Auto insurance rates for 16-year-olds in Massachusetts vary depending on factors such as gender, driving record, and whether they are added to an existing policy or purchasing their own. The average cost of car insurance for a married couple with a 16-year-old driver in Massachusetts is $4,874 per year for full coverage, which is significantly higher than the average cost of car insurance in the state. The cost of insuring a 16-year-old driver can be influenced by factors such as their gender, with males typically paying more due to higher accident rates. Adding a teen driver to an existing policy is usually much cheaper than purchasing a separate policy, with Erie and Nationwide offering some of the lowest rates for adding a 16-year-old to a parent's policy.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance for a 16-year-old male | $7,625 |

| Average annual cost of car insurance for a 16-year-old female | $6,782 |

| Average annual cost of car insurance for a married couple with a 16-year-old | $4,874 |

| Average annual cost of car insurance for a married couple with no teens | $2,169 |

| Average annual cost of car insurance for a 16-year-old with their own policy | $8,765 |

| Average annual cost of car insurance for a 16-year-old added to a parent's policy | $2,735 |

| Average annual cost of car insurance for a 16-year-old in Massachusetts | $5,046 |

What You'll Learn

- Average annual premium for a 16-year-old male driver: $7,625

- Average annual premium for a 16-year-old female driver: $6,782

- Average annual premium for a married couple with a 16-year-old driver: $4,874

- Average annual premium for a 16-year-old driver in Massachusetts: $5,046

- Average annual premium for a 16-year-old driver with full coverage: $7,625

Average annual premium for a 16-year-old male driver: $7,625

The average car insurance rate for a 16-year-old male driver in Massachusetts is $4,386 a year for individual coverage. This is a substantial cost, and it is important to note that purchasing insurance without a guardian is usually not permitted for teens under 18.

If a 16-year-old male driver is added to a family policy, the average annual rate drops to $2,520. This is a more affordable option, and it is worth considering when insuring a teen driver.

The high cost of car insurance for young drivers is due to their lack of experience and higher risk of accidents. As a result, insurance companies charge higher rates to teen drivers, as they are more likely to cost the insurance company money.

There are ways to save money on car insurance for 16-year-old male drivers. One way is to shop around and compare rates from different insurance providers. Another way is to maintain a clean driving record, as a good driving history can lead to lower premiums. Additionally, bundling car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

It is also worth considering the type of vehicle the 16-year-old male driver will be insuring. Insurance rates are typically higher for luxury or sports cars compared to more modest vehicles due to higher repair costs and an increased risk of theft.

Urine Trouble? Auto Insurance and the Unexpected Drug Test Request

You may want to see also

Average annual premium for a 16-year-old female driver: $6,782

The cost of car insurance for a 16-year-old female driver varies depending on several factors. If the 16-year-old female driver is added to an existing policy of her parents, the average annual rate is $4,144, resulting in an annual savings of $2,638. On the other hand, if the 16-year-old female driver were to purchase her own policy, the nationwide average cost for insurance is $6,782.

The reason for this significant difference in cost is that teens are considered high-risk drivers due to their lack of driving experience and the fact that they are statistically more likely to cause crashes. As a result, insurance companies charge higher rates to compensate for the increased likelihood of claims.

It's important to note that in some states, such as California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, gender does not play a role in determining insurance rates. However, in most states, insurance companies can consider gender, and males are typically charged slightly higher rates than females because they are statistically more likely to be involved in accidents.

To save money on car insurance for a 16-year-old female driver, you can look for discounts such as the good student discount, which is offered by many insurance companies if the student maintains a certain grade point average. Additionally, safe driving can help lower insurance rates, as insurance companies reward drivers who maintain a clean driving record.

The No-Fault Auto Insurance System in New York: What You Need to Know

You may want to see also

Average annual premium for a married couple with a 16-year-old driver: $4,874

The cost of car insurance varies depending on a range of factors, including age, location, credit score, driving record, and vehicle type. For a married couple with a 16-year-old driver, the average annual premium is $4,874 for full coverage. This is significantly higher than the average cost of car insurance for married couples without a teenage driver, which is $2,169 per year for full coverage.

