides financial protection and peace of mind by covering damages and injuries up to your selected limits in at-fault accidents. However, choosing insufficient coverage may result in out-of-pocket expenses for any costs exceeding those limits. Therefore, it is advisable to carefully assess your needs and customize your liability coverage accordingly.

Auto Insurance: Confirming Marital Status to the DMV

You may want to see also

Collision Coverage

Collision insurance reimburses you for the cost of repairing or replacing your car after a crash. It covers a wide range of accident types, including collisions with other vehicles, objects such as trees or lampposts, and single-car accidents like rollovers. It also covers hit-and-run incidents, where the responsible party flees the scene.

The main benefit of collision coverage is that it helps pay for the cost of repairs to your vehicle, regardless of who is at fault in the accident. This can save you from having to pay the entire bill for repairs out of your own pocket. Additionally, collision coverage may allow you to start repairs while the claim is still being investigated, getting you back on the road faster.

When choosing collision coverage, you will need to select a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. Typically, a higher deductible will result in lower insurance costs, while a lower deductible will result in higher costs. It's important to choose a deductible that strikes a balance between your financial capabilities and potential out-of-pocket expenses in the event of an accident.

It's worth noting that collision coverage only applies to damages to your own vehicle. It does not cover damage to other vehicles or property, injuries to other people, or personal belongings inside your car. Additionally, collision coverage does not include incidents such as fires, floods, vandalism, or animal collisions, which would be covered under comprehensive insurance.

Rented Vehicle Insurance: What You Need to Know

You may want to see also

Comprehensive Coverage

If your vehicle has a low cash value and you can afford a higher deductible, comprehensive coverage may not be necessary. Conversely, if your vehicle has a high cash value or you cannot afford repairs or a replacement out of pocket, comprehensive coverage could provide valuable peace of mind. It's important to note that comprehensive coverage is limited to the actual cash value of your vehicle, so if you have an older car, you may want to consider whether this coverage is worth the cost.

When purchasing comprehensive coverage, you will need to select a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. A higher deductible typically results in lower insurance costs, while a lower deductible leads to higher insurance costs. It's important to carefully consider your financial situation and how much risk you are willing to take on when choosing your deductible.

Transferring Auto Insurance: Is It Possible?

You may want to see also

Auto Replacement Coverage

Auto insurance provides financial protection in the event of an accident or damage to your vehicle. While the specific coverage offered by insurance companies may vary, there are several standard types of auto insurance coverage, including collision coverage and comprehensive coverage.

Collision coverage protects you in the event your vehicle is involved in a collision with another vehicle or object, or if your vehicle overturns. This type of coverage will pay for the repair or replacement of your vehicle, regardless of who is at fault. Typically, collision coverage is sold with a deductible, which is the amount you must pay out of pocket before the insurance company covers the remainder. The higher the deductible, the lower your premium—the amount you pay for your insurance policy.

Comprehensive coverage, on the other hand, protects you in the event of damage to your vehicle that is not caused by a collision. This includes damage due to fire, falling objects, explosions, earthquakes, windstorms, hail, floods, vandalism, riots, or contact with animals. Similar to collision coverage, comprehensive coverage is usually sold with a deductible, with higher deductibles resulting in lower premiums.

Both collision and comprehensive coverage are typically optional, unless required by a lender if you still owe money on your car. However, these types of coverage can provide valuable financial protection in the event of an accident or damage to your vehicle. It's important to review the specific details of your insurance policy, including the coverage amounts, deductibles, and exclusions, to ensure you have the protection you need.

U-Turn: USAA Auto Insurance's Flat Tire Coverage Explained

You may want to see also

Medical Payment Coverage

Medical Payments Coverage, also known as MedPay, is an optional insurance coverage in most states. It helps pay for medical and funeral expenses when the policyholder, their passengers, or family members are injured or killed in a car accident, regardless of who is at fault. MedPay covers reasonable and necessary medical bills, including hospital visits, ambulance fees, surgeries, and dental procedures. It also covers funeral expenses in the event of a fatality.

One of the main advantages of MedPay is that it provides direct payment to healthcare providers, eliminating the need for out-of-pocket expenses and reimbursement claims. Additionally, MedPay has no deductibles or co-pays, and there are no restrictions on the type of healthcare provider you can visit. This coverage is particularly beneficial for individuals without health insurance or those with high deductibles and co-pays. Even if you have good health insurance, MedPay can help cover your out-of-pocket costs and those of your passengers.

MedPay coverage limits typically range from $1,000 to $10,000, depending on the state and insurer. It is generally recommended to carry MedPay coverage equal to your health insurance deductible to cover any out-of-pocket medical expenses. However, if you don't have health insurance, you may want to consider a higher MedPay limit to adequately cover potential medical bills.

It's important to note that MedPay does not cover all expenses related to a car accident. For instance, it won't cover property damage, lost wages, or injuries to other drivers. To protect yourself from these additional costs, you may need to consider other types of insurance coverage, such as personal injury protection (PIP) or bodily injury liability insurance.

In summary, Medical Payments Coverage (MedPay) is a valuable option to consider when purchasing auto insurance. It provides peace of mind and financial protection by covering medical and funeral expenses for you, your passengers, and your family members in the event of a car accident, regardless of fault.

Usaa: Salvage Vehicle Insurance?

You may want to see also