Adding a teenage driver to a car insurance policy can result in a substantial increase in premiums. The reason for this is that teenagers are considered high-risk drivers due to their lack of driving experience and are more likely to be involved in accidents. Insurance companies set rates based on the likelihood of a driver filing a claim, and teenage drivers are statistically more likely to be involved in crashes and engage in risky behaviours such as texting while driving or not wearing a seatbelt.

While the cost of adding a teenage driver to a car insurance policy can be significant, there are ways to mitigate these insurance increases. One way is to take advantage of discounts offered by insurance companies, such as good student discounts, telematics programs, and low-mileage discounts. Additionally, it is important to shop around and compare quotes from multiple insurance companies, as rates can vary.

It is worth noting that as a teenage driver gains experience and builds a safe driving record, insurance rates will typically decrease. However, planning for higher rates during the initial years and finding ways to offset the costs can help manage the financial burden.

Insurance Fronting: Deceiving Vehicle Coverage

You may want to see also

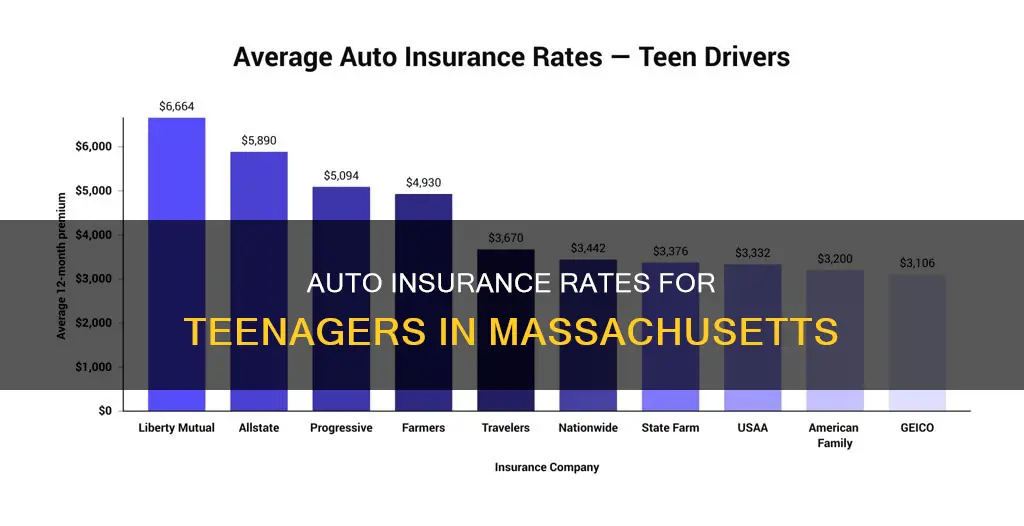

Average annual premium for a 16-year-old driver in Massachusetts: $5,046

The average annual premium for a 16-year-old driver in Massachusetts is $5,046. This is the cost of adding a 16-year-old to an existing policy that includes three drivers (the teen and their parents) and one vehicle. This rate is for full coverage, which includes collision and comprehensive insurance.

The cost of car insurance for a 16-year-old in Massachusetts is relatively affordable compared to other states. In fact, Massachusetts is the 10th cheapest state to purchase car insurance for a 16-year-old. This is partly because Massachusetts is one of a handful of states that disallows the use of gender, credit score, and marital status as rating factors in car insurance pricing.

However, the average cost of car insurance for a 16-year-old in Massachusetts is still significantly higher than the average cost for older drivers. This is because younger and inexperienced drivers are considered higher-risk and are therefore charged higher premiums. Additionally, 16-year-olds are statistically more likely to cause crashes and engage in risky behavior such as texting while driving or failing to wear a seatbelt. As a result, insurance companies charge more for policies that include teen drivers.

To save money on car insurance for a 16-year-old in Massachusetts, consider the following tips:

- Shop around and compare rates from different insurance companies.

- Encourage your teen to maintain a clean driving record.

- Look for discounts such as good student discounts or telematics programs.

- Choose a vehicle that is safe and has good insurance rates for teens.

Homeowners' Secret Weapon: Insurance Coverage for Auto Theft in Attached Garages

You may want to see also

Average annual premium for a 16-year-old driver with full coverage: $7,625

The cost of car insurance for a 16-year-old driver is significantly higher than that of older, more experienced drivers. The average annual premium for a 16-year-old with full coverage is $7,625, which is nearly $6,000 higher than the average for a 40-year-old driver with the same level of coverage. This disparity in pricing is due to the increased risk associated with young, inexperienced drivers.

Factors Affecting the High Cost of Car Insurance for 16-Year-Olds

Several factors contribute to the high cost of car insurance for 16-year-olds:

- Statistical Risk: Teenagers aged 16 to 19 have the highest risk of car crashes compared to any other age group, according to the Centers for Disease Control and Prevention. Per mile driven, teen drivers in this age group are almost three times as likely to be involved in a fatal crash as drivers aged 20 or older. As a result, insurance companies view this age group as a higher risk, leading to higher premiums.

- Limited Driving Experience: 16-year-old drivers are considered new, young drivers with limited driving experience. Insurance companies take into account the number of years a person has been driving when determining rates, and less experience often translates to higher rates.

- Gender: In most states, insurance companies can use gender as a factor when determining rates. Males, especially young male drivers, are statistically more likely to be involved in accidents and engage in risky driving behaviors. Therefore, male drivers may pay slightly higher rates than their female counterparts.

- State Requirements: The cost of car insurance for a 16-year-old also varies depending on the state they live in. Each state has its own regulations and required minimum coverage levels, which can impact the overall cost of insurance.

Strategies to Reduce the Cost of Car Insurance for 16-Year-Olds

While the cost of car insurance for 16-year-olds is high, there are some strategies that can help reduce the financial burden:

- Good Student Discounts: Many insurance companies offer discounts for teen drivers who maintain good grades, typically a B average or higher. These discounts can help lower the overall insurance premium.

- Telematics and Usage-Based Discounts: Enrolling in a telematics program or opting for usage-based insurance can encourage safe driving habits and result in lower rates. These programs track driving behavior, and safe, low-mileage driving can lead to significant savings.

- Vehicle Choice: The type of vehicle a 16-year-old drives can impact the insurance premium. Choosing a safe, modest vehicle over a sports car or luxury vehicle can result in lower rates. Additionally, considering a vehicle without comprehensive and collision coverage can reduce costs, although this comes with the risk of higher out-of-pocket expenses in the event of an accident.

- Safe Driving Agreements: While this may not directly lower insurance rates, encouraging safe driving habits and adhering to Graduated Driver License (GDL) laws can help prevent accidents and violations, which could increase insurance costs.

Cheapest Insurance Companies for 16-Year-Olds

When looking for the cheapest insurance options for 16-year-olds, it's important to compare rates from multiple companies. Here are some of the companies that have been known to offer competitive rates for this age group:

- Island

- Erie

- Mapfre

- North Carolina Farm Bureau

- State Farm

- Geico

- USAA

- Progressive

It's worth noting that rates can vary based on individual factors, so it's always a good idea to shop around and compare quotes to find the best deal for your specific situation.

Auto Body Repair Shops: Waiving Insurance Deductibles and Ethical Implications

You may want to see also

Frequently asked questions

The cost of auto insurance for a 16-year-old in Massachusetts varies depending on factors such as gender, coverage level, and driving record. On average, a 16-year-old male driver in the state can expect to pay around $2,520 annually when added to a family policy, while a female driver of the same age may pay around $4,144. For their own policy, a 16-year-old male can expect to pay around $4,386, while a female may pay around $3,543.

The cost of auto insurance for teenagers in Massachusetts is influenced by various factors, including their driving record, gender, and the type of vehicle they drive. Insurance companies consider young and inexperienced drivers to be high-risk, and as a result, charge higher premiums. Additionally, males tend to pay higher rates than females due to a higher likelihood of being involved in accidents.

Yes, there are a few discounts that 16-year-old drivers in Massachusetts may be eligible for. These include good student discounts, where students with a B average or higher can receive up to a 16% discount. Additionally, parent-teen driving contracts that outline safe driving rules can result in a discount of up to 5%. Shopping around for insurance and choosing a vehicle with good safety features can also help lower premiums.

Typically, a 16-year-old in Massachusetts cannot purchase their own auto insurance policy as they are considered minors. They usually need to be listed on a parent's or guardian's policy until they reach the age of 18 or become emancipated adults. However, there may be exceptions depending on the insurance company and state regulations.